Jacobhtml Categories Finance

Below are some updated thoughts on potential integrations, improvements, and innovations for Saffron moving forward. ⬇️

1/11 @saffronfinance_ ($SFI) is DeFi's new kid on the block with its tranched yield product that is already live with DAI on @compoundfinance. https://t.co/JpqnxhwrDw

— Benjamin Simon (@benjaminsimon97) November 19, 2020

2/18 First, if you haven't seen @Privatechad_'s alpha-leaking introductory thread, you should check it out.

I agree that @AlphaFinanceLab and @CreamdotFinance, specifically the Iron Bank, would be ideal targets for SFI risk tranches.

15/. 3. Though not the focus atm, interest from various projects and integrations are happening.

— Private Chad (@Privatechad_) February 1, 2021

* Chainlink reached out (props to the amazing $LINK team).

* Talks with $ALPHA and rumored upon V2 releases there will be a collaboration.

*Cream integrations in v2

* $COMP tranches pic.twitter.com/IXCtzvSkw7

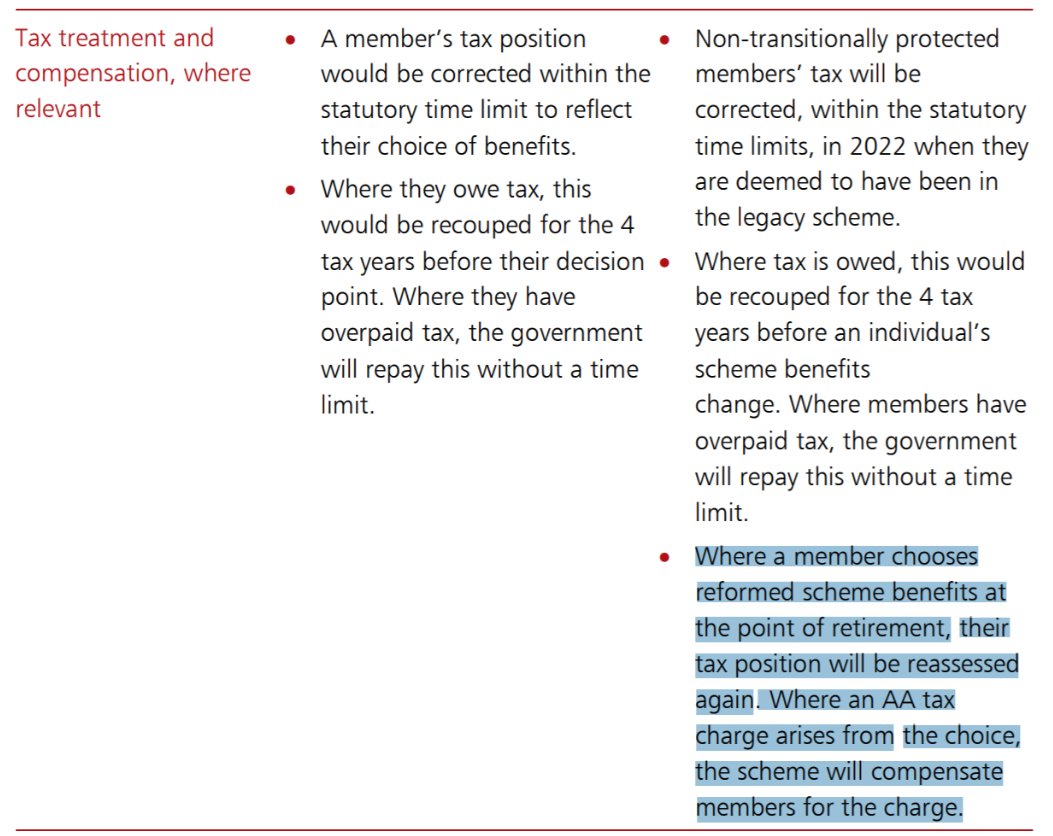

3/18 Speaking more broadly, Saffron is primarily integrated with @compoundfinance, which has served as a MVP of sorts.

The thing is, Compound is one of the safest (but also lowest yield) protocols in DeFi, so it's not surprising that there isn't much demand for the sen. tranche.

4/18 Expanding beyond Compound to higher-risk/higher-return protocols has always been key.

These protocols are the bread-and-butter target market for Saffron, and I would expect to see a surge in demand for senior tranche staking in these

4/11 Imo, the golden egg will be vault platforms like @iearnfinance, @picklefinance, etc.

— Benjamin Simon (@benjaminsimon97) November 19, 2020

Recently, some of these higher risk platforms (e.g. @harvest_finance) have been hit with a wave of attacks.

Saffron will enable cautious investors to use these products with peace of mind.

5/18 Additionally, @DeFiGod1 convinced me that Senior Tranche pools would be more appealing if they offered fixed yield.

Essentially, Saffron would augment the product offerings of @Barn_Bridge by also offering senior stakers insurance in the form of junior tranche collateral.

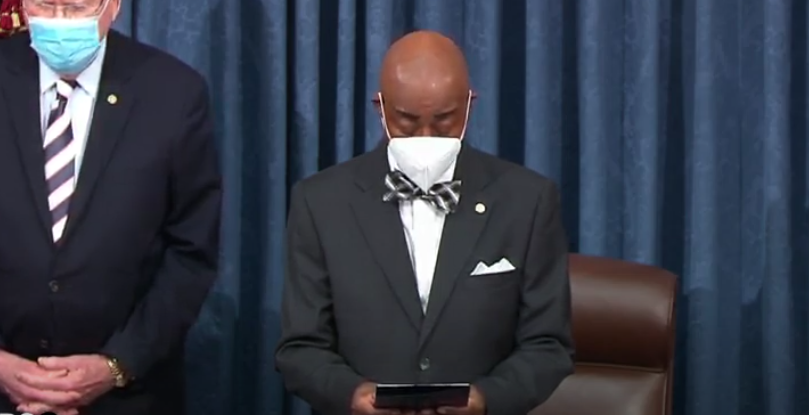

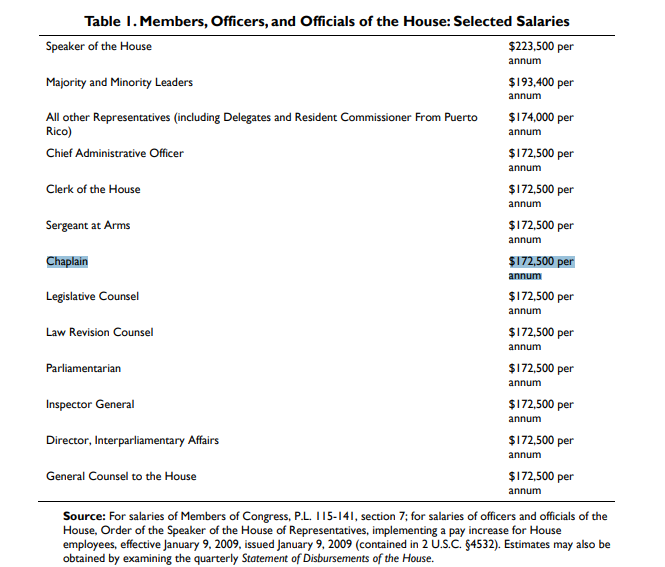

The prayer is given by Senate Chaplain Barry Black. Yes, the Senate has a chaplain. Yes, your tax dollars pay his salary. And the numbers are shocking:

I wrote about this back in 2016. https://t.co/vdc8EGhxPW

From 2000-2015, Congress spent more than $10 million on prayers, the vast majority of which are to the Christian god (more than 96% of prayers in the House were Christian).

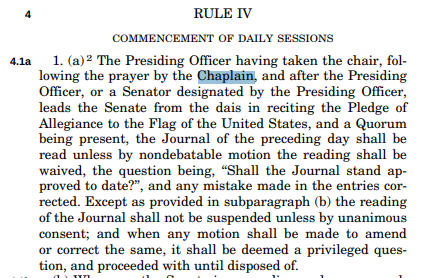

The Senate Rules give the chaplain ONE job: to pray.

https://t.co/6dEjnnfy0x

Do chaplains do other things? Sure. But they're paid to pray. The claim that they accommodate the religious freedom of Members of Congress may have made sense when DC was an unpopulated swamp...

...but not in an age where houses of worship are on every street corner in DC and when members can zoom with religious counselors of their choice back home or anywhere else. Religious consolation is easy to find.

They chaplains are paid to pray.

And they are paid an awful lot.

The House Chaplain makes $172,500 (2018)

The Senate Chaplain makes $160,787 (2018)

Again, their only job is to say the opening prayer.

https://t.co/a3YrOqPgOZ

A 🧵

To understand a broader picture, listen to this podcast by the @TakshashilaInst

https://t.co/rcp5D9ofwy

You don't need the Spotify app for this. It opens in the browser as well.

Let us deep dive into the Ministry of Defence budgets and compare it to the previous years:

Budget 2021:

Revenue Expenditure: Rs. 337,961.49 crores

Capital Expenditure: Rs. 140,234.13 crores

Total Budgetary outlay: Rs. 478,195.62

Budget Expenses 2020:

Revenue Expenditure: Rs. 322,761.99 crores

Capital Expenditure: Rs. 108,248.80 crores

Total Budgetary outlay: 431,010.79

This is how much was given to Ministry of Defence in the Union Budget in 2020.

Revised Estimates (how much the Government actually ended up spending)

Revenue Expenditure: 344,606 crores

Capital Expenditure: 140,130 crores

Total Actual spends: 484,736 crores

The Premier Agent business is prob as strong as it has ever been.

Normalized for some accounting nuances, QoQ growth was 20% in Q3 and 27% in Q4.

YoY growth was 13% in 2020 despite a 17% decline in Q2 related to the pandemic.

Reading the tea leaves, it sure sounds like Flex is one of the main drivers of PA revenue acceleration. This is something we talked about in Q3, 2019 when the stock had sold off by 20%+ and was trading in the low 30s

Takeaway No. 2\ufe0f\u20e3:$ZG is expanding its @PremierAgent Flex program.

— KiD \U0001f4b0 (@kidkapital) August 8, 2019

This is crucial so let me explain.

Not gonna claim iBuying is inevitable nor a “good” biz but even skeptics must admit the segment looks more viable today.

And we can all agree iBuying is clearly the superior customer experience compared to the tradition home selling process.

Maybe the most interesting comment made on the call?

The Zestimate will be a live initial offer in some iBuying markets this year 👀

TLDR: Capturing % of GMV great for SHOP (already well appreciated), but perhaps even better for FB (still early days, unlikely to see impact until Q3 this year)

$SHOP Expands Its Checkout System to $FB and Instagramhttps://t.co/IsM1FNsFXV

— Jerry Capital (@JerryCap) February 9, 2021

1) $SHOP launched Shopify Payments in mid 2013 and this substantially changed the trajectory of its business, which previously didn’t scale (directly) with the GMV running through its platform

Shopify Payments today is ~75% of SHOP’s faster growing non-subscription revenue

2) Shopify Payments currently drives ~50% of $SHOP revenue and is enabled by 2/3+ of all SHOP merchants (in 🇺🇸 90%) accounting for nearly 1/2 of GMV generated on SHOP digital store fronts

As we all know, Shopify Payments is powered by Stripe, so not available where Stripe is not

3) Per filings, $SHOP charges ~275 bps gross yield (rack rate is 2.4-2.9% + $0.30 depending on which subscription plan a merchant chooses) and makes ~90-100 bps net yield on Shopify Payments, after interchange and processing fees paid to Stripe and downstream (WFC/FISV)

4) For the < 1/3 of $SHOP merchants and 1/2+ of GMV not on Shopify Payments, the merchant brings its own 3rd party payment processor

In this scenario, SHOP only captures a nominal transaction fee on the non-Shopify Payments GMV (~25bps on blended basis)

H/t @JerryCap

FT EDITORIAL: Amsterdam punctures City\u2019s post-Brexit hopes #TomorrowsPapersToday pic.twitter.com/aLM442k6iS

— Neil Henderson (@hendopolis) February 11, 2021

But I also think that that Andrew Bailey misses the

The Bank of England governor has accused Brussels of double standards by blocking the City from European financial markets https://t.co/vv3OPl9i2a

— The Times (@thetimes) February 11, 2021

During the referendum the argument was made that because the EU regulatory regime was agreed with the UK that passporting would be granted.

And we were told it was crucial by Andrea Leadsom’s campaign team after the referendum.

There is a reason why financial services tend to be in separate chapters of trade deals.

They are not the average service.