Trading Lessons for total beginners.

— making sales \uea00 (@making_sales) February 3, 2021

Thanks to @ripster47, @Brady_Atlas @MullinsMomentum, @SDHILLON97, @MrZackMorris, @PJ_Matlock, @notoriousalerts, @Hugh_Henne, @bear_fuker, @Trogdaddy, @atrhodes00 and many more for teaching me all that I know about the stocks.

[THREAD]

A thread of my threads 🧵

If you\u2019re in the process of blowing up your account\u2026

— making sales \uea00 (@making_sales) February 26, 2021

STOP AND READ THIS NOW!

[THREAD]

Stop losses are your friend.

— making sales \uea00 (@making_sales) February 26, 2021

Stop losses help you to follow your rules and respect your plan.

Stop losses help keep the size of your losses minimal and recoverable.

Personally, I recommend using a hard stop loss (especially if you\u2019re new) instead of having a mental one.

People often ask me what is meant by \u201chave your own plan.\u201d

— making sales \uea00 (@making_sales) March 7, 2021

What does a plan consist of and how do you go about creating one?

That\u2019s what I\u2019m here to discuss\u2026

[THREAD]

There\u2019s a dark side to this game that #FinTwit doesn\u2019t like discussing.

— making sales \uea00 (@making_sales) March 28, 2021

People like to showcase the success, wins and glory but they don\u2019t like to talk about the failures, losses and depression.

Believe me the dark side was and still is a reality to many. We\u2019ve all been there.

If you take a catastrophic loss then accept it and don\u2019t revenge trade.

— making sales \uea00 (@making_sales) March 28, 2021

NEVER try to make it back in a few trades.

That mindset is toxic. It prompts you to make even more poor trades which means you blow up.

Forget that special number you want your portfolio value to get to.

Hindsight is 20/20.

— making sales \uea00 (@making_sales) March 30, 2021

You can get mad at yourself, dwell and regret situations from the past but it\u2019s useless.

You need to remove the \u201cwould\u2019ve, could\u2019ve, should\u2019ve\u201d sentiment from your mind.

Things are the way they are, you did what you did, and it is what it is.

The market doesn't care about your motivations.

— making sales \uea00 (@making_sales) March 30, 2021

The market doesn't care if you want to: make back losses, pay your rent, put a down payment on a house, pay off your debt etc.

We add these things to the soundtrack and that affects our emotions which results in forcing trades.

Trading notes and lessons from:

— making sales \uea00 (@making_sales) February 8, 2021

\u201cHow to think like a professional trader by Mark Douglas.\u201d

A special thanks to @NolanScalpTeam and #AtlasScalpTeam for showing me this video.

[THREAD on the 4 part series]https://t.co/7BWZQsEIpu

What happens to you when you put expectations on yourself to achieve a certain goal?

— making sales \uea00 (@making_sales) April 3, 2021

Be brutally honest with yourself and let me know.

Blowing up is one of the worst feelings ever (at that moment in time).

— making sales \uea00 (@making_sales) April 3, 2021

When I blew up: I felt physically sick, I couldn\u2019t sleep comfortably at night and I was going through a depressive episode. It\u2019s not nice.

In hindsight, it was a huge learning curve and a bump in my journey.

There is a danger that comes with fixating on making a certain dollar value.

— making sales \uea00 (@making_sales) April 18, 2021

We often look to hit that special number for our account value and we look to milk the trade until we get "$X" out of a trade.

The truth is the trade doesn't care about how much money you win or lose.

You have to slowly scale up if you\u2019re looking to go in with bigger size to make higher relative gains.

— making sales \uea00 (@making_sales) April 28, 2021

It\u2019s like building muscle memory at gym. You slowly train your muscle with a certain weight, you get used to it and adapt to that new weight.

The same stuff with stocks.

What I know about the trading style of #FinTwit\u2019s favorite FURU (@MrZackMorris).

— making sales \uea00 (@making_sales) May 1, 2021

P.S. There\u2019s a ton of stuff I don\u2019t know about Zack\u2019s style since he doesn\u2019t really talk about it too much, but this is what I\u2019ve gathered so far from the GOAT. \U0001f410

Let\u2019s #ZackAttackMFers!

[THREAD]

As a trader, my system takes precedence over my conviction.

— making sales \uea00 (@making_sales) May 2, 2021

My rules, systems and processes are designed by me in order to protect me.

My conviction is what convinces me to execute a trade and do it with size.

However, my rules are there to help me manage my risk effectively.

If you think about it\u2026 the root of most of our mistakes are emotions.

— making sales \uea00 (@making_sales) May 8, 2021

We're our own worst enemies.

In theory, all our losses should be at a random distribution and down to probability (that comes with any trading system). In reality, almost all our losses are down to emotions.

THE ULTIMATE FURU HANDBOOK!

— making sales \uea00 (@making_sales) May 17, 2021

Do you want to know how to be exactly like your favorite Twitter FURU?

Well, look no further because I will be telling you the tricks of the trade when it comes to pumping and dumping like a true FURU.

All of the secrets will be uncovered.

[THREAD]

One of my favourite strategies is channel trading.

— making sales \uea00 (@making_sales) May 23, 2021

This tactic is one of my go-to strategies since I can make small gains (base hits), in any market condition, and these compound.

It\u2019s something that can be rinsed and repeated until it breaks the channel and no longer works.

THE THREE MAIN ASPECTS OF TRADING: KNOWLEDGE, METHOD AND MINDSET.

— making sales \uea00 (@making_sales) May 25, 2021

[THREAD]

\u201cI keep buying the dip but it keeps on dipping.\u201d

— making sales \uea00 (@making_sales) May 26, 2021

It\u2019s a common thing I hear from a lot of newer traders and it\u2019s clear that this knocks people\u2019s confidence and discourages them from trading since it feels like nothing works for them.

Everything they touch seems to turn to red.

\u201cHow to brush off big failures and recover from catastrophic losses?\u201d

— making sales \uea00 (@making_sales) May 30, 2021

[THREAD]

Another thing worth understanding (especially when momentum trading) are psych levels.@RHODESA_ and @singlesdoubles have mentioned this several times before.#MomoTwit

— making sales \uea00 (@making_sales) June 3, 2021

Take the opportunity and play the setup.

— making sales \uea00 (@making_sales) June 4, 2021

Stop jumping into each and every play with the mindset that it\u2019s the next black swan event.

Don\u2019t buy into something and hope and pray that it\u2019s the next $GME, $AMC, $BTC etc.

That\u2019s an unhealthy, unrealistic and toxic mindset to carry.

Sometimes retail has the memory of a goldfish.

— making sales \uea00 (@making_sales) June 8, 2021

Yes\u2026 things are good now with stocks ripping, momentum flowing and portfolios hitting ATHs but don\u2019t get too comfortable and too complacent.

Don\u2019t let yourself become a victim of negative emotions, poor decisions and bad habits.

A comprehensive list of stock market terminology and abbreviations: pic.twitter.com/2O19vDVCzb

— making sales \uea00 (@making_sales) June 15, 2021

Attachment can be a very dangerous thing.

— making sales \uea00 (@making_sales) June 19, 2021

Attachment is something beyond conviction.

Attachment comes from bias and emotion while conviction comes from research and experience.

Conviction is great, [excess] attachment is bad- there's some overlap but they're very different.

Overcrowded trades, in either direction (long-side or short-side), aren't ideal.

— making sales \uea00 (@making_sales) June 20, 2021

What is an overcrowded trade?

It's when too many (generally retail) traders are on the same side of a trade. Traders pile into a certain name while all having the exact same biased outlook.

Today I took the biggest realized loss in my short trading career.

— making sales \uea00 (@making_sales) June 24, 2021

Am I angry? Yes.

Am I in disbelief? Sure.

Am I upset? Of course.

However, I am someone who looks to follow their rules meticulously and I don't look to change that.

I refuse to let my last trade affect my next.

Markets are designed to go higher.

— making sales \uea00 (@making_sales) June 25, 2021

That's why you buy the pull back so long as the major trend is intact.

Every "crash" has occurred due to a black swan event- that's the catalyst.

1929? Margin

1987? Tax bill + computers

2000? Accounting scandal

2008? Credit crunch

2020? Covid

Don't borrow money (use margin) to trade unless you're experienced with a proven and consistently profitable system.

— making sales \uea00 (@making_sales) June 26, 2021

Like @Qullamaggie says: "Margin isn't something you just use for the sake of it, it's something you earn the right to use, you must deserve it- it's a privilege."

Ignore \u201ccoverage initiations\u201d and \u201cprice targets\u201d on stocks because for the most part they\u2019re bullshit.

— making sales \uea00 (@making_sales) June 26, 2021

If any reaction does occur then it will only be a mere pop and drop.

These research firms and analysts don\u2019t have your best interests at heart- they have an ulterior motive.

A trade could be realized green but still a bad trade.

— making sales \uea00 (@making_sales) June 30, 2021

A trade could be realized red but still a good trade.

Red and losses doesn\u2019t necessarily mean bad.

Green and profits doesn\u2019t necessarily mean good.

However, we like to think a certain outcome equals a certain performance.

RISK MANAGEMENT AND POSITION SIZING FOR TOTAL BEGINNERS.

— making sales \uea00 (@making_sales) July 4, 2021

I will explain what risk management is and how to correctly position size for beginners with small accounts.

I will also give you examples of it.

[THREAD]

Shiny object syndrome is a big problem especially for newbie retail traders.

— making sales \uea00 (@making_sales) July 5, 2021

Everybody is interested in the next supernova. Everybody wants to be on the new hype. Everybody wants to catch the new $GME and $AMC.

Many traders now are impatiently jumping from one stock to another.

It seems like many people had a awful week in the markets and I'm sorry to hear that.

— making sales \uea00 (@making_sales) July 17, 2021

This game does get tough and red weeks are inevitable. You just have to pick yourself up, brush yourself off and go again.

Anyways, here are 10 tips on how to survive in the markets.

[THREAD]

One thing I look to start doing is journaling my trades.

— making sales \uea00 (@making_sales) July 18, 2021

A comprehensive trade journal is an effective tool for performance tracking and management.

We can record and review our trades for better output and for future reference- it gives us an opportunity to study our mistakes.

An underrated aspect of stock selection is understanding the personality of a stock.

— making sales \uea00 (@making_sales) July 25, 2021

All stocks, like humans, have their own distinctive personality.

If you learn a stock's personality then you develop an edge because you know how the stock will act under certain circumstances.

Morning flush recipe:

— making sales \uea00 (@making_sales) August 8, 2021

1) Top gappers list (with a 100%+ gain ideally)

2) High relative volume

3) Good news that reads well (determined by PM action)

4) Stock has range (check the daily)

5) Wait for a big flush (usually in the first 30m)

6) Add dip either upon key level or basing

I had a friend, who knew absolutely nothing about the markets, ask me:

— making sales \uea00 (@making_sales) August 15, 2021

\u201cHow do I learn how to day trade?\u201d

I didn\u2019t have an answer because most of my learning was through experimentation and taking bits from different gurus.

Anyways, I compiled an education list for beginners.

DOUBLE TWEEZER STRATEGY

— making sales \uea00 (@making_sales) August 20, 2021

This strategy was one of the first strategies that I ever learned and if the setup shows itself then I still use it to this day.

It\u2019s one of the more easier strategies where risk can clearly be defined.

I like to use it for scalps or longer day trades.

Here\u2019s one of the best candlestick pattern reference graphs I\u2019ve seen.

— making sales \uea00 (@making_sales) August 18, 2021

Credit: @postcubedmodern pic.twitter.com/AxsZQryoEE

MOMENTUM DAY TRADING CHART SETUP

— making sales \uea00 (@making_sales) September 6, 2021

INDICATORS:

- 9 EMA = Red

- 20 EMA = Light Blue

- 50 SMA = Yellow

- 200 SMA = Green

- VWAP = Purple

- Volume Bars

TIME FRAMES:

- 5 Minute

- 1 Minute

- 1 Day

It's the way that @MullinsMomentum taught me. \U0001f410

Chart example below... pic.twitter.com/mDzDXnExV3

How to check for an S-3: https://t.co/OxAfI7cF0n

— making sales \uea00 (@making_sales) September 13, 2021

If you\u2019re a brand new trader or someone who gets overly emotional then don\u2019t do this.

— making sales \uea00 (@making_sales) September 13, 2021

Perhaps use lower position size and risk per trade and take the longer grind (which is totally fine).

If you have some risk appetite, can manage emotions and have some experience then do this. https://t.co/9LV9F8xfxJ

I guess the key takeaway is that others don\u2019t deserve to be put through shit because something isn\u2019t going exactly the way that you want it to in your trading (or in life in general).

— making sales \uea00 (@making_sales) September 15, 2021

Stay conscious of your emotional state and the energy you\u2019re displaying.

Be self-aware. https://t.co/teBVphJoQF

The inexperienced and naive trader likes to place blame on others.

— making sales \uea00 (@making_sales) September 15, 2021

That\u2019s why I think things such as \u201cshort squeeze\u201d plays are so popular. It\u2019s because people fall in love with a story and think they can place the blame of all bad things on institutions.

Be accountable. https://t.co/x75tuaWoeA

THE TRUTH ABOUT TRADING THE MARKETS AS A HUMAN BEING.

— making sales \uea00 (@making_sales) September 18, 2021

[THREAD]

People keep asking me about the indicators I use and what they mean.

— making sales \uea00 (@making_sales) September 18, 2021

I\u2019ve always used these indicators for momentum day trading and it\u2019s the way @MullinsMomentum taught me.

Sometimes I may drop certain indicators (and naked trade) if I believe they are adding noise to my chart. pic.twitter.com/gB5WTprxya

I've been learning about Opening Range Breaks (ORBs) recently.

— making sales \uea00 (@making_sales) September 21, 2021

I'm still learning about them but so far... I've been looking at the opening range created in usually the first 15m and basing entries and/or biases based on the a 5m candle opening and closing outside of the range.

A COMPLETE BREAKDOWN OF MY MOMENTUM DAY TRADING PROCESS.

— making sales \uea00 (@making_sales) September 22, 2021

[THREAD]

If there\u2019s one thing that you drill into your mind then let it be: \u201cTHE STOCK MARKET IS FOREVER!\u201d.

— making sales \uea00 (@making_sales) September 2, 2021

Once you realize the market is open tomorrow, next week, next year etc. then you understand that opportunities are infinite.

You realize that there\u2019s always the next one to catch. https://t.co/ERFvAd7gI3

FURUs are only an issue when they\u2019re promoting a stock that has no business being in play as they front run their unsuspecting followers.

— making sales \uea00 (@making_sales) September 3, 2021

Any other play with a reason to move is a legitimate potential play.

Just because so and so is on $XYZ, it doesn\u2019t make it a pump and dump. https://t.co/To53SCzT3H

If you\u2019re an audio and/or visual learner then I\u2019ve complied a YouTube playlist of what I believe to be pretty good trading education.

— making sales \uea00 (@making_sales) September 26, 2021

NOTE: These videos aren\u2019t in any particular order. Also, some of these videos belong to series so watch them entirely.https://t.co/VGGutMjMv8

The Holy Grail doesn\u2019t exist.

— making sales \uea00 (@making_sales) September 26, 2021

It\u2019s not about finding the right system, setup, strategy, indicator or even mentor.

These are important things that deserve emphasis, no doubt, but they aren\u2019t everything.

It\u2019s about skill development and conviction in your ability for this game.

There are four kinds of basic emotions:

— making sales \uea00 (@making_sales) September 26, 2021

1) Euphoria

2) Depression

3) Fear

4) Anger

Any way that you feel while trading can be drawn back to these core emotions.

I\u2019m not saying to completely cut out your emotions because you\u2019re human.

I\u2019m saying to be consciously aware of them.

MOMENTUM SWING TRADING CHART SETUP

— making sales \uea00 (@making_sales) September 27, 2021

INDICATORS:

- 10 MA = Red

- 20 MA = Light Blue

- 50 MA = Yellow

- 100 MA = Pink

- 200 MA = Green

- ADR%

- ATR

- Volume Bars

TIME FRAMES:

- Daily

- Hourly

- Weekly

Chart example below... pic.twitter.com/5WGSykCemA

Oftentimes, we let our last trade affect our next trade.

— making sales \uea00 (@making_sales) September 28, 2021

I feel like our mentality plays a big part when it comes having lose streaks and win streaks.

If you take a loss then that doesn\u2019t mean that all is lost and you should throw in the towel.

An A+ play is around the corner. https://t.co/YD78YiHpmb

Coordinated pumps? \u2714\ufe0f

— making sales \uea00 (@making_sales) October 5, 2021

Coordinated dumps? \u274c

Stock halts up? \u201cOrganic action\u201d

Stock halts down? \u201cManipulation\u201d

The whole market is filled with agents and each one has their own agenda to suit their best interests.

Play the price action and don\u2019t fall in love with stories. #KWYO

A trading plan includes:

— making sales \uea00 (@making_sales) October 9, 2021

- Entries (starter and scale-in points)

- Exits (stop loss and target price)

- Position size (based on risk)

- Time horizon (day trade or swing)

- Your trading rules

Ask yourself about and consider these five things before you execute a trade.

If you really want to capture a big move and not miss out on the next hot play.

— making sales \uea00 (@making_sales) October 9, 2021

Then instead of doing something dumb like \u201cdiamond hands\u201d, do something smart like a \u201cdiamond finger\u201d.

This way you\u2019re not swinging for the fences and you just let a grip work for you.

Ego is a natural part of our make-up.

— making sales \uea00 (@making_sales) October 13, 2021

A healthy dosage of ego is necessary especially in the trading business because your confidence can often be derived from your ego and the perception of your ability and skill.

However, an oversized ego is detrimental and works against you.

This doesn\u2019t mean that you should be heroic with no plan and strategy because that\u2019s gambling and pure stupidity.

— making sales \uea00 (@making_sales) October 14, 2021

It\u2019s about building a system, creating a playbook and upping your game to a level that you can play your A/A+ setups in a fearless state because you trust the data. https://t.co/u2MgiLIkog

More from Tradingthread

You May Also Like

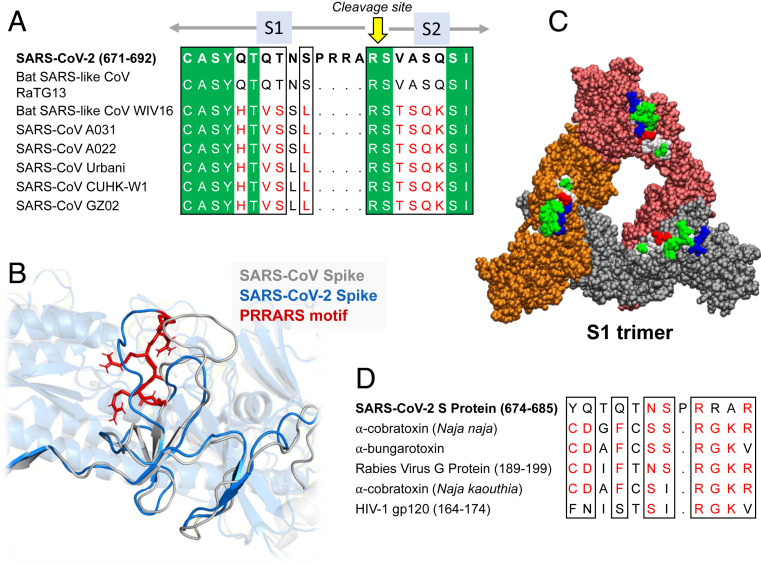

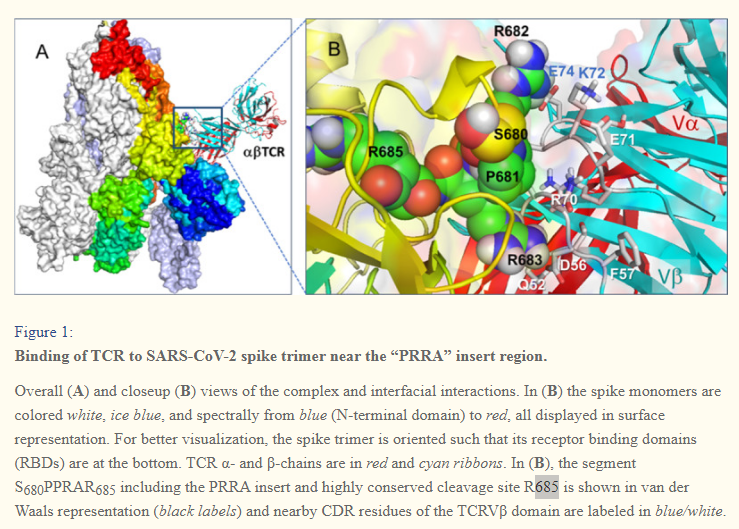

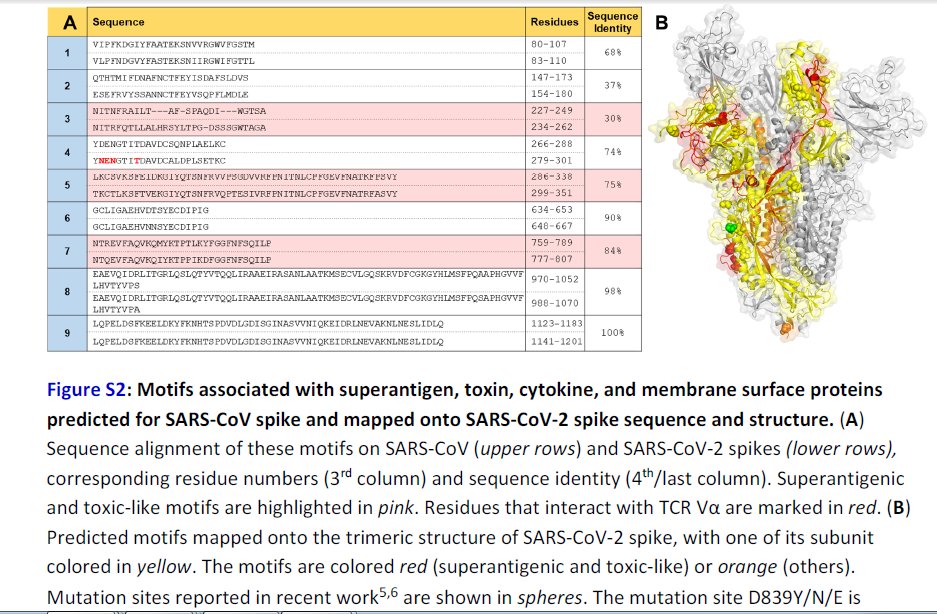

Further Examination of the Motif near PRRA Reveals Close Structural Similarity to the SEB Superantigen as well as Sequence Similarities to Neurotoxins and a Viral SAg.

The insertion PRRA together with 7 sequentially preceding residues & succeeding R685 (conserved in β-CoVs) form a motif, Y674QTQTNSPRRAR685, homologous to those of neurotoxins from Ophiophagus (cobra) and Bungarus genera, as well as neurotoxin-like regions from three RABV strains

(20) (Fig. 2D). We further noticed that the same segment bears close similarity to the HIV-1 glycoprotein gp120 SAg motif F164 to V174.

https://t.co/EwwJOSa8RK

In (B), the segment S680PPRAR685 including the PRRA insert and highly conserved cleavage site *R685* is shown in van der Waals representation (black labels) and nearby CDR residues of the TCRVβ domain are labeled in blue/white

https://t.co/BsY8BAIzDa

Sequence Identity %

https://t.co/BsY8BAIzDa

Y674 - QTQTNSPRRA - R685

Similar to neurotoxins from Ophiophagus (cobra) & Bungarus genera & neurotoxin-like regions from three RABV strains

T678 - NSPRRA- R685

Superantigenic core, consistently aligned against bacterial or viral SAgs

Some random interesting tidbits:

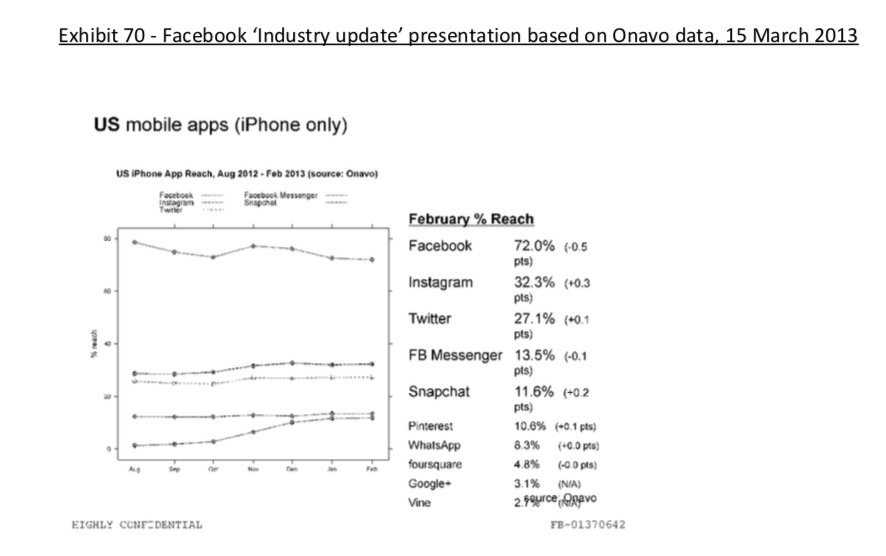

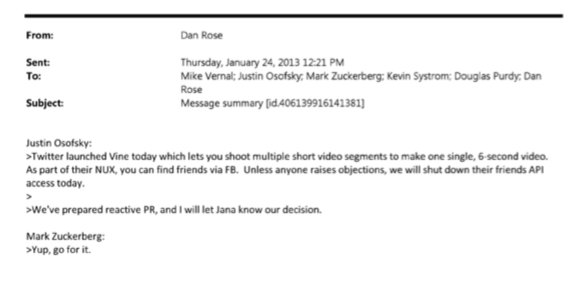

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

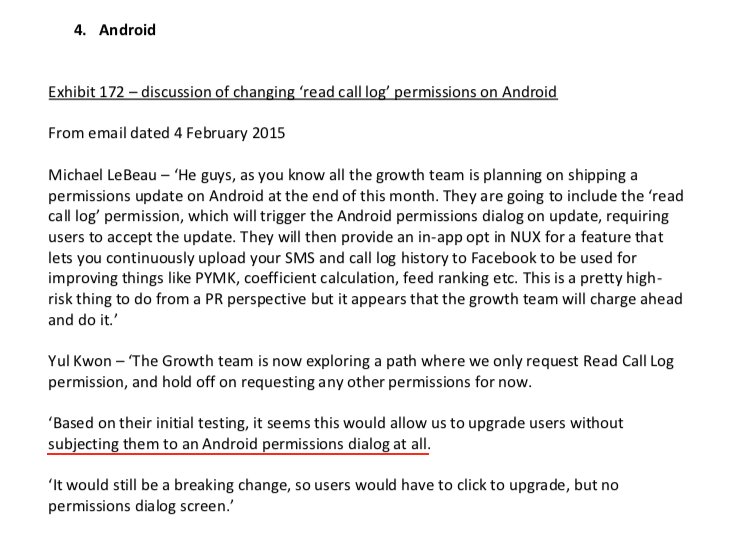

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x