Agree mate. Well done @ttmygh @profplum99 and @nic__carter on a ripping show. Im obviously in the "gold is superior" camp, though I am long #BTC (tiny position). I thought the best/most interesting point of whole debate was raised by @profplum99 regarding the fact that a 1/n

Exceptional listen on #Bitcoin.

— Joseph Skewes (@josephskewes) January 26, 2021

In particular Nic's responses to Mike's aggressive anti-BTC stance.

One dispute with Nic: Even if crypto mail list was best place to announce BTC, if Satoshi wanted fair distribution, surely creating 50% of the supply by Nov 2012 was too fast? https://t.co/e1Hpx4wWOu

More from Bitcoin

@woonomic @realmaxkeiser @stacyherbert @ToneVaysBTC @UglyOldGoat1

— Abolition (@kalsangdolmanz) January 22, 2021

What do you guys think? https://t.co/mF1z9QL1My

The notion that gold futures hold down the physical gold price or subjects the gold price to long-term manipulation is a canard. CME gold futures deliveries are settled with warrants meeting exact specifications met by approved refineries, carriers, and warehouses which (2/13)

ensures the integrity of delivery apart from the exchange. https://t.co/CpV1OBSsAT One need look no further than the 1980 Hunt Silver fiasco which illustrates how deliverable futures contracts provide for the discovery of an untapped silver supply resting in people's homes.(3/13)

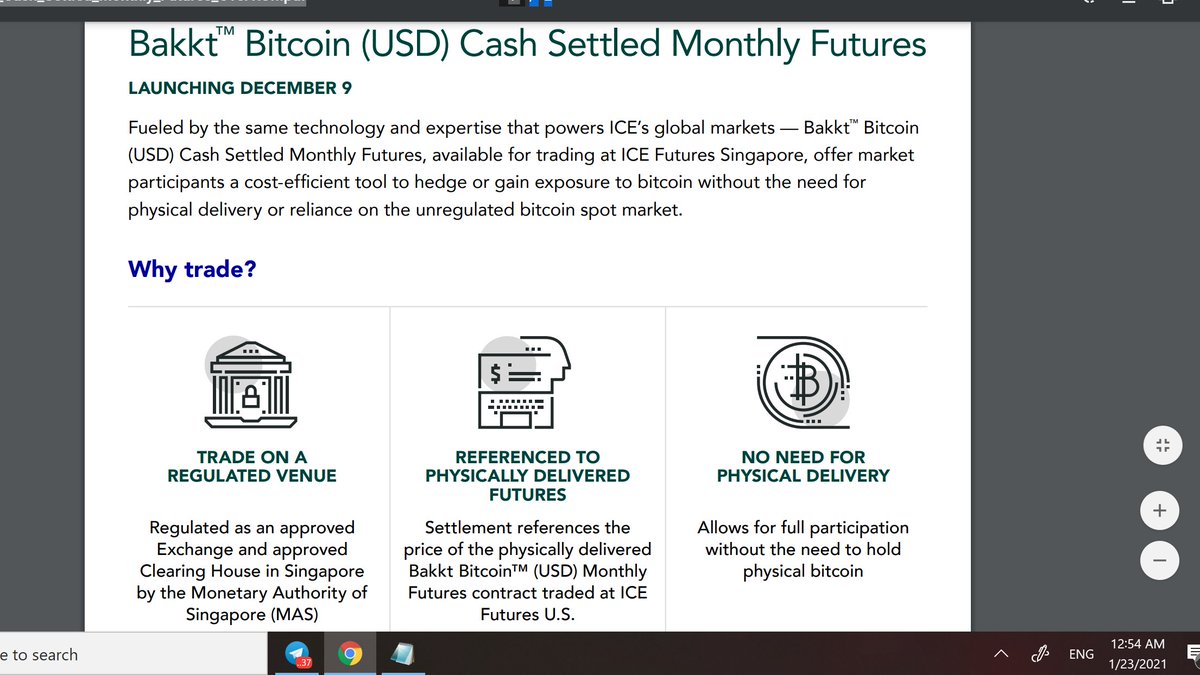

Not so for Bitcoin. The CME Bakkt Bitcoin contract is for Bakkt Bitcoin. It is not Bitcoin. Bakkt Bitcoin is a cash-settled monthly futures contract. While the Bakkt Bitcoin has geographically storage of private keys, they are not your private keys. (4/13)

Not your keys, not your bitcoin. The Bitcoin Warehouse is an internal ledger The internal ledger operates separate and apart from the Bitcoin blockchain. The only interaction with the public blockchain is during the deposit of bitcoin into the Bakkt Warehouse and the (5/13)

1. China PlusToken FUD: Old news. Please see linked thread.

2. U.S. Treasury FUD: Read thread below...

$BTC:

— David Puell (@kenoshaking) November 27, 2020

1/ So here's the deal with all the PlusToken news we've been seeing recently in the crypto media. Thing is, tho it's just being reported now after the Chinese government put out official balances, @ErgoBTC blew this story open for the on-chain community over a year ago... https://t.co/epNjZaNcJ1

1/ These news are much more relevant, as they imply severe trade-offs for people who want to keep their bitcoins undoxxed, with the cost and risks of doing so. I would not disqualify the tweet as mere FUD in the sense that what he posted is false. It should be taken seriously.

2/ For all we know, his decision of making it public before TG weekend may come out of the urgency of informing CT of a poignant anti-Bitcoin move by a Trump administration trying to cut lose ends before leaving office—not just "price manipulation" as I've seen suggested around.

3/ It implies the acceleration of a process already planned for for months in advance, not something he just came up with to "crash the market."

4/ In practicality, assuming this passes, it will have two major consencuences:

a. Armstrong's analysis is correct. And I would go further in saying, this regulation would leave the U.S. severely handicapped to continue to be the leader in the cryptocurrency industry worldwide.

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

Thus less use for currencies as people can more easily store their wealth into assets and easily trade them.

— Pierre-Yves Gendron (@pierreyvesg7) February 24, 2021

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

Price needs to let volatility wear off before its next big move. Thinking 30K-40K range for the next 1-2 weeks. Then either 50K straight or after piercing 30K and bouncing back above 30K within 1-2 days.

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

$27500-$27000 is the key area. If price heads back down to 30K, expect 30K to be breached, fall to that area, and bounce back. FAST. All very fast.

What do I do with this information?

Simple.

I'm trading the range against a core position. Buying when price pushes lower, selling when higher. It's like playing the achordeon. There's always air left inside.

Where exactly?

Nowhere.

I don't use limits for that. $BTC is liquid enough to trade at market without issues.

I'm watching PA, volume and rates for buying and euphoria as reflected in rates for reducing.

Decision making is dynamic. Nothing is set in stone. But most likely if price heads back down to 30K 'll be holding off next time. The gameplan is to have ammo to buy the dip (to redeploy). If 30K breaks absolutely no buying until down to 27Ks or back above 30K.

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

You May Also Like

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.

இது சூரிய குலத்தில் உதித்த இராமபிரானுக்கு தமிழ் முனிவர் அகத்தியர் உபதேசித்ததாக வால்மீகி இராமாயணத்தில் வருகிறது. ஆதித்ய ஹ்ருதயத்தைத் தினமும் ஓதினால் பெரும் பயன் பெறலாம் என மகான்களும் ஞானிகளும் காலம் காலமாகக் கூறி வருகின்றனர். ராம-ராவண யுத்தத்தை

தேவர்களுடன் சேர்ந்து பார்க்க வந்திருந்த அகத்தியர், அப்போது போரினால் களைத்து, கவலையுடன் காணப்பட்ட ராமபிரானை அணுகி, மனிதர்களிலேயே சிறந்தவனான ராமா போரில் எந்த மந்திரத்தைப் பாராயணம் செய்தால் எல்லா பகைவர்களையும் வெல்ல முடியுமோ அந்த ரகசிய மந்திரத்தை, வேதத்தில் சொல்லப்பட்டுள்ளதை உனக்கு

நான் உபதேசிக்கிறேன், கேள் என்று கூறி உபதேசித்தார். முதல் இரு சுலோகங்கள் சூழ்நிலையை விவரிக்கின்றன. மூன்றாவது சுலோகம் அகத்தியர் இராமபிரானை விளித்துக் கூறுவதாக அமைந்திருக்கிறது. நான்காவது சுலோகம் முதல் முப்பதாம் சுலோகம் வரை ஆதித்ய ஹ்ருதயம் என்னும் நூல். முப்பத்தி ஒன்றாம் சுலோகம்

இந்தத் துதியால் மகிழ்ந்த சூரியன் இராமனை வாழ்த்துவதைக் கூறுவதாக அமைந்திருக்கிறது.

ஐந்தாவது ஸ்லோகம்:

ஸர்வ மங்கள் மாங்கல்யம் ஸர்வ பாப ப்ரநாசனம்

சிந்தா சோக ப்ரசமனம் ஆயுர் வர்த்தனம் உத்தமம்

பொருள்: இந்த அதித்ய ஹ்ருதயம் என்ற துதி மங்களங்களில் சிறந்தது, பாவங்களையும் கவலைகளையும்

குழப்பங்களையும் நீக்குவது, வாழ்நாளை நீட்டிப்பது, மிகவும் சிறந்தது. இதயத்தில் வசிக்கும் பகவானுடைய அனுக்ரகத்தை அளிப்பதாகும்.

முழு ஸ்லோக லிங்க் பொருளுடன் இங்கே உள்ளது https://t.co/Q3qm1TfPmk

சூரியன் உலக இயக்கத்திற்கு மிக முக்கியமானவர். சூரிய சக்தியால்தான் ஜீவராசிகள், பயிர்கள்