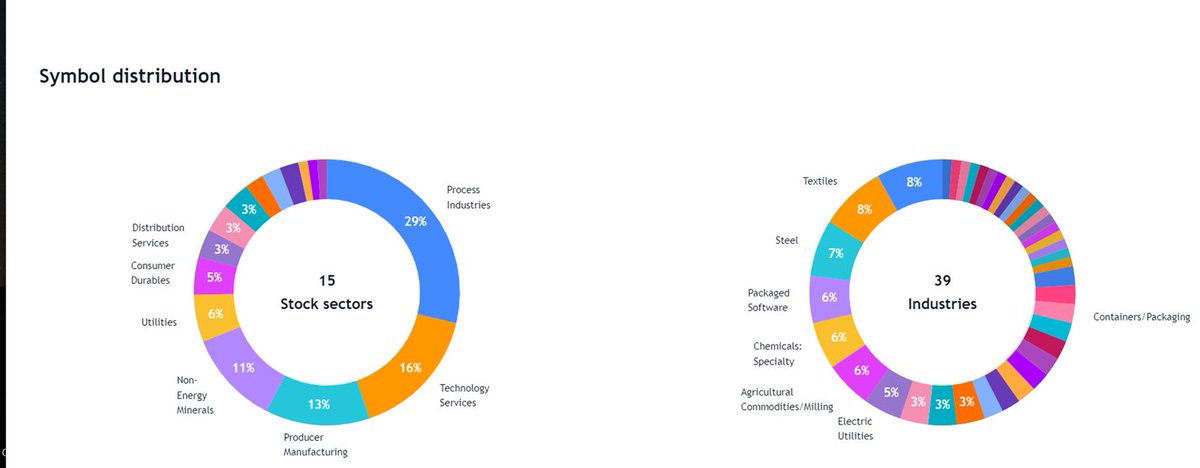

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5 1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

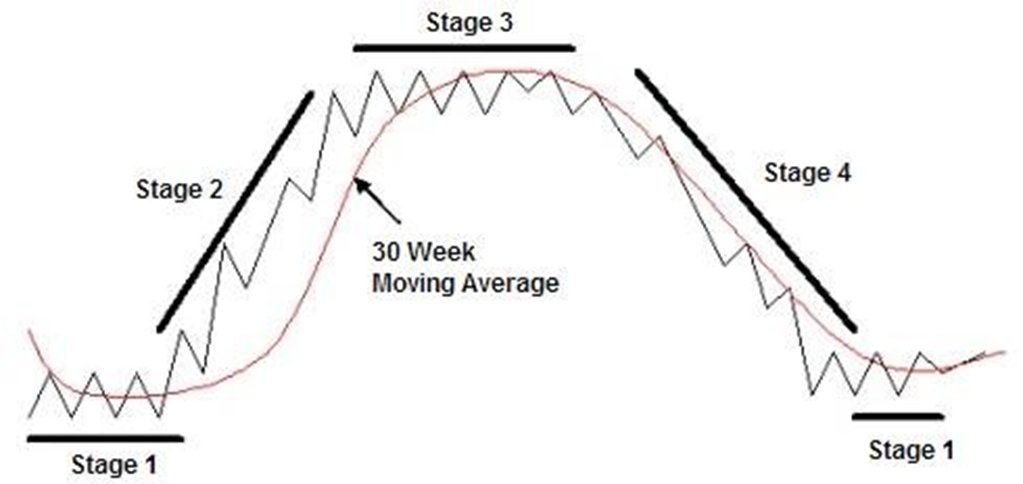

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

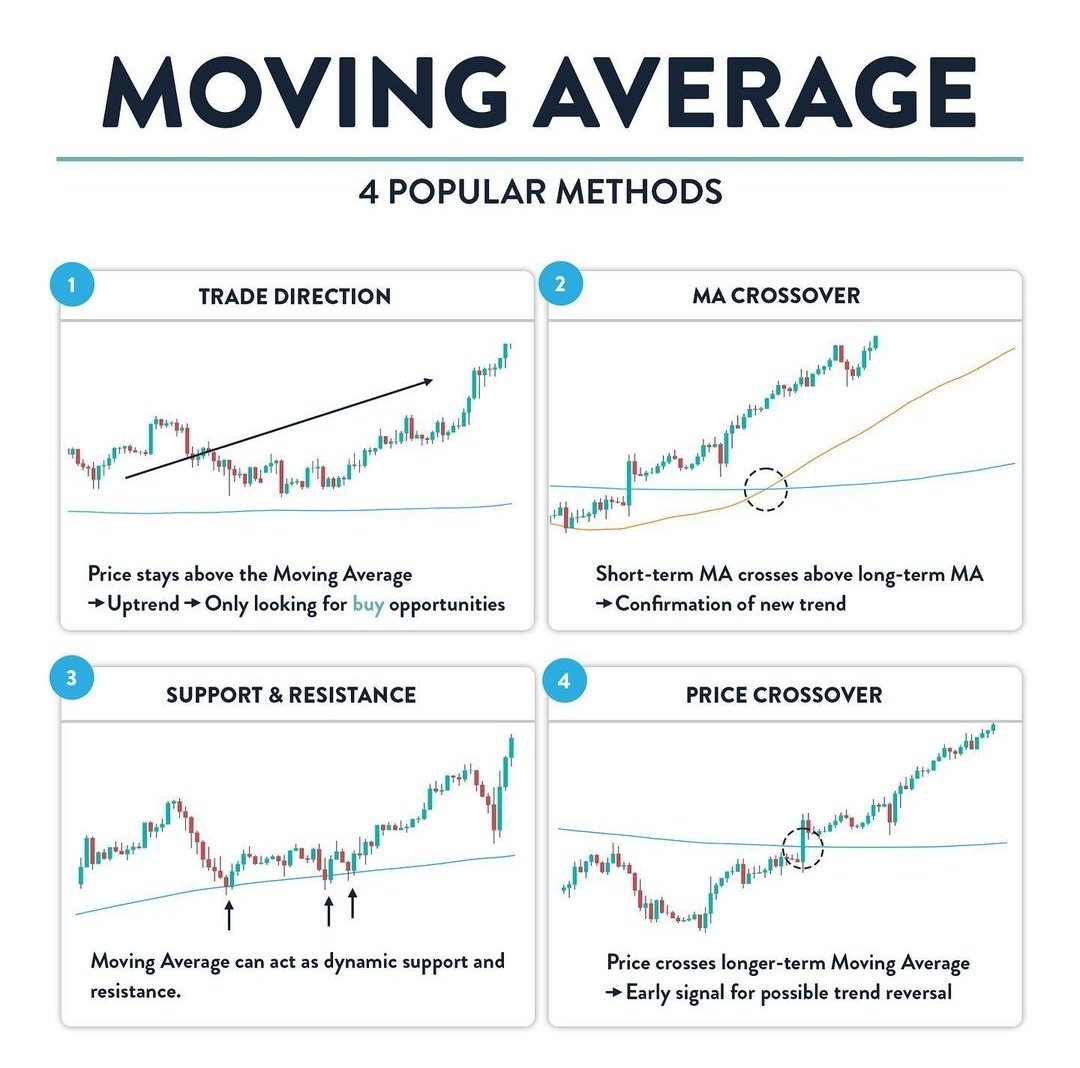

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

Helps to filter out stocks in good momentum and that are giving better returns than nifty

These stocks tend to outperform the market for a long term

These are potentially superstocks

52 period signifies 1 Year of trading

In 1 Year we have around 52 trading Weeks

5/n

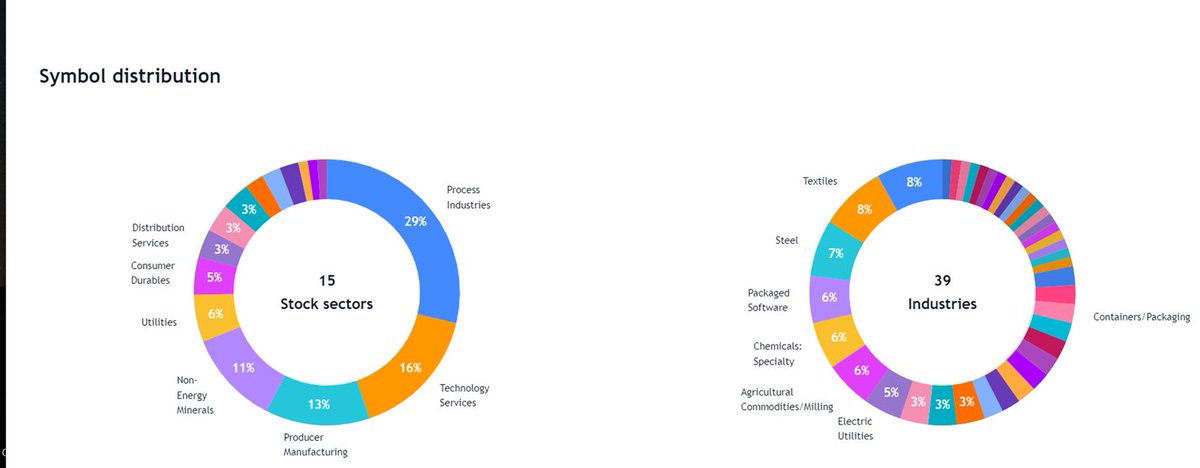

What is Stage Analysis ?

Stage 1 : Accumulation Phase

Stage 2: Advancing Phase This is the stage where we should be looking to take long positions in a stock or index. Buyers are now in control and the balance of power is now in line with demand

Look for Stocks in Stage 2

6/n

Past Leaders Charts :

3 types of entries

Stage 1 Breakout

52 week high Breakout

All time / Multi Year Breakout

#LTI #JSLHISAR #Tatalexsi

Trading Strategy to find new Leaders :

Let us now summarize everything and apply the whole concept in real trading

What are we looking for ?

Stock breaking out of stage 1 and above 30 wema

Relative strength > 0 and increasing

Example : 20 Microns , #OrbitExports

7/n

The more time RS was positive before the breakout the better .

Enter on Stage 1 Breakout

Look for rising Volumes on right side of base

Volume on Updays should be greater than Volume on Downdays

8/n

Observations of Past data

Only ¼ of the stocks were trading above 100 before they became 5X

Out of 85 Stocks only 20 were above 100 rs

Even now 50 Stocks are having market Cap less than 5000 Cr that means they were having market cap of around 1k cr before they become 5X

9/n

20 Stocks are having market cap above 20k cr now

66 Stocks have market cap 10k Cr now !

Only 11 Stocks had ROE and ROCE >20 That means Fundamentals didn’t matter that much

#CentruyPly #Onwardtech

10/n

Stoploss Also Hits using The same Stratgey

#CosmoFilms

#PrakashIndustry

Risk Reward Will always be > 1:10 As if we ride the complete trend till stage 3 Breakdown then stocks become 2X 3X easily

Small Losses should be Booked and Re entry should be Taken if stock regains momentum

Some Stocks That are coming out of stage 1 and 52 week RS Increasing and >0

#Shankara #HSCl #Goacarbon #RuchiraPapers

Using the Same Concepts of Stage Analysis and Relative Strength

12/n

RULES :

➡️Enter Near Stage 1 Breakout and Pyramid Slowly

➡️Use 30 Wema trailing Stoploss

➡️ Look for Stocks below 1000 cr Market cap

➡️Fundamentals dont matter much if you use stoploss

13/n

MentorShip Program:

SWING TRADING MENTORSHIP GROUP!

✅Mentorship starting in April on weekends only with recording

✅Covering Pure Price Action , Relative Strength, Stage Analysis, How to find Super Stocks

LINK FOR ENQUIRY:

https://t.co/Y6WIyvbcjx 14/n

Stage Analysis Thread :

https://t.co/YrFHSRd9jE Relative Strength Thread:

https://t.co/d7FtnZZDSi 15/n