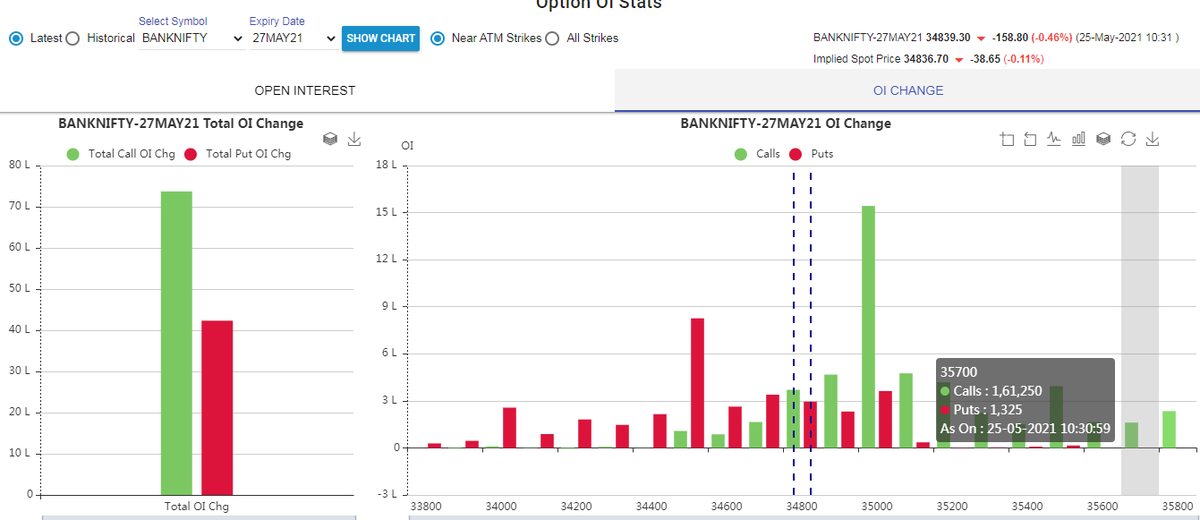

What is best way to sell strangle in Banknifty on an intraday basis

Simple

at 9:45 Open Option chain and check In which strike highest OI change in call side and put side

Sell both option with combine SL

Enjoy easy and simple intraday trading strategy

Today 35000CE and 34500PE

More from Jig's Patel

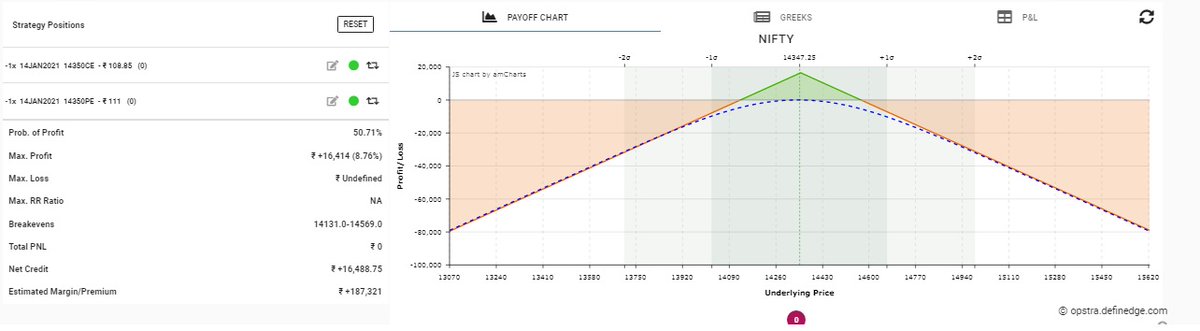

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

More from Optionslearnings

If we buy hedges, Margin will reduce & ROI increases.

More strategies will be shared going forward.

All u need is execute with Discipline & sticking with system when in DD.

(1/n) https://t.co/3KH9v0tgsb

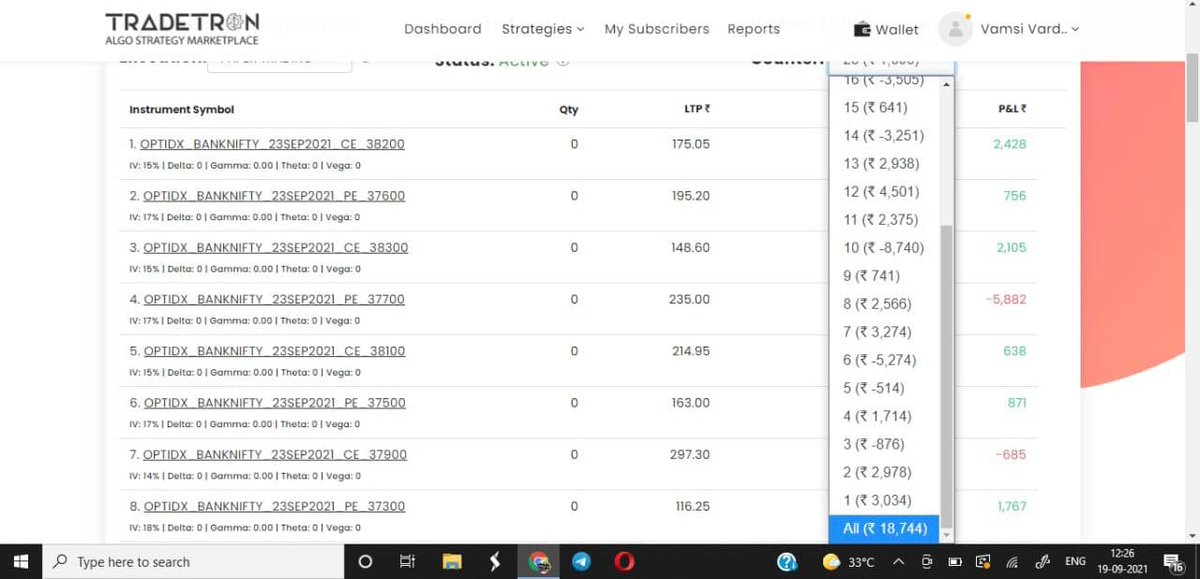

A simple INTRADAY strategy with decent BACKTEST report of more than 3-5% returns on Monthly basis.

— OptionSeller(Vardhan) (@CaVardhanCa) August 15, 2021

Will be sharing live report on daily basis for a month.

& will conduct FREE webinar to discuss about the results in coming weeks.

Sharing all rules below.

(1/n) https://t.co/VMlxNtX90s pic.twitter.com/cJaa9axRss

to learn more about Algo Trading (in both directional & non directional) , you can visit my Telegram channel especially created for Algo Strategies.

Will be updating Daily Performance of our Algos in below

How many are believing only in simple trading system?

— Mitesh Patel (@Mitesh_Engr) April 3, 2021

This is my simple trading.

I don\u2019t have any magic.

— Mitesh Patel (@Mitesh_Engr) January 7, 2021

Next week I will prefer to sell put in between strike 30500-31000 as shown in pic. Will manage upto 31000.

If breaks 31000 as first down support then will exit put nearby 31000 strike and will sell

31500 call ( will act as resistance again )

Simple hai na pic.twitter.com/hPLIMq3tSe

You May Also Like

It was Ved Vyas who edited the eighteen thousand shlokas of Bhagwat. This book destroys all your sins. It has twelve parts which are like kalpvraksh.

In the first skandh, the importance of Vedvyas

and characters of Pandavas are described by the dialogues between Suutji and Shaunakji. Then there is the story of Parikshit.

Next there is a Brahm Narad dialogue describing the avtaar of Bhagwan. Then the characteristics of Puraan are mentioned.

It also discusses the evolution of universe.( https://t.co/2aK1AZSC79 )

Next is the portrayal of Vidur and his dialogue with Maitreyji. Then there is a mention of Creation of universe by Brahma and the preachings of Sankhya by Kapil Muni.

HOW LIFE EVOLVED IN THIS UNIVERSE AS PER OUR SCRIPTURES.

— Anshul Pandey (@Anshulspiritual) August 29, 2020

Well maximum of Living being are the Vansaj of Rishi Kashyap. I have tried to give stories from different-different Puran. So lets start.... pic.twitter.com/MrrTS4xORk

In the next section we find the portrayal of Sati, Dhruv, Pruthu, and the story of ancient King, Bahirshi.

In the next section we find the character of King Priyavrat and his sons, different types of loks in this universe, and description of Narak. ( https://t.co/gmDTkLktKS )

Thread on NARK(HELL) / \u0928\u0930\u094d\u0915

— Anshul Pandey (@Anshulspiritual) August 11, 2020

Well today i will take you to a journey where nobody wants to go i.e Nark. Hence beware of doing Adharma/Evil things. There are various mentions in Puranas about Nark, But my Thread is only as per Bhagwat puran(SS attached in below Thread)

1/8 pic.twitter.com/raHYWtB53Q

In the sixth part we find the portrayal of Ajaamil ( https://t.co/LdVSSNspa2 ), Daksh and the birth of Marudgans( https://t.co/tecNidVckj )

In the seventh section we find the story of Prahlad and the description of Varnashram dharma. This section is based on karma vaasna.

#THREAD

— Anshul Pandey (@Anshulspiritual) August 12, 2020

WHY PARENTS CHOOSE RELIGIOUS OR PARAMATMA'S NAMES FOR THEIR CHILDREN AND WHICH ARE THE EASIEST WAY TO WASH AWAY YOUR SINS.

Yesterday I had described the types of Naraka's and the Sin or Adharma for a person to be there.

1/8 pic.twitter.com/XjPB2hfnUC