This is what ultimately separates the good from the great.

A Guide to Position Sizing

--- Thread 🧵 ---

This is what ultimately separates the good from the great.

It will make a huge difference on your account if you have a 100% gain in a name with 20%+ of your equity.

1️⃣ Position Size Based on Risk

2️⃣ Position Size Based on Number of Edges

Before you take a position in a stock, you must know how much you are willing to lose on a trade.

We recommend never risking more than 1% of your overall account equity on any single trade, especially if you are in the consistency phase.

▪️ Buy Point: $100

▪️ Stop Loss: $99

▪️ Total Risk: 1%

If your max risk per position is 1% of your overall equity, this setup would allow you to take a 100% equity position and still be within your rules if the trade goes against you.

▪️ Buy Point: $50.50

▪️ Stop Loss: $49.00

▪️ Total Risk: 3%

If your max risk per position is 1% of your overall equity, this setup would allow you to take a 33% equity position and still be within your rules if the trade goes against you.

To position size based on # edges, you must have a great grasp as to what your edges are in the market.

🔸Strongest edges = biggest size

🔸Weakest edges = lowest size

▪️ Highest Volume Ever: Up to 25% of equity

▪️ Volatility Contraction Pattern (VCP): Up to 20% of equity

▪️ IPO Base Breakout: Up to 15% of equity

You must still trade with a risk first mindset though, knowing where you will exit the trade and how much of your account you are risking if the trade goes against you.

▪️ Conviction drives Position Sizing

▪️ $STUDY of your edges is the only way to build conviction

▪️ Whatever style you choose, you must do it consistently

You can find that here 👇

https://t.co/hcAKEG8WX1

If you want more similar content, please follow us

@TraderLion_

Let us know how you position size in the comments below 🔽

More from TraderLion 🦁

The market’s best investors have made millions from the simple saying:

“Buy right, sit tight”

Sounds simple - but what does “buying right” even mean?

Use TraderLion's 10-Step Ultimate Guide to buying right 👇

By the end of this thread, you'll know how to:

1. Build an objective list of buy criteria

2. Have 10+ real world examples to study

3. Increase your win rate.

4. Increase your profitability

Let's dive in!

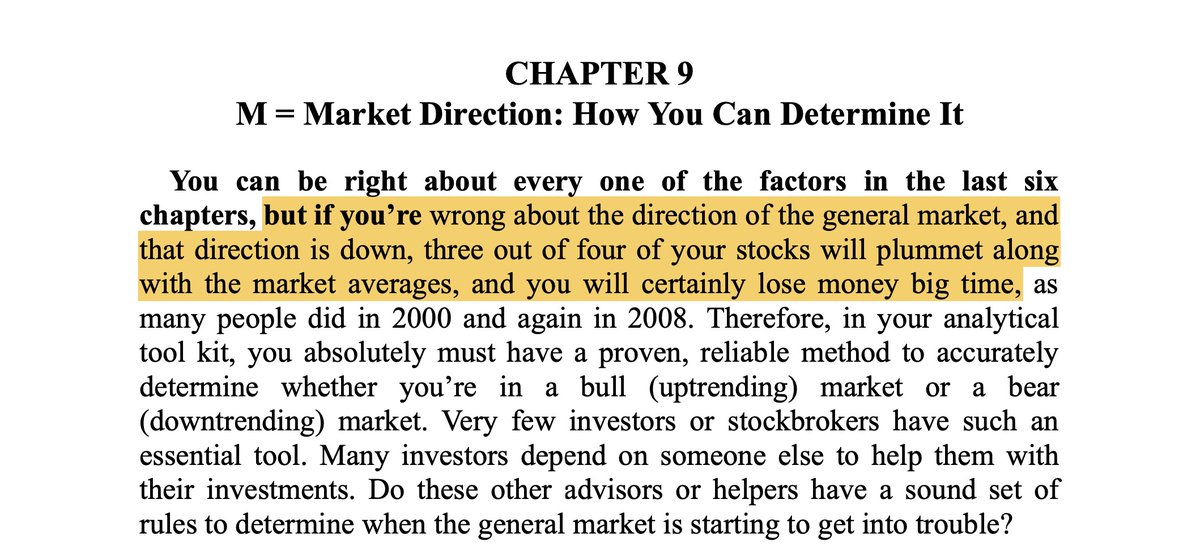

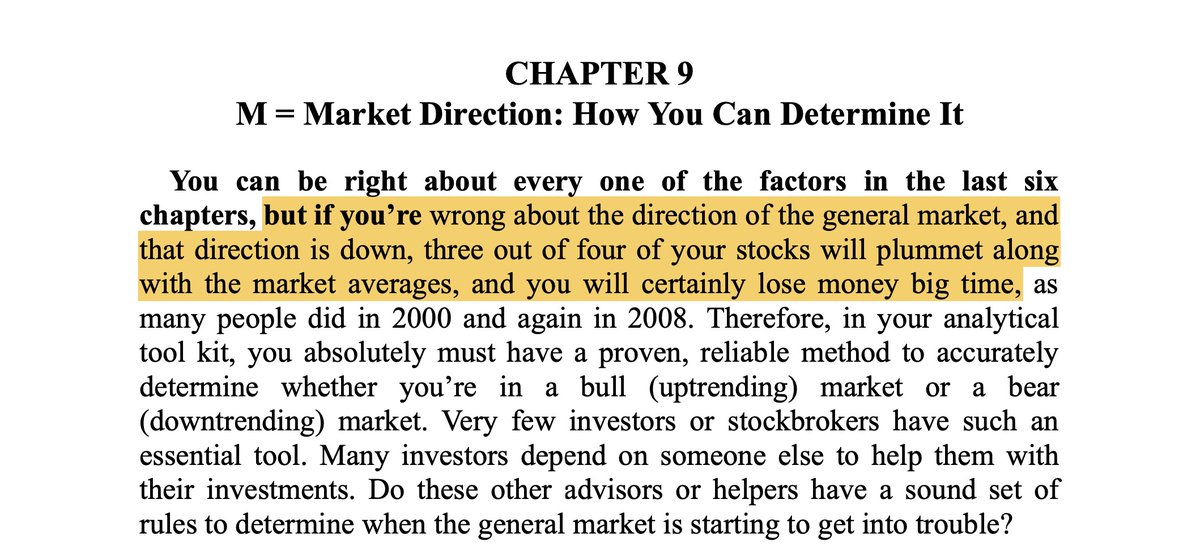

Buy Rule #1: The General market must be in an uptrend.

3 out of every 4 stocks follow the market trend both to the upside and to the downside.

This means that if you are buying a breakout in a downtrend, it already has a 75% chance of failing!

It doesn't matter if the stock is in a leading group with an impressive RS line and strong fundamental story.

At the end of the day, market direction is the MOST important factor!

Here's an excerpt from How To Make Money In Stocks by stock market legend William O'Neil:

Here's another video by @richardmoglen that will help you determine if the stock market is in a downtrend:

https://t.co/shD5OjkP6s

Let's move on to #2.

“Buy right, sit tight”

Sounds simple - but what does “buying right” even mean?

Use TraderLion's 10-Step Ultimate Guide to buying right 👇

By the end of this thread, you'll know how to:

1. Build an objective list of buy criteria

2. Have 10+ real world examples to study

3. Increase your win rate.

4. Increase your profitability

Let's dive in!

Buy Rule #1: The General market must be in an uptrend.

3 out of every 4 stocks follow the market trend both to the upside and to the downside.

This means that if you are buying a breakout in a downtrend, it already has a 75% chance of failing!

It doesn't matter if the stock is in a leading group with an impressive RS line and strong fundamental story.

At the end of the day, market direction is the MOST important factor!

Here's an excerpt from How To Make Money In Stocks by stock market legend William O'Neil:

Here's another video by @richardmoglen that will help you determine if the stock market is in a downtrend:

https://t.co/shD5OjkP6s

Let's move on to #2.

More from Traderlion

The market’s best investors have made millions from the simple saying:

“Buy right, sit tight”

Sounds simple - but what does “buying right” even mean?

Use TraderLion's 10-Step Ultimate Guide to buying right 👇

By the end of this thread, you'll know how to:

1. Build an objective list of buy criteria

2. Have 10+ real world examples to study

3. Increase your win rate.

4. Increase your profitability

Let's dive in!

Buy Rule #1: The General market must be in an uptrend.

3 out of every 4 stocks follow the market trend both to the upside and to the downside.

This means that if you are buying a breakout in a downtrend, it already has a 75% chance of failing!

It doesn't matter if the stock is in a leading group with an impressive RS line and strong fundamental story.

At the end of the day, market direction is the MOST important factor!

Here's an excerpt from How To Make Money In Stocks by stock market legend William O'Neil:

Here's another video by @richardmoglen that will help you determine if the stock market is in a downtrend:

https://t.co/shD5OjkP6s

Let's move on to #2.

“Buy right, sit tight”

Sounds simple - but what does “buying right” even mean?

Use TraderLion's 10-Step Ultimate Guide to buying right 👇

By the end of this thread, you'll know how to:

1. Build an objective list of buy criteria

2. Have 10+ real world examples to study

3. Increase your win rate.

4. Increase your profitability

Let's dive in!

Buy Rule #1: The General market must be in an uptrend.

3 out of every 4 stocks follow the market trend both to the upside and to the downside.

This means that if you are buying a breakout in a downtrend, it already has a 75% chance of failing!

It doesn't matter if the stock is in a leading group with an impressive RS line and strong fundamental story.

At the end of the day, market direction is the MOST important factor!

Here's an excerpt from How To Make Money In Stocks by stock market legend William O'Neil:

Here's another video by @richardmoglen that will help you determine if the stock market is in a downtrend:

https://t.co/shD5OjkP6s

Let's move on to #2.

You May Also Like

This is a pretty valiant attempt to defend the "Feminist Glaciology" article, which says conventional wisdom is wrong, and this is a solid piece of scholarship. I'll beg to differ, because I think Jeffery, here, is confusing scholarship with "saying things that seem right".

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?