Some people really benefit from hearing advice that everyone knows, for the same reason we keep schools open despite every subject in them having been taught before.

In that spirit, here's some quick Things Many People Find Too Obvious To Have Told You Already.

Charge more. Charge more still. Go on.

We don't see most of it every day for the same reason abstractions protect us from having to care about metallurgy while programming.

Serious people in positions of power eat Thanksgiving dinners, too. Guess what they ask at them.

More from Patrick McKenzie

On a serious note, it's interesting to observe that you can build a decent business charging $20 - $50 per month for something that any good developer can set up. This is one of those micro-saas sweet spots between "easy for me to build" and "tedious for others to build"

— Jon Yongfook (@yongfook) September 5, 2019

Every year at MicroConf I get surprised-not-surprised by the number of people I meet who are running "Does one thing reasonably well, ranks well for it, pulls down a full-time dev salary" out of a fun side project which obviates a frequent 1~5 engineer-day sprint horizontally.

"Who is the prototypical client here?"

A consulting shop delivering a $X00k engagement for an internal system, a SaaS company doing something custom for a large client or internally facing or deeply non-core to their business, etc.

(I feel like many of these businesses are good answers to the "how would you monetize OSS to make it sustainable?" fashion, since they often wrap a core OSS offering in the assorted infrastructure which makes it easily consumable.)

"But don't the customers get subscription fatigue?"

I think subscription fatigue is far more reported by people who are embarrassed to charge money for software than it is experienced by for-profit businesses, who don't seem to have gotten pay-biweekly-for-services fatigue.

More from Tech

A thread.

1. Equity is something Big Tech and high-growth companies award to software engineers at all levels. The more senior you are, the bigger the ratio can be:

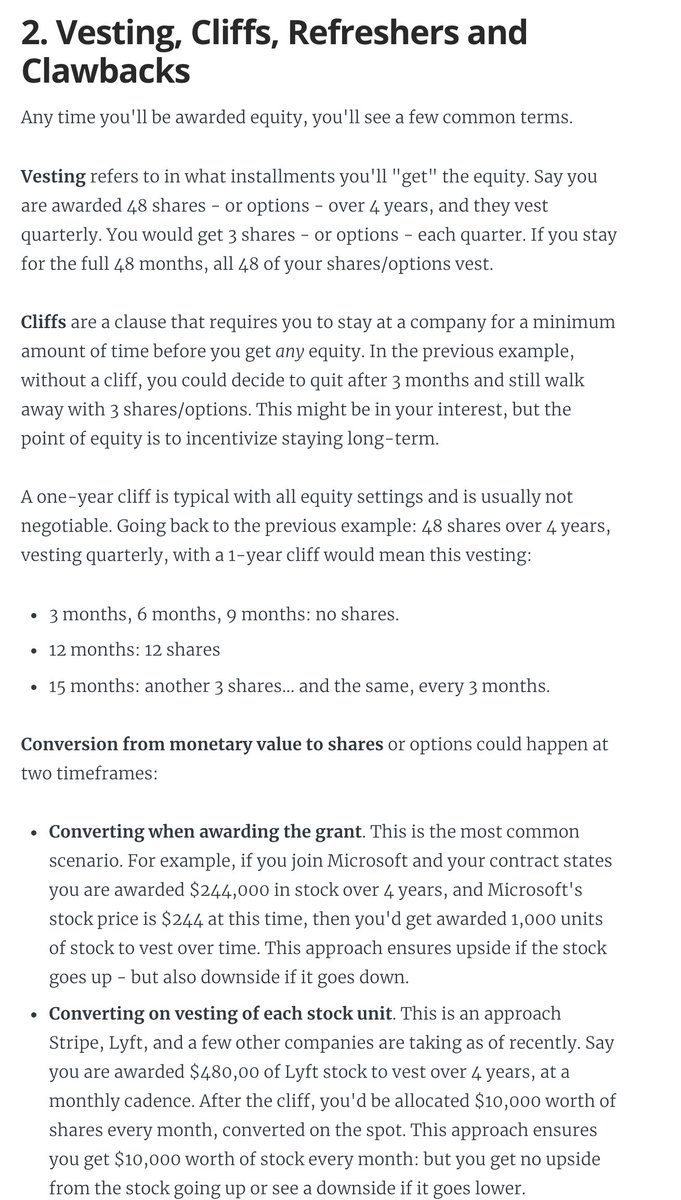

2. Vesting, cliffs, refreshers, and sign-on clawbacks.

If you get awarded equity, you'll want to understand vesting and cliffs. A 1-year cliff is pretty common in most places that award equity.

Read more in this blog post I wrote: https://t.co/WxQ9pQh2mY

3. Stock options / ESOPs.

The most common form of equity compensation at early-stage startups that are high-growth.

And there are *so* many pitfalls you'll want to be aware of. You need to do your research on this: I can't do justice in a tweet.

https://t.co/cudLn3ngqi

4. RSUs (Restricted Stock Units)

A common form of equity compensation for publicly traded companies and Big Tech. One of the easier types of equity to understand: https://t.co/a5xU1H9IHP

5. Double-trigger RSUs. Typically RSUs for pre-IPO companies. I got these at Uber.

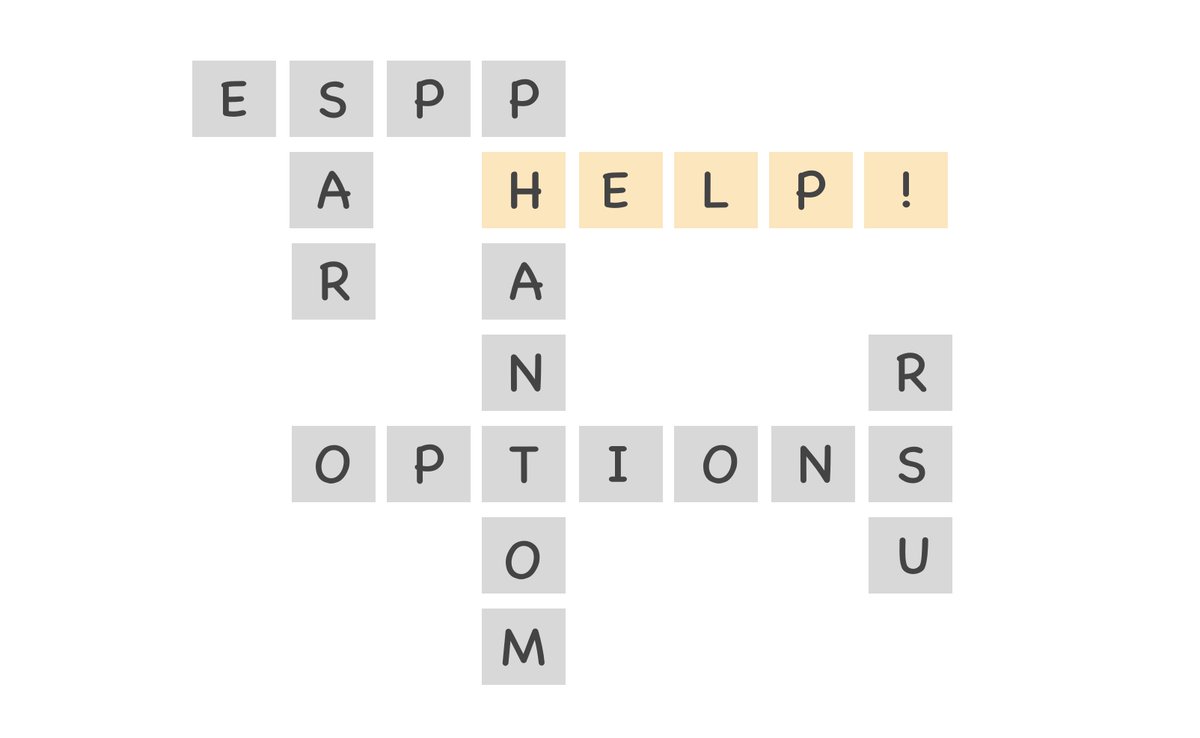

6. ESPP: a (typically) amazing employee perk at publicly traded companies. There's always risk, but this plan can typically offer good upsides.

7. Phantom shares. An interesting setup similar to RSUs... but you don't own stocks. Not frequent, but e.g. Adyen goes with this plan.

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5