Introducing “Financial Service Centers.” The future of the new Financial Service Industry.

There is a need that the banking system has provided for all of society that cannot be eliminated within the new Quantum Financial System./1

More from 신념의사나이

More from Finance

Below are some updated thoughts on potential integrations, improvements, and innovations for Saffron moving forward. ⬇️

1/11 @saffronfinance_ ($SFI) is DeFi's new kid on the block with its tranched yield product that is already live with DAI on @compoundfinance. https://t.co/JpqnxhwrDw

— Benjamin Simon (@benjaminsimon97) November 19, 2020

2/18 First, if you haven't seen @Privatechad_'s alpha-leaking introductory thread, you should check it out.

I agree that @AlphaFinanceLab and @CreamdotFinance, specifically the Iron Bank, would be ideal targets for SFI risk tranches.

15/. 3. Though not the focus atm, interest from various projects and integrations are happening.

— Private Chad (@Privatechad_) February 1, 2021

* Chainlink reached out (props to the amazing $LINK team).

* Talks with $ALPHA and rumored upon V2 releases there will be a collaboration.

*Cream integrations in v2

* $COMP tranches pic.twitter.com/IXCtzvSkw7

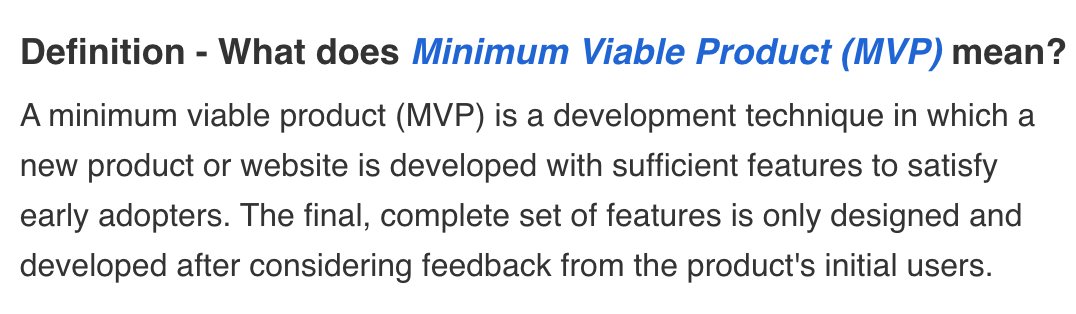

3/18 Speaking more broadly, Saffron is primarily integrated with @compoundfinance, which has served as a MVP of sorts.

The thing is, Compound is one of the safest (but also lowest yield) protocols in DeFi, so it's not surprising that there isn't much demand for the sen. tranche.

4/18 Expanding beyond Compound to higher-risk/higher-return protocols has always been key.

These protocols are the bread-and-butter target market for Saffron, and I would expect to see a surge in demand for senior tranche staking in these

4/11 Imo, the golden egg will be vault platforms like @iearnfinance, @picklefinance, etc.

— Benjamin Simon (@benjaminsimon97) November 19, 2020

Recently, some of these higher risk platforms (e.g. @harvest_finance) have been hit with a wave of attacks.

Saffron will enable cautious investors to use these products with peace of mind.

5/18 Additionally, @DeFiGod1 convinced me that Senior Tranche pools would be more appealing if they offered fixed yield.

Essentially, Saffron would augment the product offerings of @Barn_Bridge by also offering senior stakers insurance in the form of junior tranche collateral.

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

👇

Equity/ownership is a force. Getting it in the hands of the right people generously will drive alignment and execution.

— Joey Santoro (@Joey__Santoro) January 21, 2021

It is a joyful and serious responsibility \U0001f332

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

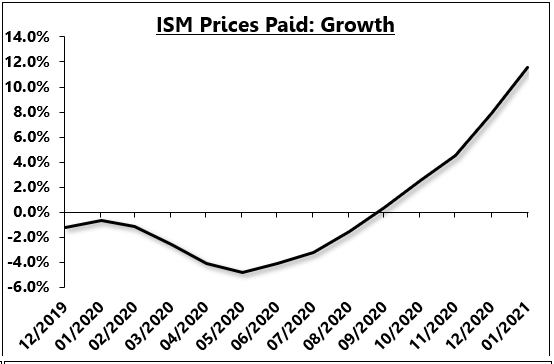

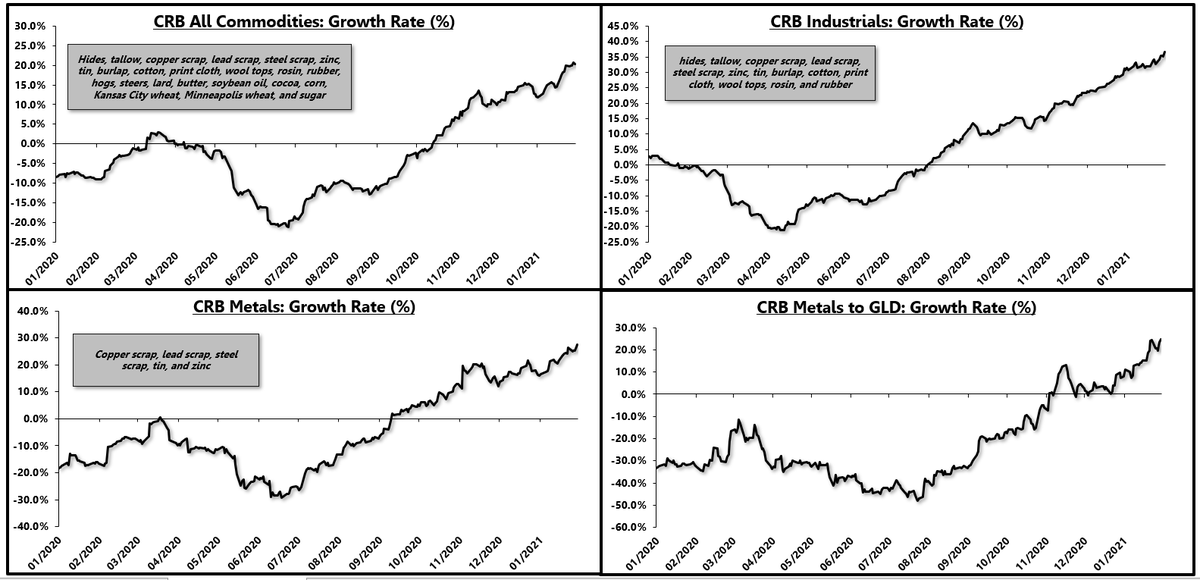

Last month I wrote about the distinction between long-term secular inflation and shorter-term cyclical inflation

It has been clear for several months that we are in the middle of a cyclical rise in

Now, in the short-term, the manufacturing sector is red hot, driven by a pent-up demand rebound in goods consumption.

— Eric Basmajian (@EPBResearch) January 4, 2021

Commodity prices are screaming which gives legs to "goods" inflation in the short-term.

8) pic.twitter.com/rQcqHf1OD0

The full thread can be reviewed here:

Consensus continues to conflate the inflation story, mixing and matching long-term and short-term charts to fit what is generally a secular inflation narrative.

— Eric Basmajian (@EPBResearch) January 4, 2021

Here are my two cents to make the distinction clear.

1)

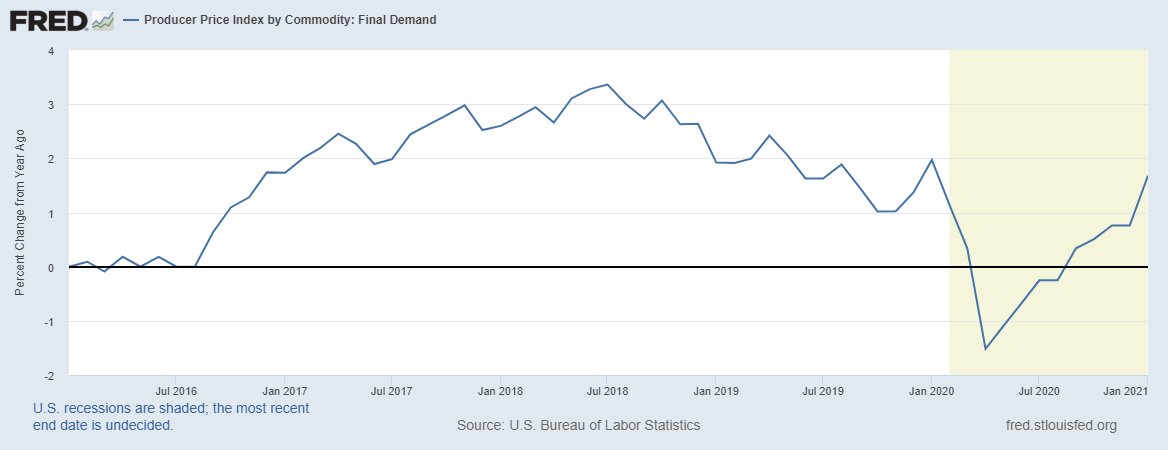

Today's PPI report should have been expected to surprise to the upside as the leading indicators of inflation have been screaming to the upside for months!

Here is the ISM prices paid index, cumulated into a growth rate

3/

Industrial commodity prices have also seen a major acceleration for months.

4/

So today's PPI report was in line with the leads, suggesting that we have a cyclical upturn in inflation that is * primarily concentrated in the manufacturing sector *

This is a key point.

5/

You May Also Like

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal

Mr. Patrick, one of the chief scientists at the Army Biological Warfare Laboratories at Fort Detrick in Frederick, Md., held five classified US patents for the process of weaponizing anthrax.

2/x

Under Mr. Patrick’s direction, scientists at Fort Detrick developed a tularemia agent that, if disseminated by airplane, could cause casualties & sickness over 1000s mi². In a 10,000 mi² range, it had 90% casualty rate & 50% fatality rate

3/x His team explored Q fever, plague, & Venezuelan equine encephalitis, testing more than 20 anthrax strains to discern most lethal variety. Fort Detrick scientists used aerosol spray systems inside fountain pens, walking sticks, light bulbs, & even in 1953 Mercury exhaust pipes

4/x After retiring in 1986, Mr. Patrick remained one of the world’s foremost specialists on biological warfare & was a consultant to the CIA, FBI, & US military. He debriefed Soviet defector Ken Alibek, the deputy chief of the Soviet biowarfare program

https://t.co/sHqSaTSqtB

5/x Back in Time

In 1949 the Army created a small team of chemists at "Camp Detrick" called Special Operations Division. Its assignment was to find military uses for toxic bacteria. The coercive use of toxins was a new field, which fascinated Allen Dulles, later head of the CIA