SAnngeri Categories Optionslearnings

My short interview with fyers -

https://t.co/4gJGvJqUSk

An alt approach to trading breakouts in high IV env -

https://t.co/KCanqfojfz

Don't fall prey to seminars (Part

Part 2- https://t.co/RRGtF8JdRB

Truth about India's training scene Part 1- https://t.co/tU24DePfLa

Part 2 - https://t.co/GKlSkXG93D

One of my earning seasons I published all trades here -

A bit on position sizing for option selling - https://t.co/09UPJQN2WV

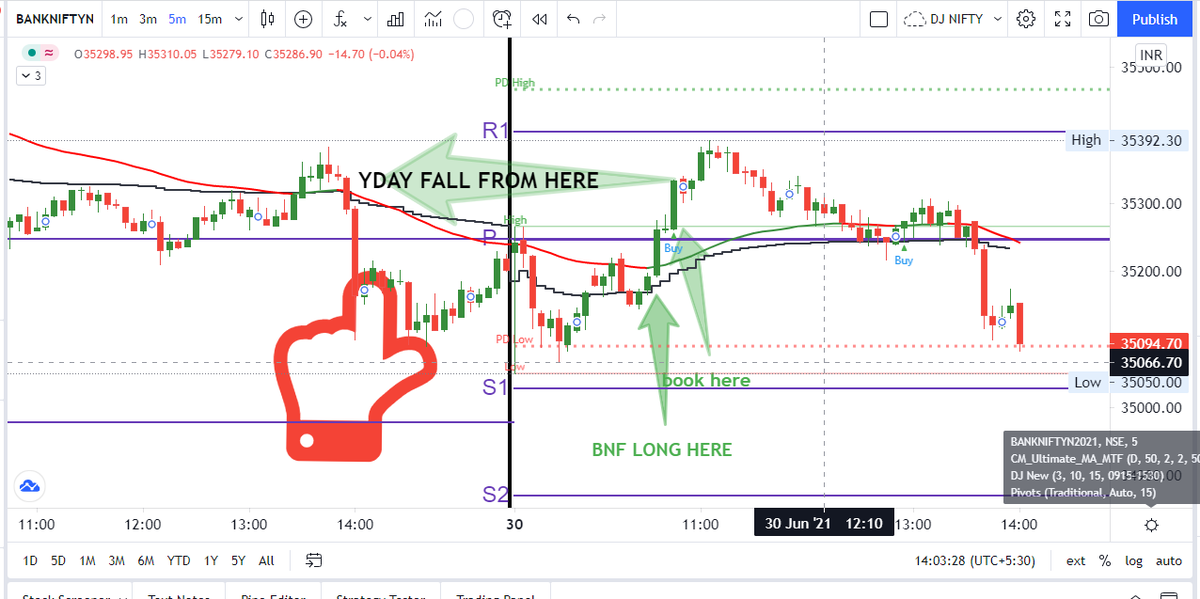

More guidelines on trading breakout approach - https://t.co/rMdHhaGZ9F

Few trades using the same approach -

New blog: Should you become a full-time trader - Fuck No !!

How to adjust a short strangle position. I might follow it up with couple of simulation videos if there is enough interest/motivation.

1. Never be Greedy in a High Vix Environment.

Sellers selling OTM get lured by higher premiums and sell near ATM or more than they usually do, this will burn your hand as High premiums also mean that you will end up giving higher premium back than usual as soom as it spikes.

2. Hope

Hope drives a man crazy and this is true for trading the most, hoping for a reversal to cut the pain. Humans have a tendency to avoid the pain and one does not accept the pain by not booking a loss

Tom Hougaard explains this well below.

https://t.co/zDbDT2hdej

3. Not having a setup in non directional Selling

You cannot make money long term if you don’t have a set of rules or adjustments in place already if you are trading long term. Make a plan or a system so that you always know how to survive. Your Position is non D not the market.

4. Getting Egoistic

Many people think they are supreme because they are selling options much likely because of the Trend on Twitter in the community,

You are a trader think like one and remain one trading a certain way does not make you better.

But 98% of the people miss out on the best tweets.

Here are our threads from March & what they can help you with:🧵

Collaborated with @niki_poojary

1. Benefits of trading in a corporate

How to save tax when income is above 50 lakhs?

— Aditya Todmal (@AdityaTodmal) March 1, 2022

Here are 9 benefits of trading in a corporate account: \U0001f9f5

Collaborated with @niki_poojary

2. 12 Technical Analysis

Some people think technical analysis is useless.

— Aditya Todmal (@AdityaTodmal) March 4, 2022

But we use technicals in all our trades.

Here's a list of 12 technical analysis books to help you learn and grow: \U0001f9f5

Collaborated with @niki_poojary

3. Breakdown of Icici Direct Free

A lot of websites provide you with data for trading.

— Aditya Todmal (@AdityaTodmal) March 5, 2022

However, I liked the free website of Icici Direct the most.

Here is a breakdown of what it can do: \U0001f9f5

Collaborated with @niki_poojary

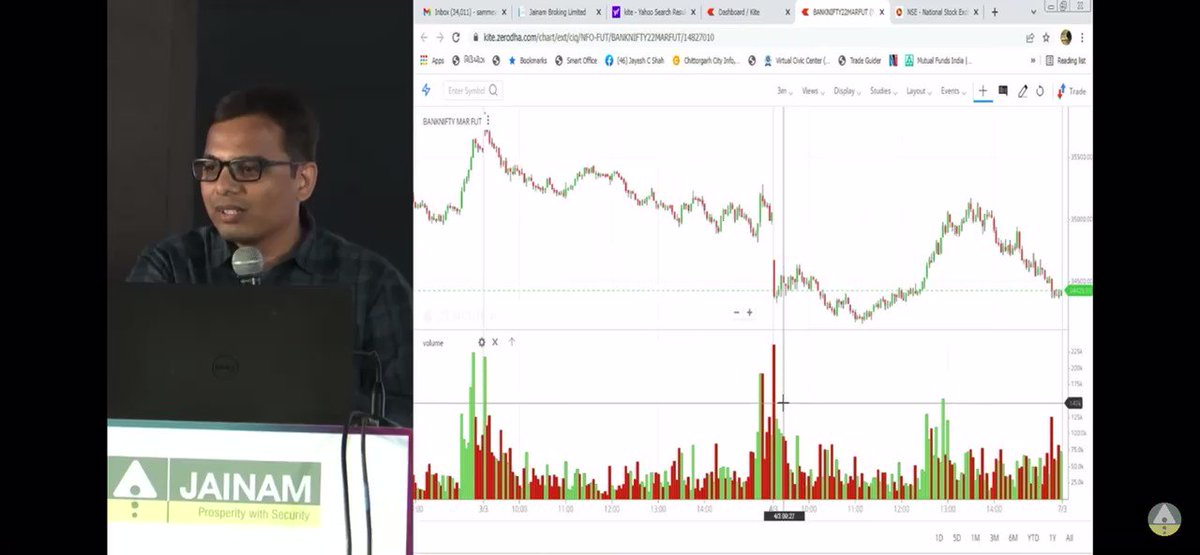

4. How to trade debit spreads? Explained by Mr. Ronak

The best spreads trader on Twitter: @Ronak_Unadkat

— Aditya Todmal (@AdityaTodmal) March 6, 2022

He trades in Nifty & Bank Nifty via spreads majorly.

In the Jainam Broking Speech, he shared how he trades debit and credit spreads:

Here's a breakdown of his 10 step method: \U0001f9f5

Collaborated with @niki_poojary