The most common problem faced by day-traders and it's easy solution which is extremely difficult to implement.

A thread.

( uses concepts I have discussed many times before in separate threads)

Train ---- Play tournaments --- Rest

Rest = taking time off markets

Train = trading in markets in training mode

Understanding REST is easy, simply take time off markets and spend time with family or do something you love

Paper trading or trading on a simulator is never good training as it never gives you the same psychological issue while actual trading. Deep down you know this is fake, you are not making or losing actual money

Trade 1 lot ( I am speaking about intraday options trading, cash traders can do this with a simple share of any stock) following your system/process for one month. This sounds easy, right?

First month = 1 lot

2nd month = 2 lots

3rd month = 4 lots

4th month = follow money mgmt/position sizing with a small bet per trade

Same with trading. Best of luck ! 🙏

https://t.co/oqCwSz8kfW

Perhaps you have the idea that calling me " 1 lot Nandy" is somehow derogatory and a easy poke at me. Allow me to explain why I look at this moniker as a badge of honour https://t.co/1Q8tOQ2U6a

— Subhadip Nandy (@SubhadipNandy16) July 16, 2021

More from Subhadip Nandy

What do you think/use as the most robust leading indicator if following technical analysis ? Please answer with reason , I will provide my answer after 2 hours

— Subhadip Nandy (@SubhadipNandy16) August 12, 2019

( At Delhi airport , bored as hell )

This thread actually had some great answers , one can learn a lot about the thought processes of different traders from the answers. Please go thru them

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

More from Finance

👇

Equity/ownership is a force. Getting it in the hands of the right people generously will drive alignment and execution.

— Joey Santoro (@Joey__Santoro) January 21, 2021

It is a joyful and serious responsibility \U0001f332

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

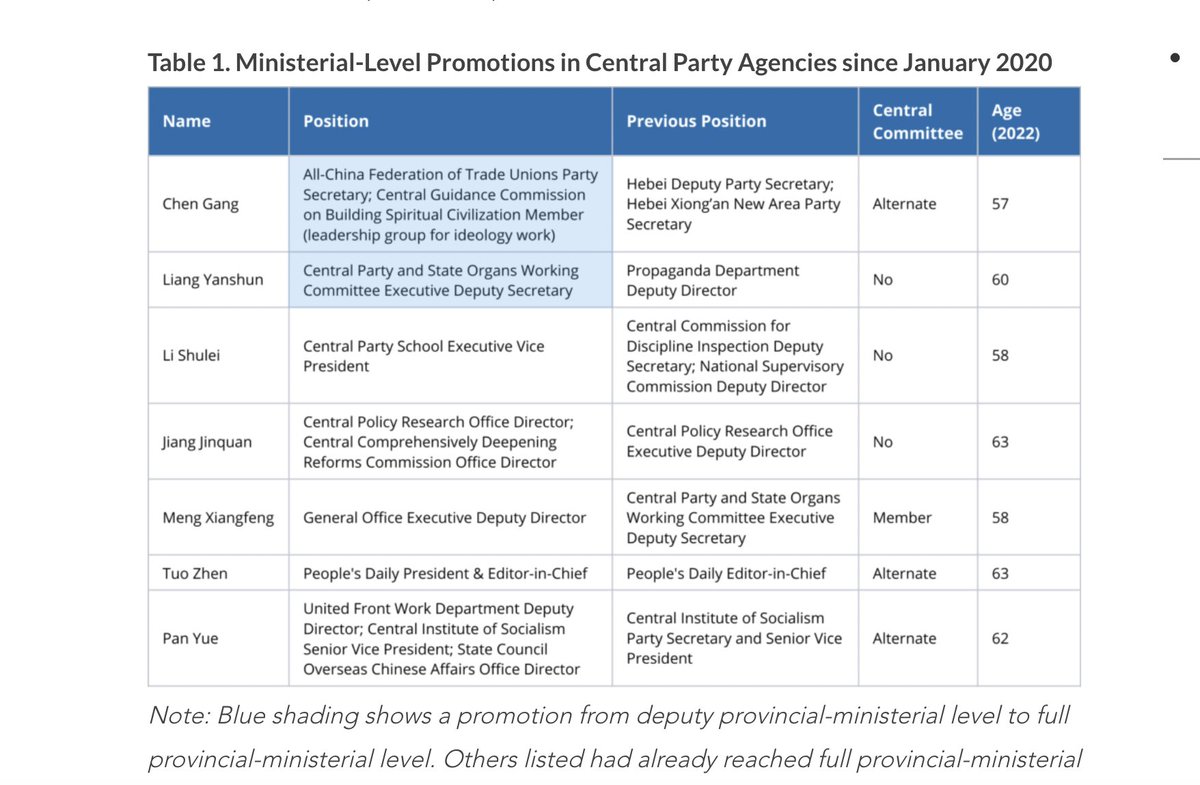

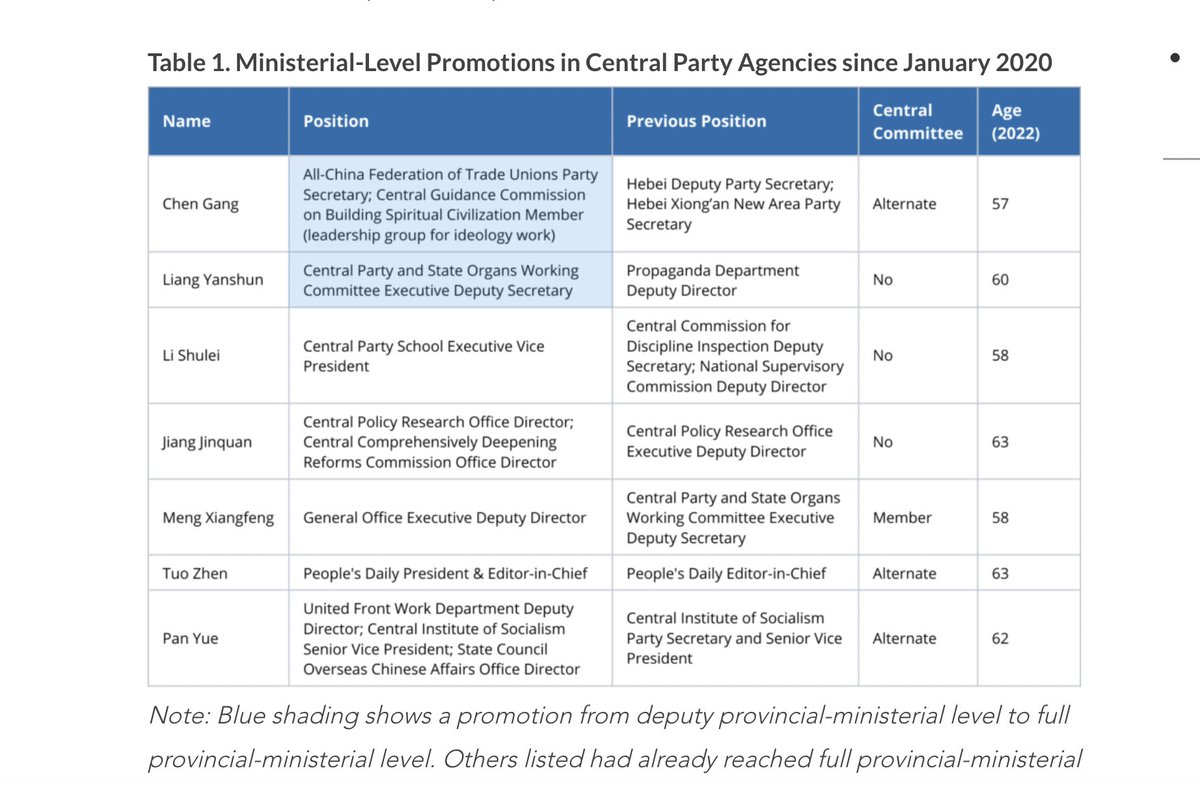

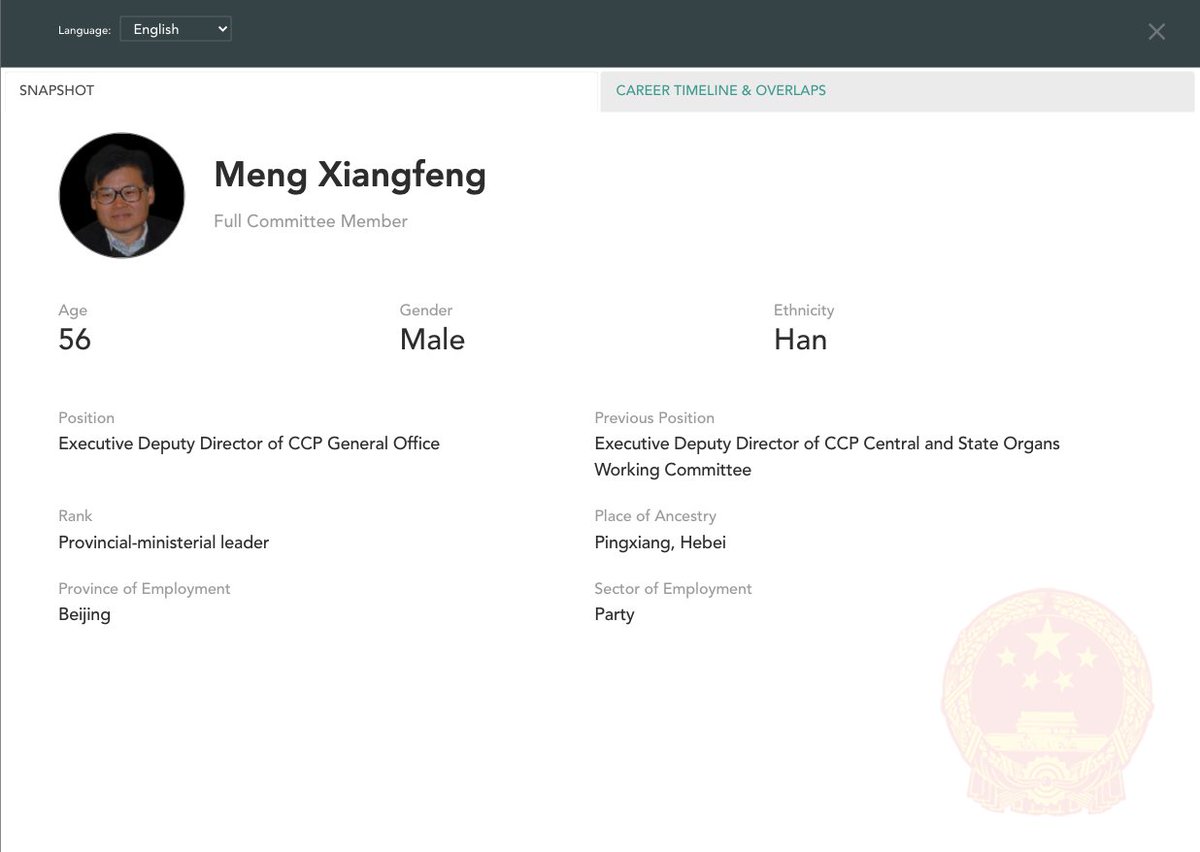

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)

What do you think/use as the most robust leading indicator if following technical analysis ? Please answer with reason , I will provide my answer after 2 hours

— Subhadip Nandy (@SubhadipNandy16) August 12, 2019

( At Delhi airport , bored as hell )

This thread actually had some great answers , one can learn a lot about the thought processes of different traders from the answers. Please go thru them

![Peter McCormack [Jan/3\u279e\u20bf \U0001f511\u220e]](https://pbs.twimg.com/profile_images/1524287442307723265/_59ITDbJ_normal.jpg)