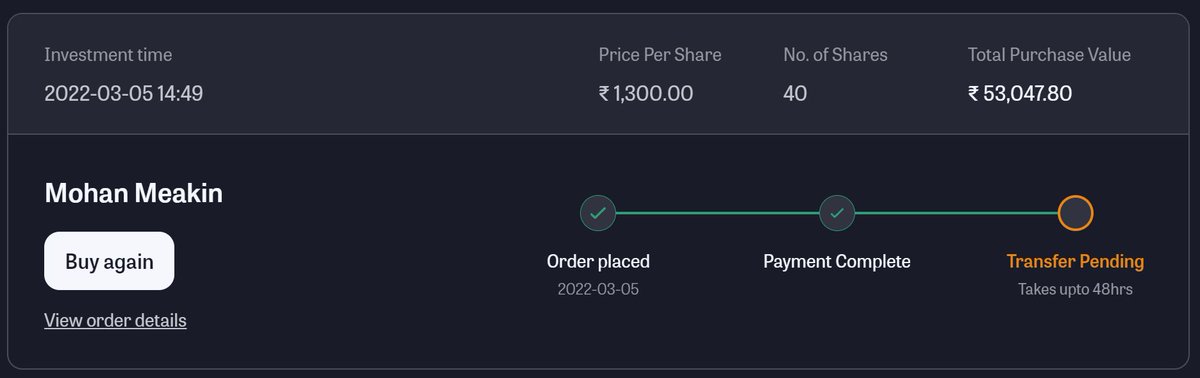

Purchased some unlisted shares from LeadOff.

Platform is reliable as shares will be transferred directly to CDSL/NSDL accounts.

Lot of unlisted companies are available, can try if interested:

1. Chennai super kings

2. Reliance Retail

3. Pharmeasy

4. NSE(sold out)

5. Kurlon

etc..

More from yashstocks

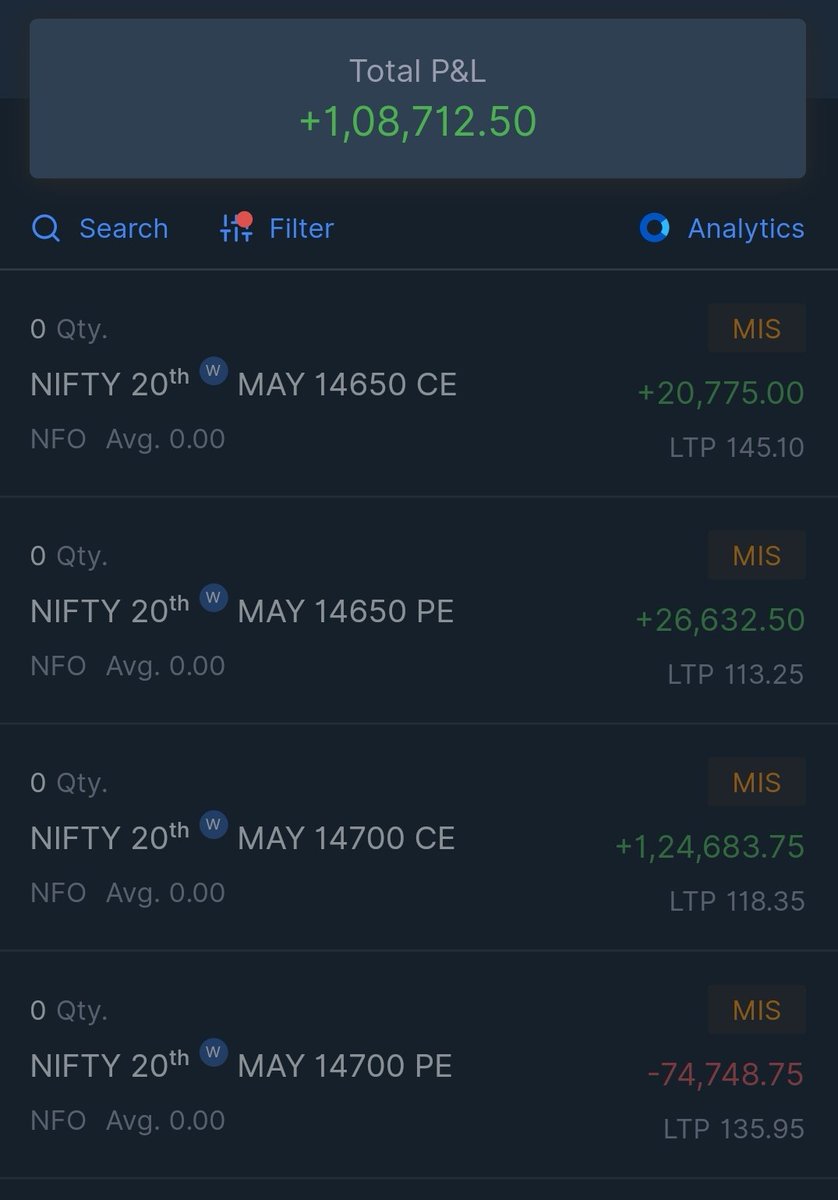

12 to 15% is easily achievable nowadays without taking much risk even though the capital is 10 crores due to leverage :)

Invest 10 crore in liquid, debt, gilt, T-bills, 10-20% equity that will give 6 to 7% average returns every year.

What kind of % return in a year is considered very best with capital more than 10 cr?

— Mitesh Patel (@Mitesh_Engr) October 12, 2021

(2/4)

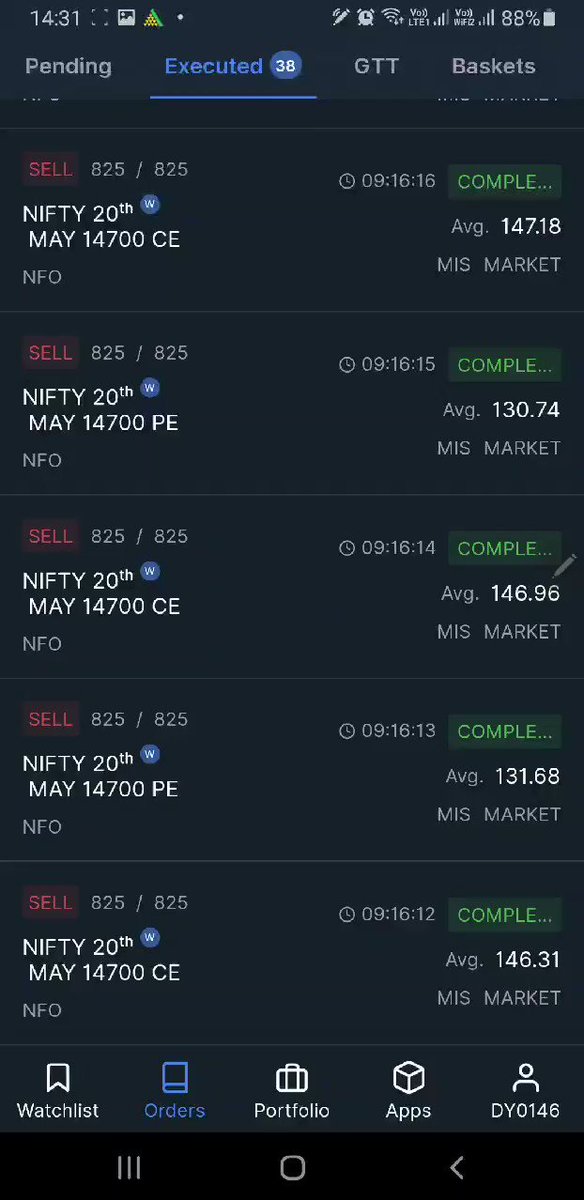

Rest can be made by selling far otm penny options only on expiries. They are trading at good premiums due to leverage and can be easily manageable if goes wrong. Thus targeting only 0.15% returns in a week

0.15% x 52 weeks = 7.8%

6% in MFs + 7.8% in trading = 14% returns

(3/4)

Now comes the hard part, doing this every week without getting bored and without affecting one's psychology is the most difficult part. And since we start making money, we take higher risks which can eventually wipe out profits.

(4/4)

And those who think about blackswan event all the time can do it only call side. And it's purely intraday & only will be done on expiry days, so chance of Black Swan, that too on upper side is mostly impossible. If there is any case as such before, do let know in comments

You May Also Like

The question is:

Is this an official account for Bahcesehir Uni (Bau)?

Bahcesehir Uni, BAU has an official website https://t.co/ztzX6uj34V which links to their social media, leading to their Twitter account @Bahcesehir

BAU’s official Twitter account

BAU has many departments, which all have separate accounts. Nowhere among them did I find @BAUDEGS

@BAUOrganization @ApplyBAU @adayBAU @BAUAlumniCenter @bahcesehirfbe @baufens @CyprusBau @bauiisbf @bauglobal @bahcesehirebe @BAUintBatumi @BAUiletisim @BAUSaglik @bauebf @TIPBAU

Nowhere among them was @BAUDEGS to find

Some random interesting tidbits:

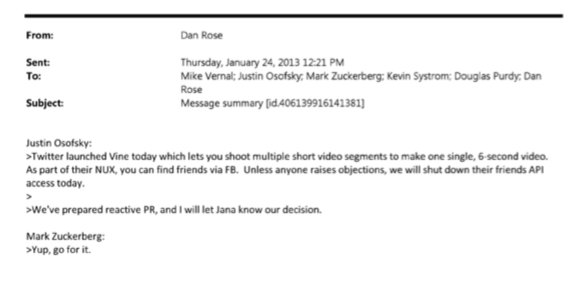

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

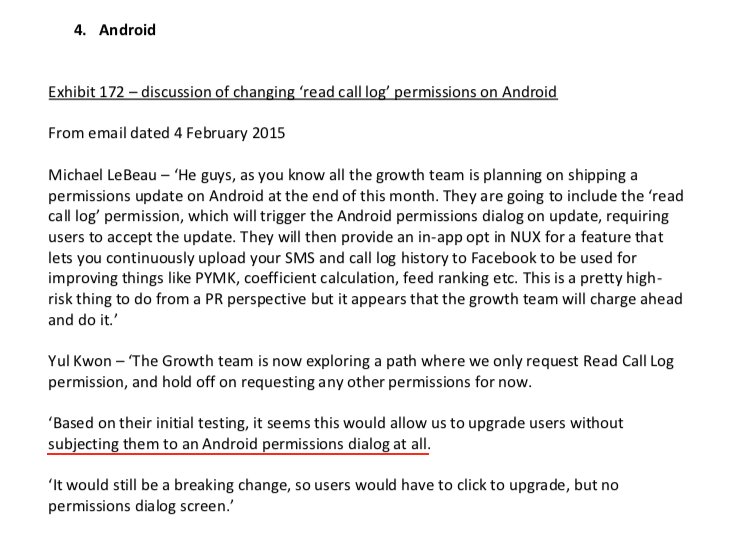

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

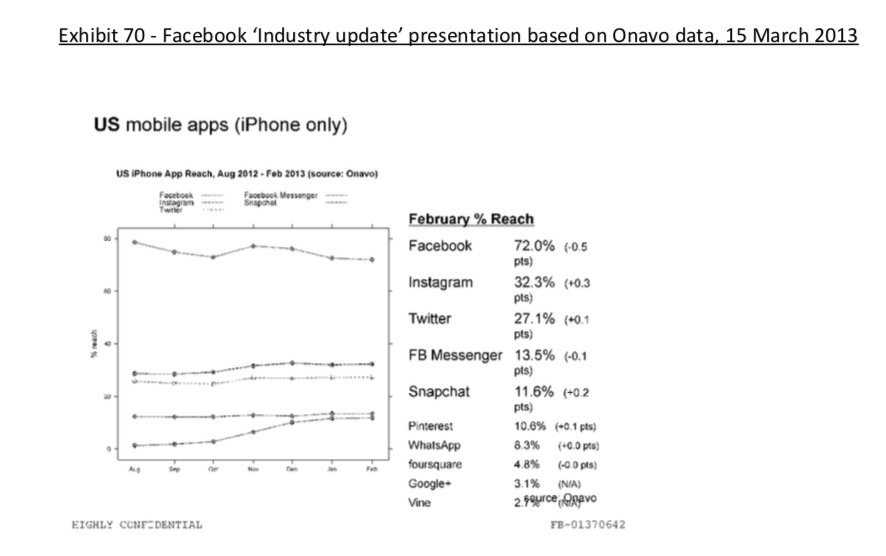

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020