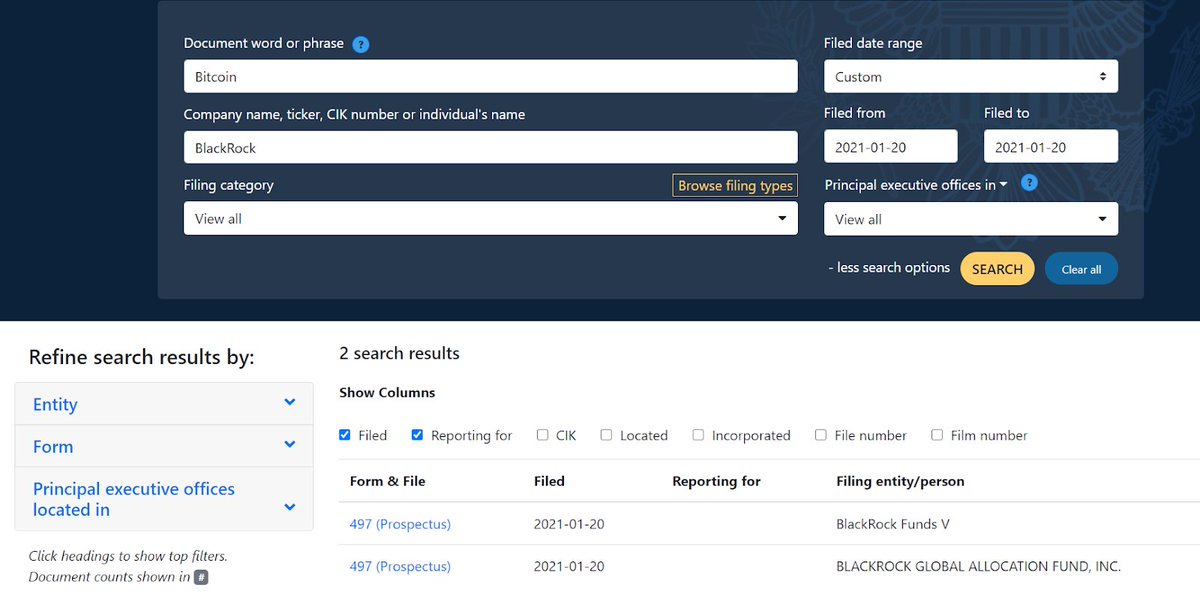

#BlackRock, the world’s largest asset manager with $7.81 trillion AUM, recently granted two of its funds the ability to invest in #Bitcoin futures.

Here's why I think BlackRock investing in Bitcoin futures is bearish, and could result in a major downturn in the coming months.

With Futures, they can either short or long. Considering BlackRock's historically bearish stance on BTC, It's quite clear they will be shorting.

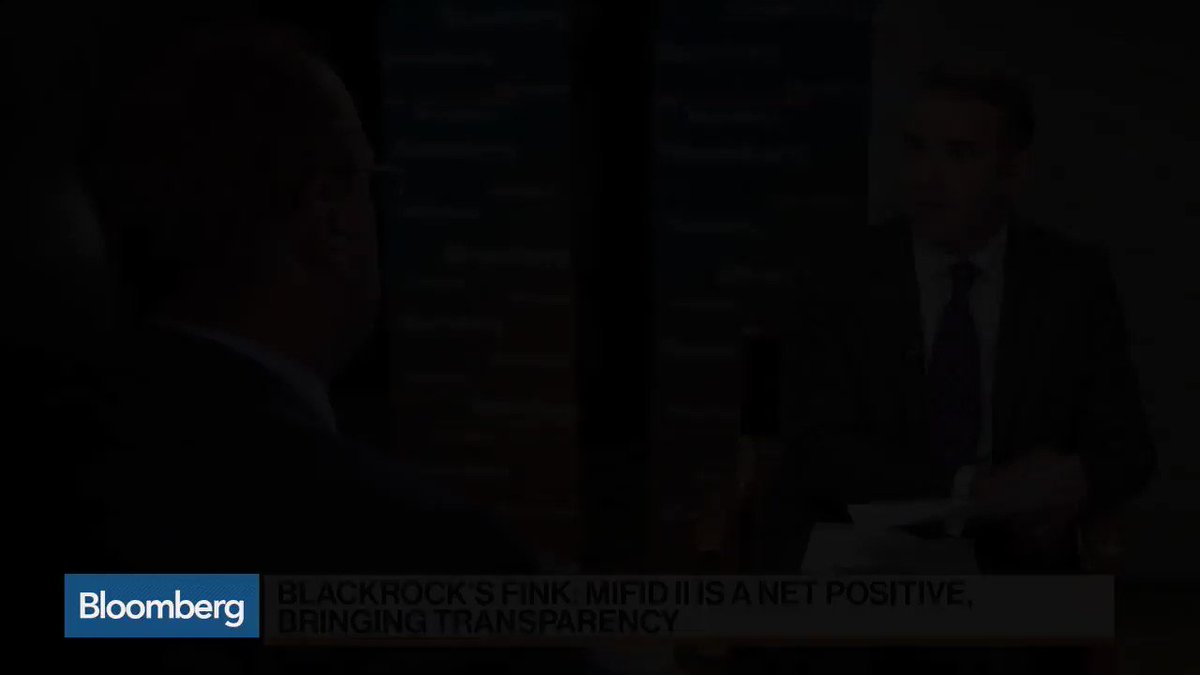

With their large cash size, BlackRock will be the largest player in this market. They can and will tank Bitcoin's price to avoid paying out. Banks have done it before...

They went live in December 2017. This was the perfect tool for Wall Street to take control of Bitcoin, and short it.

We saw an 85% crash in the proceeding months.

Over $200 billon was wiped from the crypto markets as the news spread. For something apparently so bullish, that's an odd reaction, don't you think?

Bitcoin is up over 1000% since March. If you really think the largest asset manager in the world is going to FOMO in at ATH's, I don't know what to tell you.

This is because they will be able to artificially suppress it, just like they did to Gold futures in the past.

More from Bitcoin

$BTC views

Price needs to let volatility wear off before its next big move. Thinking 30K-40K range for the next 1-2 weeks. Then either 50K straight or after piercing 30K and bouncing back above 30K within 1-2 days.

$27500-$27000 is the key area. If price heads back down to 30K, expect 30K to be breached, fall to that area, and bounce back. FAST. All very fast.

What do I do with this information?

Simple.

I'm trading the range against a core position. Buying when price pushes lower, selling when higher. It's like playing the achordeon. There's always air left inside.

Where exactly?

Nowhere.

I don't use limits for that. $BTC is liquid enough to trade at market without issues.

I'm watching PA, volume and rates for buying and euphoria as reflected in rates for reducing.

Decision making is dynamic. Nothing is set in stone. But most likely if price heads back down to 30K 'll be holding off next time. The gameplan is to have ammo to buy the dip (to redeploy). If 30K breaks absolutely no buying until down to 27Ks or back above 30K.

Price needs to let volatility wear off before its next big move. Thinking 30K-40K range for the next 1-2 weeks. Then either 50K straight or after piercing 30K and bouncing back above 30K within 1-2 days.

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

$27500-$27000 is the key area. If price heads back down to 30K, expect 30K to be breached, fall to that area, and bounce back. FAST. All very fast.

What do I do with this information?

Simple.

I'm trading the range against a core position. Buying when price pushes lower, selling when higher. It's like playing the achordeon. There's always air left inside.

Where exactly?

Nowhere.

I don't use limits for that. $BTC is liquid enough to trade at market without issues.

I'm watching PA, volume and rates for buying and euphoria as reflected in rates for reducing.

Decision making is dynamic. Nothing is set in stone. But most likely if price heads back down to 30K 'll be holding off next time. The gameplan is to have ammo to buy the dip (to redeploy). If 30K breaks absolutely no buying until down to 27Ks or back above 30K.