SUDRED12 Categories Trading strategies

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

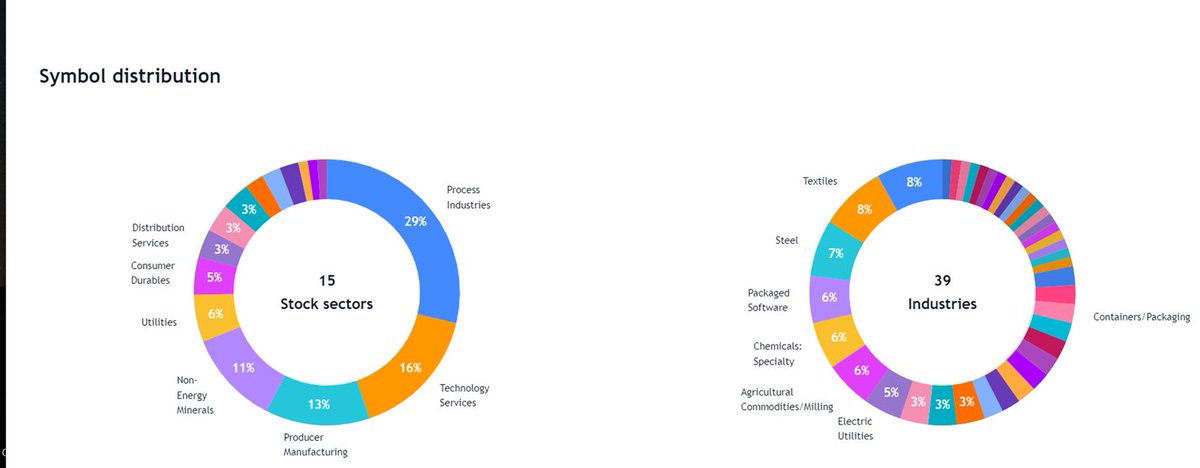

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

Here are 6⃣ simple strategies which you can use if you are still struggling to trade cash stocks!

They are very simple yet very effective if you can stick to them🤓

Ready to learn?

Let's go🧵...

1⃣ CCI & Pivot based strategy to ride massive trends in stocks

Don't forget to checkout the fundamental

For 7 yrs I struggled to ride trends..

— Trendline Investor (@dmdsplyinvestor) April 30, 2022

& in 2015-17 when I started learning TA smthng crazy happened..

Here is a simple strategy that helped me..

\u2022 Identify turning points in stocks

\u2022 Find quality stocks

\u2022 Not panic & ride trends

\u2022 Finally make \U0001f4b8

CCI & Pivot Strategy\U0001f9f5.. pic.twitter.com/S0QFx00541

2⃣ Multi-time frame positional strategy based on CCI with

There are 1000s of indicators in Technical Analysis...

— Trendline Investor (@dmdsplyinvestor) May 12, 2022

But you need to MASTER ONLY ONE\U0001f3afto win in markets...

I selected 'Commodity channel index' (CCI) as my PRIMARY INDICATOR & all my scanners are a variation of this...

MULTI TIMEFRAME POSITIONAL STRATEGY using CCI...\U0001f9f5 pic.twitter.com/4O2PrBxSw9

3⃣ Only CCI based investment strategy - You can catch massive trends in stocks with good Sales/PAT growth using this

My CCI based investment strategy - How does it work? A thread.

— Trendline Investor (@dmdsplyinvestor) May 23, 2020

Objective: Identify stocks that are entering a phase of momentum on the upside and ride the stock until momentum weakens.1/n

4⃣ Tradingview code for strategy shared by @heartwon based on the long term and short term

A brilliant concept based on the long term and short term EMA by @heartwon. I'm here on twitter for such stuff that helps me build my systems. Really good one. Here is the trading view indicator that I coded. Please RT for everyone's benefit. 1/3 https://t.co/uleWiysyL1

— Trendline Investor (@dmdsplyinvestor) July 5, 2020

I m watching your posts... amazing sir.... thanks for sharing.... can you share what is your trade set up

— Sahasra (@h_shanmugavelu) March 21, 2022

(a thread) 🧵

>Do retweet if it adds value as this took a long time for me to make

1) 10/20 Day EMA -

Enter the stock as it comes up back to the 10/20 day EMA and ride it till it drops below or SL hits as explained below

Eg -Nitin Spinners as below

2) Weekly Super trend (Setting 2,7): Whenever trend changes , volatility increases & supertrend measures volatility..That's the logic behind it

Eg - Deepak Nitrite

3) 10 Week MA : Trend following can be done using 10 w MA

Eg - Saregama

Fundamental analysis has to be done for best results as these are to be applied on a growing co + sector movt together ..Eg If you will apply to random co with low RS or low growth..This might be very choppy

Do retweet if make sense so as I can make more of such thread

Join telegram group for stock analysis & daily updates

https://t.co/lJ00OKEVd2

Download equialpha app for free momentum basics course

https://t.co/9N7vFDorC8

Thanks for reading.. Do like