—SOME QUESTIONS A GOOD JOURNALIST MIGHT ASK POLITICIANS & PUBLIC HEALTH AUTHORITIES: A THREAD—

1/ Why has the government NEVER undertaken a comprehensive impact assessment before approving & re-approving highly intrusive & costly lockdowns?

https://t.co/dcSlgZFhtr

More from Category c19

Are you ready to explore? 1/n

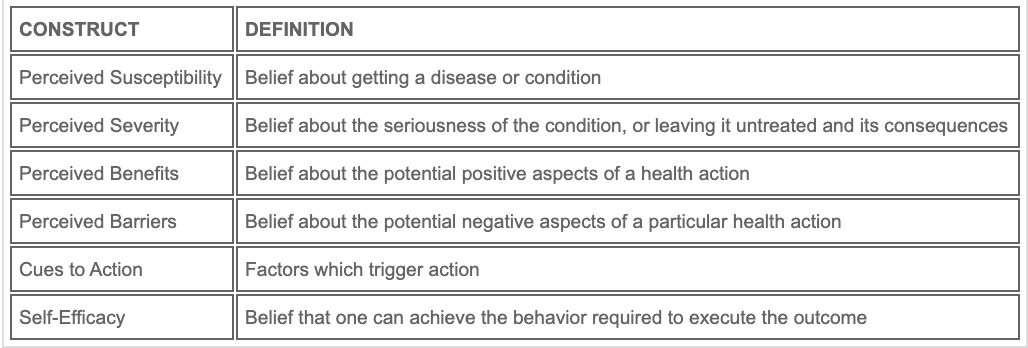

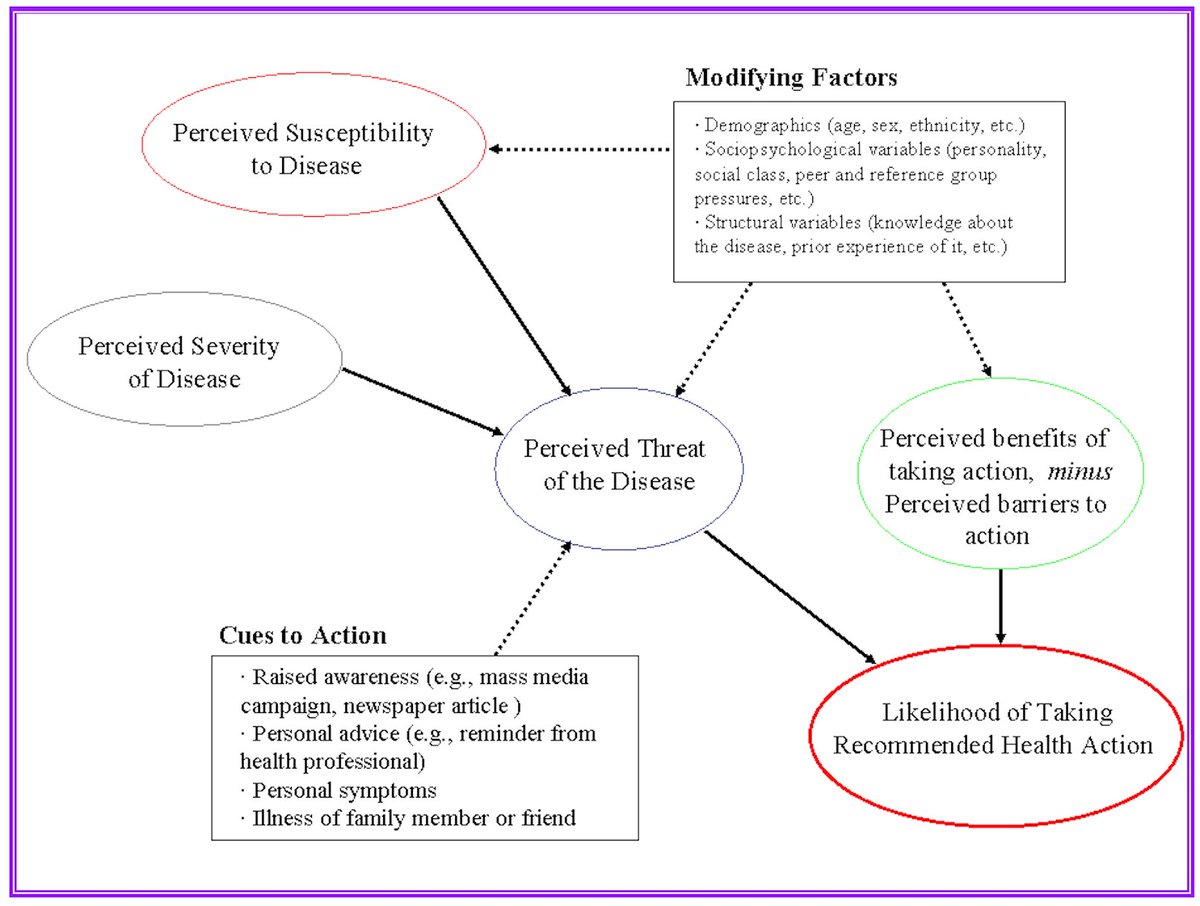

The Health Belief Model (HBM) consists of 5 components: perceived threat (lethality + Susceptibility),

perceived benefits,

perceived barriers and

cues to action.

Familiarise yourself with the definition of each concept in this table. 2/n

https://t.co/1tOz1cJFvc

Study this diagram to understand how the components are interrelated. 3/n

https://t.co/iUoaqNkgyP

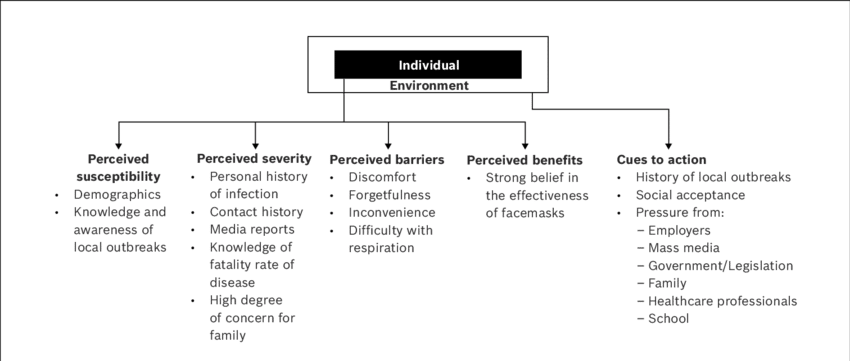

Now let’s apply this to the COVID 19 pandemic.

Review this diagram to see how the HBM applies to the behaviour of mask-wearing.

“perceived susceptibility appeared to be the most significant factor determining compliance” 4/n

https://t.co/xF6uwUx12N

Part I: The HBM

Increase the perceived threat of a disease

1) increase perceived severity: Confusing the general public with CFR & IFR- 2 indicators that are an order of magnitude apart.

People understood wrongly that the fatality rate of C19 is

"Globally, about 3.4% of reported #COVID19 cases have died. By comparison, seasonal flu generally kills far fewer than 1% of those infected"-@DrTedros #coronavirus

— World Health Organization (WHO) (@WHO) March 3, 2020

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020