Most feel bcoz of higher demand & lower supply but that’s nt the only factor. Imagine there is a shortage of laptops wrt the demand, but there is no liquidity in the market (people don’t have monies) will the price of laptop ⬆️? No

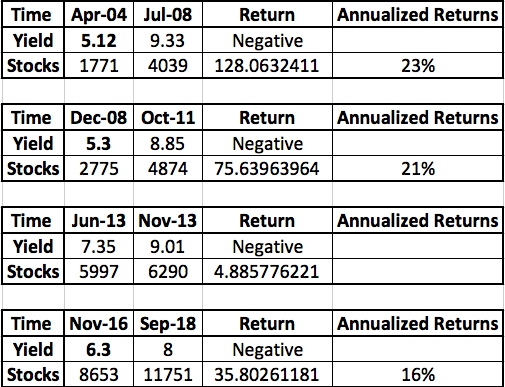

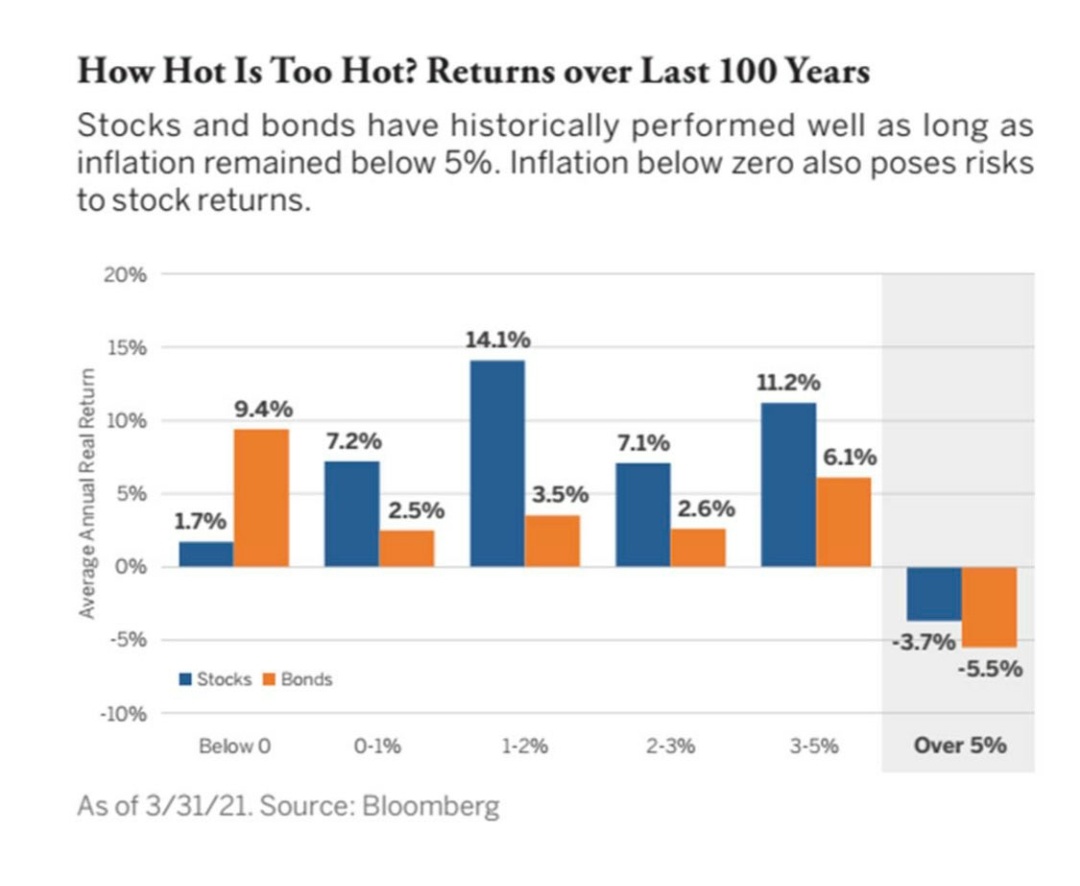

Does increase in Inflation & hence interest rates lead to a fall in equity? While theoretically yes, practically the last 20 years of data shows otherwise

Please ‘re-tweet’ 🧵& help us educate more retail investors

#Investing

Most feel bcoz of higher demand & lower supply but that’s nt the only factor. Imagine there is a shortage of laptops wrt the demand, but there is no liquidity in the market (people don’t have monies) will the price of laptop ⬆️? No

Repo rate is the rate @ which banks borrow 4m RBI. If Repo⬆️, the cost at which banks borrow is expected to ⬆️. Also the MCLR/Base rate 4 banks includes the repo rate 4 calculation & hence it is expected that if Repo ⬆️, banks will ⬆️ their lending rates. (7/n)

(b) 08-11, rates went up, equity generates 21% CAGR

(c) 2013, too small a time frame but the same reading

(d) 16-18, rates went up, equity generated 16% CAGR

#investing (14/n)

(a) In lower interest rate scenarios, corporates can raise loans at considerably low rates and redeploy it to generate higher ROCE’s till rates actually start rising much later (15/n)

#investing

Have earlier written on,

Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below, https://t.co/UrRt87OLLF…… (**END**)

Here\u2019s a compilation of Personal Finance threads I have written so far. Thank you for motivating me to do it.

— Kirtan A Shah (@KirtanShahCFP) December 13, 2020

Hit the 're-tweet' and help us educated more investors

More from Kirtan A Shah

Last Akshay Tritiya, had written the below thread 🧵 on which is the best way to buy gold, Physical, Digital, ETF or Sovereign Gold Bond and why?

Do re-tweet and help us educate more retail investors

#investing

Do re-tweet and help us educate more retail investors

#investing

What better day to discuss Gold, isn\u2019t it?

— Kirtan A Shah (@KirtanShahCFP) November 13, 2020

Topic - Physical Gold v/s Digital Gold v/s Gold ETF v/s Sovereign Gold Bond (SGB)

(Thread) \u2013 DO RE-TWEET FOR A LARGER REACH :)

(1/n)

More from Finance

You May Also Like

This is a pretty valiant attempt to defend the "Feminist Glaciology" article, which says conventional wisdom is wrong, and this is a solid piece of scholarship. I'll beg to differ, because I think Jeffery, here, is confusing scholarship with "saying things that seem right".

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?

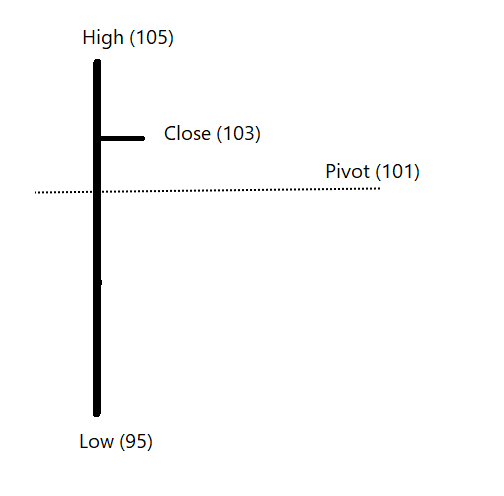

There are many strategies in market 📉and it's possible to get monthly 4% return consistently if you master 💪in one strategy .

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

![Peter McCormack [Jan/3\u279e\u20bf \U0001f511\u220e]](https://pbs.twimg.com/profile_images/1524287442307723265/_59ITDbJ_normal.jpg)