More from Sajal Kapoor

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602

Playing real estate and home improvement structural story in \U0001f1ee\U0001f1f3 via a focused proxy consumption \U0001f9fa

— Conviction | Patience (@unseenvalue) January 10, 2020

1. Asian Paints

2. Pidilite

3. SHIL (Hindware portfolio)

4. Fragrance SpecChem (Kelkar & Fairchem)

Consumption | Proxy Consumption

More from Uvlearnings

How many hospitals in India have globally comparable healthcare quality and high end molecular diagnostics, genomics diagnostics, AI/ML, Robotics for timely, accurate diagnosis and best possible prognosis, treatment at affordable cost?

— Sajal Kapoor (@unseenvalue) June 21, 2021

Any thoughts @tusharbohra @AdityaKhemka5 https://t.co/6Mhpu5Dru1

Asian Paints is the TCS of 'Home Improvement' space

Think in terms of ::

- Sustainability of Leadership over decades

- Sustainability of Consumption Megatrend

- Sustainability of CFO and Governance

- Quality of Balance Sheet

Rather than absolute MCap

Conviction | Patience

— Sajal Kapoor (@unseenvalue) December 30, 2019

TCS of CDMO in the making over the next 15Y \U0001f1ee\U0001f1f3

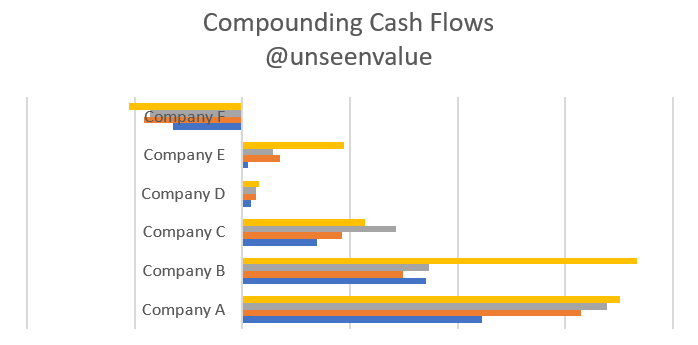

Compounding @ 25% since the IPO.

Syngene | Revisit 2030-2040 https://t.co/PHd8UEod5X