SAnngeri Categories Optionslearnings

Youtube channel:

https://t.co/Tn5s5tQucn

Telegram Group:

https://t.co/zcMFYLuFUU

1. Option Buying setup video [English]:

https://t.co/oCuI7ryOVS

2. Option Buying setup video [Hindi]:

https://t.co/GEtwvPipih

[1/3] @jitendrajain

3. learn Position Sizing:

https://t.co/mjGwmms21Y

4. overcome late OI signal:

https://t.co/rULPzfNpId

5. Gamma impact

https://t.co/6r9wKx3ewC

6. Risk Management

7. 4 part video on optimisation of various aspect:

a https://t.co/G7FDAm9VEg

b https://t.co/KjkzlbDBeR

c https://t.co/Vcn5icNO9P

d https://t.co/SsggfnwPNZ

8. examples

a https://t.co/S9OB41tNxx

b https://t.co/xZeKvZq3Uo

c https://t.co/mgQVYJu8te

d

There u have 30 now

Stick to these only !!!!

HCLTECH

— Pathik (@Pathik_Trader) March 31, 2021

WIPRO

M&M

TITAN

Adding into list

Remove AUROPHARMA, BHARTIARTL, TAMO from list (personal hate\U0001f603\U0001f603)

I keep getting msgs from ppl stuck in other stocks.

Just yday, someone asked abt Mindtree.

he shorted a CE and then when he wanted to cover,

the spread was 70 / 92 !!!

How many have faced such a problem?

Please add to this thread with actual examples

stock / strike price and rate

Yesterday sell 14700 than 14600 than 14800 market come down sell sell 15 k call going up sell 14400 put Getting some profit buy protection 14450 pe 14950 ce now u know ur max loss now wait or do adjustment with sell upar side ce or pe it\u2019s practical knowledge not books knowledge pic.twitter.com/J5sPGClVUZ

— itrade(DJ) (@ITRADE191) May 16, 2021

If we buy hedges, Margin will reduce & ROI increases.

More strategies will be shared going forward.

All u need is execute with Discipline & sticking with system when in DD.

(1/n) https://t.co/3KH9v0tgsb

A simple INTRADAY strategy with decent BACKTEST report of more than 3-5% returns on Monthly basis.

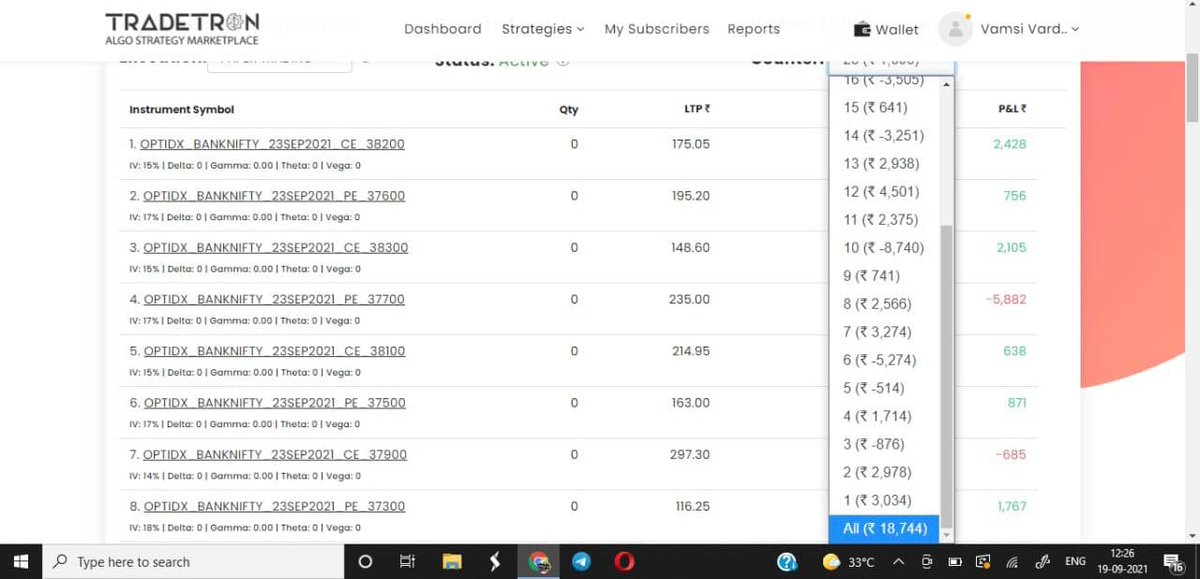

— OptionSeller(Vardhan) (@CaVardhanCa) August 15, 2021

Will be sharing live report on daily basis for a month.

& will conduct FREE webinar to discuss about the results in coming weeks.

Sharing all rules below.

(1/n) https://t.co/VMlxNtX90s pic.twitter.com/cJaa9axRss

to learn more about Algo Trading (in both directional & non directional) , you can visit my Telegram channel especially created for Algo Strategies.

Will be updating Daily Performance of our Algos in below

Today morning I was bullish looking at SGX Nifty. The first put I sold was 14000 PE.

— itrade(DJ) (@ITRADE191) April 20, 2021

After that market took resistance at R2, then I changed my view. Sold 14650 CE and then even uptill 14300 CE. pic.twitter.com/Bo4La6kJRe

He maine kyun likha tha ?? Or call buy kyun nahi kaha tha ?? Kyun sirf put sell kaha Agar maarket up hi jane wala tha to koi bata sakta he ?? https://t.co/w21XemUTLo

— itrade(DJ) (@ITRADE191) May 12, 2021

@SarangSood Sarang bhai according to you what number of vix is ideal for option buyers and what is that for option sellers? And is there any common number which is ideal for both?

— Dhaval bhatt (@Dhavalb55011726) July 14, 2021

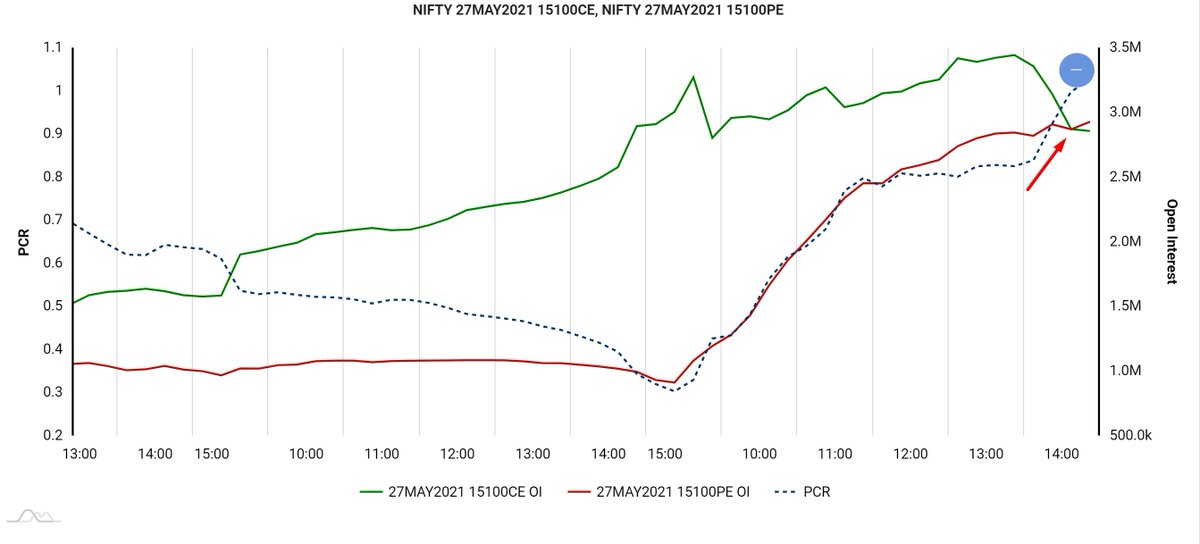

#15100 strikes OIs are still away, though 15100PE OI has risen sharply since morning but unable to cross above 15100CE OI.. any crossover intraday shall further fuel up the rally....otherwise Nifty may close below or around 15100 cash levels today. #JUSTaVIEW pic.twitter.com/6aQIPEFx3h

— Akaash (@thepnfway) May 21, 2021

How many are believing only in simple trading system?

— Mitesh Patel (@Mitesh_Engr) April 3, 2021

This is my simple trading.

I don\u2019t have any magic.

— Mitesh Patel (@Mitesh_Engr) January 7, 2021

Next week I will prefer to sell put in between strike 30500-31000 as shown in pic. Will manage upto 31000.

If breaks 31000 as first down support then will exit put nearby 31000 strike and will sell

31500 call ( will act as resistance again )

Simple hai na pic.twitter.com/hPLIMq3tSe

Subscribe to channel:

https://t.co/pzyd1ju3i9

1. Basics of Option Greeks

https://t.co/zCgZOYfh38

2. Basics of Open Interest [futures]

https://t.co/gBEA7rouxV

3. Option buying full

4. Data Analysis in Excel

https://t.co/yhWjhdbOMG

5. Understand Gamma Risk

https://t.co/DVhOBGPM19

6. Option buying setup - strike selection

https://t.co/mgQVYJu8te

7. Yogeeswar Pal live trading

https://t.co/mtIJU5VYUl

@jitendrajain @yogeeswarpal