Below, you'll find knowledgeable people 👩🏽💻, articles/essays 📝, podcasts 🎧 and videos 📹 about #Bitcoin . Enjoy!

1/ If, like me, you've been looking at #Bitcoin over the last few years with interest, but you have never really decided which side of the fence you sit on, this thread might be good for you.

This isn't another opinion piece on #Bitcoin , in-fact, it's exactly the opposite. 👇🏼

Below, you'll find knowledgeable people 👩🏽💻, articles/essays 📝, podcasts 🎧 and videos 📹 about #Bitcoin . Enjoy!

These individuals are valuable to listen to, whilst they are bullish, they justify their stance:

@RaoulGMI

@michael_saylor

@DTAPCAP

@APompliano

@VentureCoinist

@AlexSaundersAU

@danheld

@aantonop

@jchervinsky

@real_vijay

@lawmaster

@LynAldenContact

A video library of interviews from various Bitcoin enthusiasts. 👇🏼

https://t.co/CJJvHavSOn

A great guide for new investors to Bitcoin. 👇🏼

https://t.co/fOoSfTlWr5

A portal for people to go from zero knowledge to intermediate level. 👇🏼

https://t.co/JpiMGklKlT

A great thread on rebuttals from common #Bitcoin queries/criticisms. 👇🏼

https://t.co/tPEpFMMPhH

Why companies are starting to put BTC on the balance sheet. 👇🏼

https://t.co/lL71M1A3NF

“A double-spend broke Bitcoin" debunked. 👇🏼

https://t.co/CLJHeW4bJG

1/ Fear and Bitcoin.

— Dan Held (@danheld) January 10, 2021

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through \u201cFear, Uncertainty, and Doubt\u201d or what we Bitcoiners have nicknamed \u201cFUD.\u201d

The bullish case for #Bitcoin 👇🏼

https://t.co/CxgsnJP57Y

@DanHeld on how #Bitcoin came to be 👇🏼

https://t.co/d7nN9K2ogG

Jeremy Welch on ‘how Bitcoin changes everything’ 👇🏼

https://t.co/SR5xuMNul4

The Ultimate Bitcoin Argument👇🏼

https://t.co/da19NvNRrK

@Aantonop’s on ‘An Introduction To Bitcoin’ 👇🏼

https://t.co/mY25Goe5L4

Bitcoin TV’s ‘Seven Network Effects Of Bitcoin’ 👇🏼

https://t.co/jd87ypUH6b

A fun video from @RaoulGMI on why Bitcoin is a good store of value 👇🏼

https://t.co/ul6ow413TV

More from Bitcoin

The defi matrix

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

Thus less use for currencies as people can more easily store their wealth into assets and easily trade them.

— Pierre-Yves Gendron (@pierreyvesg7) February 24, 2021

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

1/9 Bitcoin has performed remarkably these past few weeks despite:

-Most of DeFi falling 50-80%

-CFTC charging BitMEX

-POTUS contracting Covid

-Delayed stimulus talks

-FCA announcing a derivative ban for retail

Why? Let’s see what we can find on-chain

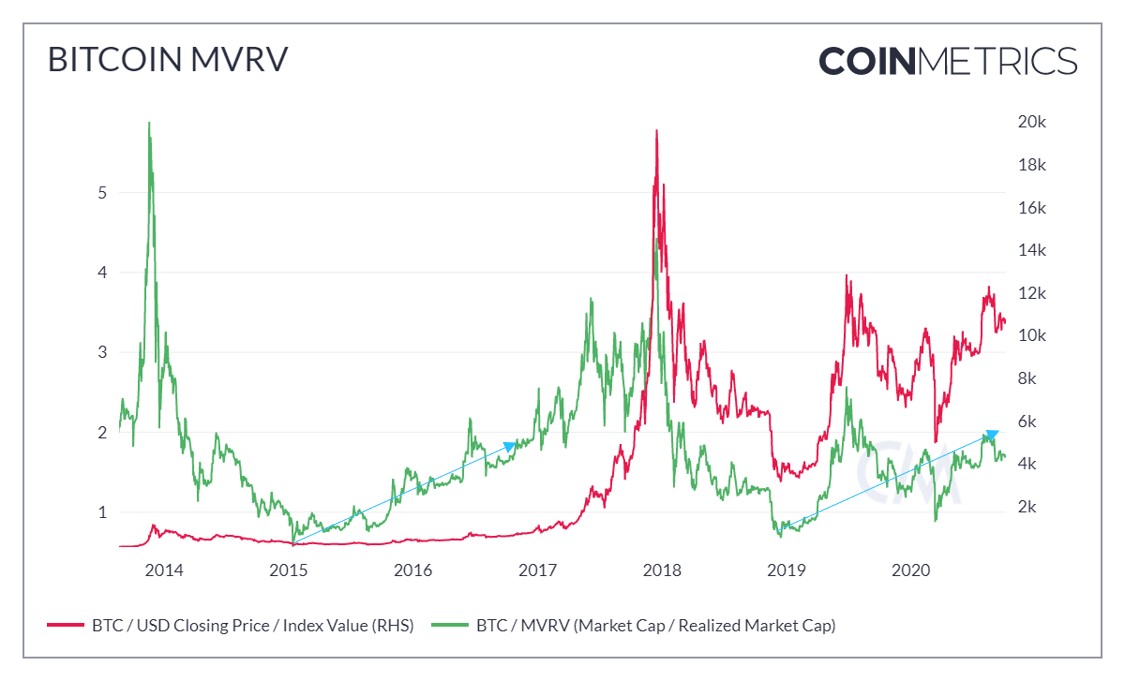

2/9 Bitcoin’s Realized Cap has been steadily increasing just as it did before the 2017 bull market took off. If it continues as it did in 2017, 2021 should be an interesting year.

https://t.co/nqgX7vTMDV

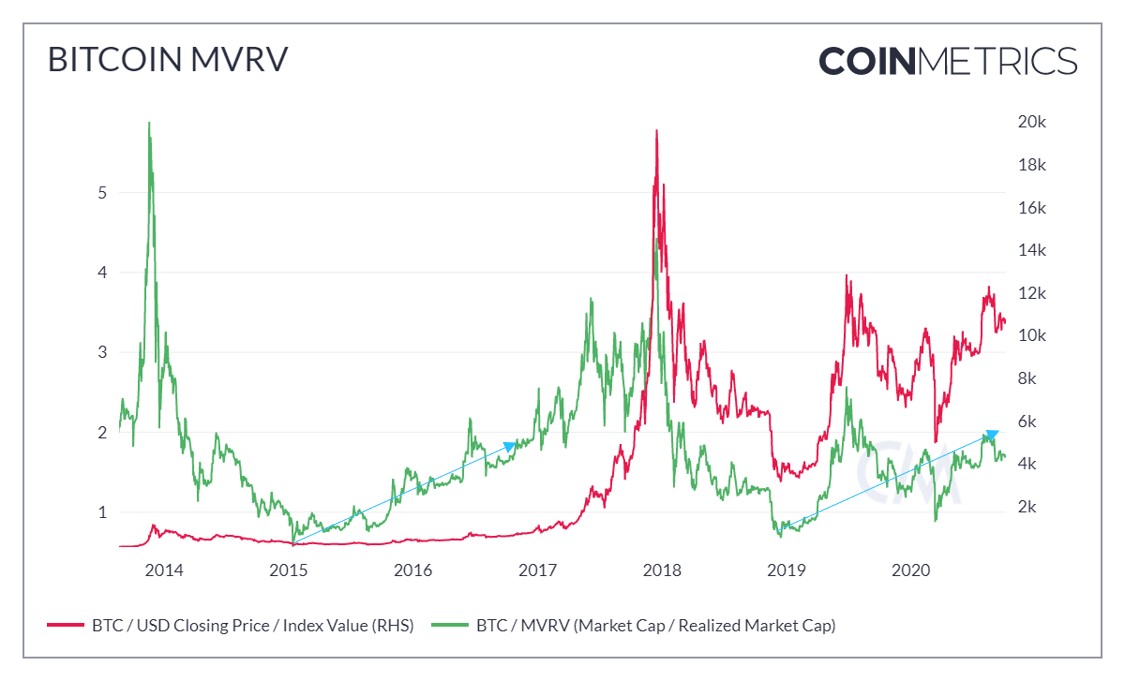

3/9 Bitcoin MVRV, whilst more volatile this market cycle, is also is holding the same trajectory it did during the 2016/17 bull market

https://t.co/jadbn6nCOB

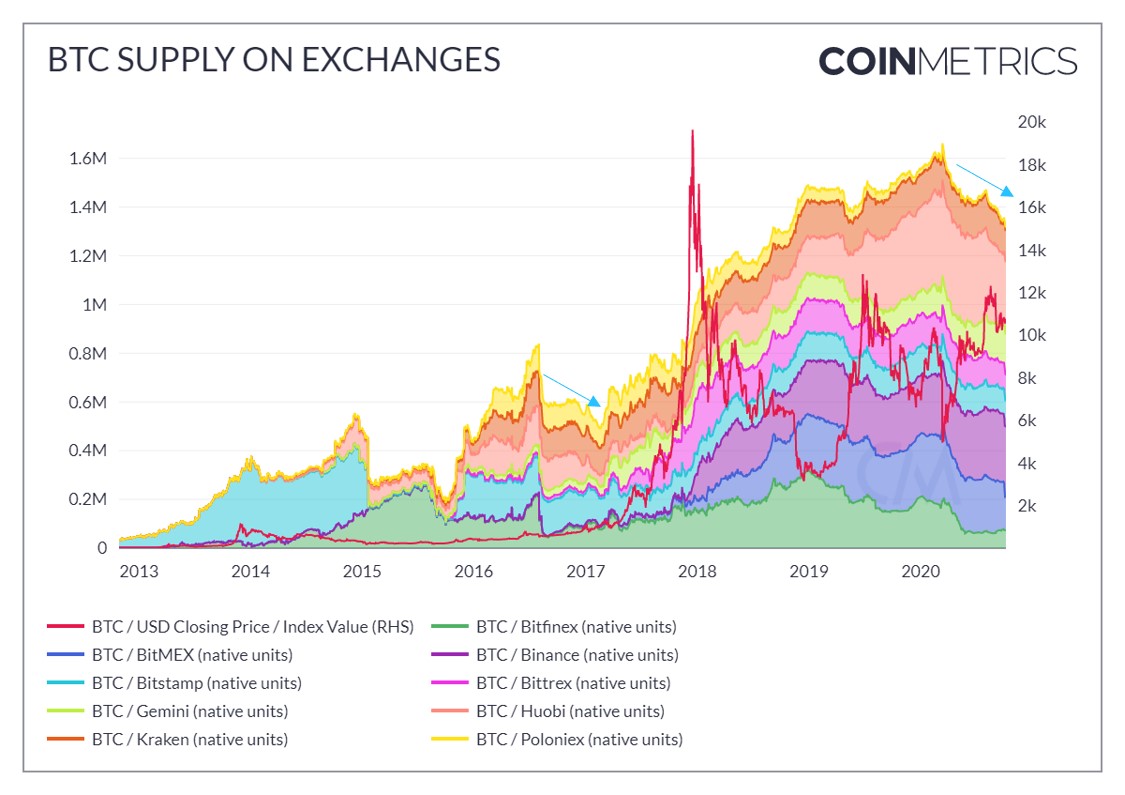

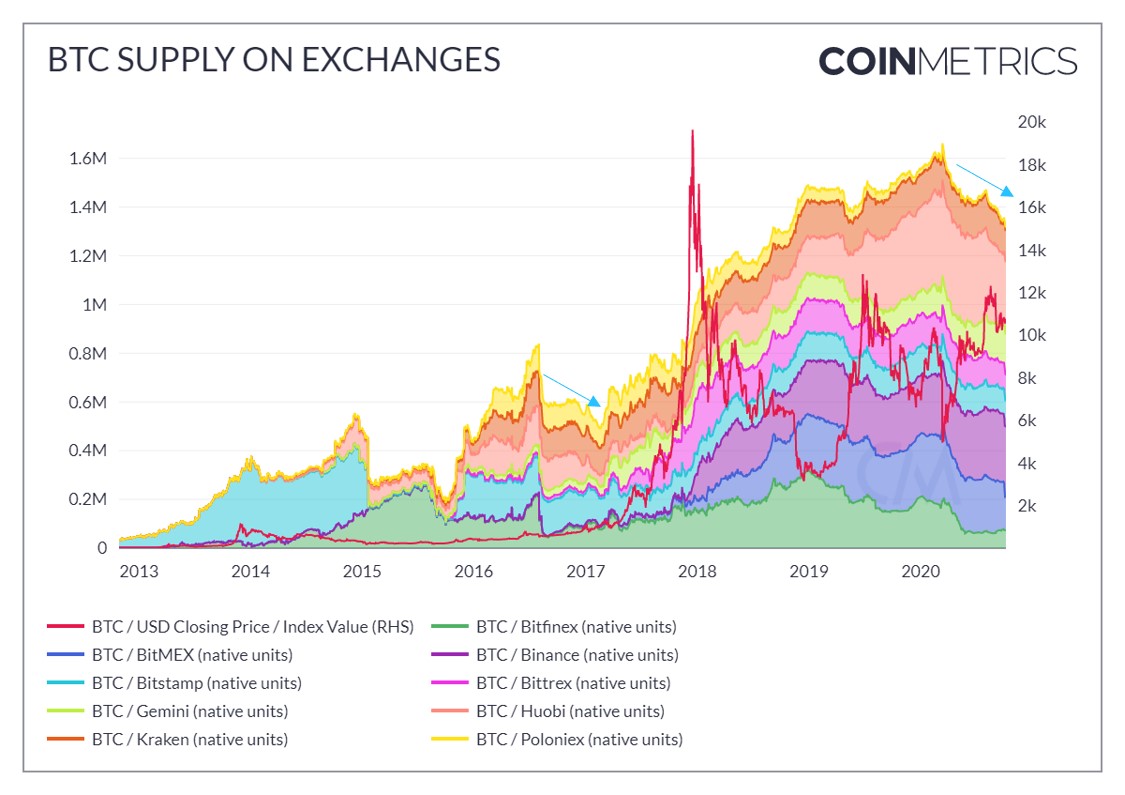

4/9 Looking at the supply of Bitcoin on exchanges is a good indication as to whether or not users are increasing trading activity, or increasing hodl activity. With supply reducing it looks like the tendency recently has been driven by hodlers

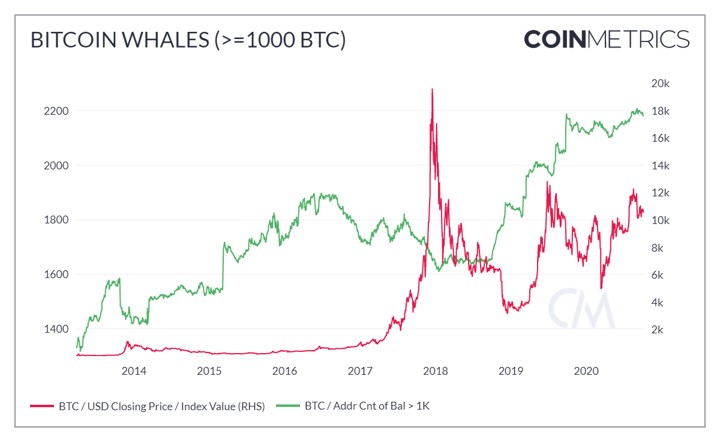

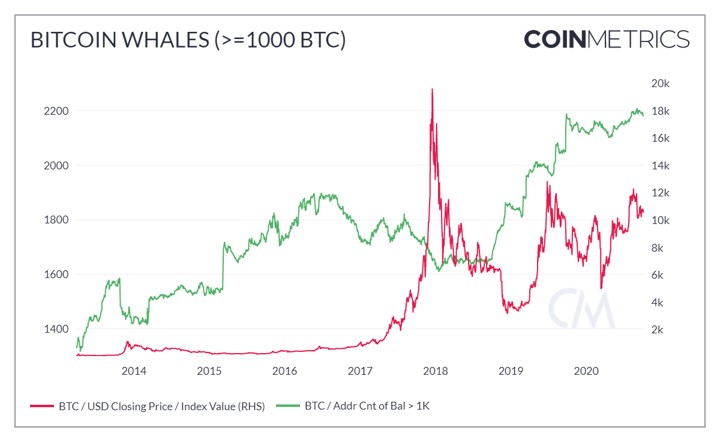

5/9 Despite the recent volatility, the number of Bitcoin whales continues to increase, indicating the growing number of large holders that have positive expectations for the future of Bitcoin

-Most of DeFi falling 50-80%

-CFTC charging BitMEX

-POTUS contracting Covid

-Delayed stimulus talks

-FCA announcing a derivative ban for retail

Why? Let’s see what we can find on-chain

2/9 Bitcoin’s Realized Cap has been steadily increasing just as it did before the 2017 bull market took off. If it continues as it did in 2017, 2021 should be an interesting year.

https://t.co/nqgX7vTMDV

3/9 Bitcoin MVRV, whilst more volatile this market cycle, is also is holding the same trajectory it did during the 2016/17 bull market

https://t.co/jadbn6nCOB

4/9 Looking at the supply of Bitcoin on exchanges is a good indication as to whether or not users are increasing trading activity, or increasing hodl activity. With supply reducing it looks like the tendency recently has been driven by hodlers

5/9 Despite the recent volatility, the number of Bitcoin whales continues to increase, indicating the growing number of large holders that have positive expectations for the future of Bitcoin

Ok, so what is the significance of the @lagarde statement on bitcoin?

We were offered a very open insight (but slightly flawed analysis) into top level policy perspective behind the crack down on selfhosted wallets.

https://t.co/1LTzrxHbgs 1/32

'It is a speculative asset, by any account. If you look at the price movements... '

It starts with an economic price perspective and we can learn that ECB is closely monitoring this price movement as one of the many indicators.

So we are in the classic central bank frame 2/32

'Those who thought it would turn into a currency. Sorry, it is an asset not a currency.'

Here she summarises a classic debate on what is currency and what is needed for that. Based on the holy three: unit of account, means of payment, store of value. 3/32

The summary is classic, but too narrow and does not incorporate the wider financial history viewpoints on money, currencies and the way we pay. 4/32

ECB overlooks the de facto unit of account role of bitcoin, having been used to 200 years of having cash around whic is both the unit of account and a means of payment. 5/32

We were offered a very open insight (but slightly flawed analysis) into top level policy perspective behind the crack down on selfhosted wallets.

https://t.co/1LTzrxHbgs 1/32

ECB President Christine Lagarde called for global regulation of #Bitcoin, saying the digital currency had been used for money laundering activities in some instances and that any loopholes needed to be closed. Follow #ReutersNext updates here: https://t.co/4MgFy4jnw5 pic.twitter.com/qlBtoDuZLW

— Reuters (@Reuters) January 13, 2021

'It is a speculative asset, by any account. If you look at the price movements... '

It starts with an economic price perspective and we can learn that ECB is closely monitoring this price movement as one of the many indicators.

So we are in the classic central bank frame 2/32

'Those who thought it would turn into a currency. Sorry, it is an asset not a currency.'

Here she summarises a classic debate on what is currency and what is needed for that. Based on the holy three: unit of account, means of payment, store of value. 3/32

The summary is classic, but too narrow and does not incorporate the wider financial history viewpoints on money, currencies and the way we pay. 4/32

ECB overlooks the de facto unit of account role of bitcoin, having been used to 200 years of having cash around whic is both the unit of account and a means of payment. 5/32

You May Also Like

Department List of UCAS-China PROFESSORs for ANSO, CSC and UCAS (fully or partial) Scholarship Acceptance

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research