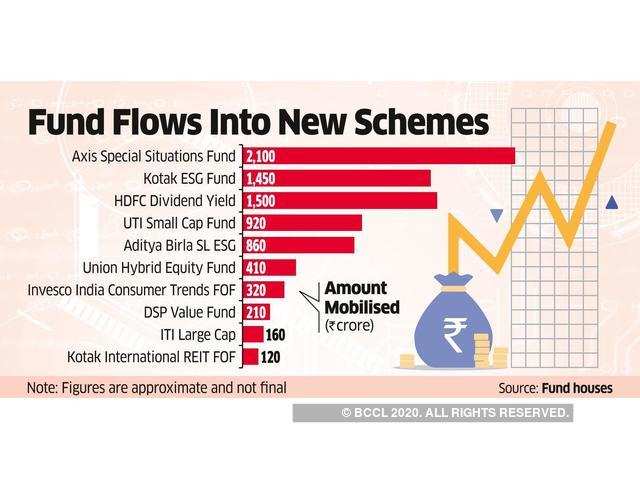

Holy shit. 8000 crores raised IN NFOs in a month. Look at the schemes, all pointless garbage!

https://t.co/jZoancOqqa

https://t.co/hRYFBGxy3O

More from #ESG compliant verbal farts

More from Trading

12 TRADING SETUPS used by professional traders:🧵

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

You May Also Like

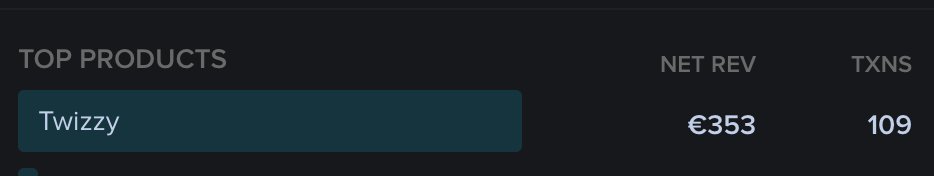

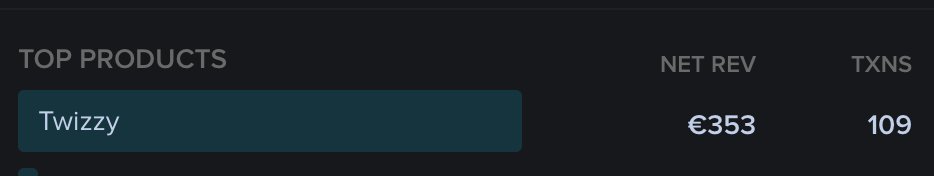

To people who are under the impression that you can get rich quickly by working on an app, here are the stats for https://t.co/az8F12pf02

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks