It's a public company, so you could go on your broker's website and trade its stock. Its price had been low for a while.

THREAD: What are some Posting Traders doing, and what do the federal securities laws say about it? A securities law professor tries to make it simple.

(Tl;dr? Some people on the Internet will be surprised when the SEC investigates them for market manipulation.)

It's a public company, so you could go on your broker's website and trade its stock. Its price had been low for a while.

Some big hedge funds (think BILLIONS) were betting that it'd go down. This is called a "short" bet.

Note for later: "borrowing" is important.

Compared with someone "short," someone "long" a stock actually has it (kinda).

Shorting is controversial; it puts downward pressure on stock price. Long investors, big (Elon Musk) and small (mom and pop) alike, don't want to lose from low stock prices.

https://t.co/abvqutbusN

Instead of buying or selling the stock, you can buy options—also bets on a stock price going up or down—more cheaply from a big financial institution middleman.

If the price goes up, it eats away at the collateral available to cover the bet if it goes bad. So you have to put up more collateral.

But because stock prices are theoretically limitless, a short investor faces potentially unlimited losses from a bad bet, if the price at which they buy back the stock skyrockets.

In fact, for GameStop there are more shares sold short than there are available to be bought back. So those holding the stock can sell.

1. Buy options to raise stock price.

2. Higher price forces short sellers to put up more margin.

3. Shorts also have to "cover" by buying back at much higher prices.

4. You sell to them at the high price.

5. Maybe destroy hedge fund?

Seems to have worked in the case of Melvin Capital, a hedge fund that had to "cover" its short position and get bailed out by other rich people. (Follow Matt if not already.)

But I'm here to talk about federal securities law. (I'm not a NE lawyer and this isn't legal advice.)

The SEC yesterday announced it was aware of all this and is "review[ing] the activities of regulated entities, financial intermediaries, and other market participants."

That last group includes everyone I talked about above short sellers, posters, all.

https://t.co/9KSUhIwXAN

It has the whiff of a pump and dump scheme, when fraudsters drum up support for a worthless stock before selling to dummies. That is undoubtedly the mental model that ENF investigators are trying to fit it in.

— James Fallows Tierney (@JamesFTierney) January 28, 2021

Sound familiar? Look again above at GameStop "strategy" steps 1-4. Can posts show that "purpose"?

https://t.co/O8qIHXzJ2T

But the SEC is undoubtedly looking into it.

Maybe it is or isn't a winning theory. But putting it to the test is costly. The SEC typically has leverage to get its targets to settle.

(The rest of her article, about open market manipulation, is great and worth reading!)

https://t.co/NsxRo3GuVk

More from Trading

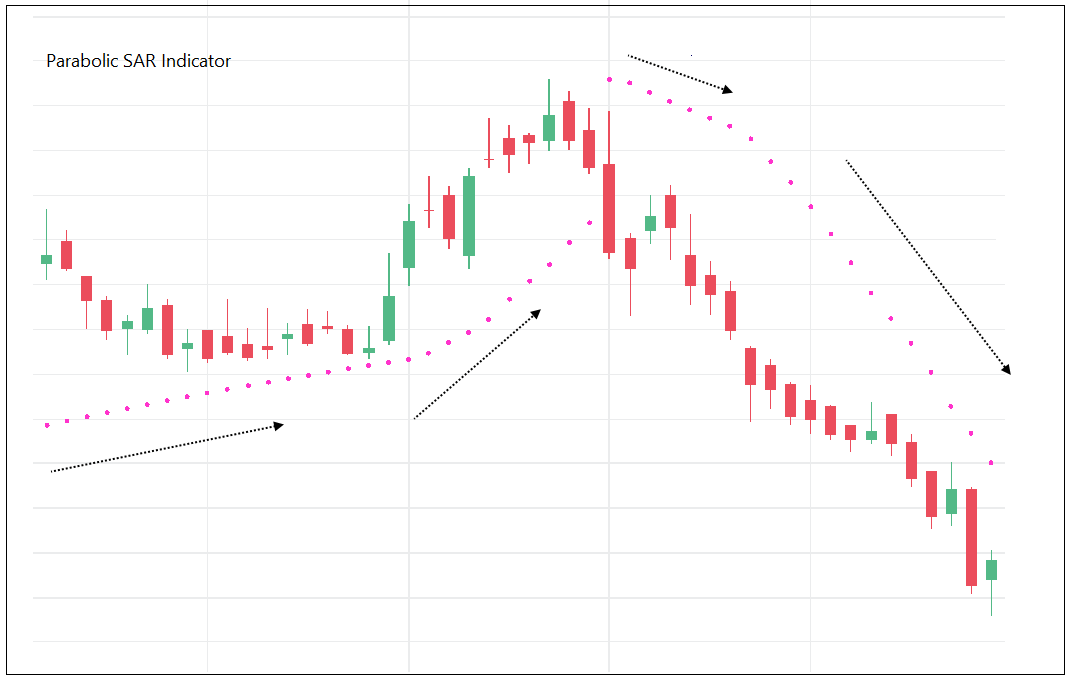

𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

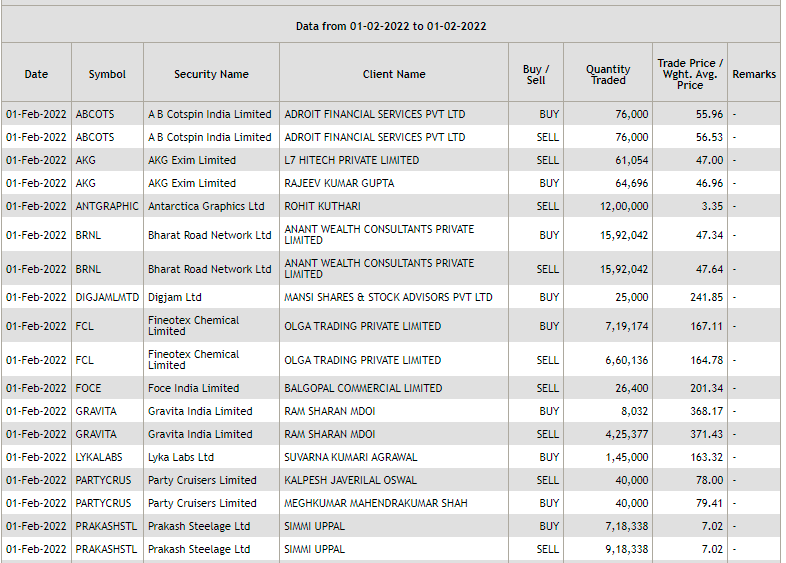

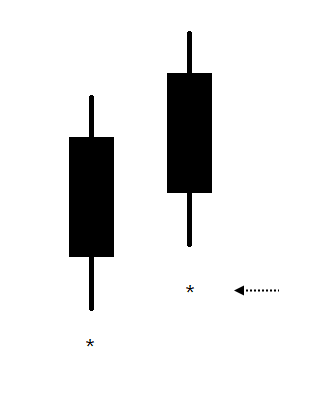

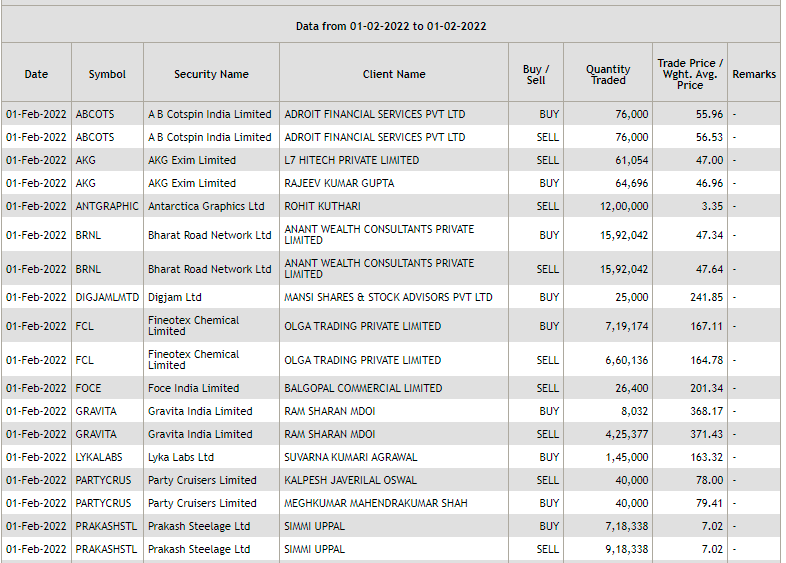

A 🧵on the basics of block and bulk deals.

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3