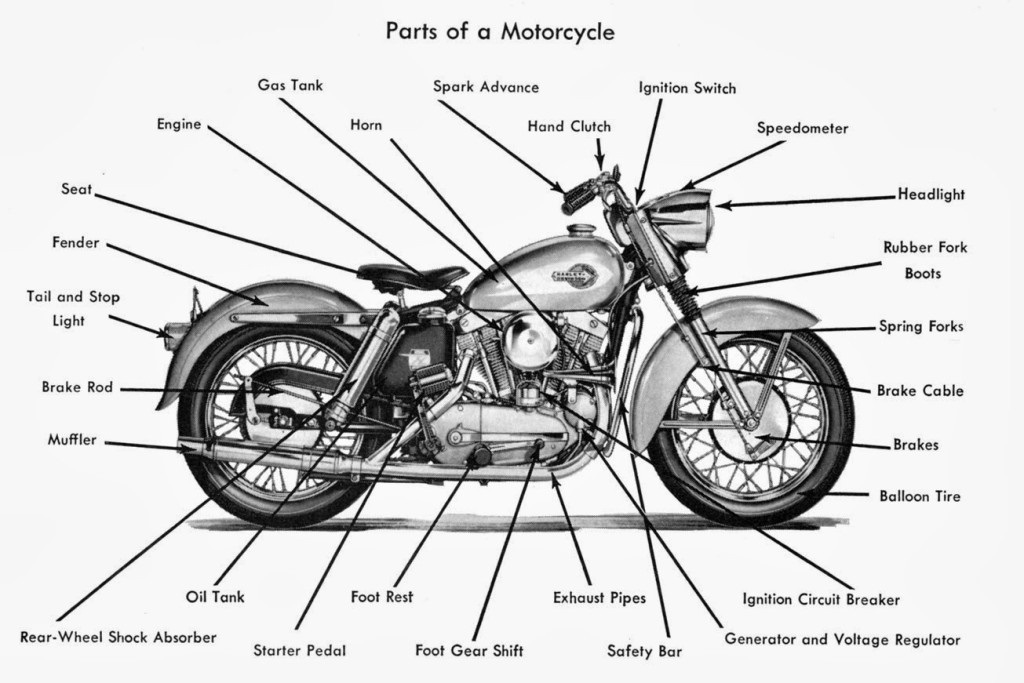

Any guesses which company? Will the resistance of PE will play again?

More from kumar saurabh

An extended analysis of the morning tweet is in this Youtube video. Like and retweet for wider reach

morning tweet on NASDAQ

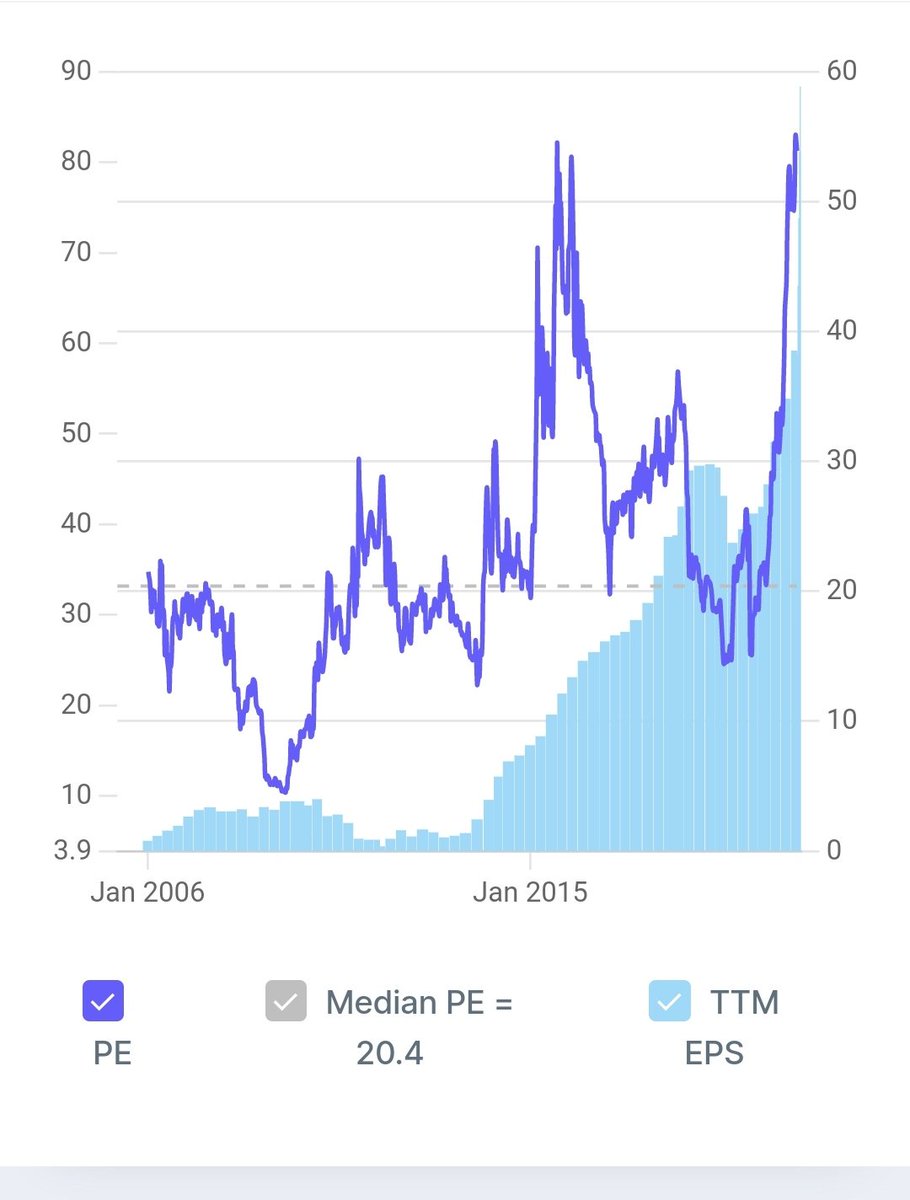

#NASDAQ How much NASDAQ can fall?

— kumar saurabh (@suru27) June 14, 2022

Since 2000, this is the 3rd worst fall in NASDAQ

2000: 77% fall from peak

2008: 55% fall from peak

2022: 34% fall from peak pic.twitter.com/MO8KNtzQez

More from Tataelxsilongterm

This is line chart based arc I plotted a few days ago to see where does the target of 2nd arc completes. We got ~9200(+/- 100/-) Switch to candles. See rejection area. Arc on candles is not really ideal but on line it is. No view above 9200! MAs need to catch up. #TATAELXSI pic.twitter.com/WNJRZZedrj

— Ameya (@Finstor85) March 30, 2022

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?