SO THAT your March GST return will be ready and your Accounting data will be ready for FY 21-22

25 MARCH/APRIL TASK FOR Year end compliances FOR GST &IT

MEGA THREAD

1. Opting or opting out Composition till 31-3 for FY 22-23 ( to whom applicable)

2. Opting or opting out QRMP till 30-4 for FY 22-23 ( to whom applicable)

3. Apply LUT in case of Exporters for FY 22-23

SO THAT your March GST return will be ready and your Accounting data will be ready for FY 21-22

Reminder to PAY YOUR LIC, MEDICLAIM, PPF AND OTHER OBLIGATIONS TO CLAIM DEDUCTIONS as soon as possible BEFORE 31ST MARCH

transactions like sale returns or purchase returns or price revision or volume discount , the required necessary Debit note or Credit notes may be raised in March 2022 . So it will form part of Fin year 21-22 & you book in your accounts in FY 21-22 .

The taxpayers who have income from interest only and it is less than the prescribed limit, then they can file manually or online in Form 15 G/ H.

For Tax deductors , Last date to file 15G/H is 30th april

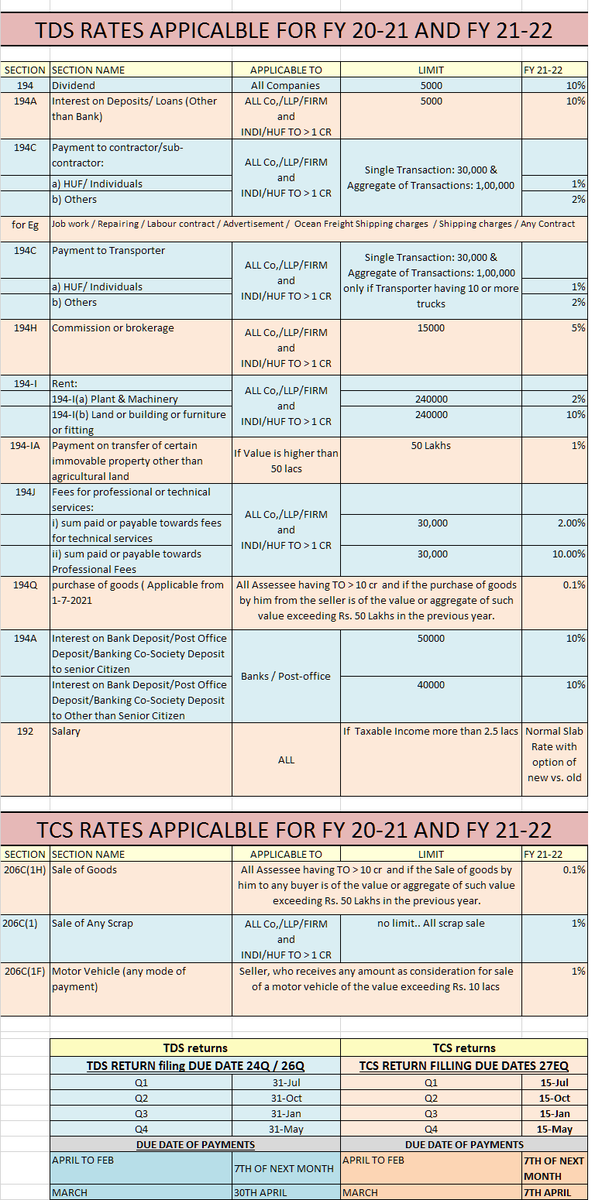

APPLICABILITY - FY 20-21 TO 10 CRORE ABOVE PARTIES THEN APPLICABLE for FY 21-22

CONDITION - ONLY IF PURCHASES from PARTY CROSS 50 lacs in CURRENT YEAR

and

That Party not charging TCS

APPLICABILITY - FY 20-21 TO 10 CRORE ABOVE PARTIES THEN APPLICABLE

CONDITION - ONLY IF COLLECTION from PARTY CROSS 50lacs in CURRENT YEAR AND

THAT PARTY IS NOT DEDUCTING TDS

Physical stock need to be reconciled with the stock as per books of accounts. This would be handy in both income tax and GST audit. In case of any discrepancies, the possibility of ITC reversal or missed sales details may be checked.

Refund of

ITC refund for Inverted duty structure

ITC in case of Export under LUT

ITC refund in case of Merchant Export 0.01%

IGST in case of SEZ with pay

ITC in case of SEZ under LUT

FOR 20-21 , 31ST MARCH 2022 is last date

ITC shall be availed by the recipient subject to satisfaction of the condition “Supplier has furnished the details of Invoices referred to in Section 16(2)(a) in Form GSTR 1

reverse ITC not reflecting

Do check your GSTR 2A of 21-22, if any ITC which is reflected in GSTR-2A and U hv not claimed credit in any previous months GSTR3B then Its better you avail this ITC in 21-22 only i.e March GSTR 3B

DATA FETCH FOR ALL IMPORTS MADE IN FY 21-22 BY SEARCH BILL OF ENTRY - FOR THOSE WHOM IMPORT NOT APPEARING IN GSTR 2A

Identify any difference in 3B vs 1 ... reconcile in March return only . Also reconcile with Books

there may be sometime CN DN not shown in GSTR -1 or 3B or both

TDS credit acceptance for period till MARCH 2022. THIS IS WE ARE TALKING ABOUT TDS OF "GST"

IF any TDS is being deducted under GST, accept the TDS credit on the GST portal.(Month to month basis). By doing so, the amount will credited in cash ledger

Maintenance of Self invoice or Payment Voucher in case of RCM tax. This seems to be an ignored act where in, it is required to issue self-invoices and payment vouchers.

GST needs to be charged on following incomes but Not charged.

20.1. Sale of fixed asset or sale of car – Forgot to charge GST On these

20.2. Rent On Commercial Property received But GST has NOT been collected & paid

20.3. Freight Charged By Supplier On Goods Sold But forgot to charge GST on that

20.4. Commission Income earned but GST NOT CHARGED

20.5. Purchase return shown as “Sales ” and discharged GST as “Outward tax” wrongly.

rectify such mistakes in March return

if any GST needed to be paid under RCM but not paid

(1) Advocate Fees (2) Security Services (3) Import of services (4) Transportation / Freight ( Whether On Inward Or Outward )

If not paid , pay in March return

22.1 If wrongly taken ITC but not reversed IT i.e CLAIMED wrong ITC u/s17(5) also if Destroyed/lost | Personal Expenses or Exempted Goods Manufactured

then you need to reverse it (R. 42/43)

22.2 Wrongly claimed ITC twice.

Expenses/Purchase bill entered twice So claimed ITC twice

22.3. Wrongly Claimed IGST instead of CGST + SGST

22.4. Wrongly claimed CGST + SGST instead of IGST

22.5 . Sales return shown as Purchase & Claimed ITC on that

rectify in march

With effect from 1st October 2021, the frequency of filing the ITC-04 form has been revised

(1) Those with TO more than Rs.5 cr – Half-yearly

(2) Those with TO up to Rs.5 cr – Yearly

E-invoice is a process through which a normally generated invoice is authenticated by GSTN. Post authentication, each invoice will be issued an IRN

If TO has exceeded 20 Cr in ANY PRECEDING FY i.e. 17-18 TO 21-22, then E-Invoicing would be applicable from 1-4-22

PL FILE if you haven't still filed . LAST DATE ALREADY GONE (28th feb)..

-end of thread

do remind me anything left as far as GST INCOME TAX concerned

More from All

@franciscodeasis https://t.co/OuQaBRFPu7

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?

You May Also Like

"I really want to break into Product Management"

make products.

"If only someone would tell me how I can get a startup to notice me."

Make Products.

"I guess it's impossible and I'll never break into the industry."

MAKE PRODUCTS.

Courtesy of @edbrisson's wonderful thread on breaking into comics – https://t.co/TgNblNSCBj – here is why the same applies to Product Management, too.

There is no better way of learning the craft of product, or proving your potential to employers, than just doing it.

You do not need anybody's permission. We don't have diplomas, nor doctorates. We can barely agree on a single standard of what a Product Manager is supposed to do.

But – there is at least one blindingly obvious industry consensus – a Product Manager makes Products.

And they don't need to be kept at the exact right temperature, given endless resource, or carefully protected in order to do this.

They find their own way.

make products.

"If only someone would tell me how I can get a startup to notice me."

Make Products.

"I guess it's impossible and I'll never break into the industry."

MAKE PRODUCTS.

Courtesy of @edbrisson's wonderful thread on breaking into comics – https://t.co/TgNblNSCBj – here is why the same applies to Product Management, too.

"I really want to break into comics"

— Ed Brisson (@edbrisson) December 4, 2018

make comics.

"If only someone would tell me how I can get an editor to notice me."

Make Comics.

"I guess it's impossible and I'll never break into the industry."

MAKE COMICS.

There is no better way of learning the craft of product, or proving your potential to employers, than just doing it.

You do not need anybody's permission. We don't have diplomas, nor doctorates. We can barely agree on a single standard of what a Product Manager is supposed to do.

But – there is at least one blindingly obvious industry consensus – a Product Manager makes Products.

And they don't need to be kept at the exact right temperature, given endless resource, or carefully protected in order to do this.

They find their own way.

fascinated by this man, mario cortellucci, and his outsized influence on ontario and GTA politics. cortellucci, who lives in vaughan and ran as a far-right candidate for the italian senate back in 2018 - is a major ford donor...

his name might sound familiar because the new cortellucci vaughan hospital at mackenzie health, the one doug ford has been touting lately as a covid-centric facility, is named after him and his family

but his name also pops up in a LOT of other ford projects. for instance - he controls the long term lease on big parts of toronto's portlands... where doug ford once proposed building an nfl stadium and monorail... https://t.co/weOMJ51bVF

cortellucci, who is a developer, also owns a large chunk of the greenbelt. doug ford's desire to develop the greenbelt has been

and late last year he rolled back the mandate of conservation authorities there, prompting the resignations of several members of the greenbelt advisory

his name might sound familiar because the new cortellucci vaughan hospital at mackenzie health, the one doug ford has been touting lately as a covid-centric facility, is named after him and his family

but his name also pops up in a LOT of other ford projects. for instance - he controls the long term lease on big parts of toronto's portlands... where doug ford once proposed building an nfl stadium and monorail... https://t.co/weOMJ51bVF

cortellucci, who is a developer, also owns a large chunk of the greenbelt. doug ford's desire to develop the greenbelt has been

and late last year he rolled back the mandate of conservation authorities there, prompting the resignations of several members of the greenbelt advisory