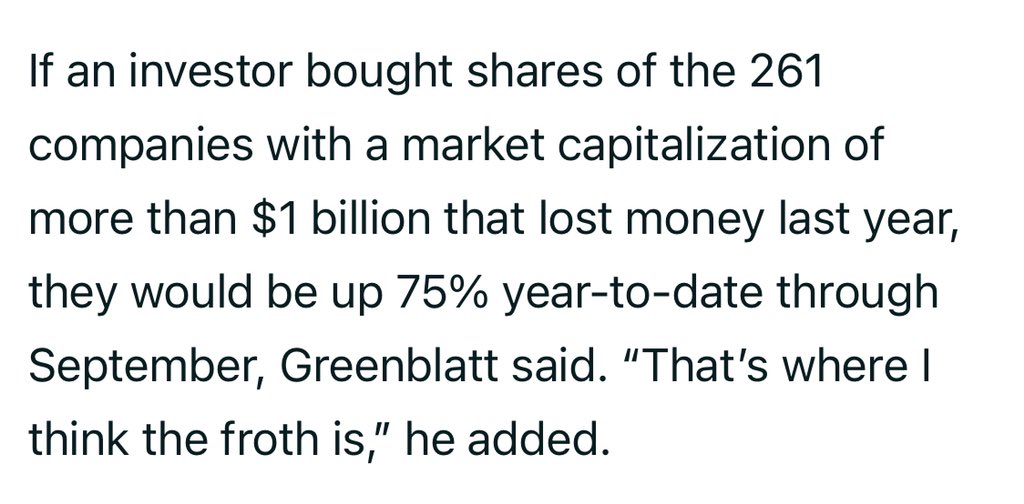

So the real question is: why is there more demand for stocks?

Here’s me trying to make sense of the unprecedented 2020 bull rally of stock markets.

(A thread)

So the real question is: why is there more demand for stocks?

Central banks across the world, especially the fed in the US, are providing cheap liquidity across the board to institutions.

With interest rates falling to 0% and below, bonds are no longer attractive.

They’ve made risk-free investments such as bonds so unattractive that the only place for money to go is towards relatively risky investments which are stocks.

They want things to become pricey so wages grow, profits grow and people’s perception of recession goes away because you’re getting more money than last year.

Instead of inflation of wages and consumer products, we are seeing inflation of stock prices.

We are not seeing inflation of employee wages and consumer products because supply of these is more than demand.

Central banks are underestimating how many people are needed to run economies these days.

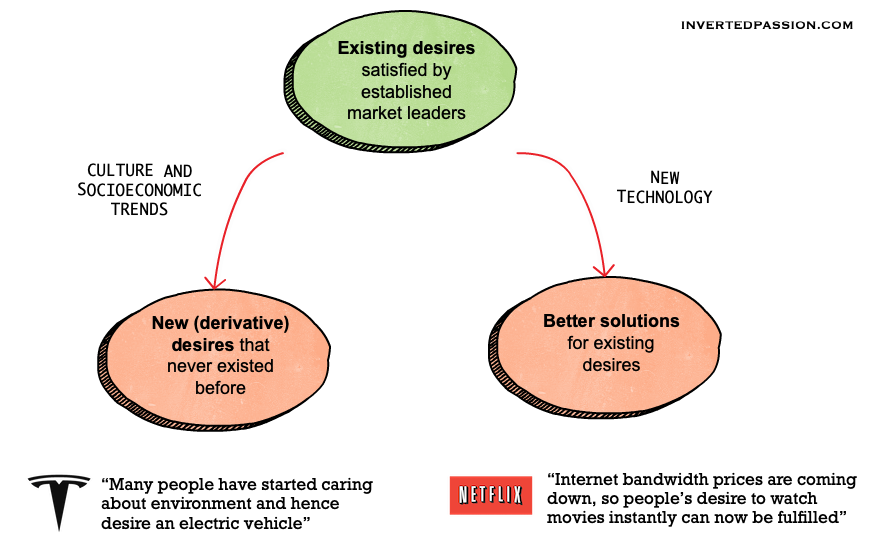

It’s tech and tech causes decrease in prices for consumers.

Why?

https://t.co/xE9j8G2oQB

Nobody wants their money back at 0% interest regime.

You don’t want a dollar today. You want five tomorrow, even if that comes with a risk.

When you invest in stock market, you really dont want to consume that money and hence naturally seek future growth over today’s growth.

More from Paras Chopra

More from Trading

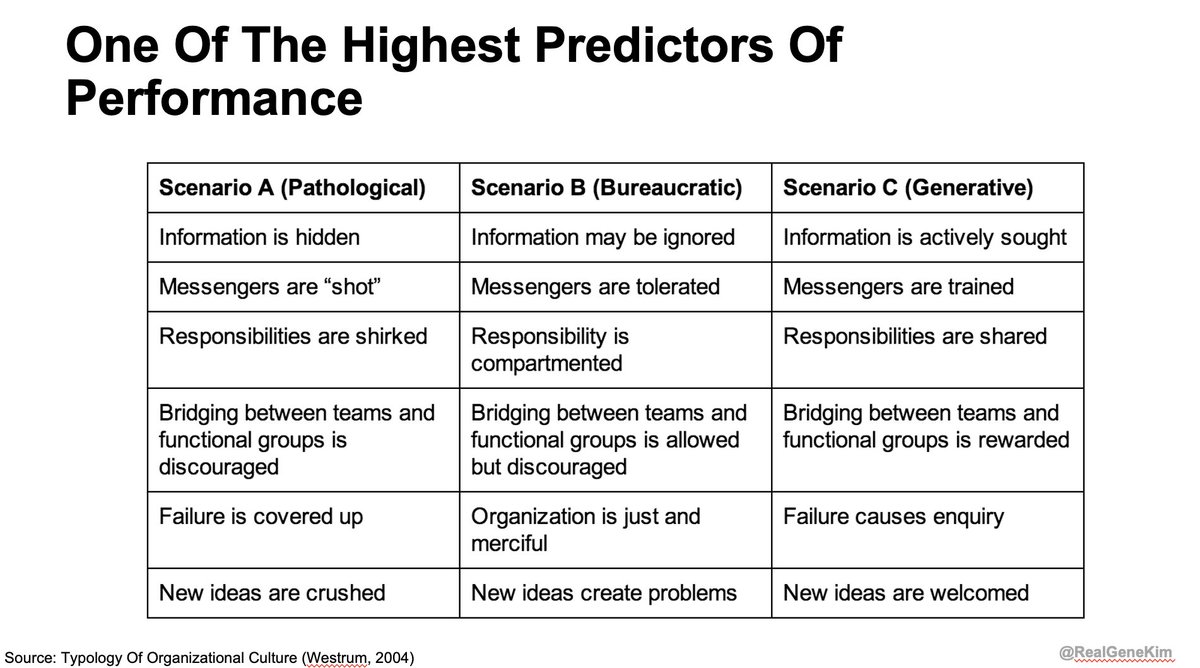

This model was created Dr. Ron Westrum, a widely-cited sociologist who studied the impact of culture on safety

Thanks to Dr. @nicolefv, I was able to interview him for an upcoming episode of the Idealcast! 🤯

It was a very heady experience, and while preparing to interview him, I was startled to discover how much work he's done in healthcare, aviation, spaceflight, but also innovation.

I've read 4+ of his papers, so I thought I was familiar with his work. (Here's one paper: https://t.co/7X00O67VgS)

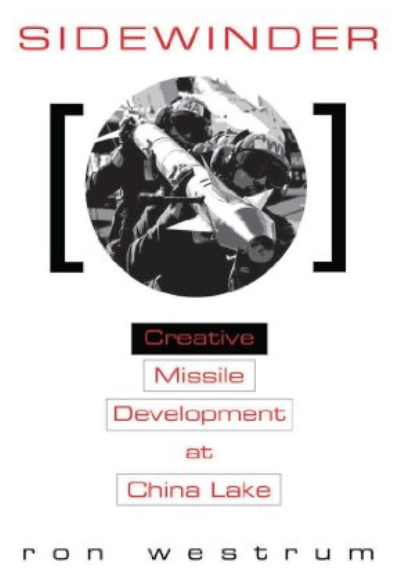

I was startled to learn he has also studied in depth what enables innovation. He wrote a wonderful book "Sidewinder: Creative Missile Development at China Lake"

Dr. Westrum writes about China Lake Research Labs: "its design and structure had one purpose: to foster technical creativity. It did; China Lake operated far outside the normal envelope... Sidewinder & others were "impossible" accomplishments,

I love this book because it describes traits of organizations that routinely create and maintain greatness: US space program (Mercury, Gemini, Apollo), US Naval Reactors, Toyota, Team of Teams, Tesla, the tech giants (Amazon, Google, Netflix, Google)

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

You May Also Like

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal