He says that no authority seems to be looking into the grievances of the borrowers.

<< 𝙇𝙤𝙖𝙣 𝙈𝙤𝙧𝙖𝙩𝙤𝙧𝙞𝙪𝙢 & 𝙄𝙣𝙩𝙚𝙧𝙚𝙨𝙩 𝙒𝙖𝙞𝙫𝙚𝙧 >>

#SupremeCourt bench led by Justice Ashok will today take up plea(s) seeking extension of loan moratorium owing to the pandemic alongwith sector-specific plea’s.

@RBI

#loan

#loanmoratorium #ExtendMoratorium

He says that no authority seems to be looking into the grievances of the borrowers.

He adds that he is unable to understand how the RBI is holding the borrowers hands with the present policy stipulations.

“But there has to be a cut off date. Otherwise how will there be invocation?” Justice Reddy asks

More from Live Law

More from Court

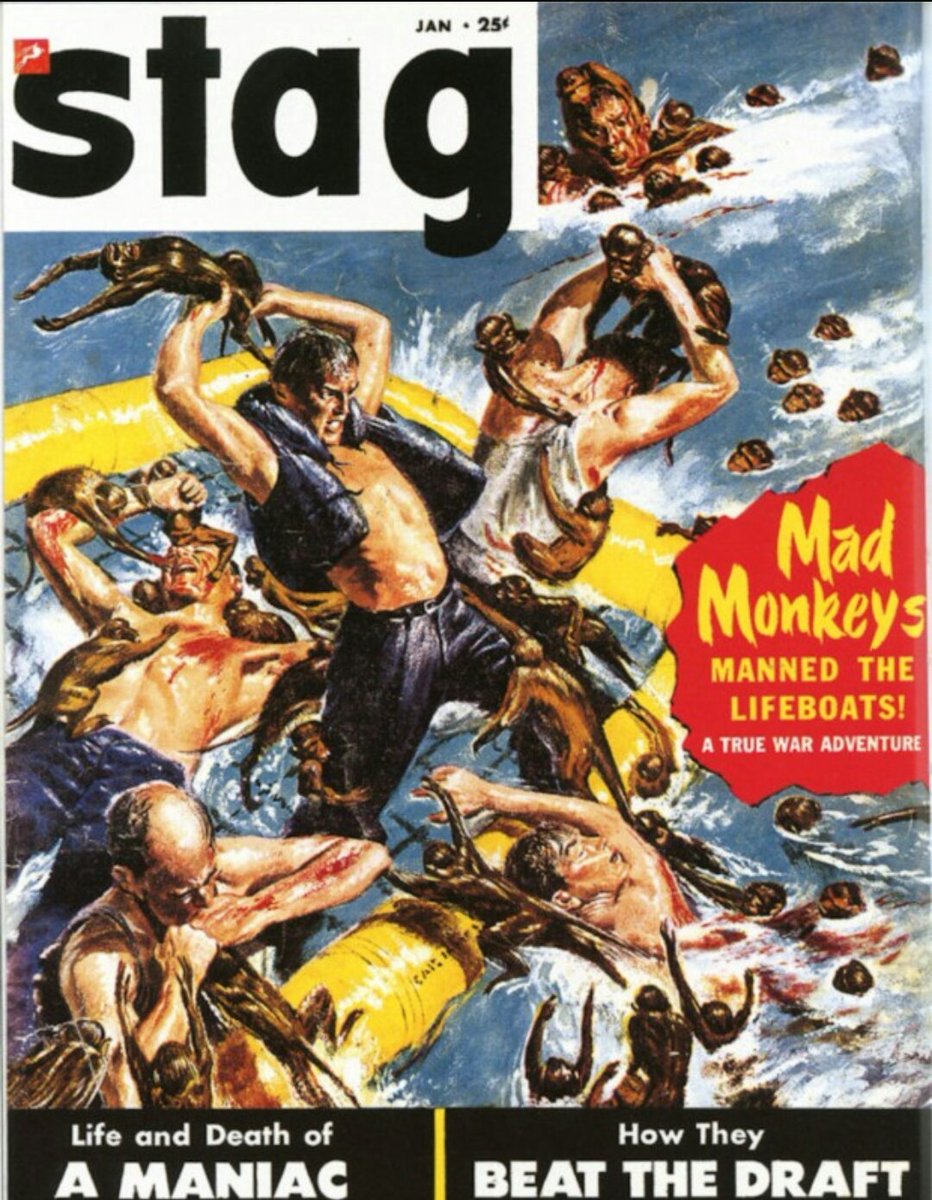

so @tedwheeler did you hear? today we are discussing "public whippings" thanks to @JamesBuchal

its a great chance to study the history of public beatings.

understandably, women feel threatened. https://t.co/jck05JGM4B

#PDX #tourism

FIRST OREGON WIFE-BEATER TO RECEIVE WHIPPING POST PUNISHMENT

https://t.co/3SJOODbuLf

PORTLAND. Or., June 7—The whipping post law passed at the last session of the Legislature was Into execution for the first time today, the victim being Charles Mcdlnty, convicted of wlfe-beatlng

whip was a braided blacksnake, made of rawhide, with four lashes. ..hustled to jail, stripped to the

waist, manacled, and his hands tied to the door high above his head. The whipping was as severe as the powerful deputy was capable of administering. Blood drawn on the 4th blow.

its a great chance to study the history of public beatings.

understandably, women feel threatened. https://t.co/jck05JGM4B

#PDX #tourism

@MultCoDA https://t.co/GgR1rCGIdG @OregonStateBar @BrentWeisberg @USAO_OR

— braingarbage (@braingarbage) November 28, 2020

Even if this is a "joke" or a drunk tweet, it appears that he is inciting gender-based violence on a woman via Twitter@twittersupport pic.twitter.com/TcaBiQ2wvU

FIRST OREGON WIFE-BEATER TO RECEIVE WHIPPING POST PUNISHMENT

https://t.co/3SJOODbuLf

PORTLAND. Or., June 7—The whipping post law passed at the last session of the Legislature was Into execution for the first time today, the victim being Charles Mcdlnty, convicted of wlfe-beatlng

whip was a braided blacksnake, made of rawhide, with four lashes. ..hustled to jail, stripped to the

waist, manacled, and his hands tied to the door high above his head. The whipping was as severe as the powerful deputy was capable of administering. Blood drawn on the 4th blow.