here’s a slightly wonky thread that people who use post-nominal letters will not like: let’s talk about real-time learning in quant-driven strategies and how to do it in practice, because a lot us do this as a result of real-world constraints. its basically TA with a dress-code.

1) volatilities are not stationary but they undergo relatively synchronized regime changes

2) exponentially weighted vols are more responsive to changes in current conditions

4) honestly the numerical methods are just simpler and i’m a dumdum so it makes it easier for me

6) for long-short baskets of like assets it avoids painful assumptions about intercepts (and therefore betas)

instead of weighing long and short baskets with betas, you just use an ewma of your preferred volatility estimator, i happen to really like GKYZ for anything involving leverage or synthetic options like “stops” or “risk-control” implementation

More from Trading

𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Option Trading is very difficult to master as there are so many things to understand.

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

3/ What are the things that you should look at before taking any Option

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

Here is a master thread related that will help a beginner to understand about Options Trading.

A complete course worth Rs 50K for free.

1/ A detailed thread on basics of Option Greeks and how it impacts Options

There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

— Yash Mehta (@YMehta_) September 4, 2022

A complete guide on how these #Option Greeks impact option price.

2/ Basic Option Trading Strategies:

There are many option strategies to trade. But keeping your strategy simple is the key.

In this thread, all the basic option trading strategies are being

Option trading is tough but here\u2019s what can make it easier for you

— The Chartians (@chartians) September 17, 2022

8 option strategies that you can use in any market (sold as a \u20b9 50,000 course !)

3/ What are the things that you should look at before taking any Option

They say options trading can make YOU BANKRUPT - is it true ?

— The Chartians (@chartians) September 23, 2022

If yes then why ?

A thread on Risk management and Position sizing in options trading (worth 50k\u20b9 course)\U0001f9f5

4/ Is Option Selling Possible with Rs 1 Lakh Capital?

Even a beginner can start trading in option selling with capital as low as Rs 1 Lakh.

What are the techniques one can use and how to mitigate the infinite loss risk is shared in this

101 guide on how you can start option selling to generate active returns with less capital (Rs 1 Lakh) \U0001f9f5:

— Yash Mehta (@YMehta_) August 19, 2022

A course on option selling available for free.

You May Also Like

Keep dwelling on this:

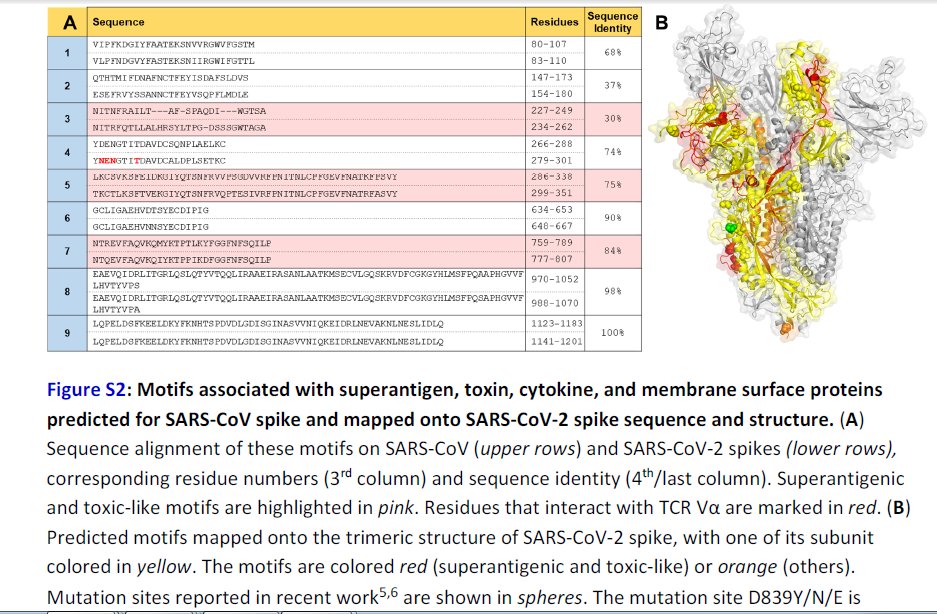

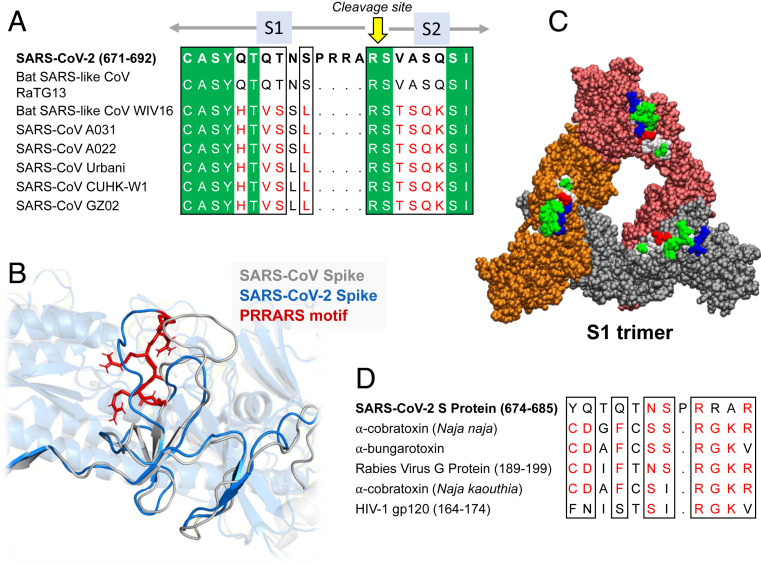

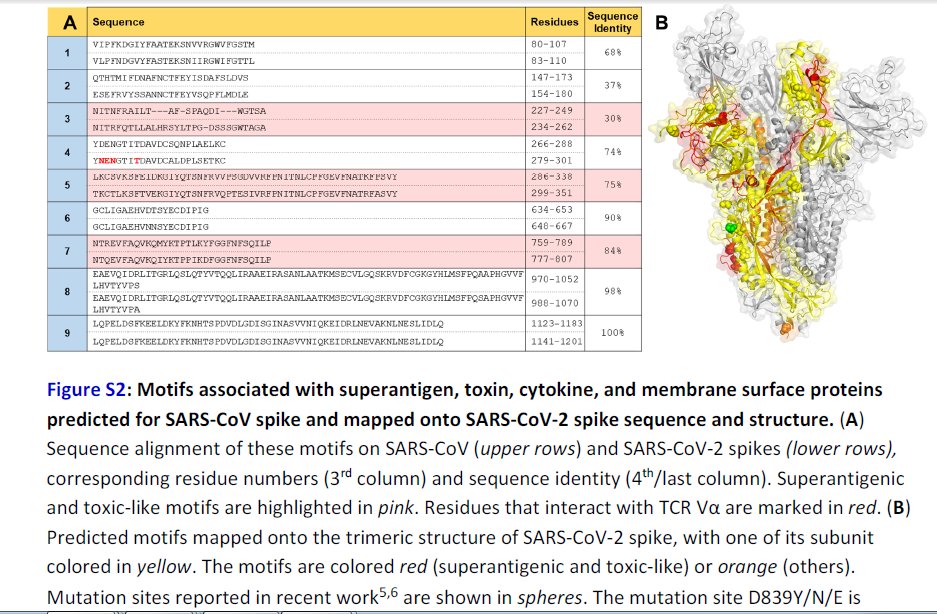

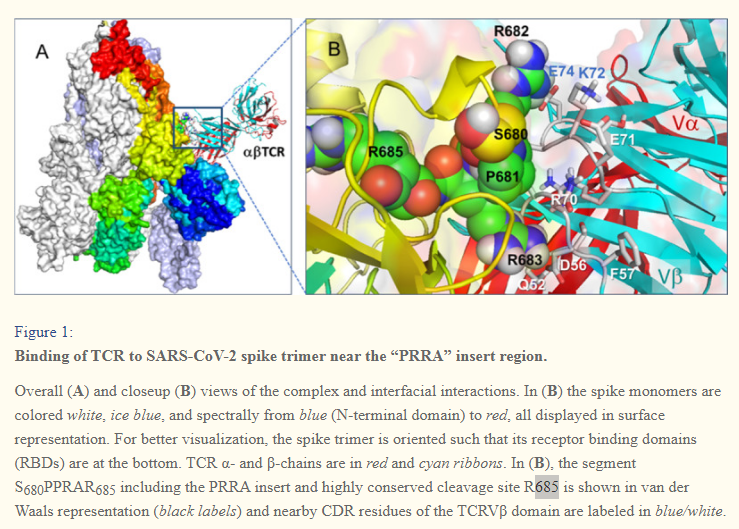

Further Examination of the Motif near PRRA Reveals Close Structural Similarity to the SEB Superantigen as well as Sequence Similarities to Neurotoxins and a Viral SAg.

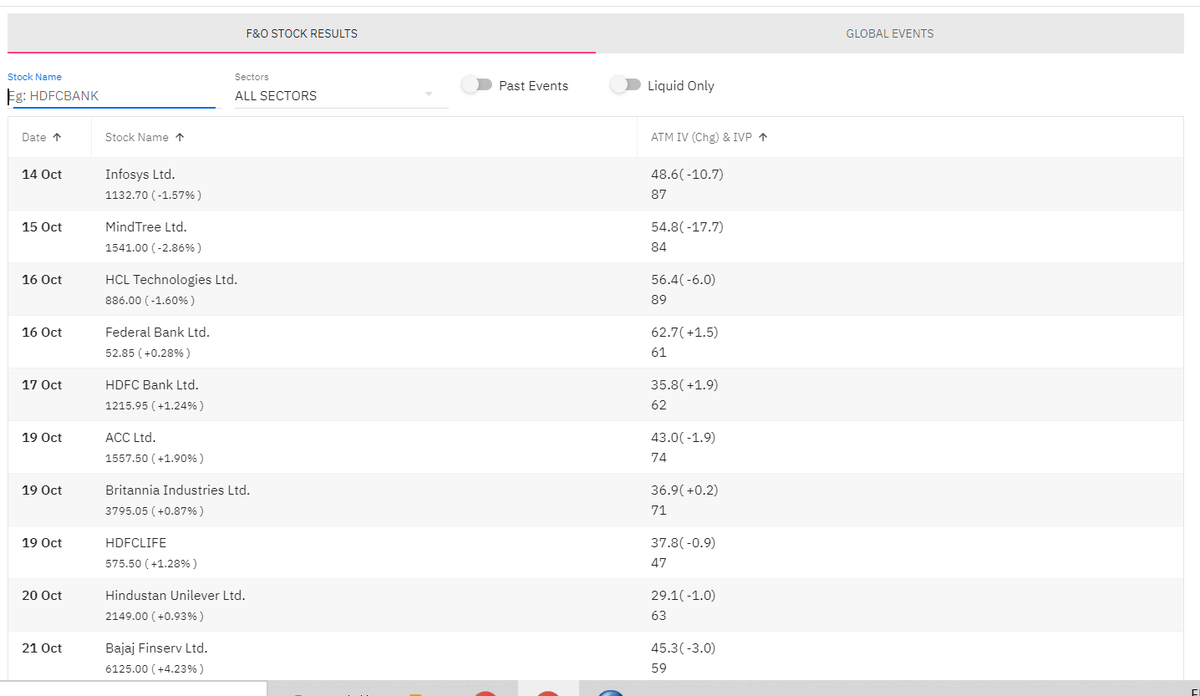

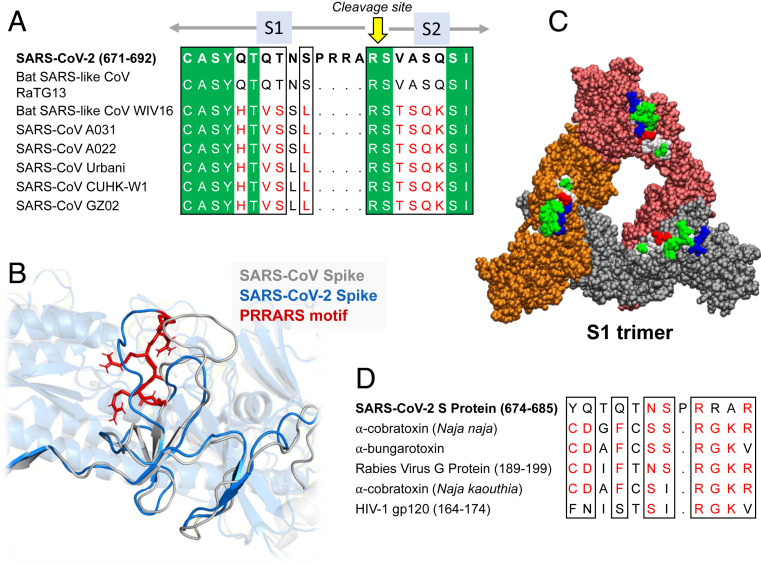

The insertion PRRA together with 7 sequentially preceding residues & succeeding R685 (conserved in β-CoVs) form a motif, Y674QTQTNSPRRAR685, homologous to those of neurotoxins from Ophiophagus (cobra) and Bungarus genera, as well as neurotoxin-like regions from three RABV strains

(20) (Fig. 2D). We further noticed that the same segment bears close similarity to the HIV-1 glycoprotein gp120 SAg motif F164 to V174.

https://t.co/EwwJOSa8RK

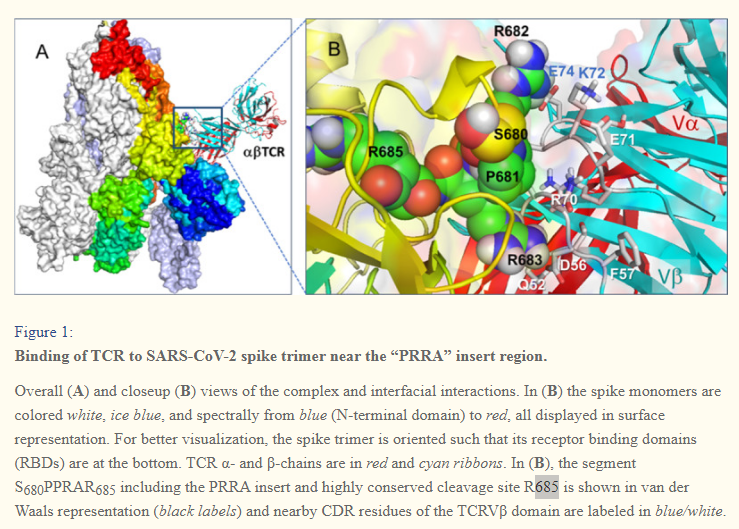

In (B), the segment S680PPRAR685 including the PRRA insert and highly conserved cleavage site *R685* is shown in van der Waals representation (black labels) and nearby CDR residues of the TCRVβ domain are labeled in blue/white

https://t.co/BsY8BAIzDa

Sequence Identity %

https://t.co/BsY8BAIzDa

Y674 - QTQTNSPRRA - R685

Similar to neurotoxins from Ophiophagus (cobra) & Bungarus genera & neurotoxin-like regions from three RABV strains

T678 - NSPRRA- R685

Superantigenic core, consistently aligned against bacterial or viral SAgs

Further Examination of the Motif near PRRA Reveals Close Structural Similarity to the SEB Superantigen as well as Sequence Similarities to Neurotoxins and a Viral SAg.

The insertion PRRA together with 7 sequentially preceding residues & succeeding R685 (conserved in β-CoVs) form a motif, Y674QTQTNSPRRAR685, homologous to those of neurotoxins from Ophiophagus (cobra) and Bungarus genera, as well as neurotoxin-like regions from three RABV strains

(20) (Fig. 2D). We further noticed that the same segment bears close similarity to the HIV-1 glycoprotein gp120 SAg motif F164 to V174.

https://t.co/EwwJOSa8RK

In (B), the segment S680PPRAR685 including the PRRA insert and highly conserved cleavage site *R685* is shown in van der Waals representation (black labels) and nearby CDR residues of the TCRVβ domain are labeled in blue/white

https://t.co/BsY8BAIzDa

Sequence Identity %

https://t.co/BsY8BAIzDa

Y674 - QTQTNSPRRA - R685

Similar to neurotoxins from Ophiophagus (cobra) & Bungarus genera & neurotoxin-like regions from three RABV strains

T678 - NSPRRA- R685

Superantigenic core, consistently aligned against bacterial or viral SAgs