All the recent partnerships are probably hard to grasp for the outsiders/disappointed, but ...

|1| I have seen a lot of tweets emphasizing the partnership between @iotatoken and @renaultgroup. It's a great compliment for IOTAs tech, but everyone who ...

#IOTA #greentech #ElonMusk #Bitcoin

All the recent partnerships are probably hard to grasp for the outsiders/disappointed, but ...

IOTA is ...

#Bicoin

While the media and public judged over IOTA, they put in years of research into #coordicide

While the media and public categorized IOTA as failure (many of them to this very day), they kept fighting for ...

#research #DLT

More from Bitcoin

@woonomic @realmaxkeiser @stacyherbert @ToneVaysBTC @UglyOldGoat1

— Abolition (@kalsangdolmanz) January 22, 2021

What do you guys think? https://t.co/mF1z9QL1My

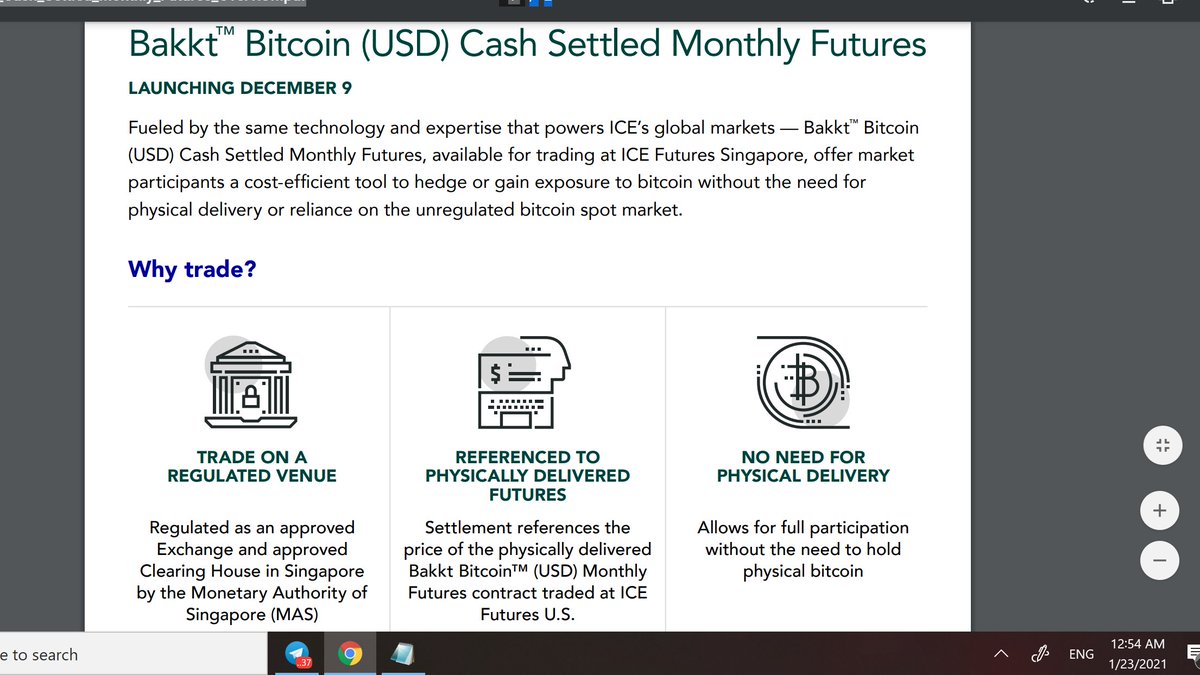

The notion that gold futures hold down the physical gold price or subjects the gold price to long-term manipulation is a canard. CME gold futures deliveries are settled with warrants meeting exact specifications met by approved refineries, carriers, and warehouses which (2/13)

ensures the integrity of delivery apart from the exchange. https://t.co/CpV1OBSsAT One need look no further than the 1980 Hunt Silver fiasco which illustrates how deliverable futures contracts provide for the discovery of an untapped silver supply resting in people's homes.(3/13)

Not so for Bitcoin. The CME Bakkt Bitcoin contract is for Bakkt Bitcoin. It is not Bitcoin. Bakkt Bitcoin is a cash-settled monthly futures contract. While the Bakkt Bitcoin has geographically storage of private keys, they are not your private keys. (4/13)

Not your keys, not your bitcoin. The Bitcoin Warehouse is an internal ledger The internal ledger operates separate and apart from the Bitcoin blockchain. The only interaction with the public blockchain is during the deposit of bitcoin into the Bakkt Warehouse and the (5/13)

Can also speak with authority on nation state violence

"Nothing makes you feel more free than taking another person's freedom"

After much investigation and conversations with people on here, I\u2019ve formed a relatively robust theory of what may be happening with Tether.

— Travis Kimmel (@coloradotravis) January 18, 2021

This thread will attempt to lay it out with neutral language for the purpose of discussion.

1/

and @profplum99 concerns with tether, bitcoin, and decentralization make sense yet I remain long BTC

They are correct on force, I worked in decentralized societies, they are dangerous because the state does not have a monopoly on violence

For those in the first world who have never seen a milita ride out of the desert, kill and enslave farmers, and the government cannot stop it because the 21st century slave trade pays better than the UN, the reality of decentralization is might equals right

I know, that isn't the decentralized future Buterin talks about while wearing a t-shirt with a cat fighting space invaders on it (love those shirts)

But we need to be real, disrupting the global centralized economy won't be like Uber putting taxis out of work

It will be war and faminine level disruption as old empires come alive again

For decentralization to rise the centralized global power of the last 70 years (US Hegemony) has to weaken

Yes we will be rich, but as the Big Short says,

"you can be happy, just don't fucking dance"

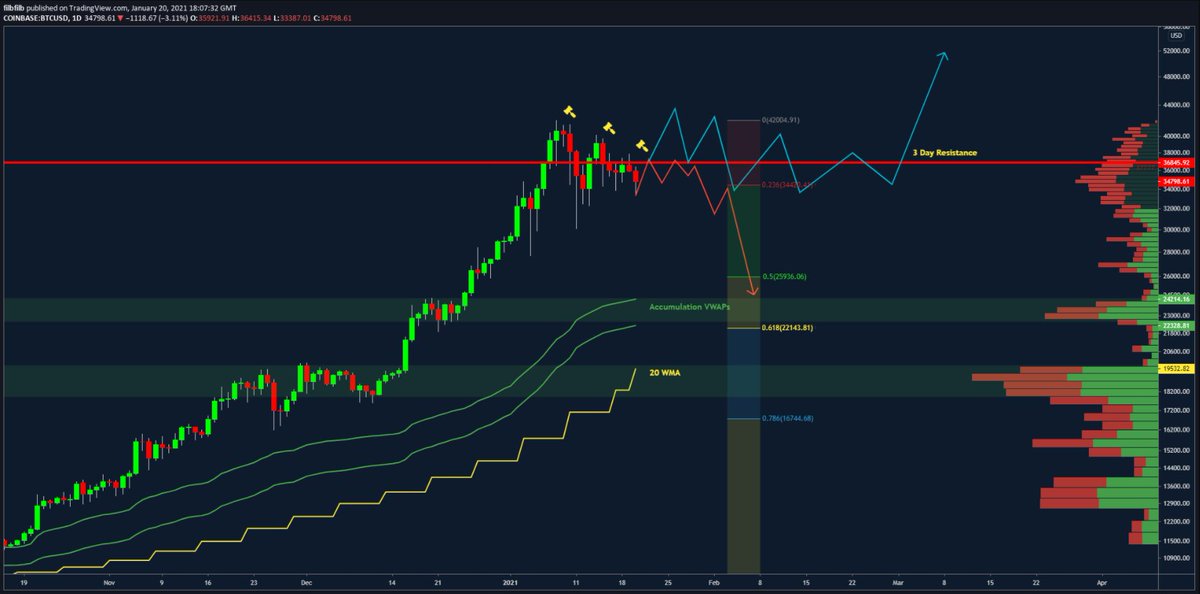

- Trapped in consolidation between $30 and $38k

- Lower highs and supply above c$38k

- Buying interest on the books £30-33k

- Meme consolidation triangle

- 20 wma @ $19.5k

- Accumulation VWAPs in the 20s

- underlying tether fud

- 61.8% retracement c. $22k

- 3 Day predator unconfirmed Orange candle

- Demand at low $30s was tested today and has since bounced & Coinbase led price on the drop

- Market structure is complex - Triangle is misleading

- Lots of orders stacked @ 30-33k.

- Market is fearful in the demand zone as shown by funding; i do not think we are ready to drop quite yet; Expecting longer consolidation.

- New Tether output has been on hold but new money came today

- Tether case request for 30 more days; could be indicative of consolidation

- Breakdown in price deeper than high $20s / lower $30s would IMO most likely require FUD induced event

- If stars align 20 WMA is catching up fast and will probably be resting in with the accumulation VWAPs, 61.8% retracement &d drives into big buy orders.

- Why did we stop @ $40k?

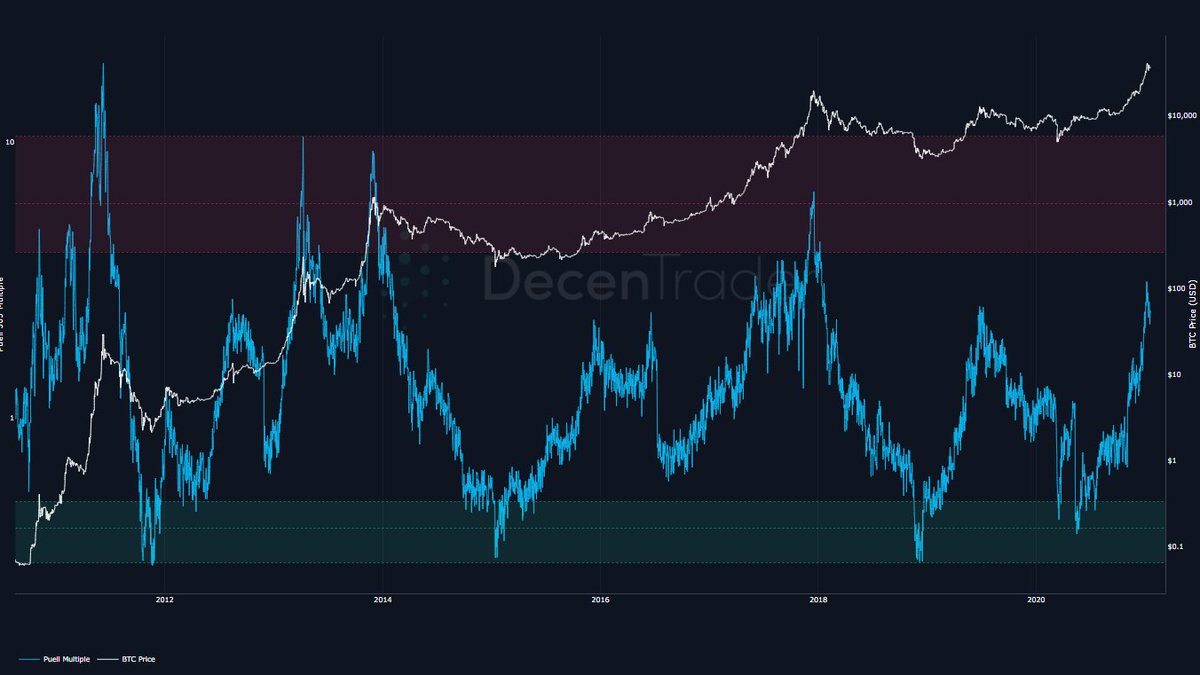

- Miners deep in profit vs. 654 average; time to tp

- SImilar response in other cycles

https://t.co/Iurd68NnZZ

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.

You May Also Like

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602