Categories Finance

7 days

30 days

All time

Recent

Popular

Buffett's letters taught me more about investing than any business school ever could.

Even after investing for 14 years, I uncover new insights every time I reread his letters.

Recently, I reread his letters from 1977 to 2020 for a third time.

Here are my key insights:

1. Moat is NEVER stagnant

A company's competitive position either grows stronger or weaker each day.

Widening the moat must always take precedence over short-term targets.

2. Commodity businesses

A business without moat will have its returns competed away.

Regardless of improvement, your competitors will quickly copy your advantage away.

Where returns on capital is dismal, reinvestment will only destroy value.

3. The flywheel effect

Buffett was preaching about the flywheel effect before it became cool.

Back then, newspapers were similar to today's platform businesses like Amazon, Meta, and App Store.

More readers beget more advertisers beget more readers.

4. Operating leverage

Companies with high fixed costs and low variable costs will see earnings rise faster than revenue.

However, it cuts both ways.

It becomes a disaster when revenue is declining.

Check out my article on how operating leverage works: https://t.co/Nv747oBAK0

Even after investing for 14 years, I uncover new insights every time I reread his letters.

Recently, I reread his letters from 1977 to 2020 for a third time.

Here are my key insights:

1. Moat is NEVER stagnant

A company's competitive position either grows stronger or weaker each day.

Widening the moat must always take precedence over short-term targets.

2. Commodity businesses

A business without moat will have its returns competed away.

Regardless of improvement, your competitors will quickly copy your advantage away.

Where returns on capital is dismal, reinvestment will only destroy value.

3. The flywheel effect

Buffett was preaching about the flywheel effect before it became cool.

Back then, newspapers were similar to today's platform businesses like Amazon, Meta, and App Store.

More readers beget more advertisers beget more readers.

4. Operating leverage

Companies with high fixed costs and low variable costs will see earnings rise faster than revenue.

However, it cuts both ways.

It becomes a disaster when revenue is declining.

Check out my article on how operating leverage works: https://t.co/Nv747oBAK0

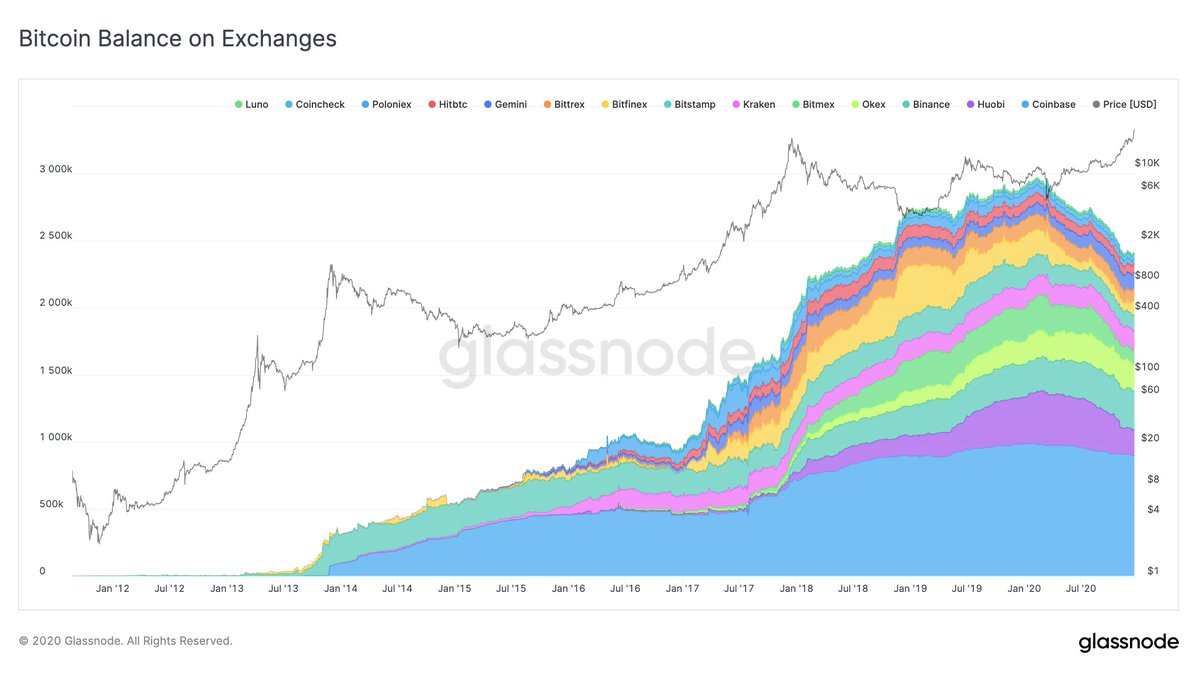

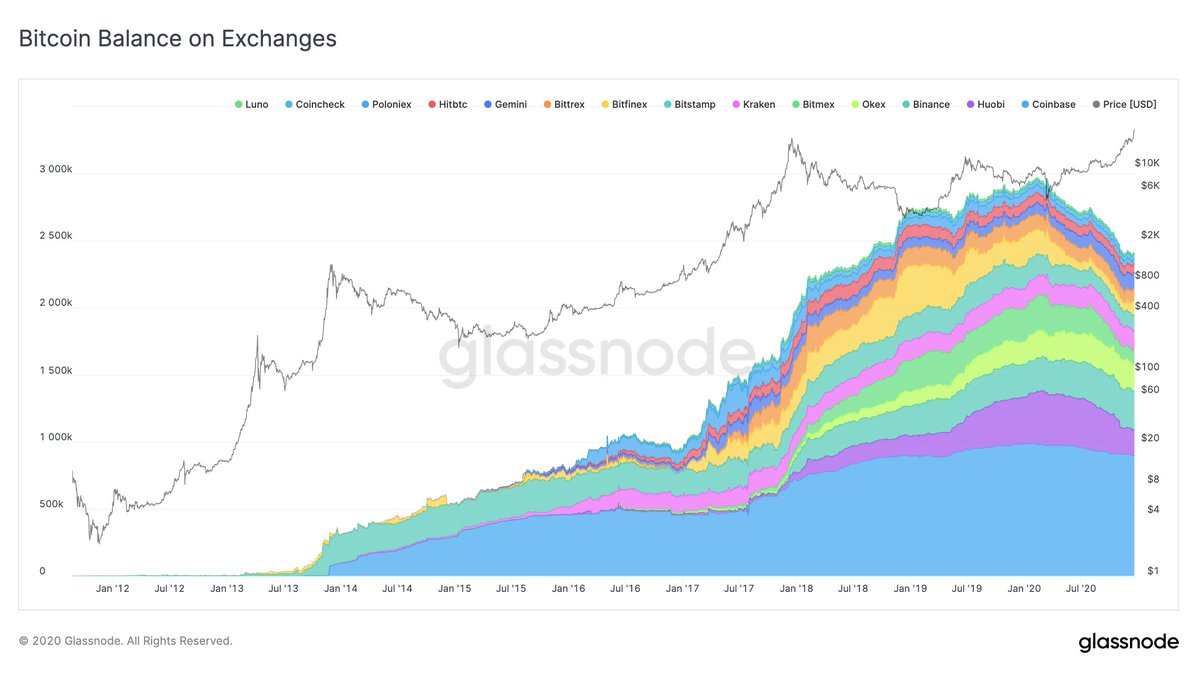

#Bitcoin is in a supply and liquidity crisis.

This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread 👇👇👇

1/ Accumulation Balance

The amount of bitcoins held in accumulation addresses is 2.7M BTC.

Those are addresses that have only received bitcoins, and never spent funds.

True HODLers, hoarding 14.5 % of the circulating supply.

#Bitcoin

Chart: https://t.co/IgKgCpz3Vi

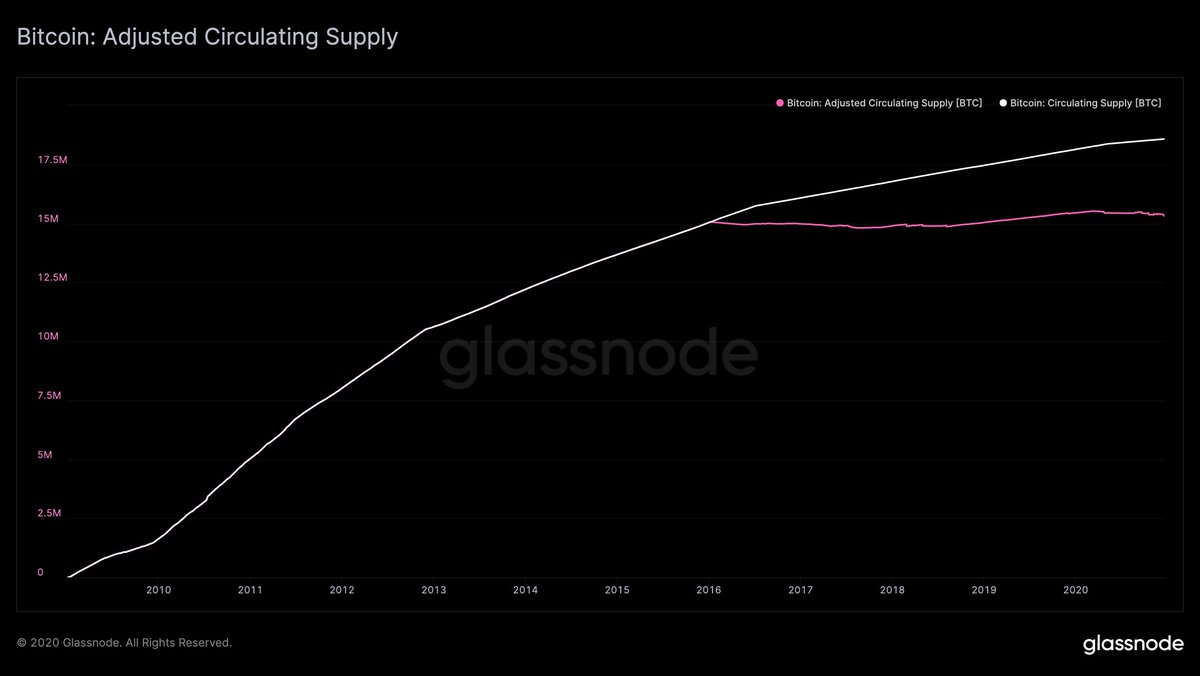

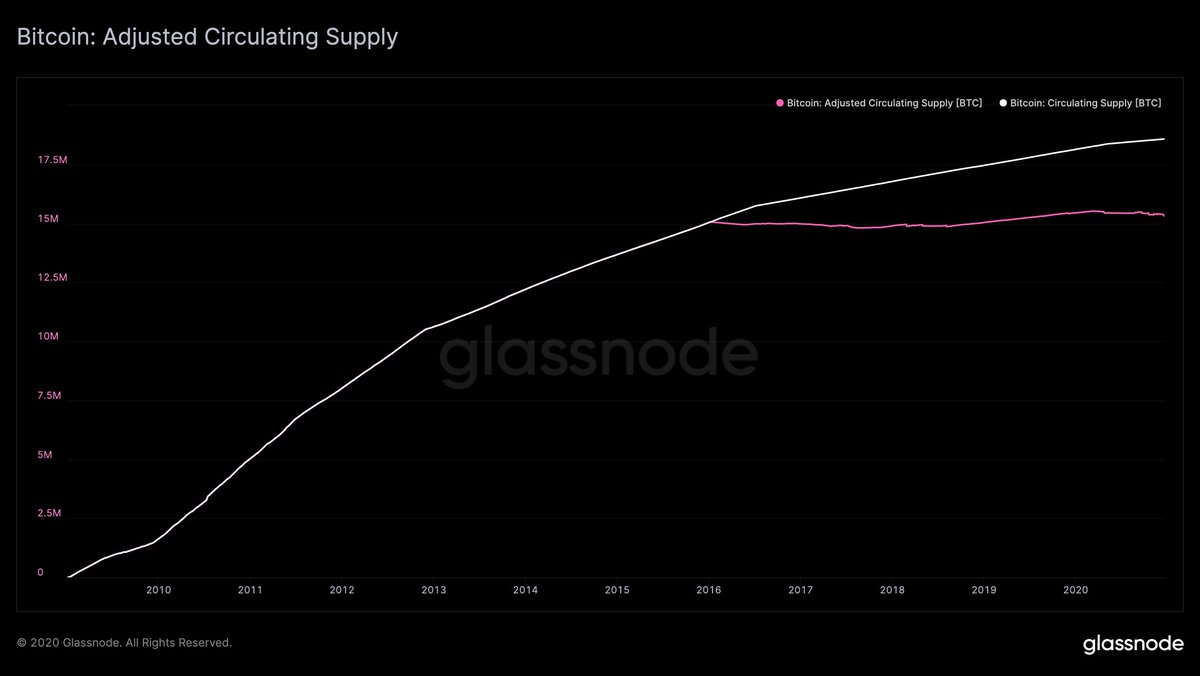

2/ Lost Coins

21 milltion bitcoins? You wish.

That's just the hard cap – considering lost coins, the real number is much less.

No one knows for sure how many, but estimations point to at least 3M.

That's 16% less circulating BTC available.

#Bitcoin

https://t.co/3WtnLBF4P1

3/ Institutional #BTC Demand

@Grayscale (573M BTC), @MicroStrategy ($475M), @sqcrypto ($50M), Ruffer ($745M), @massmutual ($100M) – all buying up supply.

Do you really think they're alone? Of course not.

Expect many more on the move. They're coming – gradually, then suddenly.

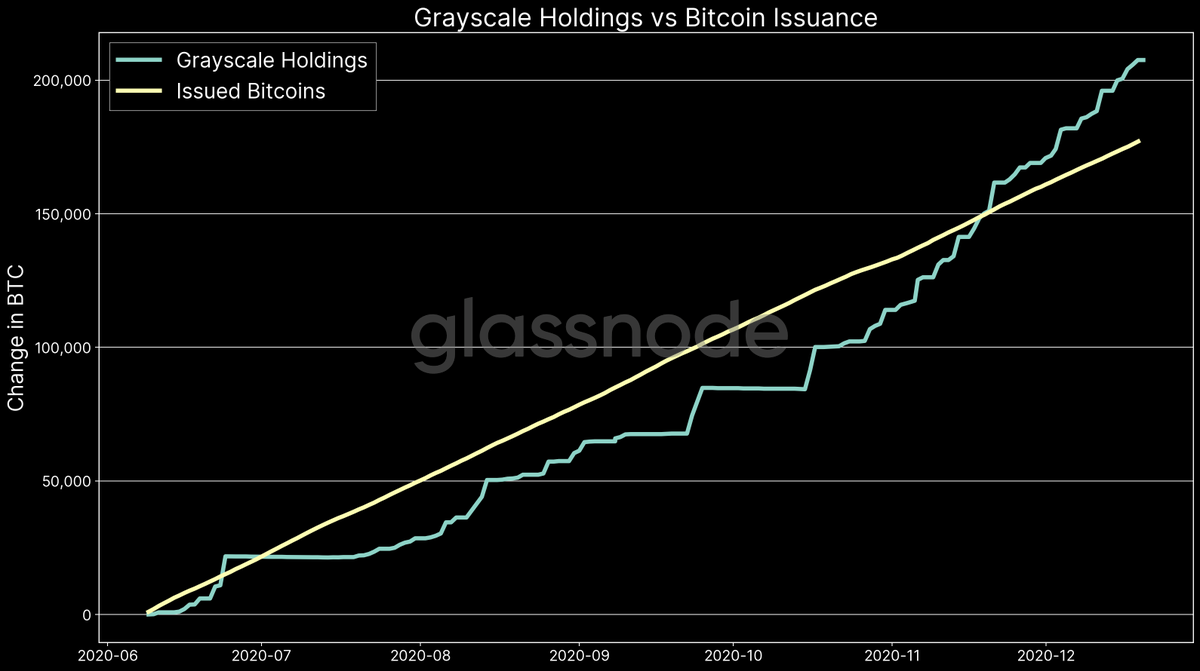

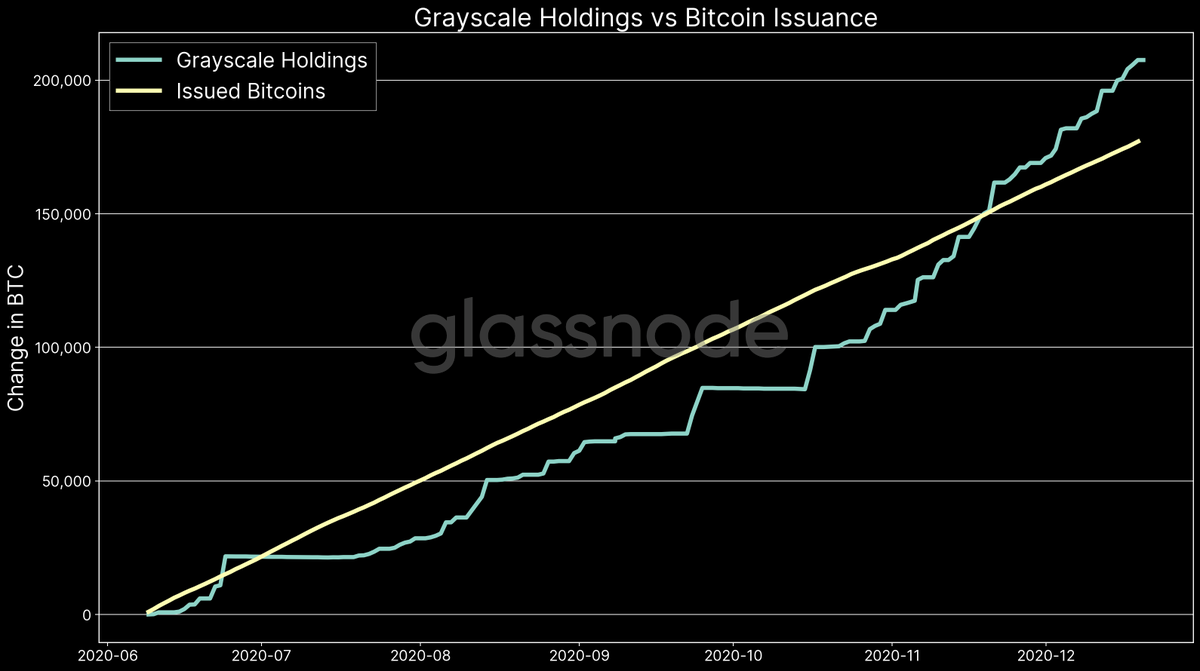

4/ Speaking of @Grayscale:

Bitcoins added to the Grayscale Bitcoin Trust in the past 6 months: ~210,000 BTC

Bitcoins mined in the past 6 months: ~185.000 BTC

That's right, Grayscale has been buying up more bitcoins than the amount issued.

Talk about a supply crisis!

#Bitcoin

This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread 👇👇👇

1/ Accumulation Balance

The amount of bitcoins held in accumulation addresses is 2.7M BTC.

Those are addresses that have only received bitcoins, and never spent funds.

True HODLers, hoarding 14.5 % of the circulating supply.

#Bitcoin

Chart: https://t.co/IgKgCpz3Vi

2/ Lost Coins

21 milltion bitcoins? You wish.

That's just the hard cap – considering lost coins, the real number is much less.

No one knows for sure how many, but estimations point to at least 3M.

That's 16% less circulating BTC available.

#Bitcoin

https://t.co/3WtnLBF4P1

3/ Institutional #BTC Demand

@Grayscale (573M BTC), @MicroStrategy ($475M), @sqcrypto ($50M), Ruffer ($745M), @massmutual ($100M) – all buying up supply.

Do you really think they're alone? Of course not.

Expect many more on the move. They're coming – gradually, then suddenly.

4/ Speaking of @Grayscale:

Bitcoins added to the Grayscale Bitcoin Trust in the past 6 months: ~210,000 BTC

Bitcoins mined in the past 6 months: ~185.000 BTC

That's right, Grayscale has been buying up more bitcoins than the amount issued.

Talk about a supply crisis!

#Bitcoin

here's a thread of valuable non-tech skills you can learn and master lol

https://t.co/IJL2g1HZp7 Signing + notary this channel highly recommend she gives good info

2. Insurance adjusting claims adjuster of the year goes over everything you need to become an adjuster and more and yeah she cool

Drones drone drones i swear drones are more than just taking photos lol swear drones gonna make me rich but yeah get your FAA 107 drone license and freelance and

4.Wholesaling

Learn how to help homeowners out of their tough situations they may be going through and flip real estate with little money

https://t.co/IJL2g1HZp7 Signing + notary this channel highly recommend she gives good info

2. Insurance adjusting claims adjuster of the year goes over everything you need to become an adjuster and more and yeah she cool

Drones drone drones i swear drones are more than just taking photos lol swear drones gonna make me rich but yeah get your FAA 107 drone license and freelance and

4.Wholesaling

Learn how to help homeowners out of their tough situations they may be going through and flip real estate with little money