Have you gotten tired of mechanical keyboards with all their physical feedback?

Have you considered... A completely flat keyboard?

Surprise! the plastic cover can be lifted up. The keyboard layout is on a piece of paper.

I think the middle two might be host connectors (AT and PS/2): you can hook a regular keyboard up through them.

The rightmost one is RS-232 serial, most likely

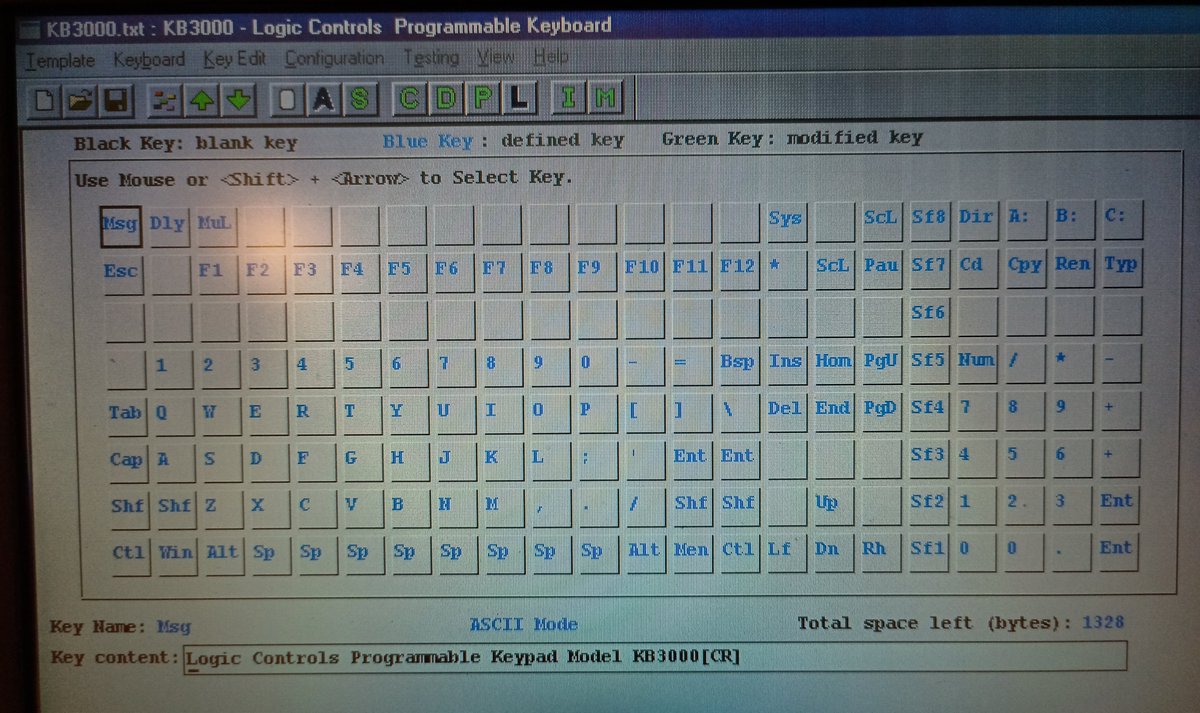

So it's by Logic Controls, apparently.

if you want the DOS version you gotta ask for it.

WELL that info isn't on their page anymore... but I'm gonna ask.

The other thing is that apparently you can program it without connecting the serial: serial is fully optional. So it must use some kind of out-of-band PS/2 messages to program it.

As much as I want them to provide the files, I will be 0% surprised if they just reply "bruh it's 2020"

https://t.co/op7ByWT9au

Dunno if you still need, but this page has a 7zip which includes DOS [supposedly, I have looked in the zip, but obv can't verify its usefulness - it seems cobbled from sources by the folder names in the zip]https://t.co/okmAr6FPIn

— 'ingie (@yngling) December 23, 2020

I'll have to grab a more generic computer and try it there.

Like this one!

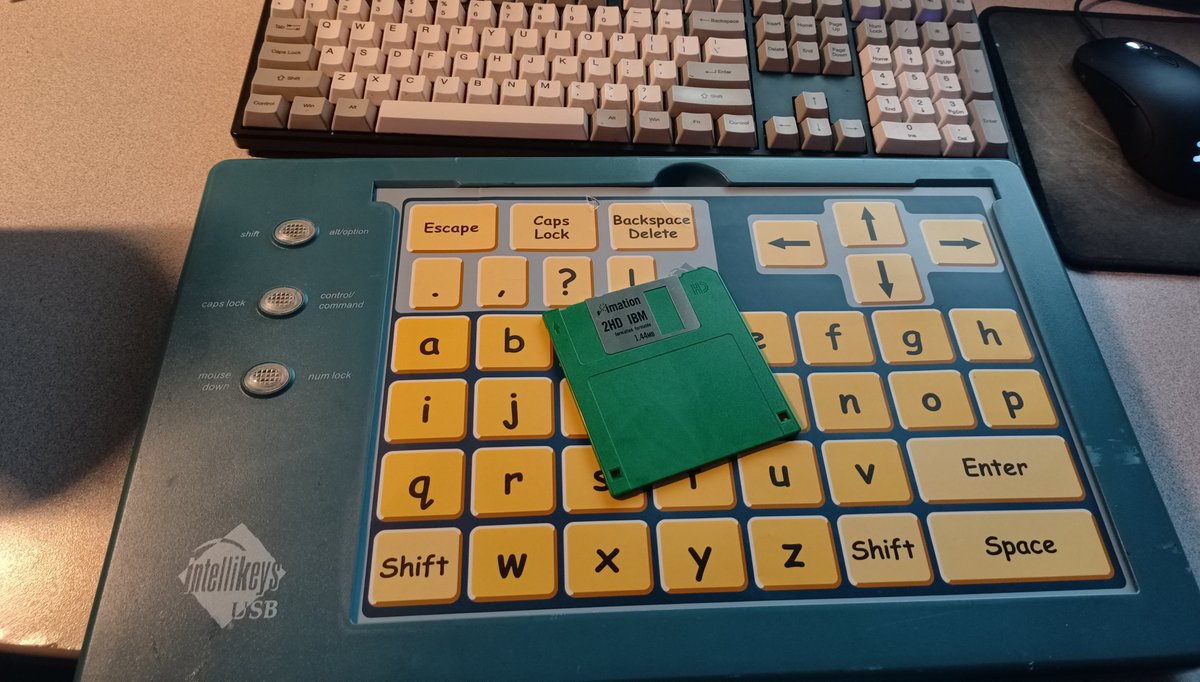

Have you ever wanted to type on alphabetical comic sans?

no? Fuck you, you're gonna.

Surprisingly little, for how incredibly heavy this keyboard is.

(the case is sheet metal!)

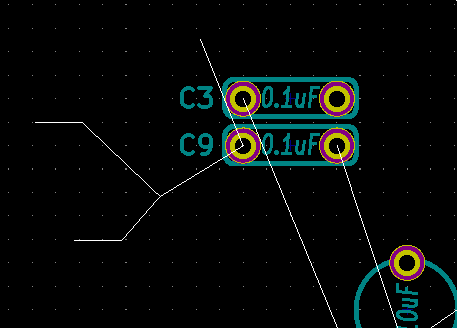

There's some missing parts: I think that's because this one has the serial port but doesn't actually support serial. That's an optional function, so those missing chips are probably serial-TTL chips

This is a RAMTRON FM24C16, a 2 kilobyte FRAM.

FRAM is ferroelectric RAM, it's non-volatile storage, but acts much like a RAM chip for simplicity.

2K is about how much storage is needed to store the keyboard layout.

More from foone

More from Tech

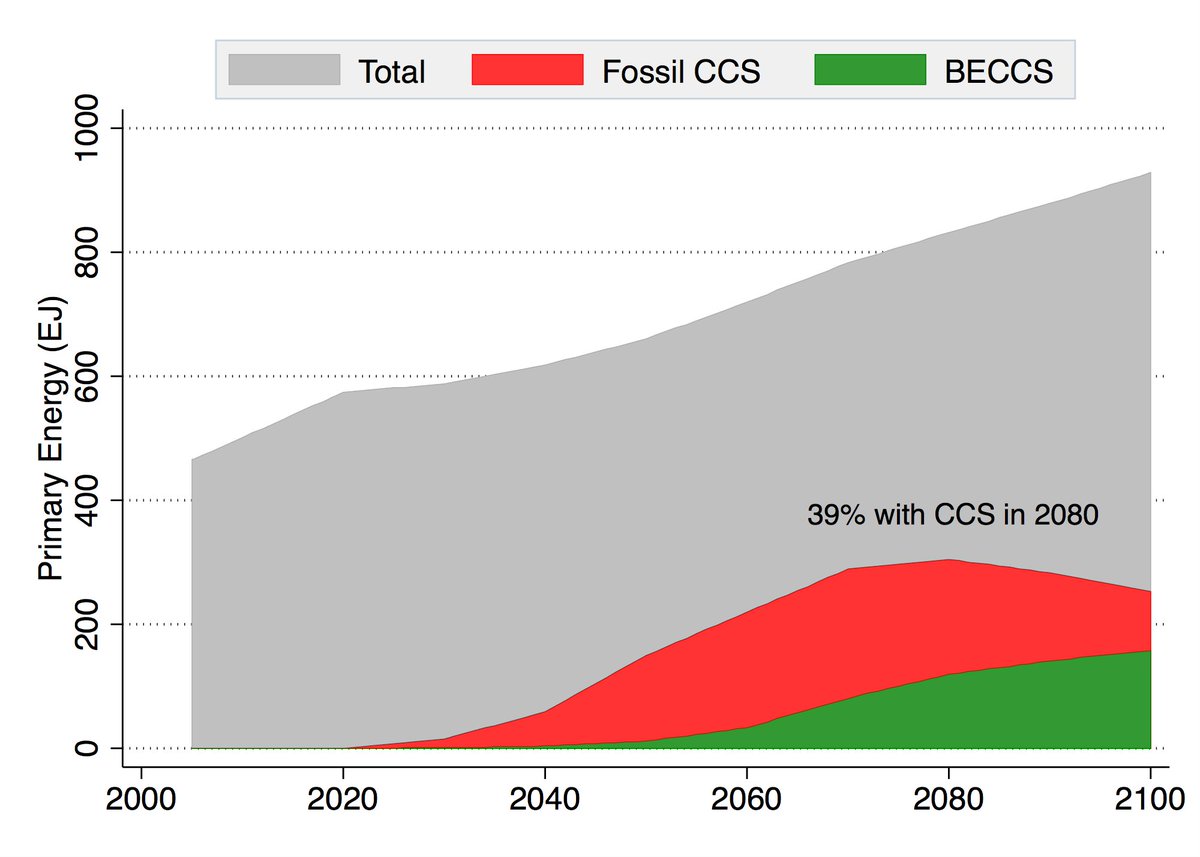

Energy system models love NETs, particularly for very rapid mitigation scenarios like 1.5C (where the alternative is zero global emissions by 2040)! More problematically, they also like tons of NETs in 2C scenarios where NETs are less essential. https://t.co/M3ACyD4cv7 2/10

There is a lot of confusion about carbon budgets and how quickly emissions need to fall to zero to meet various warming targets. To cut through some of this morass, we can use some very simple emission pathways to explore what various targets would entail. 1/11 pic.twitter.com/Kriedtf0Ec

— Zeke Hausfather (@hausfath) September 24, 2020

In model world the math is simple: very rapid mitigation is expensive today, particularly once you get outside the power sector, and technological advancement may make later NETs cheaper than near-term mitigation after a point. 3/10

This is, of course, problematic if the aim is to ensure that particular targets (such as well-below 2C) are met; betting that a "backstop" technology that does not exist today at any meaningful scale will save the day is a hell of a moral hazard. 4/10

Many models go completely overboard with CCS, seeing a future resurgence of coal and a large part of global primary energy occurring with carbon capture. For example, here is what the MESSAGE SSP2-1.9 scenario shows: 5/10

So I have been studying this entire communication layer as its relevance is ever growing with more devices coming online, staying connected, and relying on real-time communication. Not that this domain under penetrated, but there is a change underway.

— Ameya (@Finstor85) February 10, 2021

This thread is inspired by one of the articles I read on the-ken about #postman API & how they are transforming & expediting software product delivery & consumption, leading to enhanced developer productivity.

We all know that #Twilio offers host of APIs that can be readily used for faster integration by anyone who wants to have communication capabilities. Before we move ahead, let's get a few things cleared out.

Can anyone build the programming capability to process payments or communication capabilities? Yes, but will they, the answer is NO. Companies prefer to consume APIs offered by likes of #Stripe #twilio #Shopify #razorpay etc.

This offers two benefits - faster time to market, of course that means no need to re-invent the wheel + not worrying of compliance around payment process or communication regulations. This makes entire ecosystem extremely agile

You May Also Like

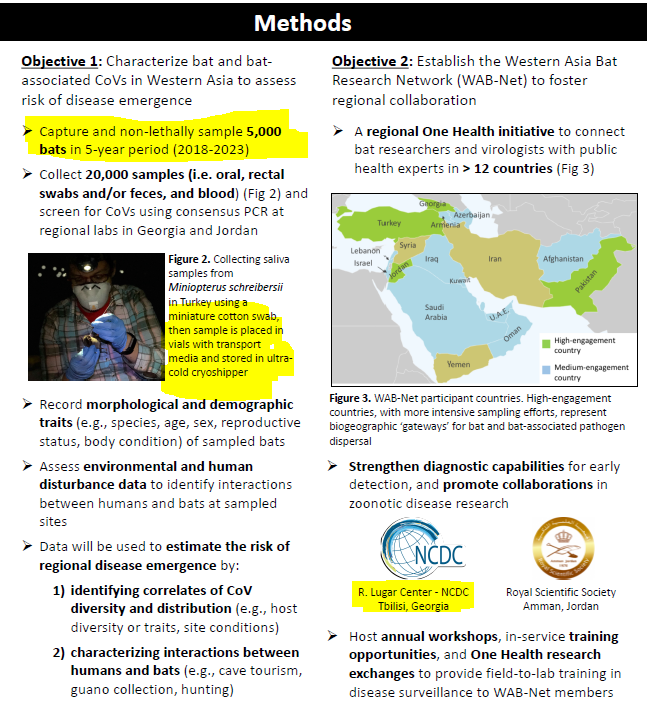

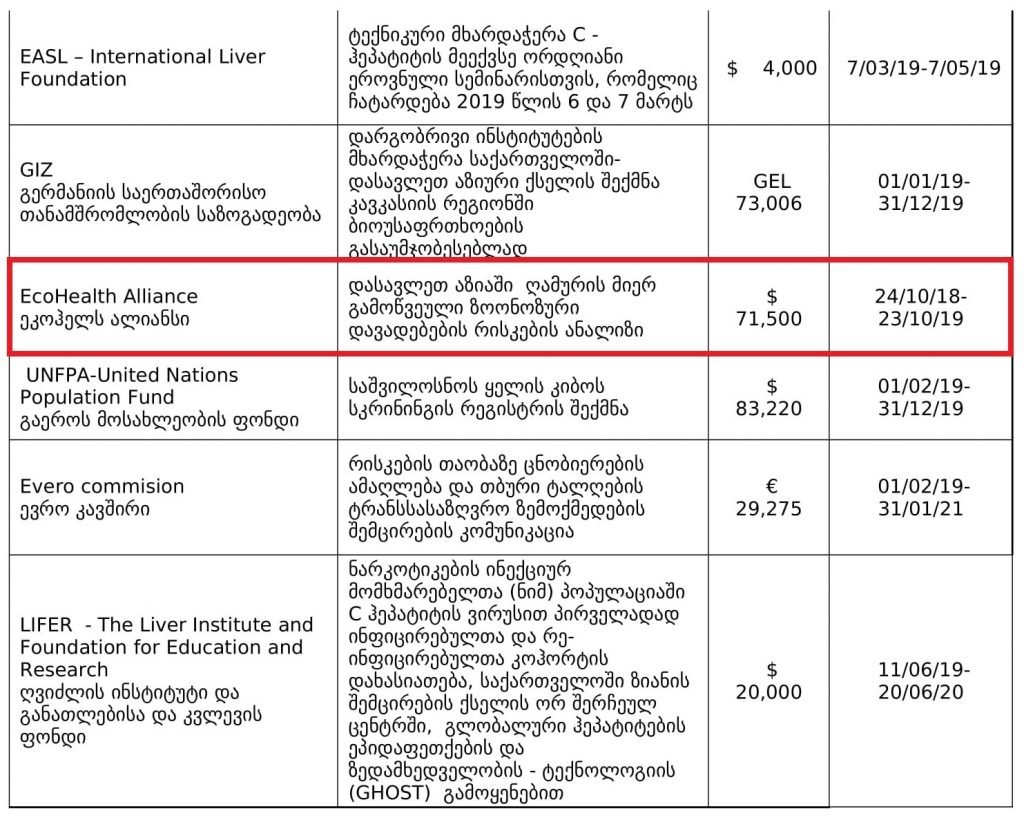

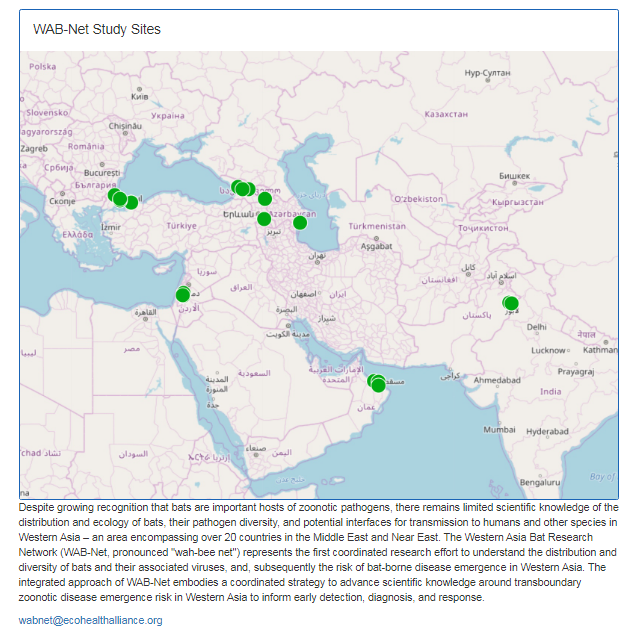

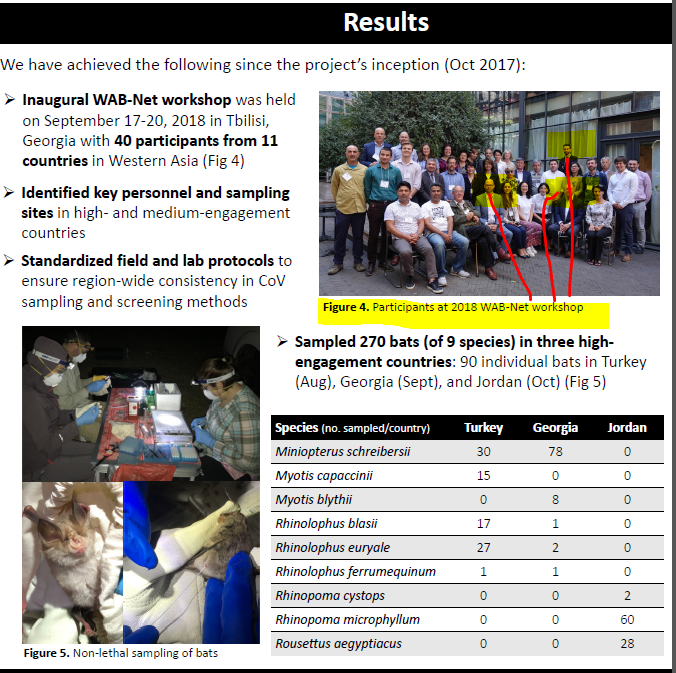

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)