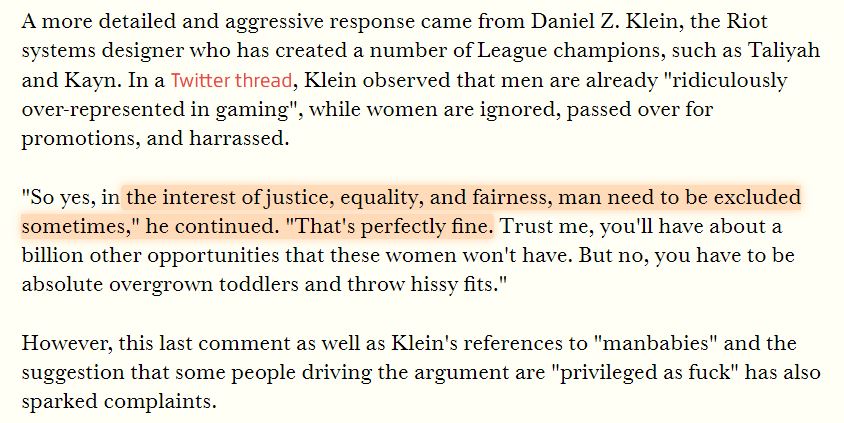

I broadly categorize stocks in two categories-

1. The momentum stocks-

These are the stocks where most of the moves are swift in nature, or we can say that the pullbacks in a trend are smaller.

I have been asked many times about my views on Closing basis Stop loss.

— Trader knight (@Traderknight007) November 5, 2021

So here's a thread on the same. pic.twitter.com/qFgujKAFqS

Experience don't count in trading IMO, i can show you people who are trading from last 20 years and still losing money and i can also show you people who are in market since 3-4 years and are Profitable.

— Trader knight (@Traderknight007) June 25, 2021

What matters is how much time do you take to learn from a mistake,

90% of the difference between the performance of a super trader and a normal joe is due to the position sizing.

— Trader knight (@Traderknight007) July 3, 2021

In this article, we will learn why position sizing is important and how we can implement it by learning 3 effective position sizing techniques.https://t.co/gWS4Ifi4OJ

The biggest trading mistakes that cost me lakhs of Rupees.

— Trader knight (@Traderknight007) July 17, 2021

And the lessons that I learned from them. \U0001f447https://t.co/NCwMM8SVYz

\U0001d413\U0001d421\U0001d42b\U0001d41e\U0001d41a\U0001d41d \U0001d41f\U0001d428\U0001d42b \U0001d40e\U0001d429\U0001d42d\U0001d422\U0001d428\U0001d427\U0001d42c

— Abhishek Kar (@Abhishekkar_) December 29, 2020

The entire thread will have some quick pointers on options trading. These bullet points are based on experience and learning and even if you are completely new,will help you to build some perspective. So,lets go :

\U0001d413\U0001d42b\U0001d41a\U0001d41d\U0001d41e\U0001d42b \U0001d430\U0001d421\U0001d428 \U0001d41d\U0001d41e\U0001d42c\U0001d42d\U0001d42b\U0001d428\U0001d432\U0001d41e\U0001d41d \U0001d401\U0001d41a\U0001d42b\U0001d422\U0001d427\U0001d420\U0001d42c \U0001d401\U0001d41a\U0001d427\U0001d424

— Abhishek Kar (@Abhishekkar_) October 11, 2020

This thread is about the trader who with his reckless trading destroyed the entire Barings bank. In case you would like to read more such informative threads,do not forget to retweet and share as acts as encouragement

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5e7\U0001d5e2\U0001d5e3 \U0001d7f1 \U0001d5e7\U0001d5db\U0001d5e5\U0001d5d8\U0001d5d4\U0001d5d7

— Abhishek Kar (@Abhishekkar_) July 21, 2020

The following thread will have top 5 for everything you need in the world of stock market and as learner who wants to REALLY grow. Make sure you #retweet the thread and let it reach the maximum number of people as sharing is caring.

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5d7\U0001d5d4\U0001d5e5\U0001d5de \U0001d5e6\U0001d5dc\U0001d5d7\U0001d5d8 \U0001d5e2\U0001d5d9 \U0001d5e6\U0001d5e7\U0001d5e2\U0001d5d6\U0001d5de \U0001d5e7\U0001d5e5\U0001d5d4\U0001d5d7\U0001d5dc\U0001d5e1\U0001d5da

— Abhishek Kar (@Abhishekkar_) July 6, 2020

In the following thread you will understand a few dark truths about stock trading as a profession.

Sadly everyone touches the only green side but there has to be a balance. Don't forget to #retweet for wider reach.

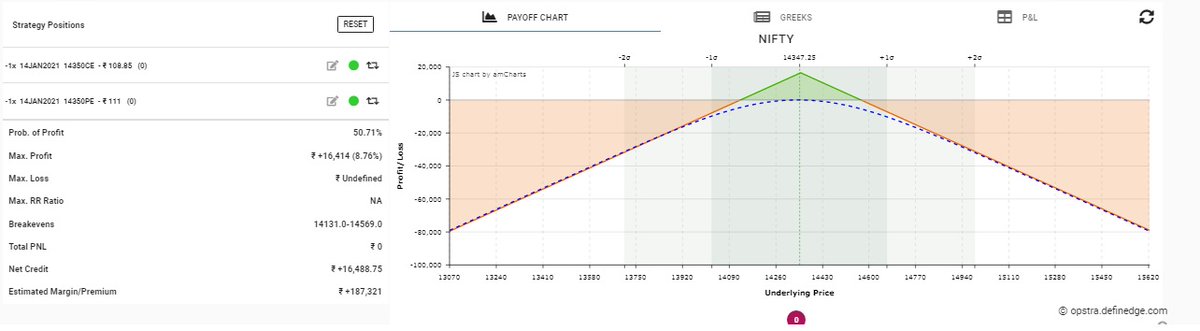

There are various Options Greeks like: Delta, Gamma, Vega, Rho, Theta.

— Yash Mehta (@YMehta_) September 4, 2022

A complete guide on how these #Option Greeks impact option price.

Option trading is tough but here\u2019s what can make it easier for you

— The Chartians (@chartians) September 17, 2022

8 option strategies that you can use in any market (sold as a \u20b9 50,000 course !)

They say options trading can make YOU BANKRUPT - is it true ?

— The Chartians (@chartians) September 23, 2022

If yes then why ?

A thread on Risk management and Position sizing in options trading (worth 50k\u20b9 course)\U0001f9f5

101 guide on how you can start option selling to generate active returns with less capital (Rs 1 Lakh) \U0001f9f5:

— Yash Mehta (@YMehta_) August 19, 2022

A course on option selling available for free.

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602