Buy high to gain higher. CMP above 50 Day Moving Average (DMA) and 50 DMA above 200 DMA signifies the stock to be in an uptrend. This is an uncompromisable rule. @ZerodhaVarsity @zerodhaonline

#stocks

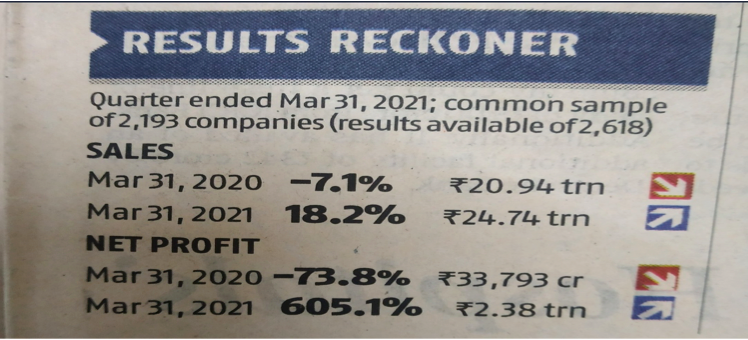

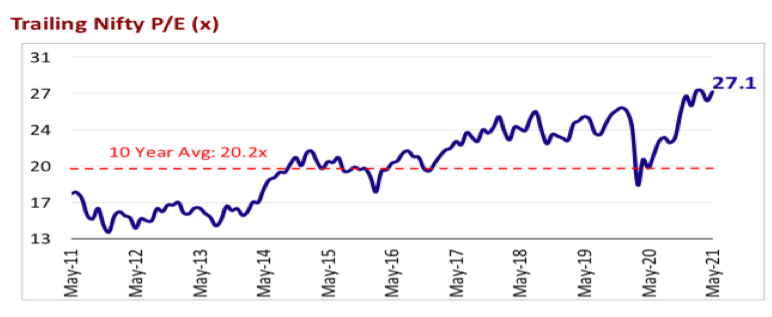

Market PE at 40 and yet the market is not falling, why? Getting asked this question multiple times. Here's a thread covering \u2018very basic\u2019 premier on valuation for my retail investor friends.

— Kirtan A Shah (@KirtanShahCFP) January 14, 2021

Do hit the \u2018re-tweet\u2019 and help us educate more investors (1/n) pic.twitter.com/8oCkBmmOXY