Company has strong order book of 2000 cr which is 4x its FY20 revenue gives visibility of next 2 -3 years. The company has started

Vascon Engineers; Price objective INR 30

Buy in 2 tranches between INR 14.5-12

Strong Execution record:

The company has strong clientale and has more than 30 plus years of experience across commercial, residential and own real estate development which include big names

Company has strong order book of 2000 cr which is 4x its FY20 revenue gives visibility of next 2 -3 years. The company has started

The company is confident of reducing its current NET debt of INR 187crores substantially from revenues of existing projects only, Montization of non core assets and sale of Windermere.

The company has taken various cost measures during COVID and

The company has good real estate pipe line of more than 100 cr plus for next 12 -18 months.

75 pc of order book is largely from Government based projects where cash flow issues are

Company has witnessed good traction in real estate biz post Maharashtra Government announced stamp duty reduction from 5 pc to 2 pc.

Company is confidence of achieving FY20 numbers in FY21 as execution is now at normalcy with sufficient labor availability against

Most of EPC projects are working in normal fashion now. The company sees maximum impact of 200 cr of slowdown in execution in order book.

The company would sell its non core assets like Mumbai building,

Mid size segment is doing better than affordable and luxury segment. There has been price cuts on luxury segments ( Windermere) by the company but it would help buyer

The revenue from MMRCL, Goa and Police housing to start contributing from Q4 FY21 onwards.

Margins are expected to normalcy in Q3.

The company has inventory of 130 crores in Windermere ( Bungalow require some construction ) and

More from Trading

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

— Yash Mehta (@YMehta_) September 4, 2022

A complete guide on how these #Option Greeks impact option price.

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

Option trading is tough but here\u2019s what can make it easier for you

— The Chartians (@chartians) September 17, 2022

8 option strategies that you can use in any market (sold as a \u20b9 50,000 course !)

3/ What are the things that you should look at before taking any Option

They say options trading can make YOU BANKRUPT - is it true ?

— The Chartians (@chartians) September 23, 2022

If yes then why ?

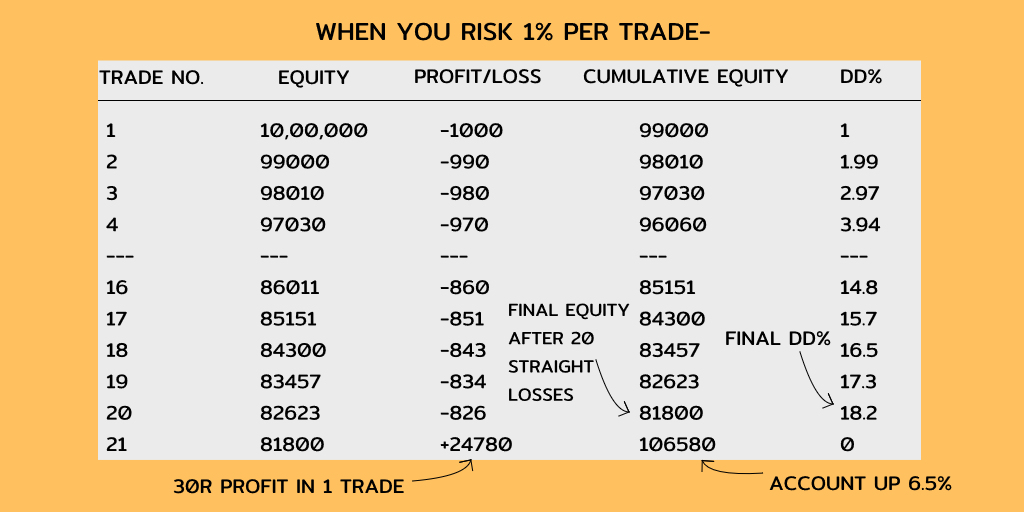

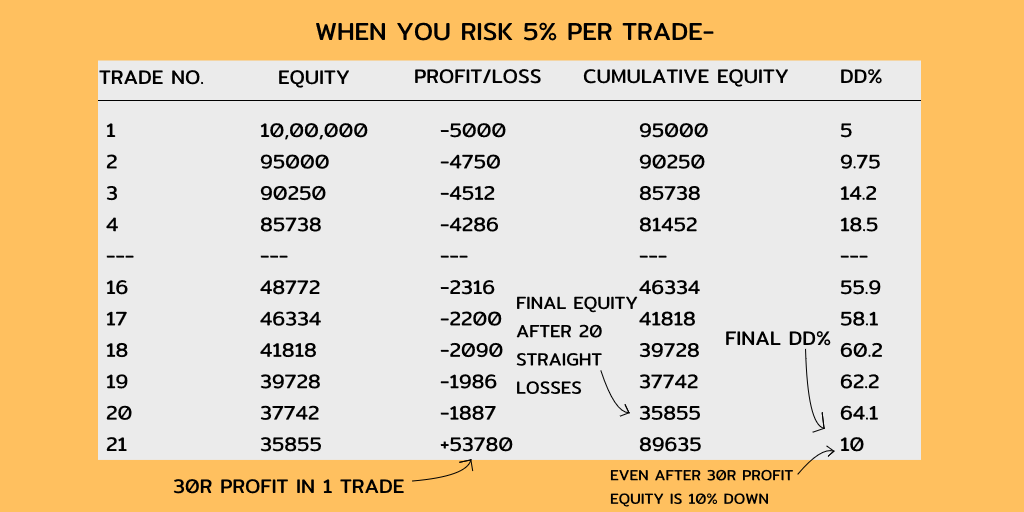

A thread on Risk management and Position sizing in options trading (worth 50k\u20b9 course)\U0001f9f5

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

101 guide on how you can start option selling to generate active returns with less capital (Rs 1 Lakh) \U0001f9f5:

— Yash Mehta (@YMehta_) August 19, 2022

A course on option selling available for free.

You May Also Like

Flat Earth conference attendees explain how they have been brainwashed by YouTube and Infowarshttps://t.co/gqZwGXPOoc

— Raw Story (@RawStory) November 18, 2018

This spring at SxSW, @SusanWojcicki promised "Wikipedia snippets" on debated videos. But they didn't put them on flat earth videos, and instead @YouTube is promoting merchandising such as "NASA lies - Never Trust a Snake". 2/

A few example of flat earth videos that were promoted by YouTube #today:

https://t.co/TumQiX2tlj 3/

https://t.co/uAORIJ5BYX 4/

https://t.co/yOGZ0pLfHG 5/