The comment from renowned investor was in a lighter vein. You ought to listen to the tone. He was spot on in comparing the capability and scale of two businesses, as both started around the same time - one could scale up, whilst other couldn't. Let's not read too much into it 🙂

In an example of how deeply ingrained misogyny is in the Indian system, billionaire investor Rakesh Jhunjhunwala asked the management of Jubilant Pharmova: \u201cHow can we be lower than the lady? We have to beat her,\u201d in a slighting reference to @kiranshaw.

— Dr. Kailashnath Koppikar (@koppik) June 26, 2021

https://t.co/1dkZ9JMLLr

More from Sajal Kapoor

The Almanack of Naval Ravikant

The Psychology of Money

The Wealth of common sense

Masterclass with super investors

100 Baggers

Which are the books in your re-read list?

— Investment Books (@InvestmentBook1) October 8, 2021

Mine as Follows \U0001f447

The Psychology of Money

The Wealth of common sense

100 Baggers

Once upon a wall street

Masterclass with super investors

Atomic Habits

Richer, Wiser, Happier

More from Uvlearnings

https://t.co/hItmOud8Pm

#Hikal has stepped up R&D in recent years. Next few years (capex & launches) should yield superior earnings. Wish them all the luck \U0001f44d

— Sajal Kapoor (@unseenvalue) September 26, 2020

D: invested and biased view for sure, but it was below 1x price to sales vs 12x price to sales for many chemicals and generic players. No reco!! pic.twitter.com/aqPUKbziHK

You May Also Like

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

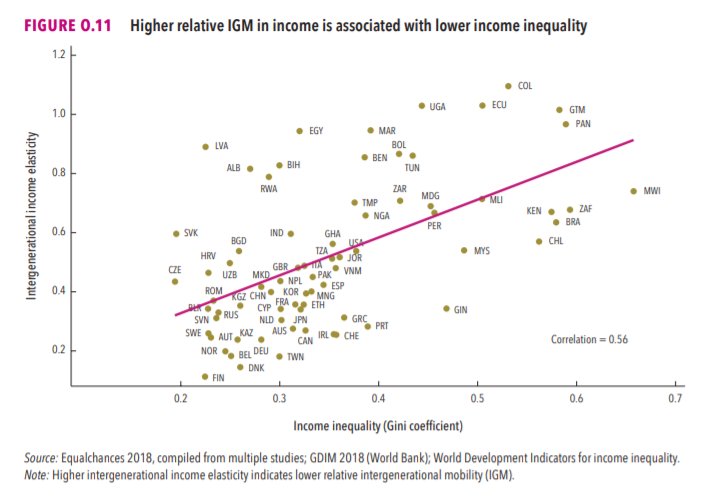

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*