Please don’t get jacked up on cheap SBA money and go tag the 14th thing you look at.

This is a valuable thread and @XavierHelgesen has excellent intentions. If you were planning to buy a SMB using the SBA, the deal got sweeter.

That said, there are caution flags I'd like to raise:

1) It's brutally hard. I outline the steps here https://t.co/MZ0beEl0UU

Please don’t get jacked up on cheap SBA money and go tag the 14th thing you look at.

If things turn against you, you’ll declare bankruptcy. Seen it happen. Not pretty.

The idea of cashing checks and “allocating capital” is a joke. Someone somewhere has done it, but I’ve never seen it.

It’s going to be a challenging 7/365 grind to hopefully make very good money. That’s the best you can hope for.

You’ll often have top employees getting more cash out of the business than the owner.

There's a chasm between the world of finance and operations. If this is surprising, be worried.

Cash is like oxygen. You only pay attention to it when it's in short supply and that's often too late.

More from Tech

The entire discussion around Facebook’s disclosures of what happened in 2016 is very frustrating. No exec stopped any investigations, but there were a lot of heated discussions about what to publish and when.

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

The story doesn\u2019t say you were told not to... it says you did so without approval and they tried to obfuscate what you found. Is that true?

— Sarah Frier (@sarahfrier) November 15, 2018

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.

Next.js has taken the web dev world by storm

It’s the @reactjs framework devs rave about praising its power, flexibility, and dev experience

Don't feel like you're missing out!

Here's everything you need to know in 10 tweets

Let’s dive in 🧵

Next.js is a @reactjs framework from @vercel

It couples a great dev experience with an opinionated feature set to make it easy to spin up new performant, dynamic web apps

It's used by many high-profile teams like @hulu, @apple, @Nike, & more

https://t.co/whCdm5ytuk

@vercel @hulu @Apple @Nike The team at @vercel, formerly Zeit, originally and launched v1 of the framework on Oct 26, 2016 in the pursuit of universal JavaScript apps

Since then, the team & community has grown expotentially, including contributions from giants like @Google

https://t.co/xPPTOtHoKW

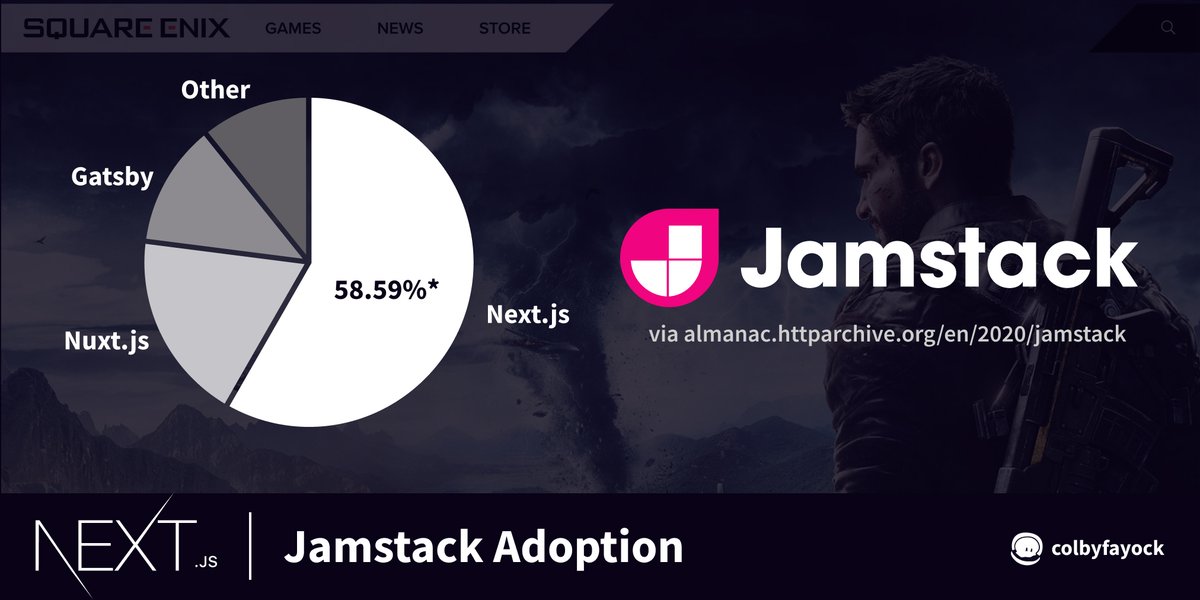

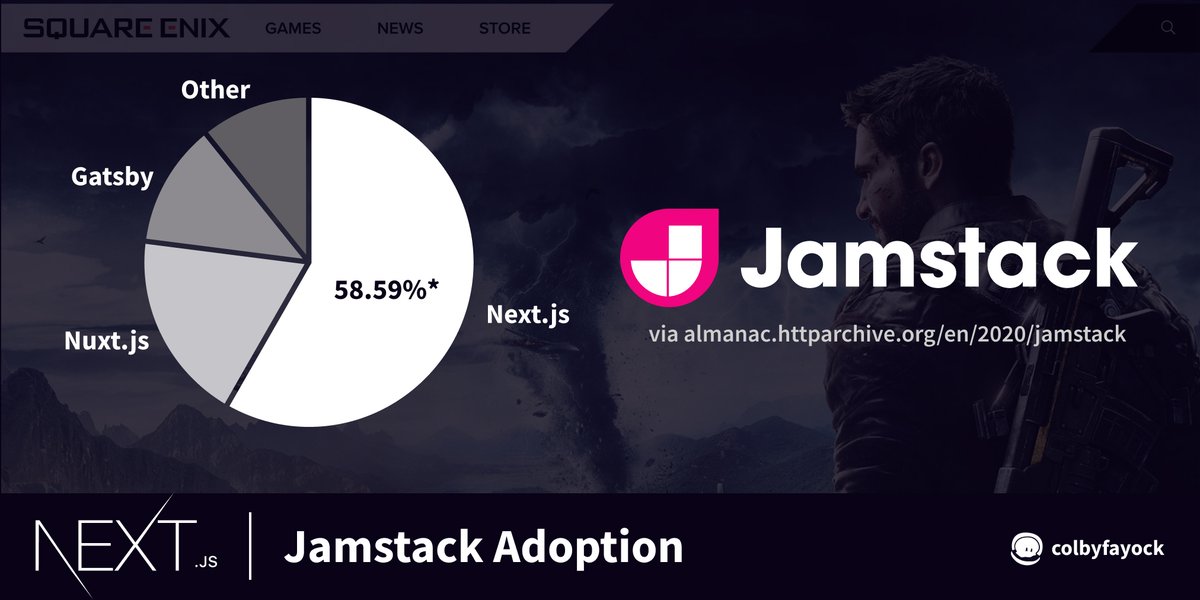

@vercel @hulu @Apple @Nike @Google In the #jamstack world, Next.js pulled a hefty 58.6% share of framework adoption in 2020

Compared to other popular @reactjs frameworks like Gatsby, which pulled in 12%

*The Next.js stats likely include some SSR, arguably not Jamstack

https://t.co/acNawfcM4z

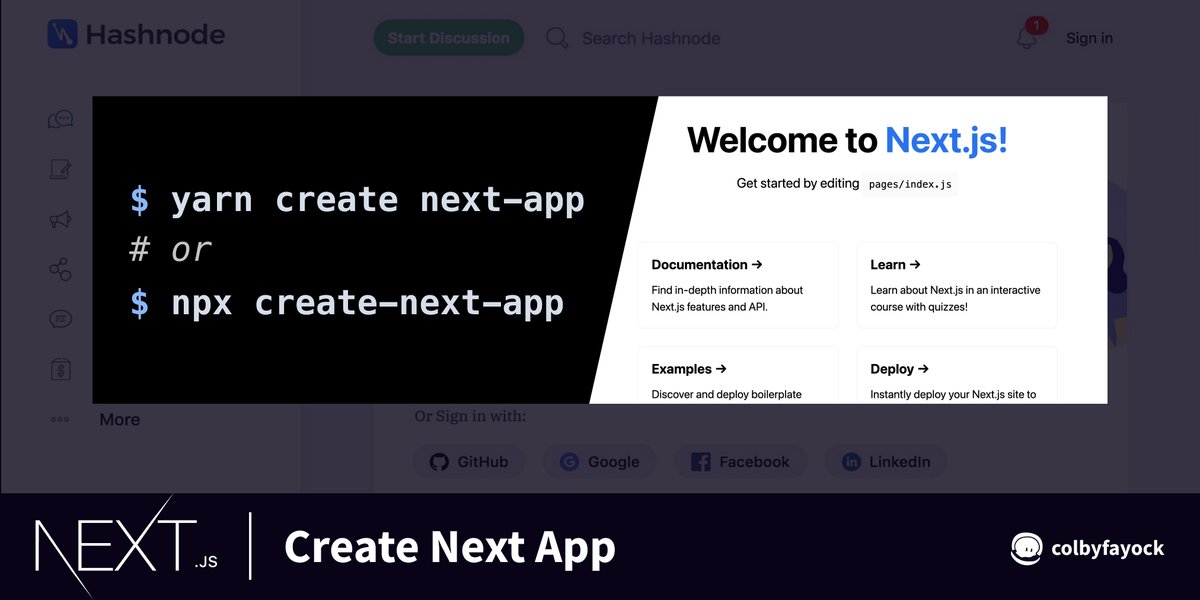

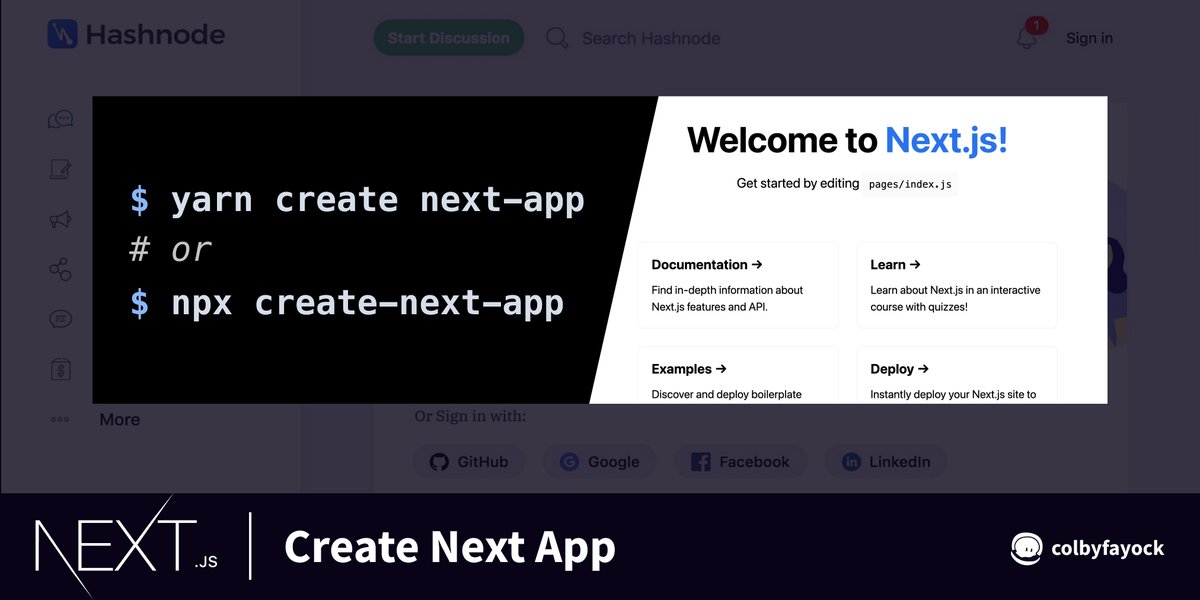

@vercel @hulu @Apple @Nike @Google The easiest way to get started with a new Next.js app is with Create Next App

Simply run:

yarn create next-app

or

npx create-next-app

You can even start from a git-based template with the -e flag

yarn create next-app -e https://t.co/JMQ87gi1ue

https://t.co/rwKhp7zlys

It’s the @reactjs framework devs rave about praising its power, flexibility, and dev experience

Don't feel like you're missing out!

Here's everything you need to know in 10 tweets

Let’s dive in 🧵

Next.js is a @reactjs framework from @vercel

It couples a great dev experience with an opinionated feature set to make it easy to spin up new performant, dynamic web apps

It's used by many high-profile teams like @hulu, @apple, @Nike, & more

https://t.co/whCdm5ytuk

@vercel @hulu @Apple @Nike The team at @vercel, formerly Zeit, originally and launched v1 of the framework on Oct 26, 2016 in the pursuit of universal JavaScript apps

Since then, the team & community has grown expotentially, including contributions from giants like @Google

https://t.co/xPPTOtHoKW

@vercel @hulu @Apple @Nike @Google In the #jamstack world, Next.js pulled a hefty 58.6% share of framework adoption in 2020

Compared to other popular @reactjs frameworks like Gatsby, which pulled in 12%

*The Next.js stats likely include some SSR, arguably not Jamstack

https://t.co/acNawfcM4z

@vercel @hulu @Apple @Nike @Google The easiest way to get started with a new Next.js app is with Create Next App

Simply run:

yarn create next-app

or

npx create-next-app

You can even start from a git-based template with the -e flag

yarn create next-app -e https://t.co/JMQ87gi1ue

https://t.co/rwKhp7zlys