SAnngeri's Categories

SAnngeri's Authors

Latest Saves

In options strategy brought the wings inside and locked more profits https://t.co/wIPMUofhm6

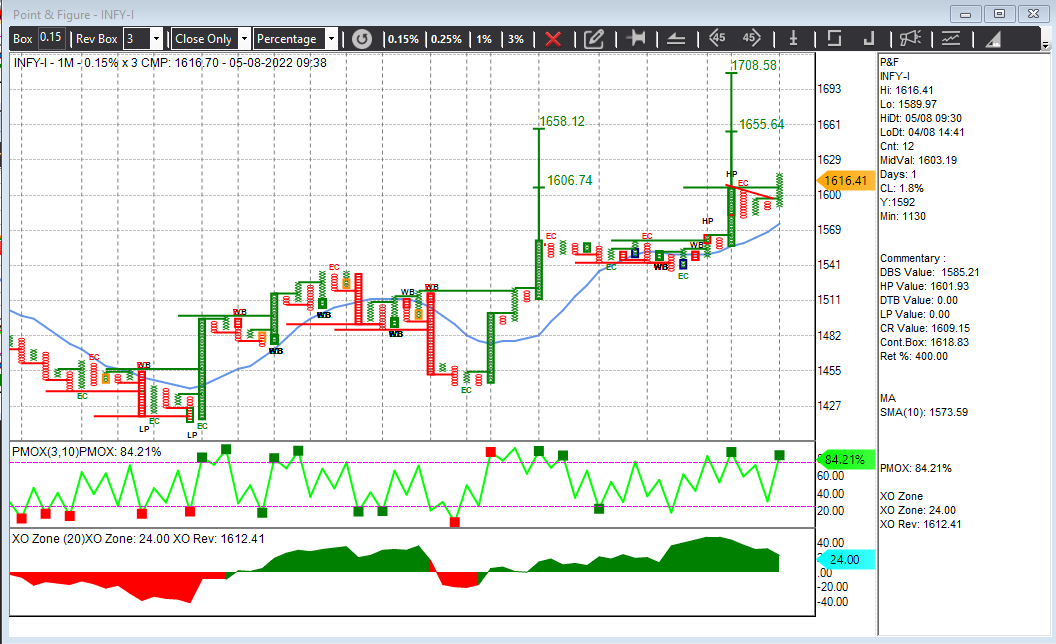

#Infy futures crossed 1600

— DTBhat (@dtbhat) August 4, 2022

Booked half in 1600CE in Call Debit Spread and converted to a butterfly https://t.co/NZdSOC4wrd pic.twitter.com/p8FgBaAyhC

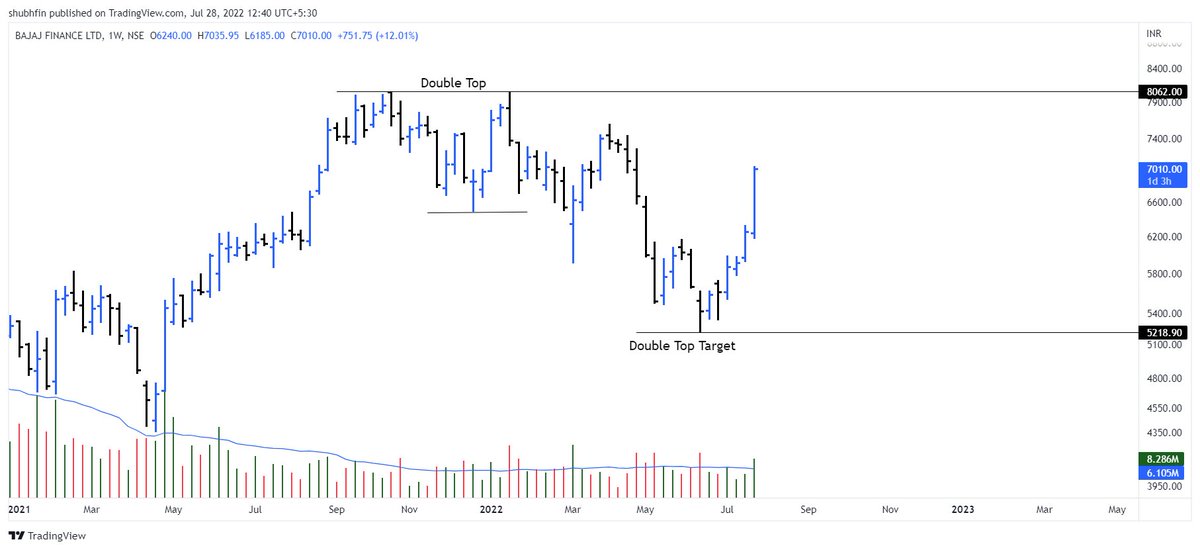

Bajaj Finance cmp 6266, Breakout of double bottom pattern with bullish RSI divergence.

— The Anonymous Trader (@Anony_mous_Bull) July 22, 2022

Expecting levels of 6500/6750/ 7000. Support at zone of 5800-6000. Keep on radar.#BajajFinance #StockMarketindia #stocks #investing #Nifty #BREAKOUTSTOCKS pic.twitter.com/a5N0oj549T

#bearrun

#BearMarket

Head & Shoulders pattern, double top and bearish RSI divergences fail more often in bull market and generally gives a very good SAR trade. Vice versa is also true for bear market.#bullrun #BullMarket

— Aakash Gangwar (@akashgngwr823) February 9, 2021

This might be the answer why I prefer long on any Dip. https://t.co/ne0b96QH9s

#ADANIENT - Can we ? https://t.co/Zdb4fy0eSL pic.twitter.com/oPmNYax5of

— VVikas Kumaarr (@flyingvikas129) July 11, 2022

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.