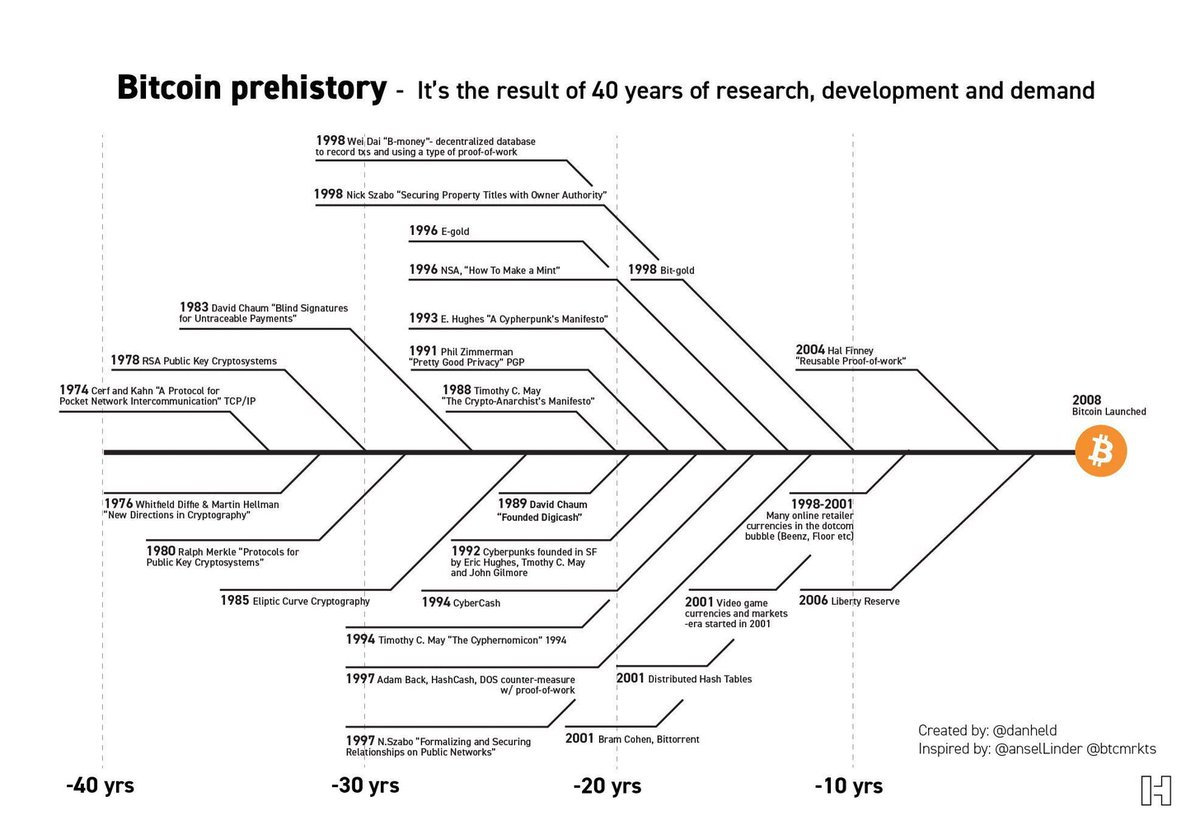

He had been working on Bitcoin for at least a year and a half before publishing the white paper.

1/ Bitcoin: a bold new world.

Satoshi published the white paper on 10/31/2008. Right at the moment of peak despair during the 2008 financial crisis. Trust had been lost in a world that ran on trust.

He had been working on Bitcoin for at least a year and a half before publishing the white paper.

Satoshi was ready and waiting to hit the send button throughout 2008. What was so special about October 31st?

The early Catholic church, in an attempt to gain believers, adopted Samhain, and created “All Saints Day” to coincide on 10/31. This is what we call “Halloween” or “All hallows’ eve"

Similarly, Satoshi was outraged at the massive breach of trust by existing financial institutions:

“The present is theirs; the future, for which I really worked, is mine.” - Nikola Tesla

Sign up here to receive it first👇

https://t.co/TYJDEruzvc

More from Dan Held

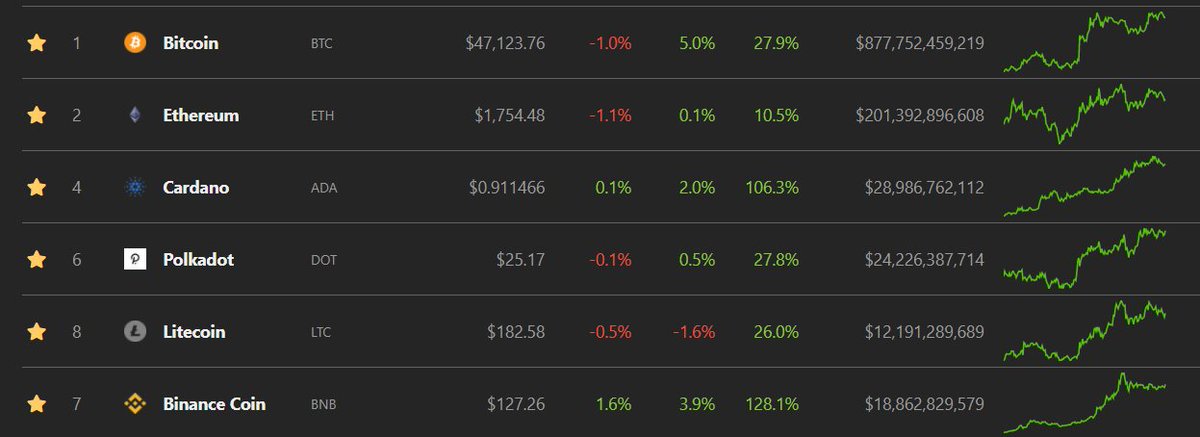

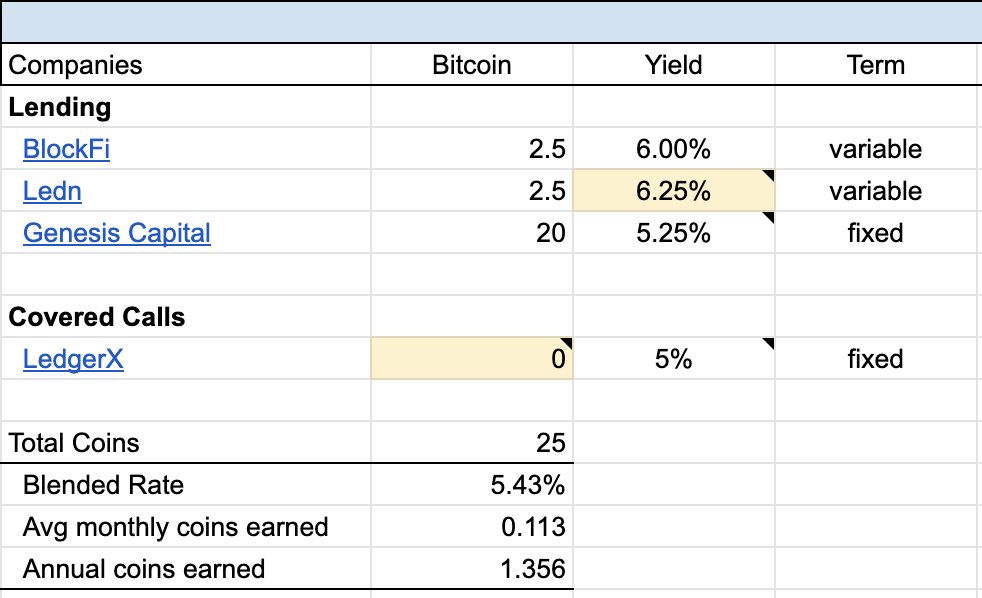

1/ [December Bitcoin yield update]

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

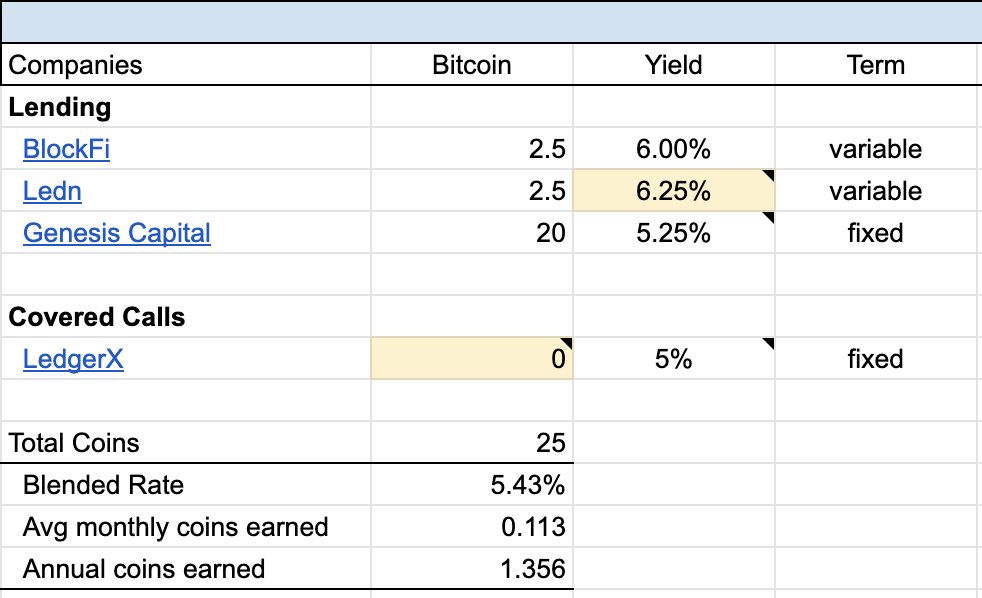

Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here’s my journey and how to guide👇

2/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://t.co/4x0YATuQ0v

- BlockFi: https://t.co/90Xtg2cNka

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://t.co/2iQVkXlylP

- LedgerX:

3/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

Below is my current allocation for Dec (will update MoM)

(yellow = changes)

https://t.co/PZwVYs8lFT

4a/ [Nov > Dec Changelog]

- Covered calls: approx. 4 BTC was in $40k 12/28/20 contracts. Those closed without them being exercised (a good outcome for me). However, I was nervous about my January 1/28 $50k contract so I decided to close out my position at a small loss.

4b/ [Nov > Dec Changelog]

- In process of reallocating the 5 BTC (probably will be a lending platform).

- I incorrectly had my Ledn rate at 6.5%, it's 6.25%

More from Crypto

Michael Pettis @michaelxpettis argues that it is not always obvious who (China or the U.S.) adjusts best to "turbulent changes."

Bitcoin answers that question.

Thread:

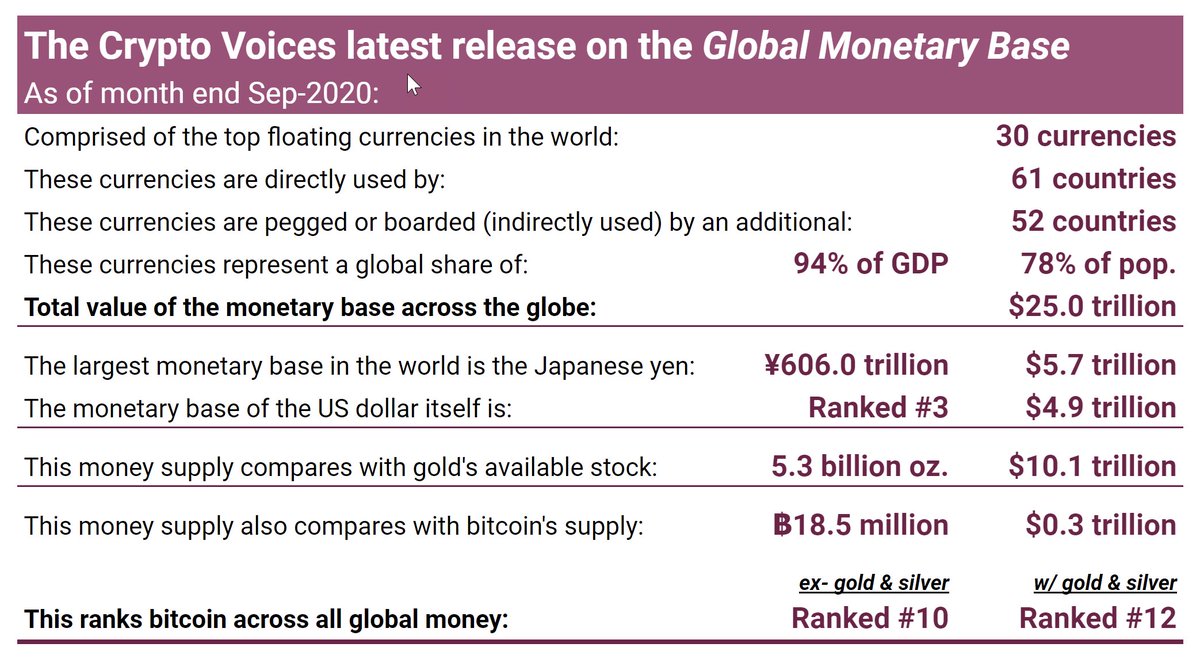

World economies currently suffer four major redistribution challenges:

The most important is increasing government stealth use of the monetary system to confiscate assets from productive actors.

/2

That process is exacerbated by "Cantillon Effect" transfers to interest groups close to government ("the entitled class," public sector workers, the medical industrial complex, academia, etc....), which is destroying much of that wealth /3

The shadow nature (see Keynes) of government inflation makes the process unidentifiable, un-addressable and undemocratic.

The biggest victims (America's poorly educated young) are unequipped to counter generational confiscation tactics of today's wily senior beneficiaries. /4

Government control of the numéraire in key economic statistics (GDP, inflation, etc...) makes it impossible for economic actors to measure progress and liabilities. /5

Bitcoin answers that question.

Thread:

1/11

— Michael Pettis (@michaelxpettis) January 11, 2021

An article worth thinking about: \u201cAs changes to the world structure accelerate, China\u2019s rule is in sharp contrast with the turmoil in the West,\u201d says Beijing.

I agree, but I draw a different conclusion. The world is certainly currently going...https://t.co/ugha7ygqqx

World economies currently suffer four major redistribution challenges:

The most important is increasing government stealth use of the monetary system to confiscate assets from productive actors.

/2

That process is exacerbated by "Cantillon Effect" transfers to interest groups close to government ("the entitled class," public sector workers, the medical industrial complex, academia, etc....), which is destroying much of that wealth /3

The shadow nature (see Keynes) of government inflation makes the process unidentifiable, un-addressable and undemocratic.

The biggest victims (America's poorly educated young) are unequipped to counter generational confiscation tactics of today's wily senior beneficiaries. /4

Government control of the numéraire in key economic statistics (GDP, inflation, etc...) makes it impossible for economic actors to measure progress and liabilities. /5