SUDRED12's Categories

SUDRED12's Authors

Latest Saves

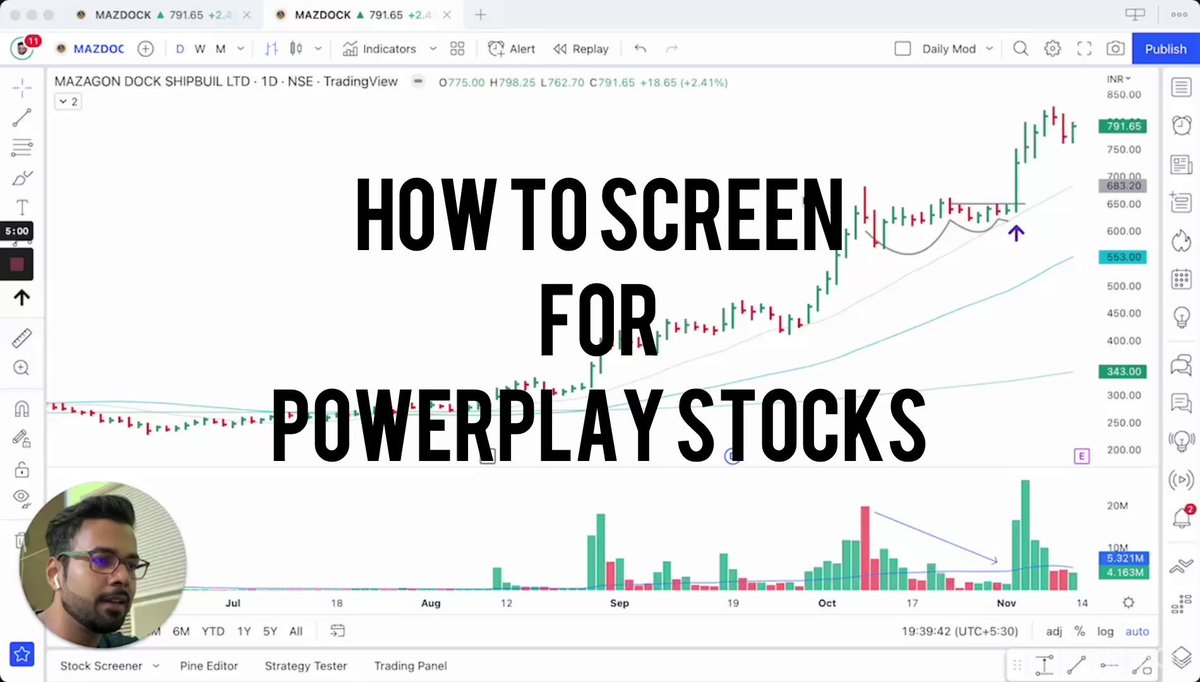

Here is a compilation of past PowerPlay Trades in the Indian Markets I have tried to analyse and study (taken minimum stock advance of 75%)

Taken some past trades of @iManasArora @iArpanK @RahulKhemka16 to analyse these kind of setups

YouTube video link:

https://t.co/Oaau7X7CkG

Here are 6⃣ simple strategies which you can use if you are still struggling to trade cash stocks!

They are very simple yet very effective if you can stick to them🤓

Ready to learn?

Let's go🧵...

1⃣ CCI & Pivot based strategy to ride massive trends in stocks

Don't forget to checkout the fundamental

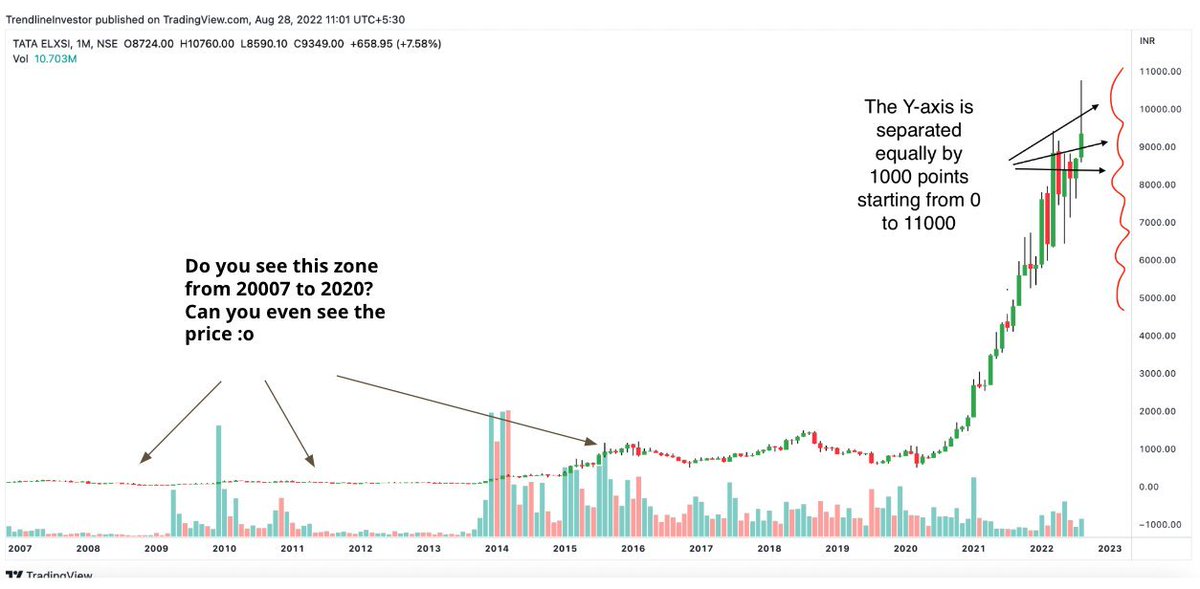

For 7 yrs I struggled to ride trends..

— Trendline Investor (@dmdsplyinvestor) April 30, 2022

& in 2015-17 when I started learning TA smthng crazy happened..

Here is a simple strategy that helped me..

\u2022 Identify turning points in stocks

\u2022 Find quality stocks

\u2022 Not panic & ride trends

\u2022 Finally make \U0001f4b8

CCI & Pivot Strategy\U0001f9f5.. pic.twitter.com/S0QFx00541

2⃣ Multi-time frame positional strategy based on CCI with

There are 1000s of indicators in Technical Analysis...

— Trendline Investor (@dmdsplyinvestor) May 12, 2022

But you need to MASTER ONLY ONE\U0001f3afto win in markets...

I selected 'Commodity channel index' (CCI) as my PRIMARY INDICATOR & all my scanners are a variation of this...

MULTI TIMEFRAME POSITIONAL STRATEGY using CCI...\U0001f9f5 pic.twitter.com/4O2PrBxSw9

3⃣ Only CCI based investment strategy - You can catch massive trends in stocks with good Sales/PAT growth using this

My CCI based investment strategy - How does it work? A thread.

— Trendline Investor (@dmdsplyinvestor) May 23, 2020

Objective: Identify stocks that are entering a phase of momentum on the upside and ride the stock until momentum weakens.1/n

4⃣ Tradingview code for strategy shared by @heartwon based on the long term and short term

A brilliant concept based on the long term and short term EMA by @heartwon. I'm here on twitter for such stuff that helps me build my systems. Really good one. Here is the trading view indicator that I coded. Please RT for everyone's benefit. 1/3 https://t.co/uleWiysyL1

— Trendline Investor (@dmdsplyinvestor) July 5, 2020

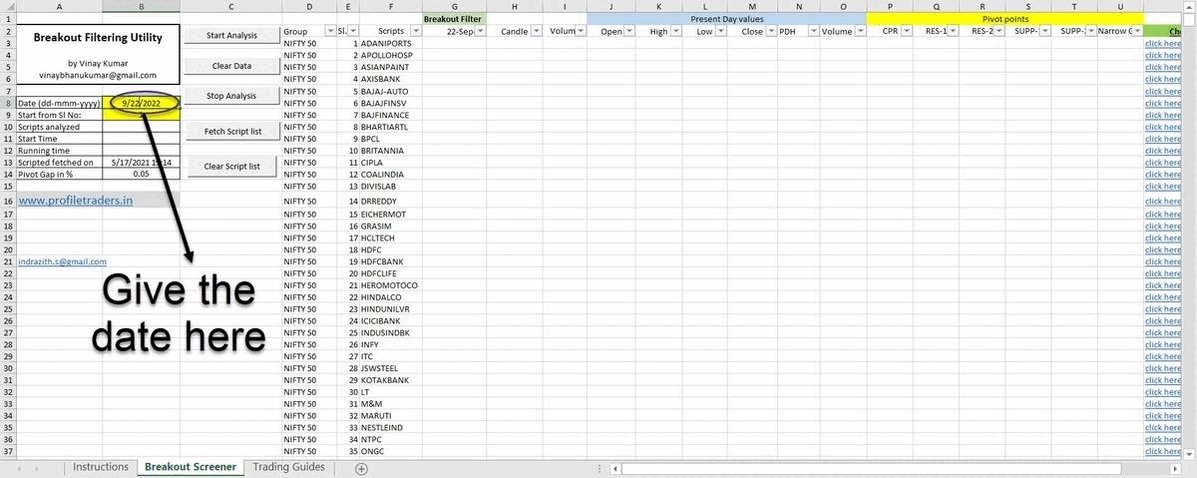

Nowadays everyday market is opening with big gaps.

Solution?

Shifting to Stocks!

But How to Pick Good Stocks for Tomorrow's Trading?

Presenting 11 FREE Screeners to scan Stocks for the Next Trading Day!

Thread 🧵

(1/N)

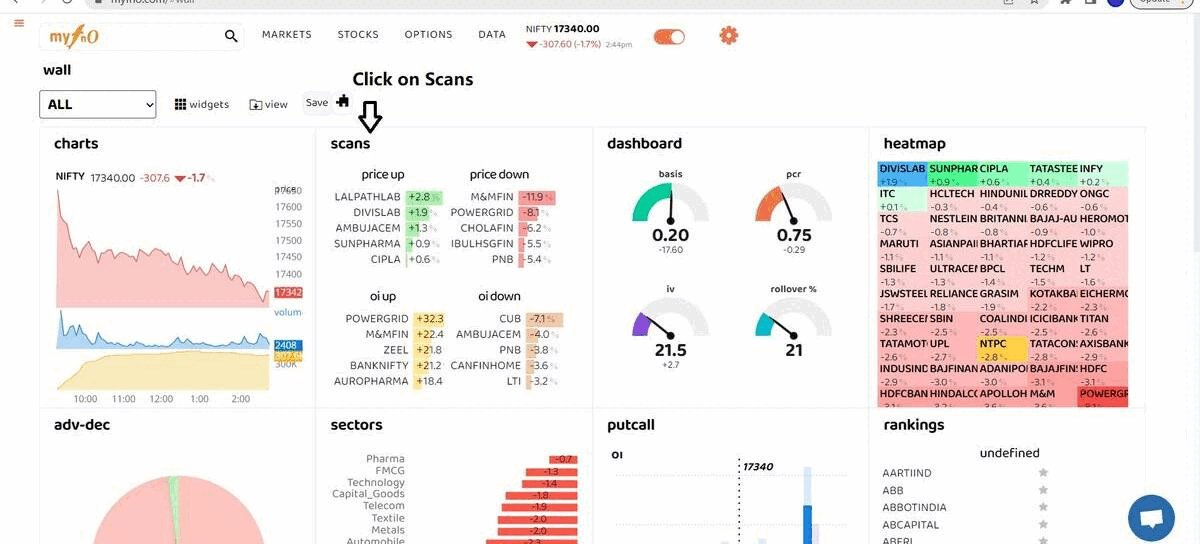

MYFNO - To Know the Stocks Which Received High and Low Open Interest (OI)

https://t.co/FURZDTArKK

(2/N)

Shortlist Bullish Momentum Stocks

This Screener shortlists all the bullish momentum stocks from NSE for the next day's trading (based on price action).

https://t.co/3teN7JLDMs

(3/N)

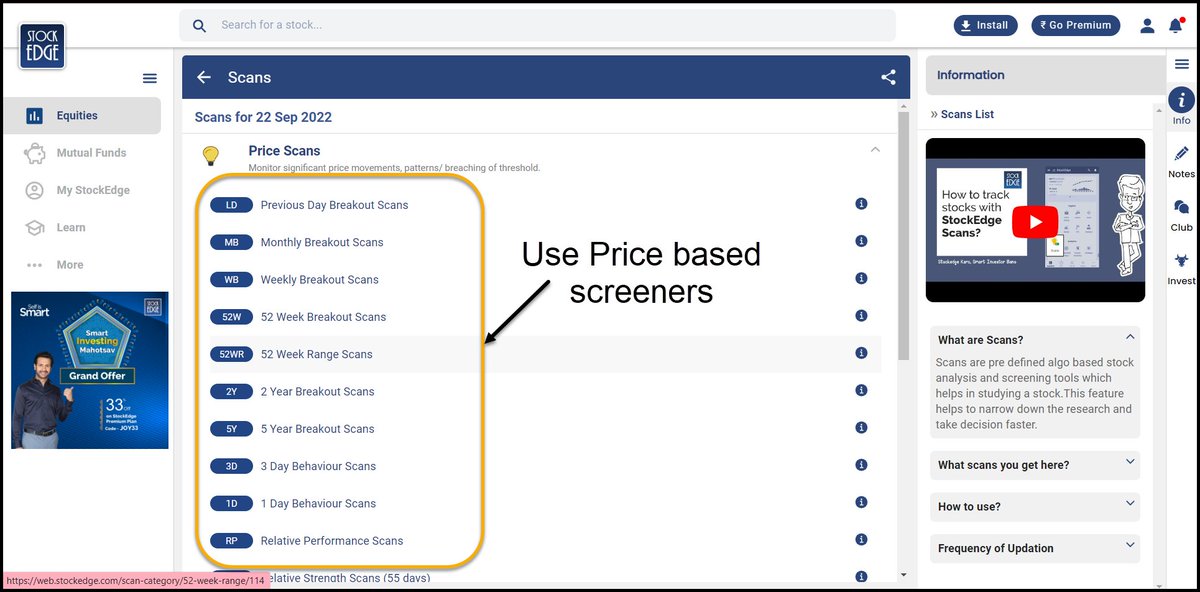

Screeners Based on Price (ex: Previous Day Breakout, Weekly Breakout, Monthly Breakout, etc.)

https://t.co/Y5naQIx967

(4/N)

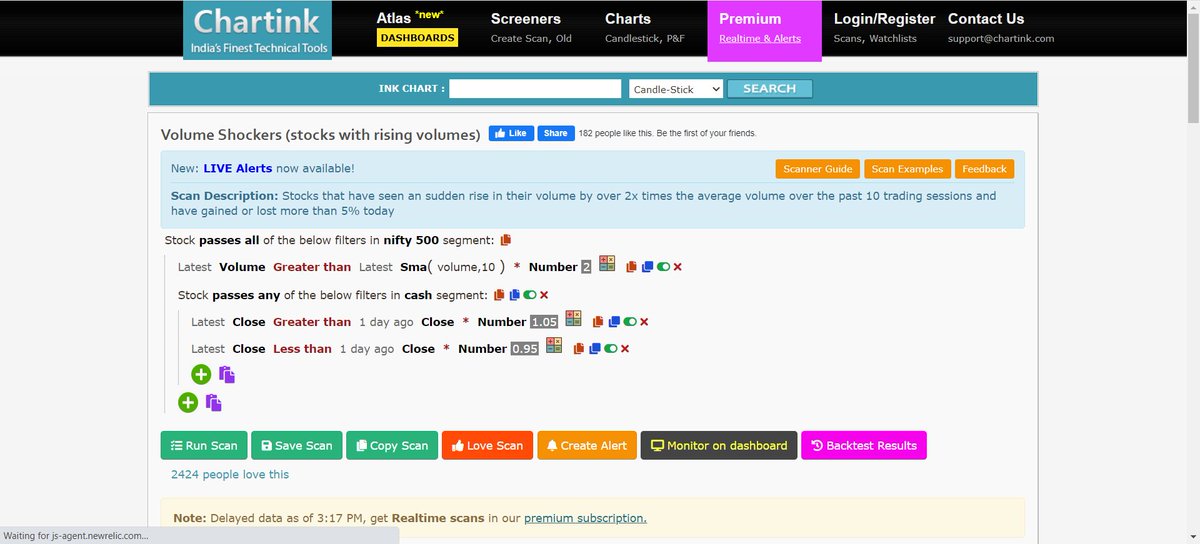

Volume Shockers - Stocks that received a huge volume

https://t.co/u9LTY5Yiir

(5/N)