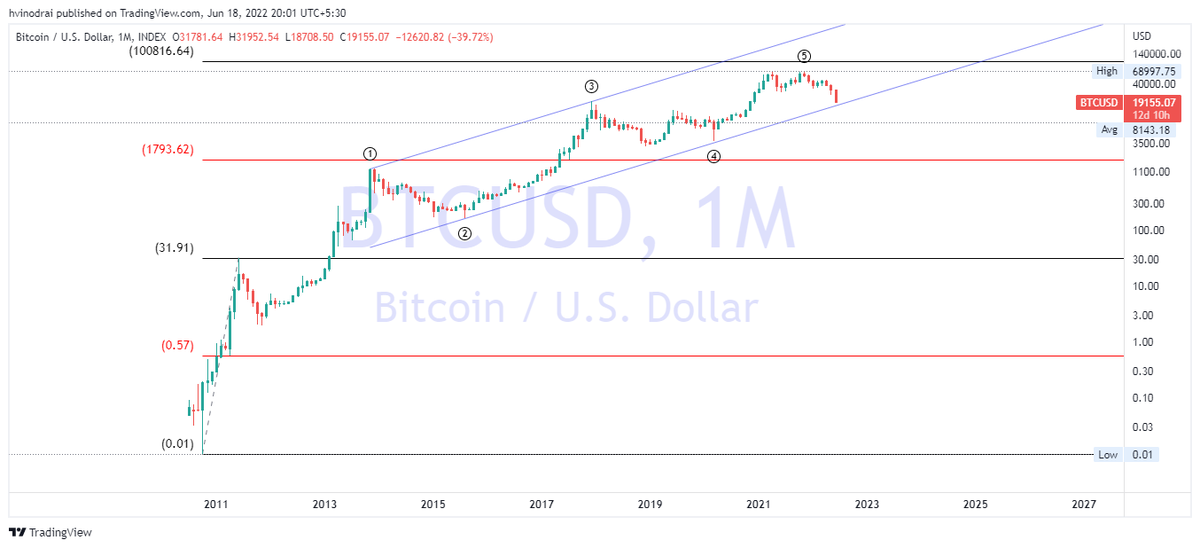

Here’s my thoughts with BTC lending as this cycle heats up. During the previous cycle we saw BTC prices jump from 10,000 to 20,000 in 16 days. This means that if the borrower overcollateralized with an LTV of 50%, their escrow will be liquidated (unless margin is met)...1/

More from Bitcoin

1/ #Bitcoin FUD-busting time!

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin" 🤣

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

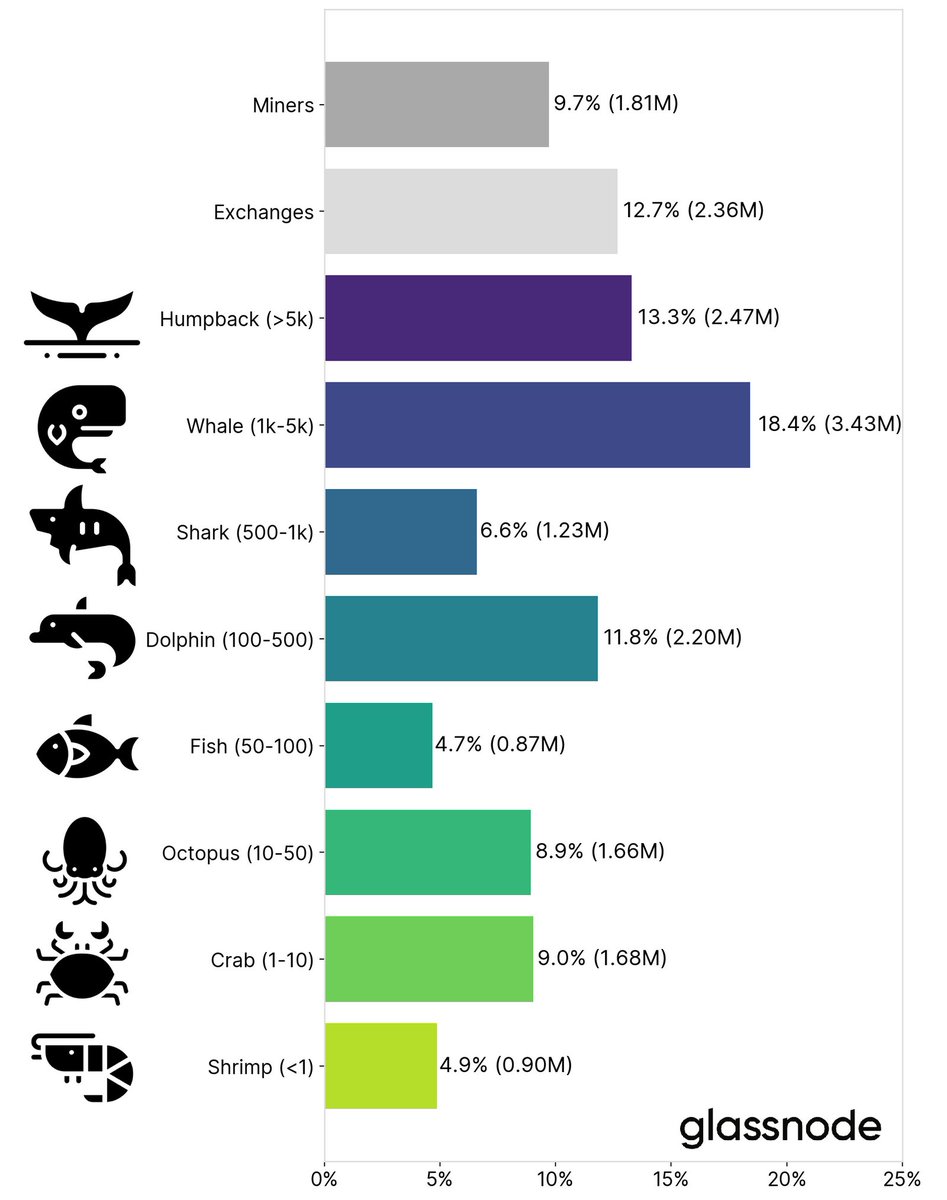

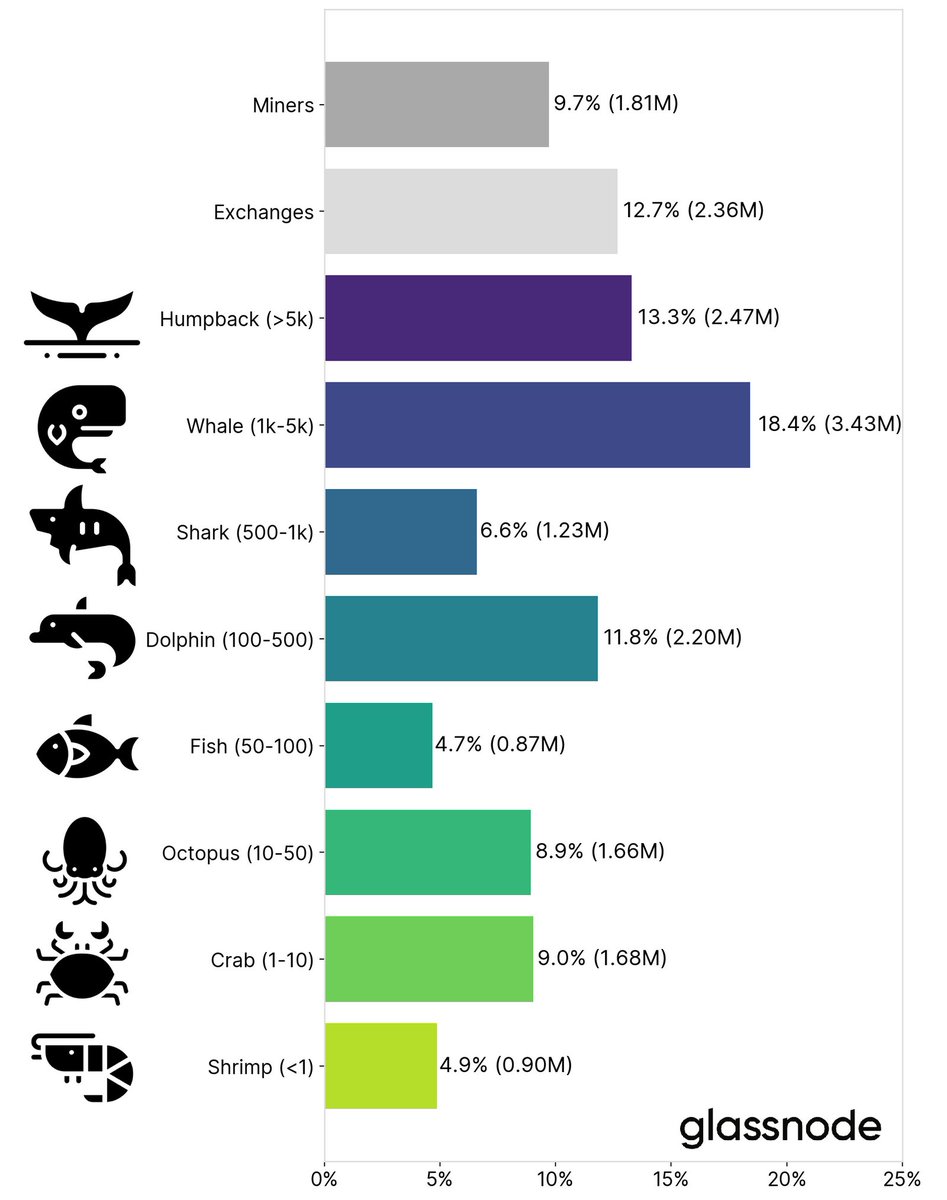

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://t.co/n5IdIQdNoA

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs -

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin" 🤣

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://t.co/n5IdIQdNoA

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs -

Afternoon all,

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

1/ outlook for bitcoin: positive 🚀

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

You May Also Like

I'm going to do two history threads on Ethiopia, one on its ancient history, one on its modern story (1800 to today). 🇪🇹

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹