(2/25)

💥WHY I HAVE OVER $1 MILLION IN $TSLA STOCK💥

Tesla's price may seem out of whack today. The P/E Ratio is insane, right?

But Amazon had similar P/E ratios back in 2014 and 3X higher in 2012. Look at where $AMZN is today.

(1/25)

(2/25)

(3/25)

(4/25)

Level 5 FSD (Full self-driving) #Tesla at way safer levels than humans (5X, 10x SAFER?) I'll buy these for my elderly parents. You'll essentially be able to sleep in your car while it drives you to your destination.

(5/25)

I did a poll, and assuming autonomous driving data shows it's safer, most people said they'd prefer to hail a driverless car vs a human-driven car like Uber.

(6/25)

It doesn't get paid overtime, doesn't need breaks, doesn't get sick, doesn't get Holidays, doesn't get road rage, and makes essentially...

(7/25)

Long-haul truck drivers are going the way of the coal miner.

(8/25)

(9/25)

(10/25)

During peak hours, you get charged more. At 3 am, it's probably cheap. Your #Tesla will likely become its own power center, charging itself when the...

(11/25)

#Tesla also makes a #powerwall to do this, and the price of these units will fall as efficiency goes up.

(12/25)

Especially if the data shows the #TESLA OS for FSD is way safer than other OS's, and way, wayyyy safer than human drivers.

(13/25)

(14/25)

(15/25)

People will pay monthly to have FSD or unique features activated.

(16/25)

Tesla will generate revenue through partnerships for gaming, media content, GPS, etc.

(17/25)

While not technically #Tesla, I see it helping massively with the supercharging network Tesla continues to grow.

(18/25)

#Elon owns the boring company, which is starting to create underground high-speed transit.

Just a feeling, but I imagine that once cars are allowed, it will likely only ...

(19/25)

This will benefit the $TSLA robo-taxi fleet as well, allowing MUCH faster travel during congested times.

This one is definitely a long-term play (10+ years.)

(20/25)

Their valuation has to be different than Telsa's because of this.

(21/25)

Tesla moves fast. Rivian was founded 3 yrs before the Model S. 12 yrs later, Rivian still doesn't have a production vehicle.

(22/25)

(23/25)

Market penetration to be massive in the next 5 years.

(24/25)

More from Trading

TradingView isn't just charts

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

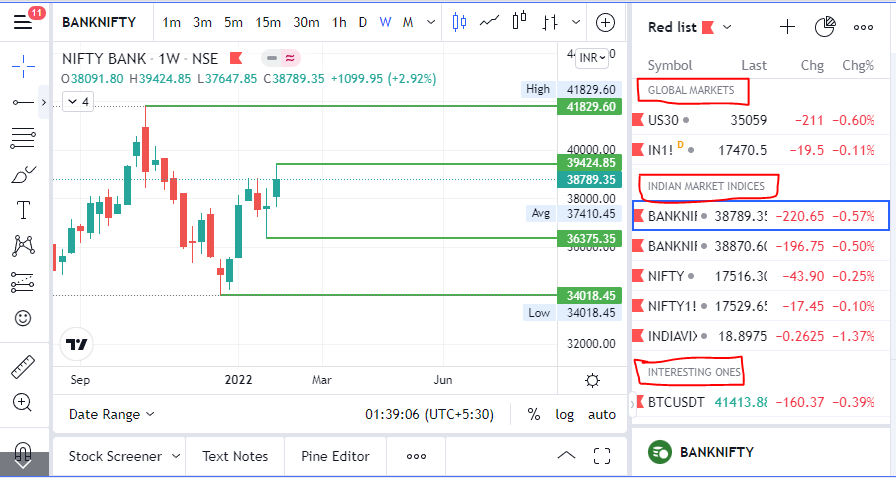

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

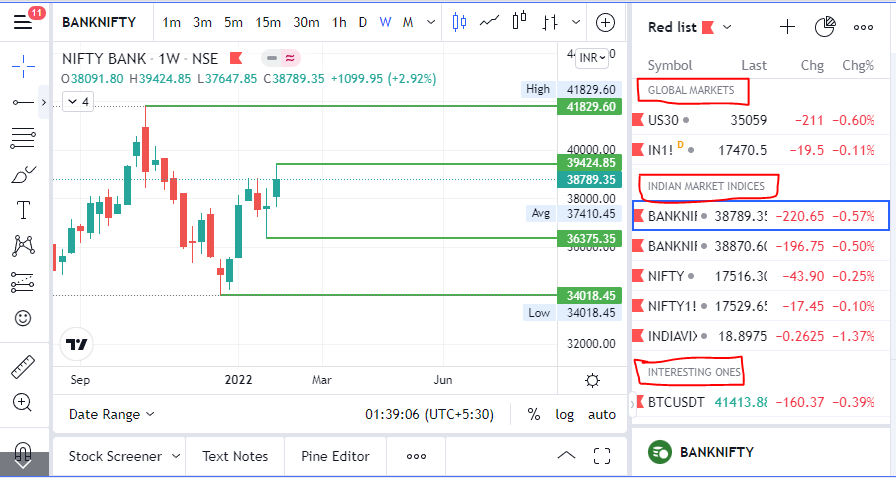

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.

You May Also Like

Speech Delay is most common in children nowadays

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"

Department List of UCAS-China PROFESSORs for ANSO, CSC and UCAS (fully or partial) Scholarship Acceptance

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research