Categories Finance

Below are some updated thoughts on potential integrations, improvements, and innovations for Saffron moving forward. ⬇️

1/11 @saffronfinance_ ($SFI) is DeFi's new kid on the block with its tranched yield product that is already live with DAI on @compoundfinance. https://t.co/JpqnxhwrDw

— Benjamin Simon (@benjaminsimon97) November 19, 2020

2/18 First, if you haven't seen @Privatechad_'s alpha-leaking introductory thread, you should check it out.

I agree that @AlphaFinanceLab and @CreamdotFinance, specifically the Iron Bank, would be ideal targets for SFI risk tranches.

15/. 3. Though not the focus atm, interest from various projects and integrations are happening.

— Private Chad (@Privatechad_) February 1, 2021

* Chainlink reached out (props to the amazing $LINK team).

* Talks with $ALPHA and rumored upon V2 releases there will be a collaboration.

*Cream integrations in v2

* $COMP tranches pic.twitter.com/IXCtzvSkw7

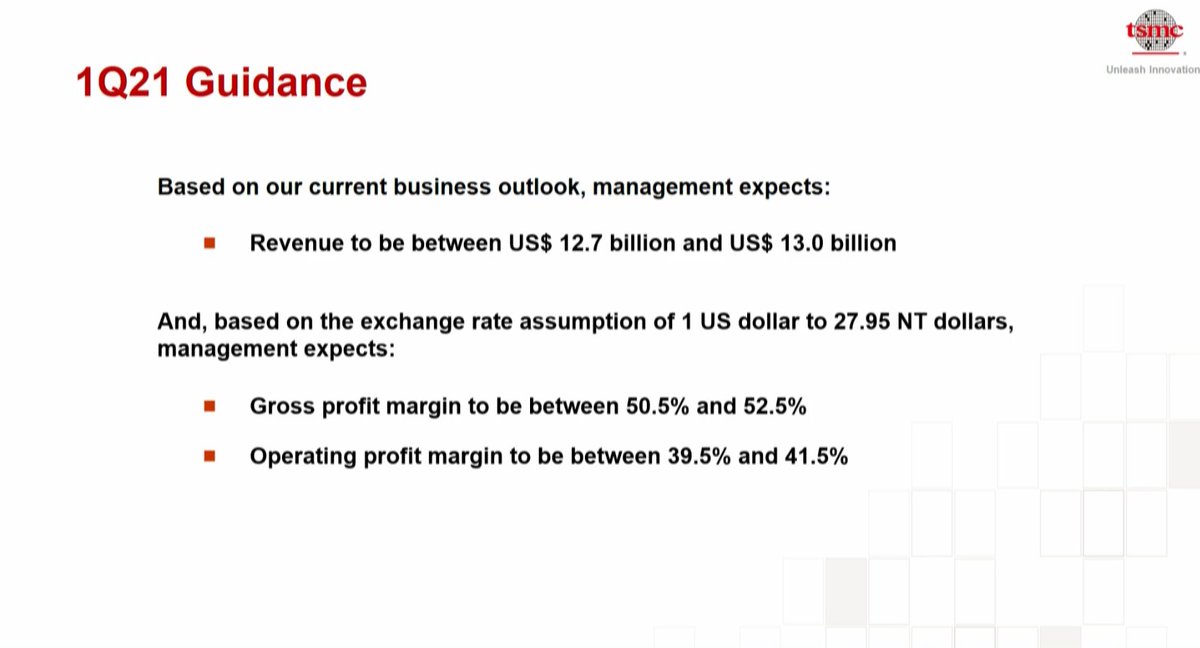

3/18 Speaking more broadly, Saffron is primarily integrated with @compoundfinance, which has served as a MVP of sorts.

The thing is, Compound is one of the safest (but also lowest yield) protocols in DeFi, so it's not surprising that there isn't much demand for the sen. tranche.

4/18 Expanding beyond Compound to higher-risk/higher-return protocols has always been key.

These protocols are the bread-and-butter target market for Saffron, and I would expect to see a surge in demand for senior tranche staking in these

4/11 Imo, the golden egg will be vault platforms like @iearnfinance, @picklefinance, etc.

— Benjamin Simon (@benjaminsimon97) November 19, 2020

Recently, some of these higher risk platforms (e.g. @harvest_finance) have been hit with a wave of attacks.

Saffron will enable cautious investors to use these products with peace of mind.

5/18 Additionally, @DeFiGod1 convinced me that Senior Tranche pools would be more appealing if they offered fixed yield.

Essentially, Saffron would augment the product offerings of @Barn_Bridge by also offering senior stakers insurance in the form of junior tranche collateral.

👇

Equity/ownership is a force. Getting it in the hands of the right people generously will drive alignment and execution.

— Joey Santoro (@Joey__Santoro) January 21, 2021

It is a joyful and serious responsibility \U0001f332

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

Finding collateral where there isn’t any ... aka, my most innovative idea (and I’m giving it to you for free)!

Let’s revisit this thread from my early (active) Twitter days. A few questions you might ask:

1) What was my collateral (why did I make this loan)?

2) Why did I have any leverage with the company at all (short of a foreclosure)?

3) Why did the “deep pockets” buy me out?

My typical mezz deals are to companies in 1/3 categories:

— Matt Willes (@SkolCapital) August 27, 2020

1) M&A

2) Growth Capital

3) Special Situations ...

Here\u2019s an example on #3:

Let me pick up the story with two assumptions I had going in:

1) I didn’t trust the owner/operator (at all)

2) I knew the PE group (that had offered $200 M) well, and I knew who they were proposing to bring in to run the company had they bought it

#2 (plan B) made sense to me

The senior ($ZION) had the collateral locked up and controlled any formal foreclosure/bankruptcy.

The idea of a convertible had some appeal but you can’t really do anything with 5-10% of a business

My solution: “default conversion” at an unfair valuation

I negotiated a deal that if the company defaulted (and only if they didn’t cure the defaults) I had the option to convert into preferred stock representing a fully diluted 40% of the business

He grab many multibagger stocks and His style also unique(1st Seen interview in @TraderHarneet's YT Channel)

He follow Simple process

Young Intelligent Investor who also appeared in ET

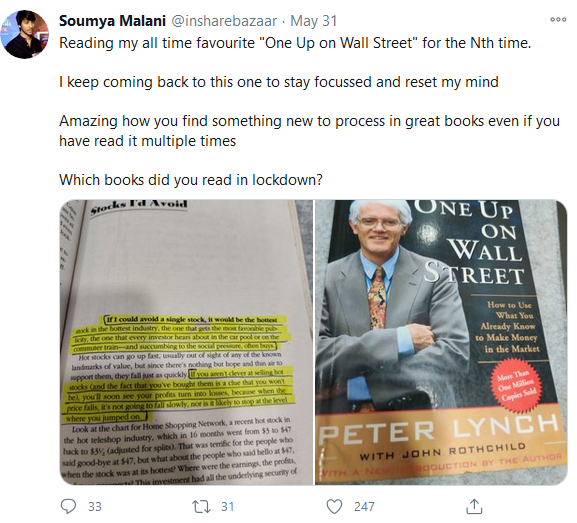

1. One Up On Wall Street

2. Rich Dad Poor Dad

Access here : https://t.co/UWOCF732z6

3. The Unusual Billionaires

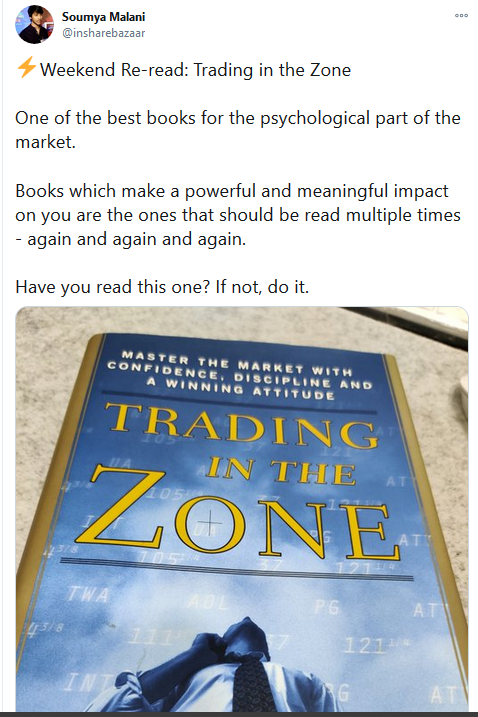

4. Trading in the Zone

https://t.co/G7mqVPtEM0

5. Market Wizards

6. The Intelligent Investor

https://t.co/yPKBzYyPAl

7. The Five Rules for Successful Stock Investing

8. Reminiscences of a Stock Operator

https://t.co/PiioB3hdHP

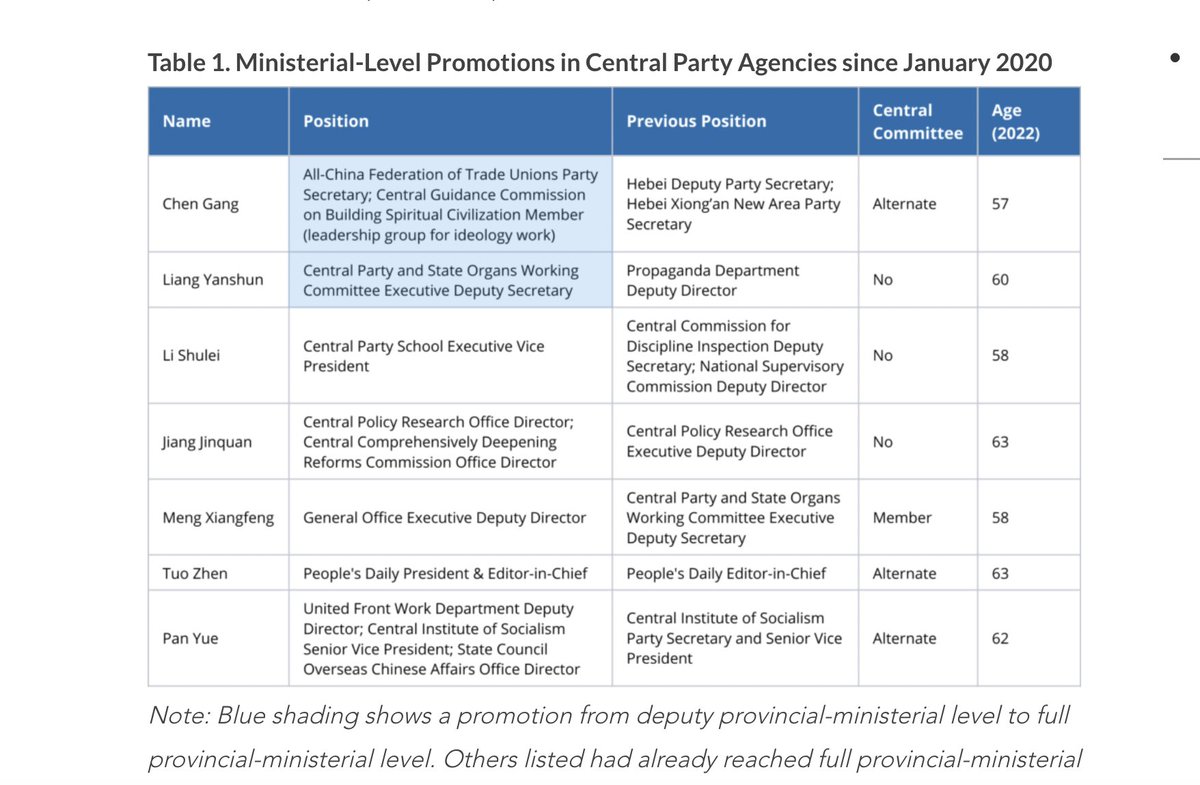

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

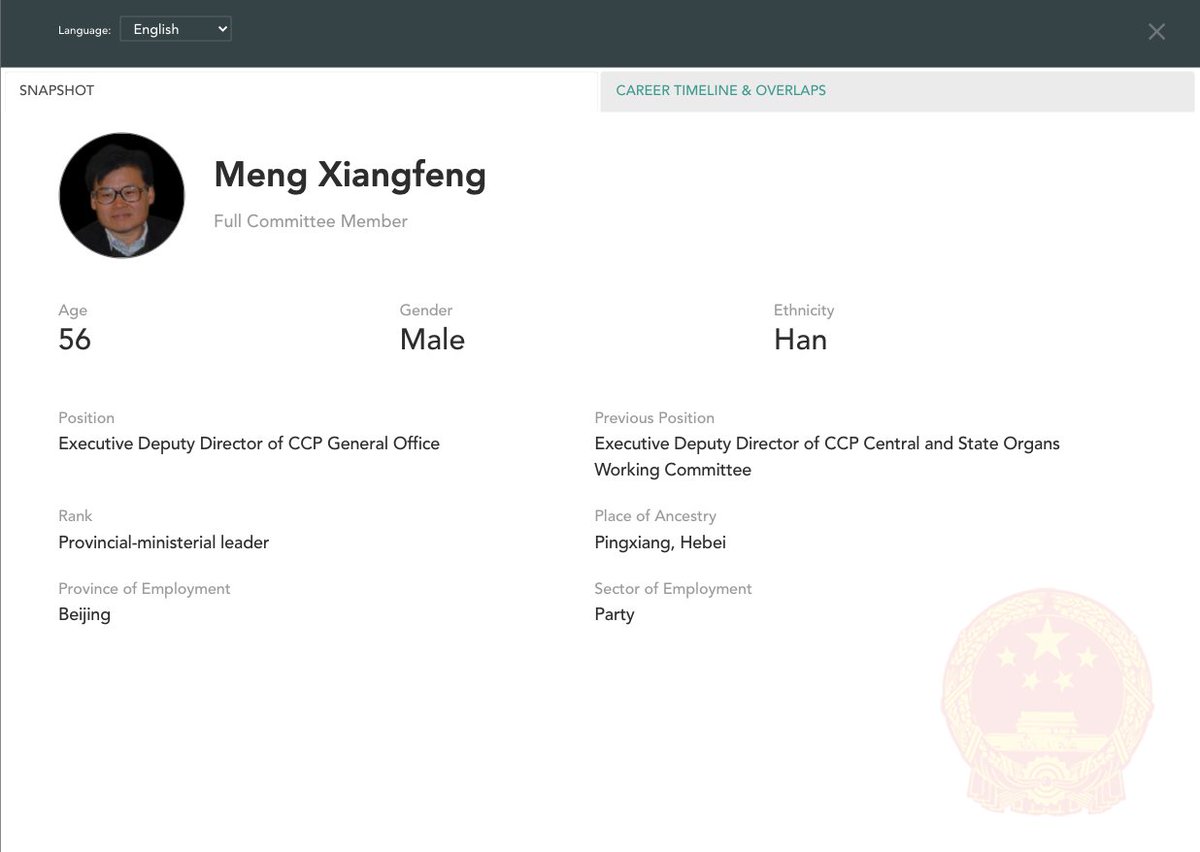

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)

In a high IV environment or when the market is very volatile

— Subhadip Nandy (@SubhadipNandy16) January 21, 2022

" OTM options will behave like ATM options", one will get almost the same delta movement

Say we have two options, one 50 delta ATM options and another 30 delta OTM option. Normally for a 100 point move, the ATM option will move 50 points and the OTM option will move 30 points. But in a high volatile environment, the OTM option will also move nearly 50 points

To understand why this happens, first understand why an ATM option is 50 delta. An ATM option has the probability of 50% of expiring as ITM. The price just has to close a rupee above the strike for the CE to be ITM and vice versa for PEs

Now think of a highly volatile day like today. If someone is asked where the BNF will close for the day or expiry, no one can answer. BNF can close freakin anywhere, That makes every option of an equal probability of being ITM. So all options have a 50% probability of being ITM

Hence, when a huge volatile move starts, all OTM options behave like ATM options. This phenomenon was first observed in the Black Monday crash of 1987 at Wall Street, which also gave rise to the volatility skew/smirk