More from RealRLD

https://t.co/4URpPnni05 @scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

The Road to 2021 Thread.

https://t.co/dSznB4Wg46

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/GvExaHUoqS

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/RS3RcYEgsH

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/Z8vYbaC5Cu

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

The Road to 2021 Thread.

https://t.co/dSznB4Wg46

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/GvExaHUoqS

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/RS3RcYEgsH

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

https://t.co/Z8vYbaC5Cu

@scientificecon @jbhearn @wesfree @financialeyes @JoeBlob20 @GrubStreetJorno @wiki_ballot @Pathos14658352

Financial Crisis (1667) avoided by Charles II, via London Goldsmiths' Loans https://t.co/UxtABIpH2n via @old_currency_ex

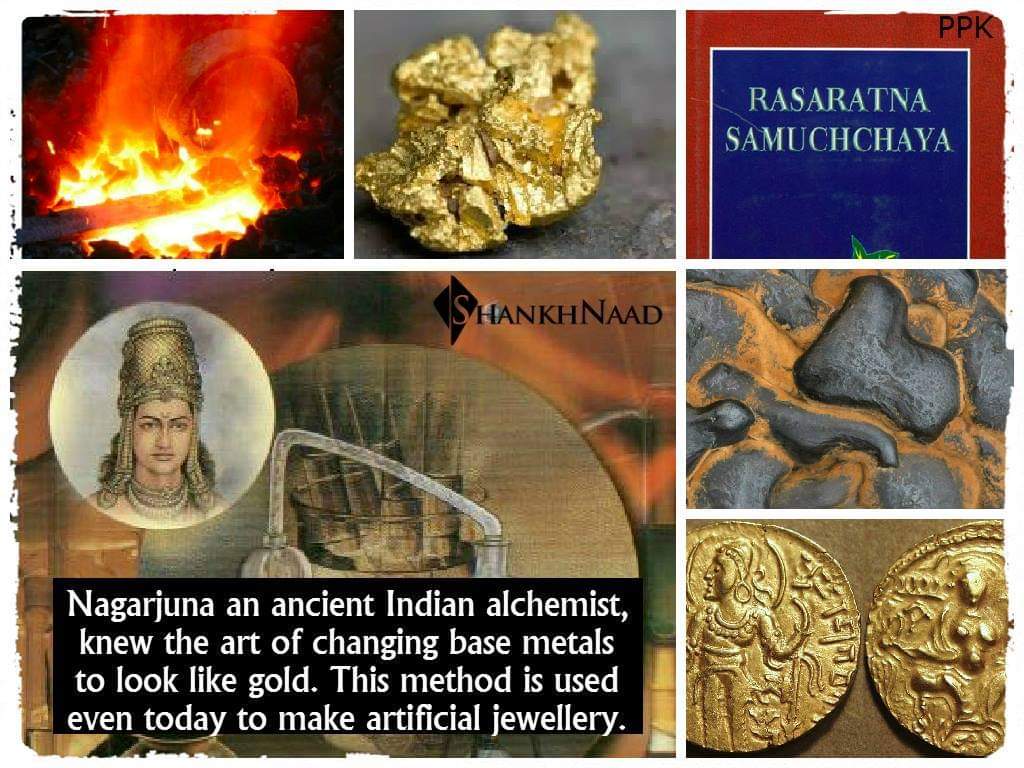

Coining and Debasement in Henry's Reign https://t.co/bGitKkj7wl via @wordpressdotcom

When Henry VIII and Francis I Spent $19 Million on an 18-Day Party

England's Unwanted Reformation https://t.co/n1a0u1DzNB via @YouTube

Unusual Historicals: Money Matters: The Country Without a Currency https://t.co/gGGHOFG9rk

Coining and Debasement in Henry's Reign https://t.co/bGitKkj7wl via @wordpressdotcom

When Henry VIII and Francis I Spent $19 Million on an 18-Day Party

England's Unwanted Reformation https://t.co/n1a0u1DzNB via @YouTube

Unusual Historicals: Money Matters: The Country Without a Currency https://t.co/gGGHOFG9rk

More from Bitcoin

The defi matrix

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

Thus less use for currencies as people can more easily store their wealth into assets and easily trade them.

— Pierre-Yves Gendron (@pierreyvesg7) February 24, 2021

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

1/ If, like me, you've been looking at #Bitcoin over the last few years with interest, but you have never really decided which side of the fence you sit on, this thread might be good for you.

This isn't another opinion piece on #Bitcoin , in-fact, it's exactly the opposite. 👇🏼

This thread is a list of resources I have found to be useful and insightful when it comes to understanding the pros and cons of #Bitcoin .

Below, you'll find knowledgeable people 👩🏽💻, articles/essays 📝, podcasts 🎧 and videos 📹 about #Bitcoin . Enjoy!

/2 People 👩🏽💻

These individuals are valuable to listen to, whilst they are bullish, they justify their stance:

@RaoulGMI

@michael_saylor

@DTAPCAP

@APompliano

@VentureCoinist

@AlexSaundersAU

@danheld

@aantonop

@jchervinsky

@real_vijay

@lawmaster

@LynAldenContact

/3 Resources 🏢

A video library of interviews from various Bitcoin enthusiasts. 👇🏼

https://t.co/CJJvHavSOn

A great guide for new investors to Bitcoin. 👇🏼

https://t.co/fOoSfTlWr5

A portal for people to go from zero knowledge to intermediate level.

/4 Tweet threads 🐦

A great thread on rebuttals from common #Bitcoin queries/criticisms. 👇🏼

https://t.co/tPEpFMMPhH

Why companies are starting to put BTC on the balance sheet. 👇🏼

https://t.co/lL71M1A3NF

“A double-spend broke Bitcoin" debunked.

This isn't another opinion piece on #Bitcoin , in-fact, it's exactly the opposite. 👇🏼

This thread is a list of resources I have found to be useful and insightful when it comes to understanding the pros and cons of #Bitcoin .

Below, you'll find knowledgeable people 👩🏽💻, articles/essays 📝, podcasts 🎧 and videos 📹 about #Bitcoin . Enjoy!

/2 People 👩🏽💻

These individuals are valuable to listen to, whilst they are bullish, they justify their stance:

@RaoulGMI

@michael_saylor

@DTAPCAP

@APompliano

@VentureCoinist

@AlexSaundersAU

@danheld

@aantonop

@jchervinsky

@real_vijay

@lawmaster

@LynAldenContact

/3 Resources 🏢

A video library of interviews from various Bitcoin enthusiasts. 👇🏼

https://t.co/CJJvHavSOn

A great guide for new investors to Bitcoin. 👇🏼

https://t.co/fOoSfTlWr5

A portal for people to go from zero knowledge to intermediate level.

/4 Tweet threads 🐦

A great thread on rebuttals from common #Bitcoin queries/criticisms. 👇🏼

https://t.co/tPEpFMMPhH

Why companies are starting to put BTC on the balance sheet. 👇🏼

https://t.co/lL71M1A3NF

“A double-spend broke Bitcoin" debunked.

1/ Fear and Bitcoin.

— Dan Held (@danheld) January 10, 2021

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through \u201cFear, Uncertainty, and Doubt\u201d or what we Bitcoiners have nicknamed \u201cFUD.\u201d