AchuthArora's Categories

AchuthArora's Authors

Latest Saves

If you are new to F&O, you can start with Vertical Spreads (Debit and Credit spreads) instead of buying options in Stocks and Indices.

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

Traders who are trading in cash and want to explore options generally start with options buying without much knowledge. They buy OTM strikes and trade with wrong position sizing. With no idea about the perfect entry, they end up feeling that F&O is risky. (2/25)

After losses in F&O buying, this is how I approached it and it rewarded me pretty well in initial phase. I find this strategy easy to start things off. And then, you can explore other strategies too and find what works for you. (3/25)

Vertical spread is a directional, defined risk options trading strategy:

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

https://t.co/KQvYOsu9kv

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

Traders who are trading in cash and want to explore options generally start with options buying without much knowledge. They buy OTM strikes and trade with wrong position sizing. With no idea about the perfect entry, they end up feeling that F&O is risky. (2/25)

After losses in F&O buying, this is how I approached it and it rewarded me pretty well in initial phase. I find this strategy easy to start things off. And then, you can explore other strategies too and find what works for you. (3/25)

Vertical spread is a directional, defined risk options trading strategy:

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

https://t.co/KQvYOsu9kv

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

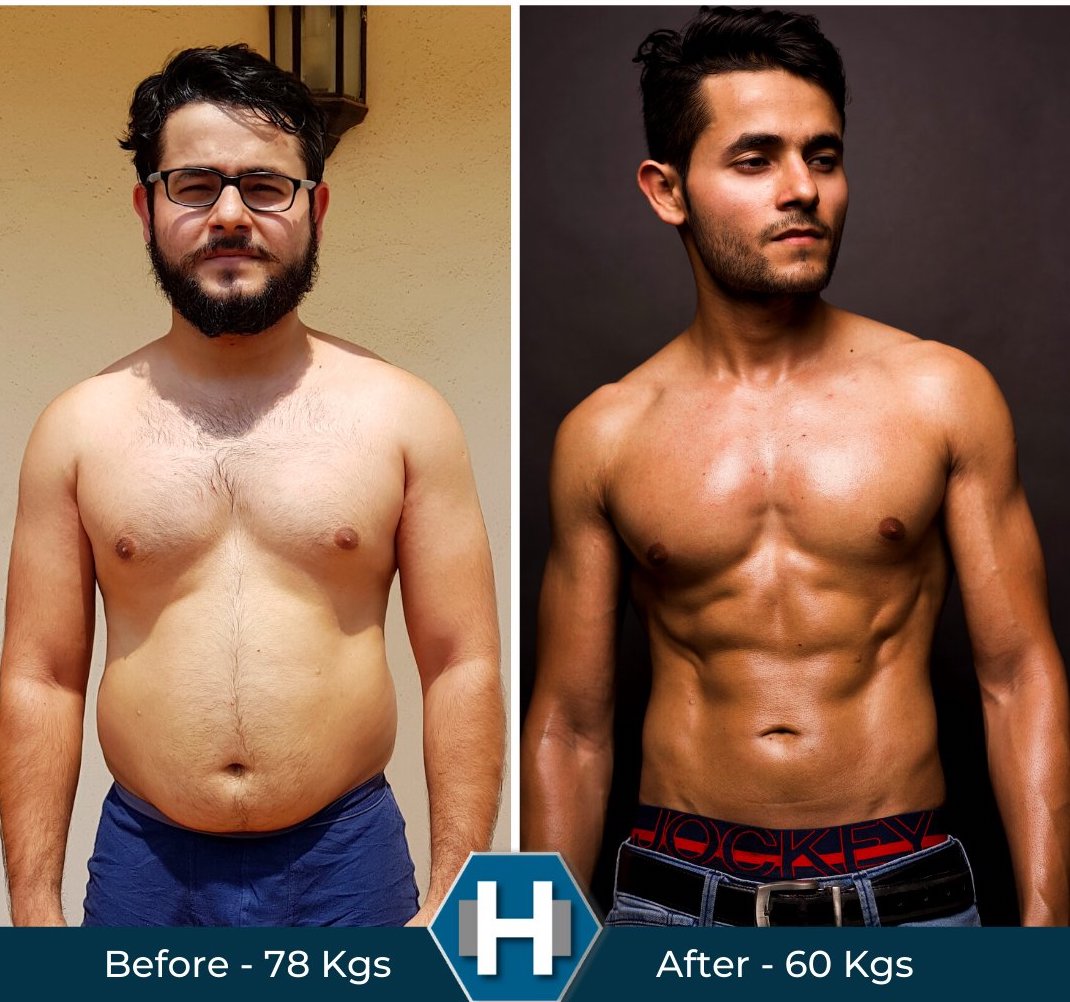

Bodies fall apart when they lack the strength and mobility to hold a Deep Squat.

Your compromised frame attracts pain and injury.

I’ve met too many adults over the years who failed to hold the position.

Practice your Deep Squat to spare yourself from future torments.

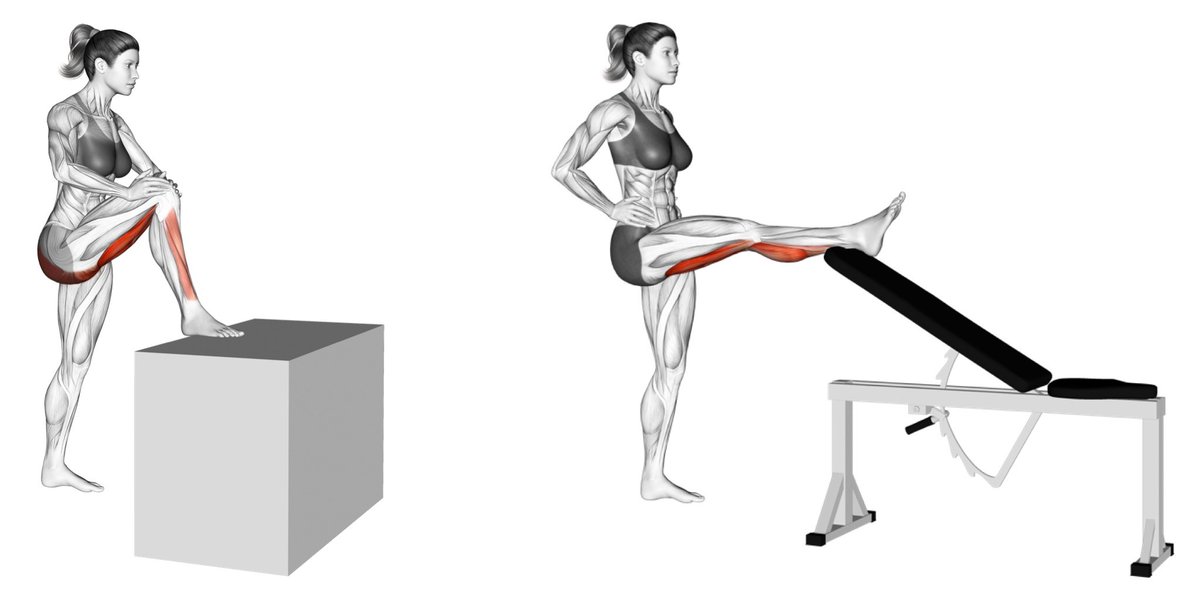

Step 1 - Strengthen the back of your legs one side at a

Step 2 - Stretch both ends of your Hamstrings

Your compromised frame attracts pain and injury.

I’ve met too many adults over the years who failed to hold the position.

Practice your Deep Squat to spare yourself from future torments.

Step 1 - Strengthen the back of your legs one side at a

This simple exercise changes people\u2019s hips and lower backs.

— Alex Bernier (@mythoughtfood) November 27, 2021

You have no idea how much energy you waste when your glutes and hamstrings are weak.

I\u2019ve assessed too many people who cramp after a few reps.

They can\u2019t lift their pelvis lying down, so imagine when they stand.

Fix pic.twitter.com/NMAJaMuuCU

Step 2 - Stretch both ends of your Hamstrings

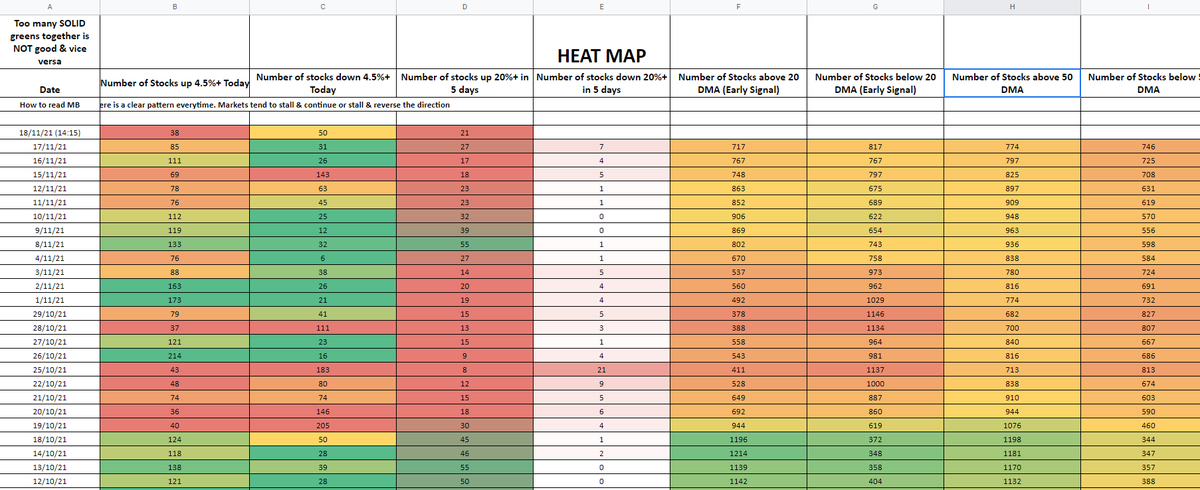

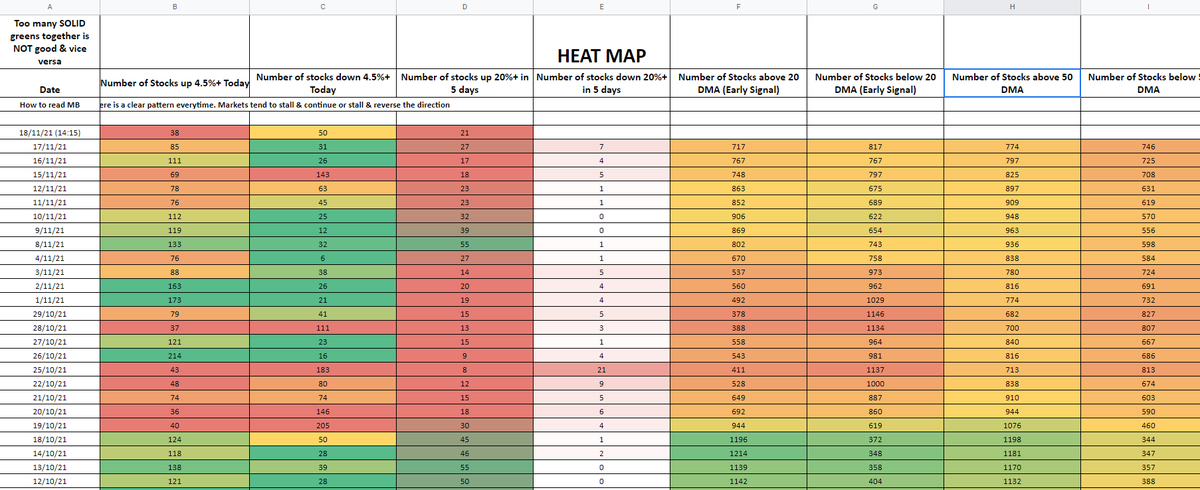

🧵Market Breadth 101

It is a broad approach to overall market analysis that helps traders to realize the underlying strength or weakness associated with a market move

Thanks @PradeepBonde for the blogpost & @iManasArora for making breadth tool in context of Indian Market

(1/n)

(2/n)

Breadth will treat all stocks in an index equally. Stock with largest capitalization and the smallest are both equal in breadth analysis. It can be applied to any exchange or index of securities, any sector or industry group.

(3/n)

One may consider it "oscillating indicator", when reached a threshold level, either positive or negative, they tend to reverse or take a halt.

It is concerned with probability that market is approaching a major turning point, so it isn't helpful knowing everyday trends.

(4/n)

Breadth is based on the price of the variables, still it can offer leading indications based upon the identification and use of previous levels or thresholds that are consistent with similar market action.

(5/n)

Breadth directly indicates/represents the market, no matter what the indices are doing.

Might look complex to understand it at sight. Let's try to break it down.

Link: https://t.co/nvEuNXoiZ7

It is a broad approach to overall market analysis that helps traders to realize the underlying strength or weakness associated with a market move

Thanks @PradeepBonde for the blogpost & @iManasArora for making breadth tool in context of Indian Market

(1/n)

(2/n)

Breadth will treat all stocks in an index equally. Stock with largest capitalization and the smallest are both equal in breadth analysis. It can be applied to any exchange or index of securities, any sector or industry group.

(3/n)

One may consider it "oscillating indicator", when reached a threshold level, either positive or negative, they tend to reverse or take a halt.

It is concerned with probability that market is approaching a major turning point, so it isn't helpful knowing everyday trends.

(4/n)

Breadth is based on the price of the variables, still it can offer leading indications based upon the identification and use of previous levels or thresholds that are consistent with similar market action.

(5/n)

Breadth directly indicates/represents the market, no matter what the indices are doing.

Might look complex to understand it at sight. Let's try to break it down.

Link: https://t.co/nvEuNXoiZ7