https://t.co/mgWQbsFQGN

1/Today's @bopinion post is about Trump's taxes, and what they show about how America allocates capital.

We appear to have some big problems.

https://t.co/mgWQbsFQGN

Why would creditors give money to a guy who wastes the money on bad businesses and doesn't even pay them back?

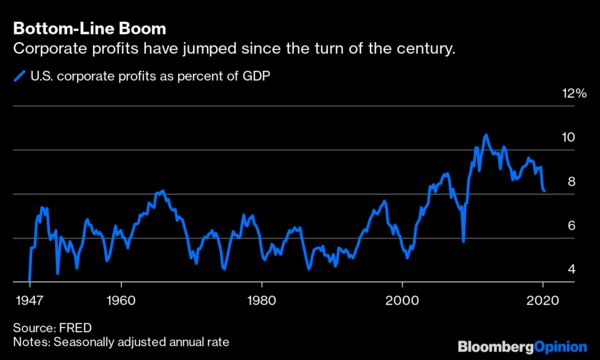

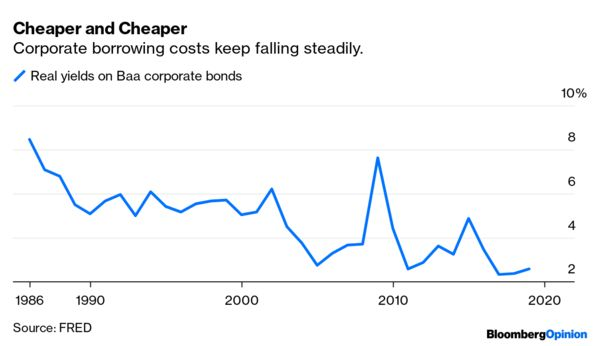

Why hasn't an abundance of cheap capital caused the return on financial capital to fall? Interest rates are low, but stock returns have held up strongly.

When you increase the supply of loanable funds, prices are supposed to go down. In other words, cheap capital should fund a lot of marginal businesses that compete away profits...

Simcha Barkai and Matt Rognlie have both written about this:

1. https://t.co/OLln8npr8b

2. https://t.co/BY1EWyluD7

https://t.co/xNzE9SO8nY

https://t.co/BY1EWyluD7

And it doesn't really explain Trump, does it? He's not a monopolist, and he doesn't even make profit. He's just a huckster who can borrow cheaply because he's famous.

Financiers are willing to throw tons of cheap money at big powerful companies or at famous hucksters like Trump, but charge inordinate prices to fund new entrants or marginal businesses.

We need to figure out what's going wrong, and fix it!

(end)

https://t.co/dHVCEQGa9q

More from Noah Smith 🐇

Krugman is, of course, right about this. BUT, note that universities can do a lot to revitalize declining and rural regions.

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote:

One thing I've been noticing about responses to today's column is that many people still don't get how strong the forces behind regional divergence are, and how hard to reverse 1/ https://t.co/Ft2aH1NcQt

— Paul Krugman (@paulkrugman) November 20, 2018

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote:

1/OK, data mystery time.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

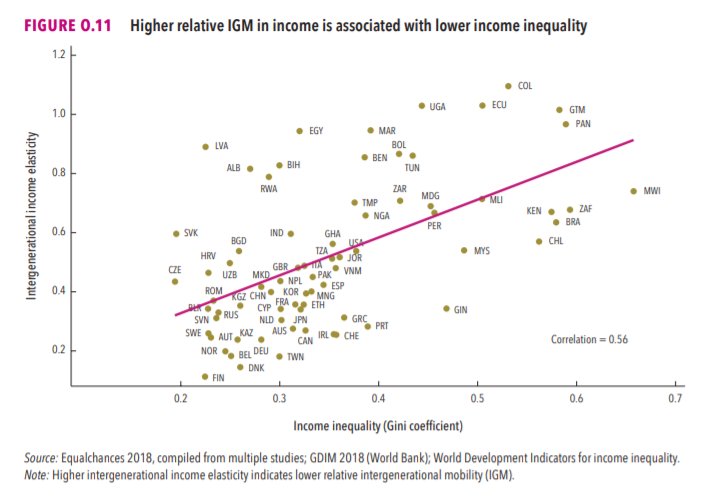

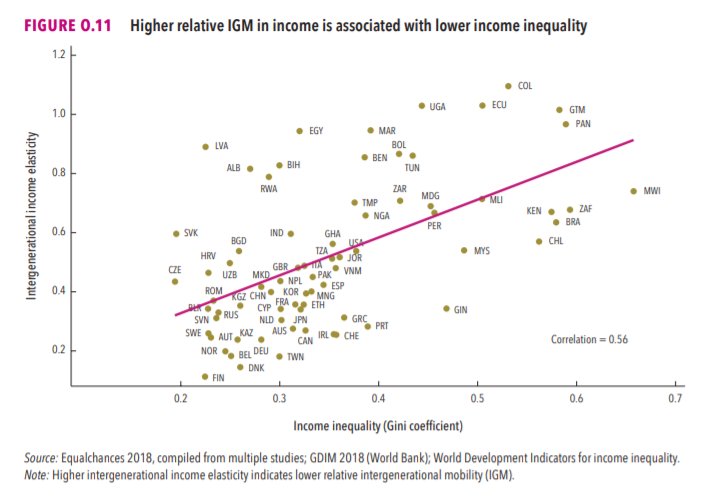

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

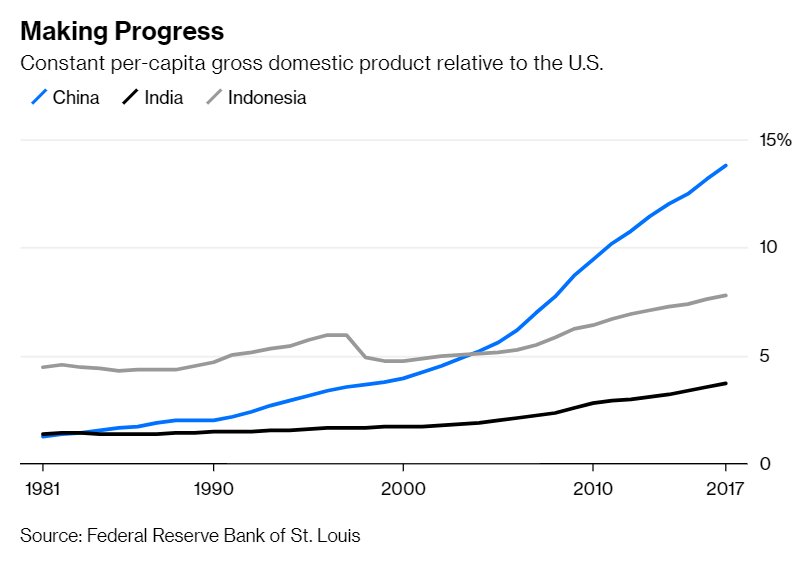

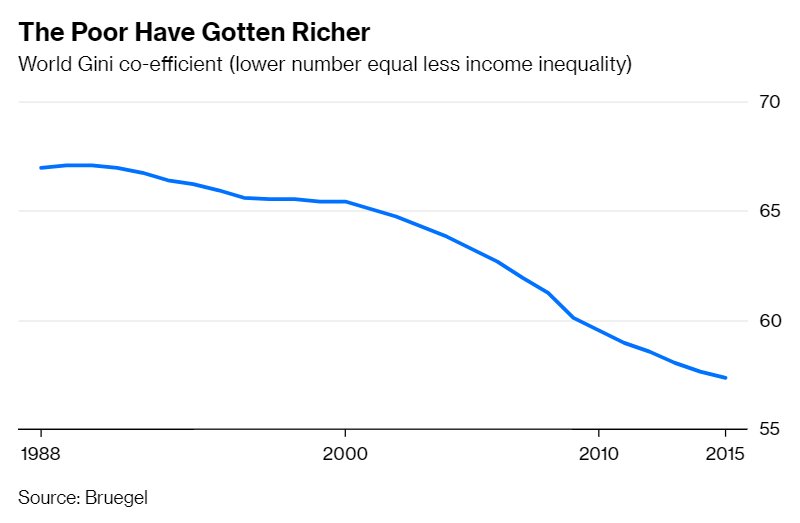

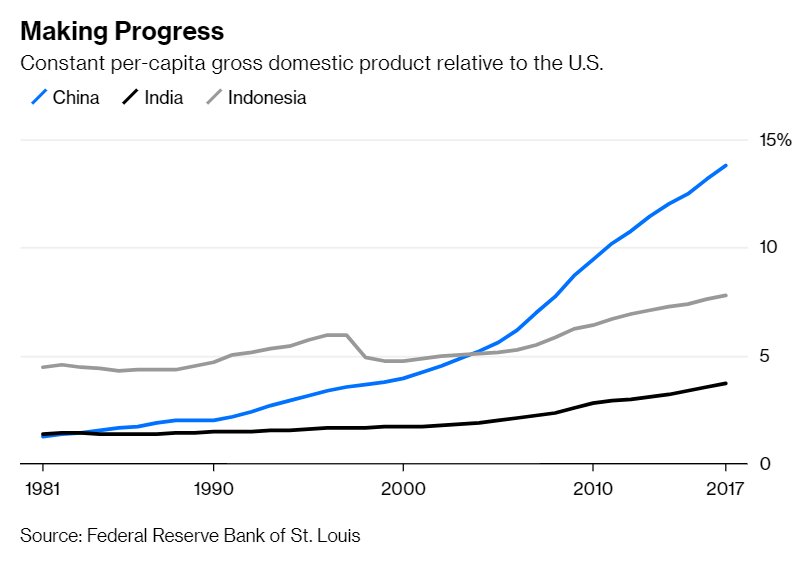

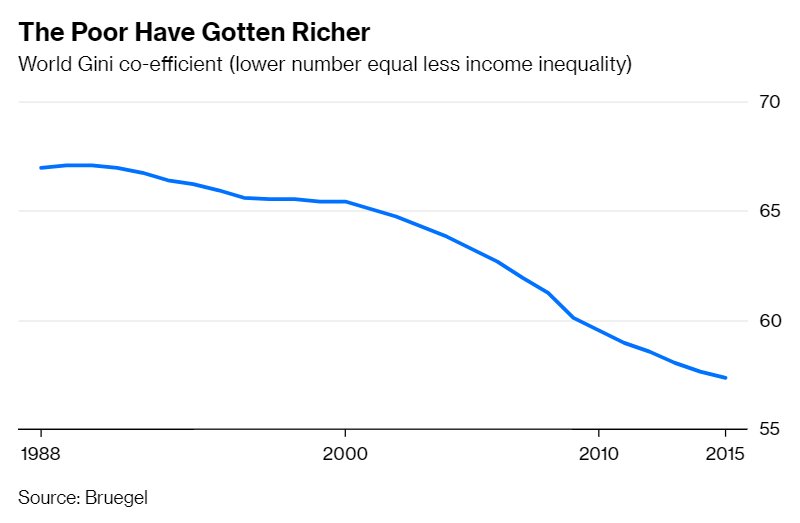

Today's @bopinion post is about how poor countries started catching up to rich ones.

It looks like decolonization just took a few decades to start

Basic econ theory says poor countries should grow faster than rich ones.

But for much of the Industrial Revolution, the opposite happened.

https://t.co/JjjVtWzz5c

Why? Probably because the first countries to discover industrial technologies used them to conquer the others!

But then colonial empires went away. And yet still, for the next 30 years or so, poor countries fell further behind rich ones.

https://t.co/hilDvv0IQV

Why??

Possible reasons:

1. Bad institutions (dictators, communism, autarkic trade regimes)

2. Civil wars

3. Lack of education

But then, starting in the 80s (for China) and the 90s (for India and Indonesia), some of the biggest poor countries got their acts together and started to catch up!

Global inequality began to fall.

It looks like decolonization just took a few decades to start

Basic econ theory says poor countries should grow faster than rich ones.

But for much of the Industrial Revolution, the opposite happened.

https://t.co/JjjVtWzz5c

Why? Probably because the first countries to discover industrial technologies used them to conquer the others!

But then colonial empires went away. And yet still, for the next 30 years or so, poor countries fell further behind rich ones.

https://t.co/hilDvv0IQV

Why??

Possible reasons:

1. Bad institutions (dictators, communism, autarkic trade regimes)

2. Civil wars

3. Lack of education

But then, starting in the 80s (for China) and the 90s (for India and Indonesia), some of the biggest poor countries got their acts together and started to catch up!

Global inequality began to fall.

Time for panel #3: Big Tech and regulation!

I will be live-tweeting again, and you can also watch video at either the Twitter or Facebook links below!

Kaissar: Every industry gets regulated when it gets big. The question is what kind of regulation Big Tech will get,and whether the companies will be proactive in shaping it.

Kaissar: More profitable companies have higher returns. Why? Maybe it's a risk factor, because more profit = higher risk of getting regulated.

Bershidskyis showing a diagram of GDPR complaince pop-ups. What a massive ill-conceived bureaucratic mess.

Ritholtz: It's 2018 and we're still talking about Facebook privacy settings?! If you're still giving your personal data to Facebook, you just don't care about privacy!

I will be live-tweeting again, and you can also watch video at either the Twitter or Facebook links below!

Bloomberg Ideas conference now starting! I will be live-tweeting it. You can watch on our Facebook or Twitter pages (links below)! https://t.co/Mbr9dZzWBy

— Noah Smith (@Noahpinion) October 25, 2018

Kaissar: Every industry gets regulated when it gets big. The question is what kind of regulation Big Tech will get,and whether the companies will be proactive in shaping it.

Kaissar: More profitable companies have higher returns. Why? Maybe it's a risk factor, because more profit = higher risk of getting regulated.

Bershidskyis showing a diagram of GDPR complaince pop-ups. What a massive ill-conceived bureaucratic mess.

Ritholtz: It's 2018 and we're still talking about Facebook privacy settings?! If you're still giving your personal data to Facebook, you just don't care about privacy!

More from Trump

Allow me to offer some commentary on several SCOTUS cases that are NOT the #moab, but which, considered in aggregate, will reveal my impressions on the #TRUMPSMASH #lawOfFunny

Can someone give me a google number or something? I want a party line.

https://t.co/SlJCsjWMUa

I'm sorry, but #lawOFFunny #nominologicaldeterminism.

#thomists

This one is important:

Can someone give me a google number or something? I want a party line.

https://t.co/SlJCsjWMUa

We will be INTERVENING in the Texas (plus many other states) case. This is the big one. Our Country needs a victory!

— Donald J. Trump (@realDonaldTrump) December 9, 2020

I'm sorry, but #lawOFFunny #nominologicaldeterminism.

#thomists

This one is important:

To those who want to actually help Claudia Conway after her mom (Kellyanne Conway, Trump’s former aide) posted her underage daughter’s nudes to Fleets, fill out a report on the NCMEC CyberTipline.

CPS refused to help her.

#HelpClaudia

Kellyanne Conway has a well-documented history of verbally abusing, gaslighting, and threatening her daughter. It gets worse when highly public things go viral (such as exposing the truth about Trump and Conway catching COVID-19 last October). Kellyanne coerces false statements.

Insider did a thorough chronological background of the history of exposing her parents abuse and control of her here: https://t.co/ncjaEyLOSC

We all know that “statement” last year was coerced. She talks constantly about being abused by them.

Personally? I suspect Kellyanne is a narcissist. From my own experience being sexually and emotionally abused by a narcissist, they are obsessed with controlling the narrative (coerced typed statement), discrediting their victim (posting her nudes) & gaslighting

If you haven’t experienced gaslighting or aren’t familiar with it, it’s when someone causing you harm (physical, emotional, sexual, financial, etc) twists the facts and asserts that reality is just you being delusional and you don’t actually understand what happened.

CPS refused to help her.

#HelpClaudia

Kellyanne Conway has a well-documented history of verbally abusing, gaslighting, and threatening her daughter. It gets worse when highly public things go viral (such as exposing the truth about Trump and Conway catching COVID-19 last October). Kellyanne coerces false statements.

Insider did a thorough chronological background of the history of exposing her parents abuse and control of her here: https://t.co/ncjaEyLOSC

We all know that “statement” last year was coerced. She talks constantly about being abused by them.

Personally? I suspect Kellyanne is a narcissist. From my own experience being sexually and emotionally abused by a narcissist, they are obsessed with controlling the narrative (coerced typed statement), discrediting their victim (posting her nudes) & gaslighting

If you haven’t experienced gaslighting or aren’t familiar with it, it’s when someone causing you harm (physical, emotional, sexual, financial, etc) twists the facts and asserts that reality is just you being delusional and you don’t actually understand what happened.

You May Also Like

A brief analysis and comparison of the CSS for Twitter's PWA vs Twitter's legacy desktop website. The difference is dramatic and I'll touch on some reasons why.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.