Cur10uslearner Categories Screeners

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

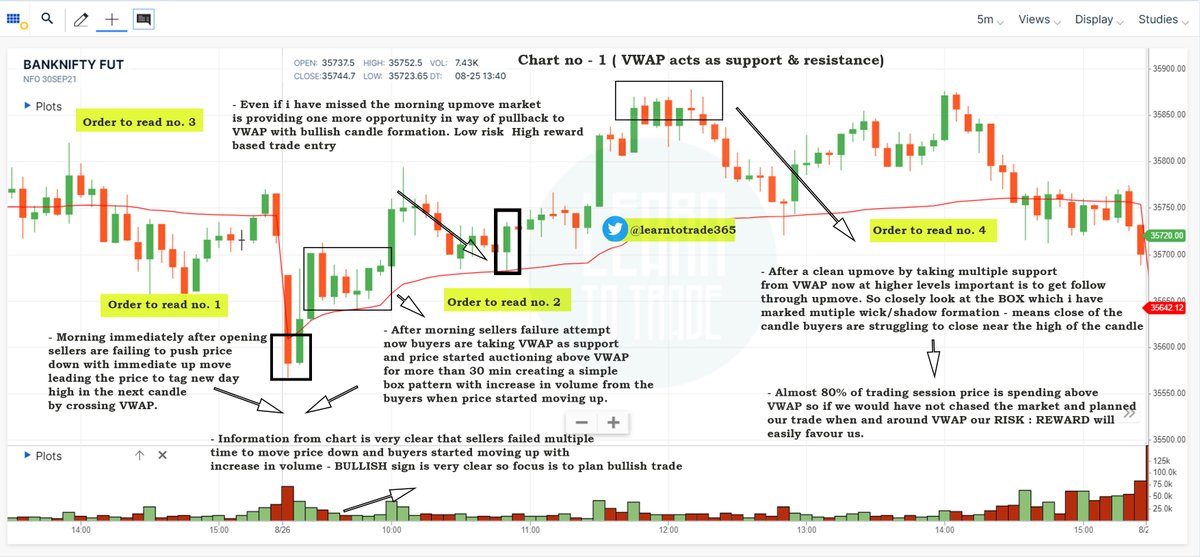

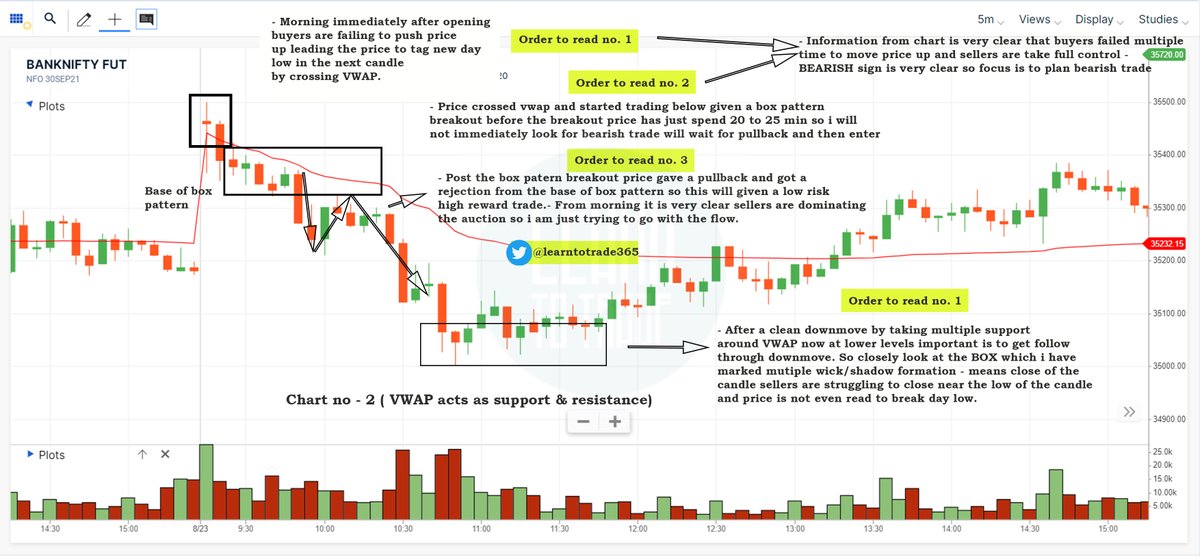

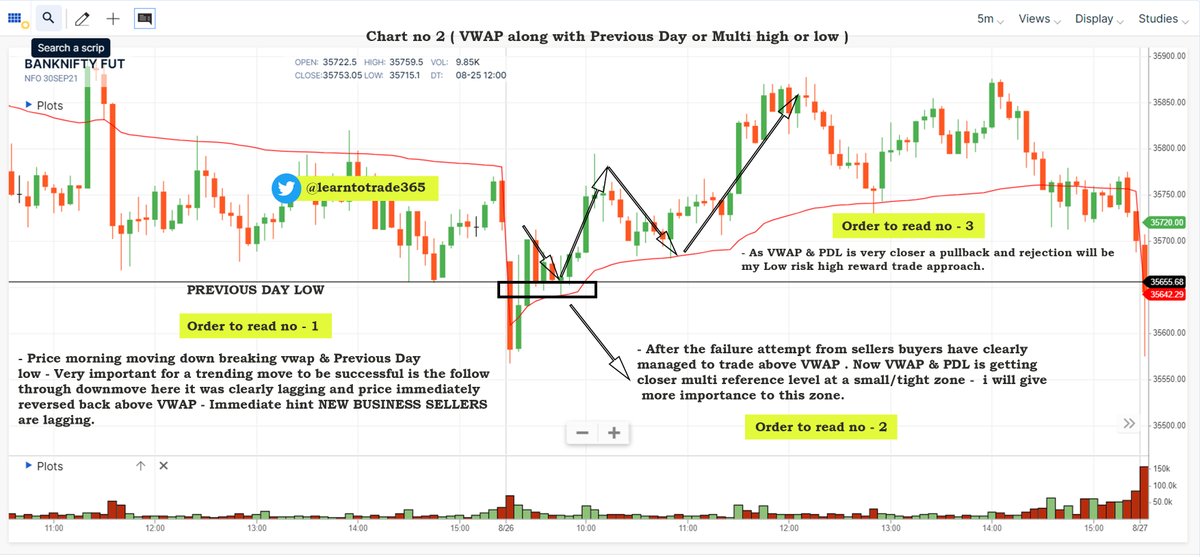

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

Chart 3

Chart 4

📌Rs + Macd Strategy

📌Darvas Box Strategy

📌Breakout Trading

📌Retest Trading

📌Range Trading

Retweet and Share !

@kuttrapali26 @Techno_Charts

1/no

RS + MACD Strategy

Swing Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) November 12, 2021

That can help you generate 3 to 5% Monthly

A thread \U0001f4d5

Using RS , MACD , 21 EMA and Price Action

All Concepts Explained !

RETWEET AND SHARE !#StockMarket @kuttrapali26 @ArjunB9591

1/n

Range Trading Strategy

SWING TRADING STRATEGY FOR RANGE BOUND STOCKS

— JayneshKasliwal (@JayneshKasliwal) December 23, 2021

A Thread :

Using Concept of Support and Resistance

Using Minimum StopLoss

Retweet And Share !

1/n

Darvas Box Trading Strategy

The Darvas Box Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) December 30, 2021

A Detailed Thread \U0001f516 + 1 Book Give Away !

Rules For Giveaway :

Follow @JayneshKasliwal

\U0001f504Retweet and

\u2665\ufe0f Like this Tweet

One Lucky Winner will be Selected in Live for the Giveaway #StockMarket #darvasbox pic.twitter.com/pYdofszMML

Breakout Trading

Breakout Trading Strategy

— JayneshKasliwal (@JayneshKasliwal) November 17, 2021

How to Trade Breakouts Effectively?

How to avoid Big losses in BO Failures ?

How to Position Size?

A THREAD\U0001f516

RETWEET SHARE!\U0001f504@kuttrapali26 @AdityaTodmal

1/n

Please note Screener will help you to reach momentum but you need to see chart & further segregate trends manually (1/n)

Do retweet & like so that it reaches maximum people

Screener 1) +ve ADX DMI Breakout to find out where the action is going on a particular day, you can then look onto stocks and find setups and patterns to trade.

Link - https://t.co/fIKlWSloNw

(1/4)

Screener 2) Going one level more deep into ADX where we find up stocks which are already in trend on weekly

1) Weekly ADX >25 indicating the trend is already there

2) +DMI breaking out

3) Stock within 15% of 52w high

4) Stock above 200 SMA

Link-

Screener 3) This is based out of within 20% of ATH Stocks. I have also added few fundamentals to it. You can change variables according to it

Link -

Screener 4) RSI which is a momentum indicator

RSI breaking out can give you names where momentum is picking up and then you can look onto charts for buy points

Link -