Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

The defi matrix

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash. https://t.co/Hg7W32iCDY

Thus less use for currencies as people can more easily store their wealth into assets and easily trade them.

— Pierre-Yves Gendron (@pierreyvesg7) February 24, 2021

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

Total global liquidity for everything via automated market makers will drive the world to minimize national currency holdings.

Because the scale-up of AMMs & yield farming will allow anyone to instantly get a better return than holding cash!

But no more than that. Every excess unit of fiat beyond the necessary minimum goes into crypto to seek higher returns in the defi matrix.

It all becomes arbitrage.

Maybe you can constantly find a better job too...

https://t.co/NhCP1AGNzu

And what follows is the end of the bullshit job. What you do has tokenized and appreciable value, since otherwise, by definition, that capital could be earning immediate yield. There\u2019s a mark-to-market cost to bullshit.

— manhattanbeachproject (@manbeachproject) February 25, 2021

From drudgery to flourishing.

More from Bitcoin

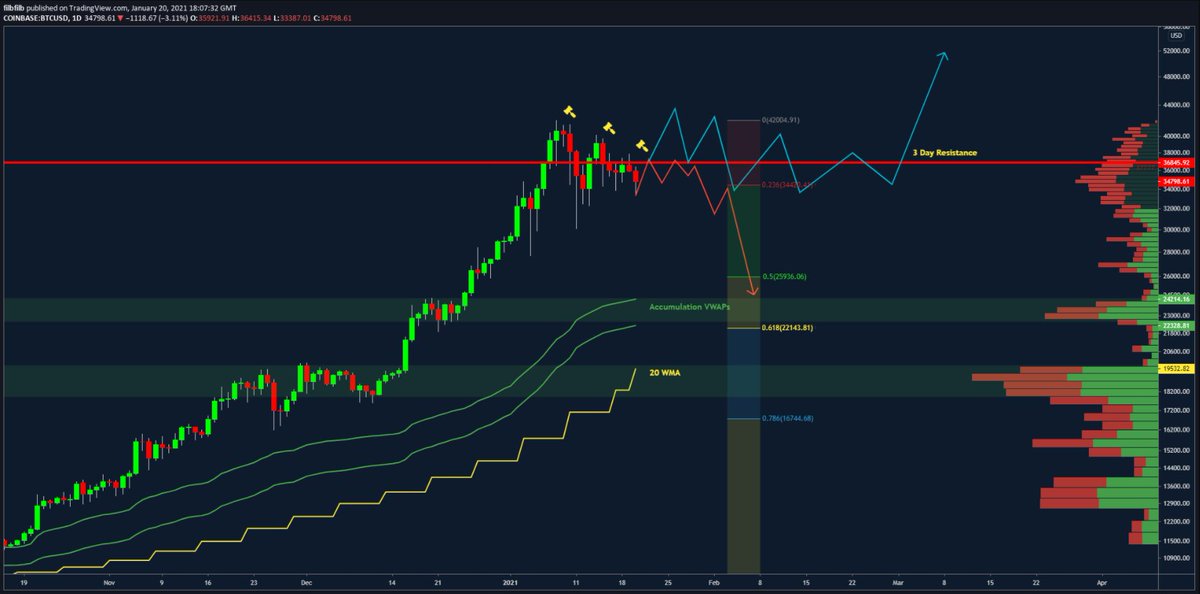

- Trapped in consolidation between $30 and $38k

- Lower highs and supply above c$38k

- Buying interest on the books £30-33k

- Meme consolidation triangle

- 20 wma @ $19.5k

- Accumulation VWAPs in the 20s

- underlying tether fud

- 61.8% retracement c. $22k

- 3 Day predator unconfirmed Orange candle

- Demand at low $30s was tested today and has since bounced & Coinbase led price on the drop

- Market structure is complex - Triangle is misleading

- Lots of orders stacked @ 30-33k.

- Market is fearful in the demand zone as shown by funding; i do not think we are ready to drop quite yet; Expecting longer consolidation.

- New Tether output has been on hold but new money came today

- Tether case request for 30 more days; could be indicative of consolidation

- Breakdown in price deeper than high $20s / lower $30s would IMO most likely require FUD induced event

- If stars align 20 WMA is catching up fast and will probably be resting in with the accumulation VWAPs, 61.8% retracement &d drives into big buy orders.

- Why did we stop @ $40k?

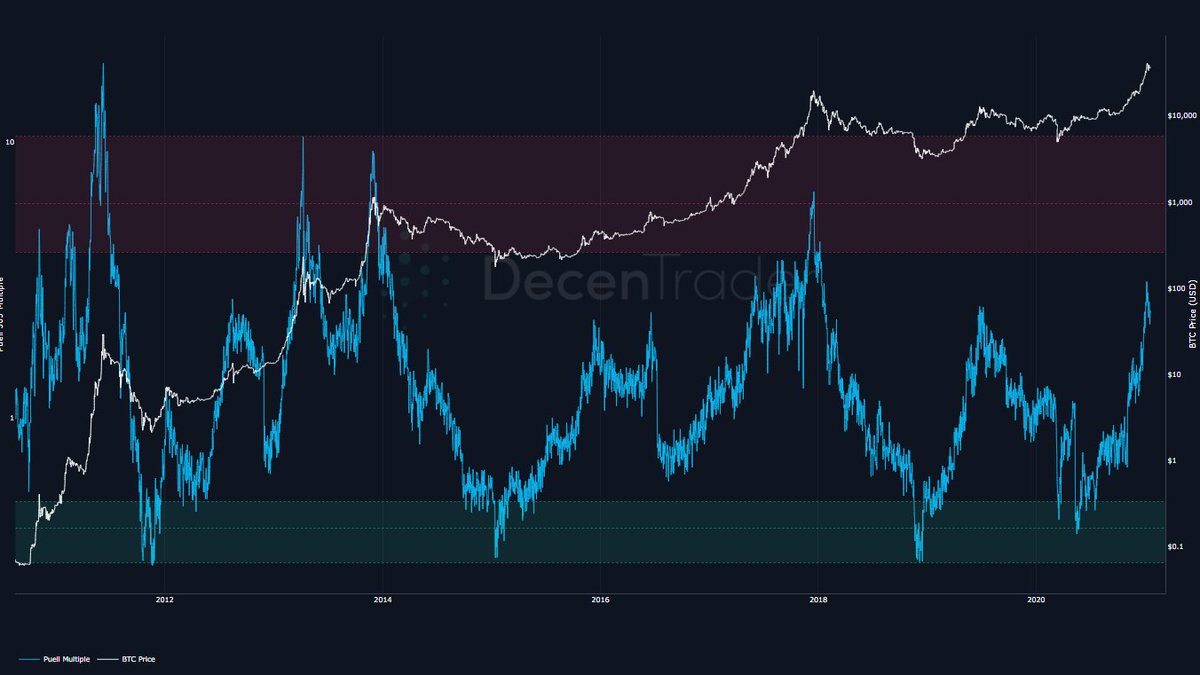

- Miners deep in profit vs. 654 average; time to tp

- SImilar response in other cycles

https://t.co/Iurd68NnZZ

Price needs to let volatility wear off before its next big move. Thinking 30K-40K range for the next 1-2 weeks. Then either 50K straight or after piercing 30K and bouncing back above 30K within 1-2 days.

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

$27500-$27000 is the key area. If price heads back down to 30K, expect 30K to be breached, fall to that area, and bounce back. FAST. All very fast.

What do I do with this information?

Simple.

I'm trading the range against a core position. Buying when price pushes lower, selling when higher. It's like playing the achordeon. There's always air left inside.

Where exactly?

Nowhere.

I don't use limits for that. $BTC is liquid enough to trade at market without issues.

I'm watching PA, volume and rates for buying and euphoria as reflected in rates for reducing.

Decision making is dynamic. Nothing is set in stone. But most likely if price heads back down to 30K 'll be holding off next time. The gameplan is to have ammo to buy the dip (to redeploy). If 30K breaks absolutely no buying until down to 27Ks or back above 30K.

Exceptional listen on #Bitcoin.

— Joseph Skewes (@josephskewes) January 26, 2021

In particular Nic's responses to Mike's aggressive anti-BTC stance.

One dispute with Nic: Even if crypto mail list was best place to announce BTC, if Satoshi wanted fair distribution, surely creating 50% of the supply by Nov 2012 was too fast? https://t.co/e1Hpx4wWOu

#Bitcoin transaction is never really final, given the energy required to keep the network running, and obviously its scale issues will only grow over time. That said, I actually though @nic__carter "won" the debate as it were, and I was unconvinced by the threat to national 2/n

security or undermining Fed policy angles Mike put forward. Two areas that are super interesting to me. One is the issue of #Bitcoin ownership, and how concentrated it is in terms of a small % of addresses that own most of it (2% addresses > 95% of holdings I think). 3/n

made great point a lot of this is omnibus/exchange related - so exchange or fund - ie @Grayscale holds #bitcoin for multiple investors. That may well be true - but it brings up 2 other issues. One - it proves that #bitcoin doesn't really "work" without 4/n

centralisation - as this implies most people need exchanges or funds (or @Paypal) to buy it. If so, that kills off a major "bitcoin is better than gold argument" - as in reality, gold is way more decentralised (from mine supply to ownership distribution). It also brings up a 5/n

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see