This made them a luxury good reserved for the rich and affluent of the upper class living in mansions with big gardens.

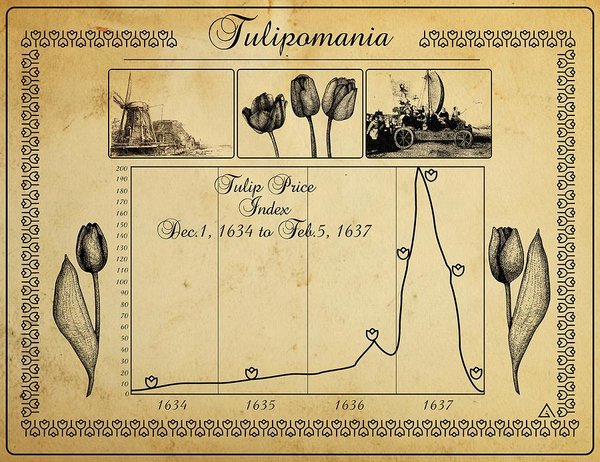

Tulips, the #Bitcoin of the 17th century

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 13, 2021

How a pandemic, FOMO, and speculation made a flower worth the same as a mansion

/THREAD/ pic.twitter.com/ELoTlpW552

List of Educational Threads on Financial Independence and Investing for Beginners#FinancialIndependence #financialeducation #financialfreedom #investing

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 3, 2021

1/ Financial Freedomhttps://t.co/8j5KG5ioFK

Shorts, Squeezes, and Betting Against Stocks

— Kostas on FIRE \U0001f525 (@itsKostasOnFIRE) January 27, 2021

What is short selling, how is it used and why is it risky?

/THREAD/ pic.twitter.com/PyDd208hFe

Budgeting, the 50-30-20 rule, and the envelope method

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 6, 2021

Your first step towards financial independence

/THREAD/ pic.twitter.com/Tmuc3Itca5

The most important number for your retirement: The 4% rule

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 7, 2021

What Is the Four Percent Rule?

/THREAD/ pic.twitter.com/8n1R1UZI5c

The Miracle of Compound Interest and the Rule of 72

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 2, 2021

//THREAD// pic.twitter.com/AOqd3kL6cn

Jack Bogle, the Father of Indexing

— Kostas \U0001f468\u200d\U0001f4bc \U0001f4c8 \U0001f4b8 (@itsKostasWithK) January 8, 2021

How John "Jack" Bogle's creation impacted investors more than Bill Gates, Steve Jobs, and Warren Buffett combined

/THREAD/ pic.twitter.com/4wPi8x3cXn

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0