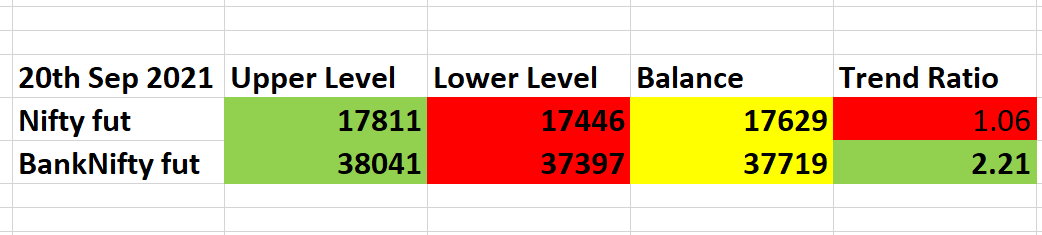

On a bullish Trend Ratio if Balance breaks, expect all longs to be trapped . Can short with stop above upper breakout figure. And vice versa

Along with the levels, there is Trend Ratio.

Near 1 or below is bearish, near 2 or above is bullish

( this as per last day's closing).

If Trend Ratio is bullish, expect support at Balance or breakout above Upper level will mean rally will continue.

On a bullish Trend Ratio if Balance breaks, expect all longs to be trapped . Can short with stop above upper breakout figure. And vice versa

1. DO NOT play bearish is market above Balance

2. DO NOT play bullish is market below Balance

The Balance basically tells you which side is a bit trapped

Nifty fut : Has closed on Friday below the Balance for Monday. So if Nifty opens a little below, will go short with a stop above Balance. Below lower levels will short more

More from Subhadip Nandy

My presentation on Money Management was based on a lot of sources as I mentioned. For traders interested on those sources , here they are

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

This question might have rose in your mind too, that why VIX was lower than yesterday despite the huge selloff today.

This is what I think happens . A thread.

What is VIX ?

https://t.co/VOkAwGRsHL

What is IV ( implied volatility ) ?

Now my explanations. IV is simply demand and supply. IV is back calculated from option prices and not given by the BSM model. When demand for options ( by buyers) are high, IVs will be high. When supply of options ( by sellers) are high, IV will be low.

Now look at this chart. Nifty fut and VIX are plotted together ( red line is the VIX). Yesterday's massive breakdown forced traders to hedge their positions by buying puts ( could be cash holdings, could be future longs, could be sold puts). This excess demand spiked up IVs /VIX

This is what I think happens . A thread.

Market is highly volatile but vix is down by 4%

— Jegathesan Durairaj (Jegan) (@itjegan) May 13, 2022

What is VIX ?

https://t.co/VOkAwGRsHL

What is IV ( implied volatility ) ?

Now my explanations. IV is simply demand and supply. IV is back calculated from option prices and not given by the BSM model. When demand for options ( by buyers) are high, IVs will be high. When supply of options ( by sellers) are high, IV will be low.

Now look at this chart. Nifty fut and VIX are plotted together ( red line is the VIX). Yesterday's massive breakdown forced traders to hedge their positions by buying puts ( could be cash holdings, could be future longs, could be sold puts). This excess demand spiked up IVs /VIX