The counterparty risk of a third-party holding fiat in reserves.

Another #FreeLoveFriday. So far, I’ve covered Bitcoin, Mastercoin/Omni, and last week ChainLink and the importance of decentralized oracles. Today, let’s talk about one of the most fascinating projects in crypto - @MakerDAO

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

The counterparty risk of a third-party holding fiat in reserves.

https://t.co/Pz3BkJLUM7

More from Bitcoin

Afternoon all,

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

1/ outlook for bitcoin: positive 🚀

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

You May Also Like

THE MEANING, SIGNIFICANCE AND HISTORY OF SWASTIK

The Swastik is a geometrical figure and an ancient religious icon. Swastik has been Sanatan Dharma’s symbol of auspiciousness – mangalya since time immemorial.

The name swastika comes from Sanskrit (Devanagari: स्वस्तिक, pronounced: swastik) &denotes “conducive to wellbeing or auspicious”.

The word Swastik has a definite etymological origin in Sanskrit. It is derived from the roots su – meaning “well or auspicious” & as meaning “being”.

"सु अस्ति येन तत स्वस्तिकं"

Swastik is de symbol through which everything auspicios occurs

Scholars believe word’s origin in Vedas,known as Swasti mantra;

"🕉स्वस्ति ना इन्द्रो वृधश्रवाहा

स्वस्ति ना पूषा विश्ववेदाहा

स्वस्तिनास्तरक्ष्यो अरिश्तनेमिही

स्वस्तिनो बृहस्पतिर्दधातु"

It translates to," O famed Indra, redeem us. O Pusha, the beholder of all knowledge, redeem us. Redeem us O Garudji, of limitless speed and O Bruhaspati, redeem us".

SWASTIK’s COSMIC ORIGIN

The Swastika represents the living creation in the whole Cosmos.

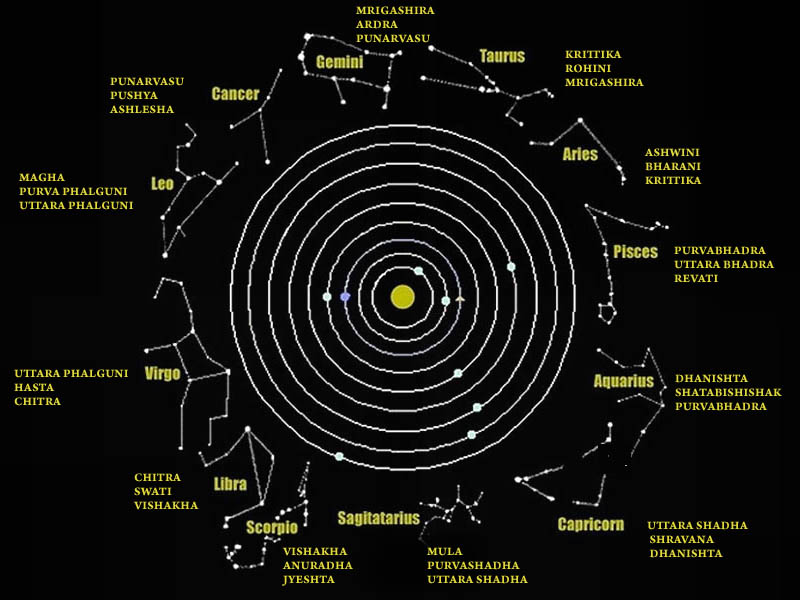

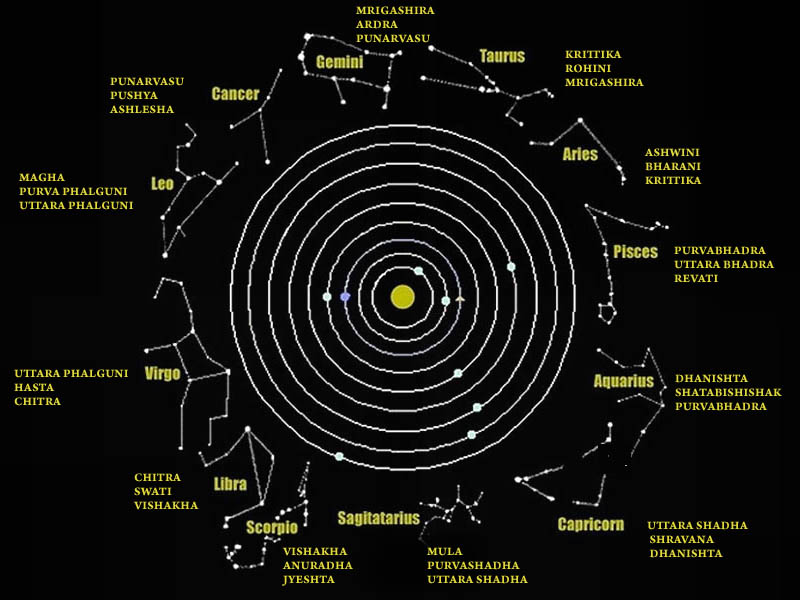

Hindu astronomers divide the ecliptic circle of cosmos in 27 divisions called https://t.co/sLeuV1R2eQ this manner a cross forms in 4 directions in the celestial sky. At centre of this cross is Dhruva(Polestar). In a line from Dhruva, the stars known as Saptarishi can be observed.

The Swastik is a geometrical figure and an ancient religious icon. Swastik has been Sanatan Dharma’s symbol of auspiciousness – mangalya since time immemorial.

The name swastika comes from Sanskrit (Devanagari: स्वस्तिक, pronounced: swastik) &denotes “conducive to wellbeing or auspicious”.

The word Swastik has a definite etymological origin in Sanskrit. It is derived from the roots su – meaning “well or auspicious” & as meaning “being”.

"सु अस्ति येन तत स्वस्तिकं"

Swastik is de symbol through which everything auspicios occurs

Scholars believe word’s origin in Vedas,known as Swasti mantra;

"🕉स्वस्ति ना इन्द्रो वृधश्रवाहा

स्वस्ति ना पूषा विश्ववेदाहा

स्वस्तिनास्तरक्ष्यो अरिश्तनेमिही

स्वस्तिनो बृहस्पतिर्दधातु"

It translates to," O famed Indra, redeem us. O Pusha, the beholder of all knowledge, redeem us. Redeem us O Garudji, of limitless speed and O Bruhaspati, redeem us".

SWASTIK’s COSMIC ORIGIN

The Swastika represents the living creation in the whole Cosmos.

Hindu astronomers divide the ecliptic circle of cosmos in 27 divisions called https://t.co/sLeuV1R2eQ this manner a cross forms in 4 directions in the celestial sky. At centre of this cross is Dhruva(Polestar). In a line from Dhruva, the stars known as Saptarishi can be observed.