Going looking for a cofounder (whether you’re pressured to or not) seems like a disaster

I don’t buy into “you should have a cofounder”

I think investors are just hedging their bets on the team

Actively finding a cofounder seems odd and forced to tick a box ✅

If you (potentially) have one, great!

💰Pay amazing folks (contract/FTE/PTE)

More from Startups

There are a *lot* of software shops in the world that would far rather have one more technical dependency than they'd like to pay for one of their 20 engineers to become the company's SPOF expert on the joys of e.g. HTTP file uploads, CSV parsing bugs, PDF generation, etc.

Every year at MicroConf I get surprised-not-surprised by the number of people I meet who are running "Does one thing reasonably well, ranks well for it, pulls down a full-time dev salary" out of a fun side project which obviates a frequent 1~5 engineer-day sprint horizontally.

"Who is the prototypical client here?"

A consulting shop delivering a $X00k engagement for an internal system, a SaaS company doing something custom for a large client or internally facing or deeply non-core to their business, etc.

(I feel like many of these businesses are good answers to the "how would you monetize OSS to make it sustainable?" fashion, since they often wrap a core OSS offering in the assorted infrastructure which makes it easily consumable.)

"But don't the customers get subscription fatigue?"

I think subscription fatigue is far more reported by people who are embarrassed to charge money for software than it is experienced by for-profit businesses, who don't seem to have gotten pay-biweekly-for-services fatigue.

On a serious note, it's interesting to observe that you can build a decent business charging $20 - $50 per month for something that any good developer can set up. This is one of those micro-saas sweet spots between "easy for me to build" and "tedious for others to build"

— Jon Yongfook (@yongfook) September 5, 2019

Every year at MicroConf I get surprised-not-surprised by the number of people I meet who are running "Does one thing reasonably well, ranks well for it, pulls down a full-time dev salary" out of a fun side project which obviates a frequent 1~5 engineer-day sprint horizontally.

"Who is the prototypical client here?"

A consulting shop delivering a $X00k engagement for an internal system, a SaaS company doing something custom for a large client or internally facing or deeply non-core to their business, etc.

(I feel like many of these businesses are good answers to the "how would you monetize OSS to make it sustainable?" fashion, since they often wrap a core OSS offering in the assorted infrastructure which makes it easily consumable.)

"But don't the customers get subscription fatigue?"

I think subscription fatigue is far more reported by people who are embarrassed to charge money for software than it is experienced by for-profit businesses, who don't seem to have gotten pay-biweekly-for-services fatigue.

You May Also Like

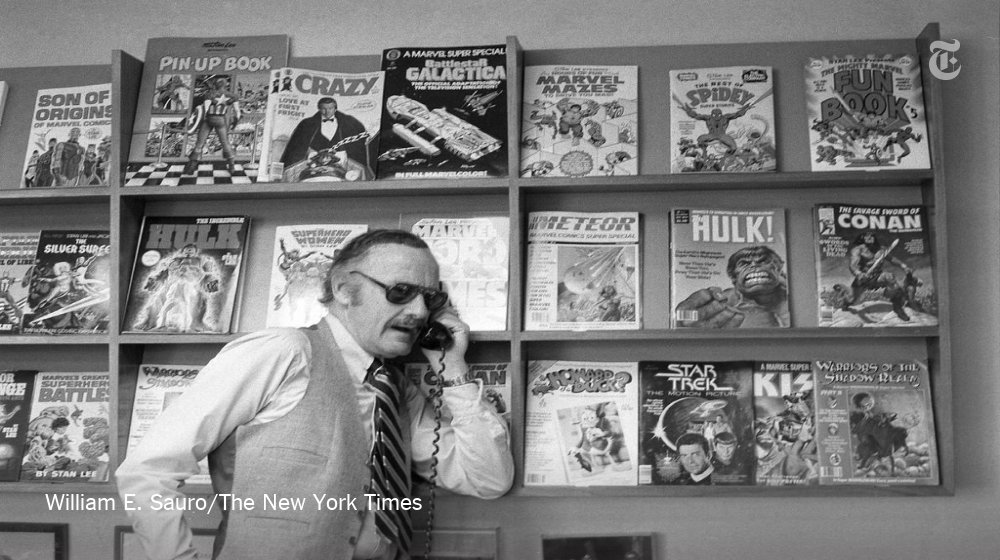

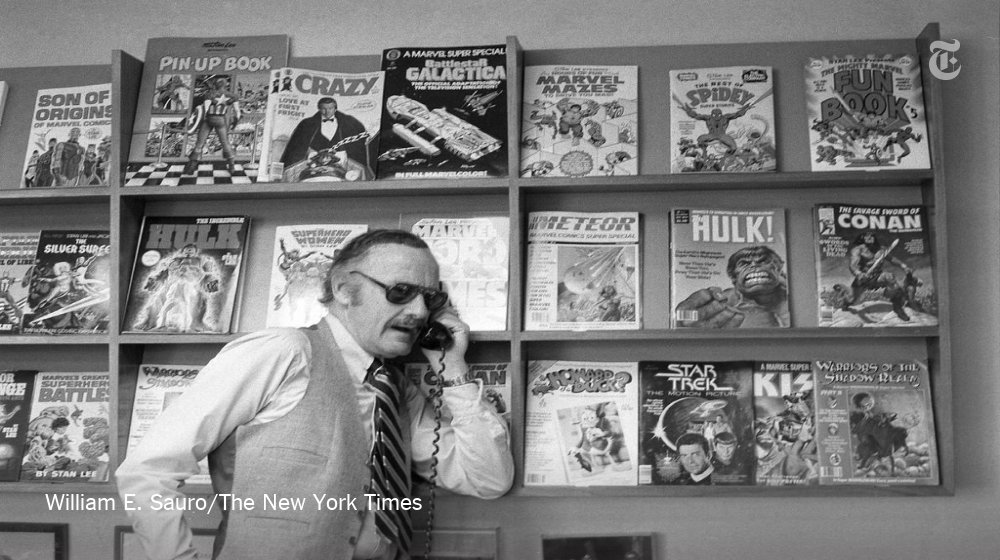

Stan Lee’s fictional superheroes lived in the real New York. Here’s where they lived, and why. https://t.co/oV1IGGN8R6

Stan Lee, who died Monday at 95, was born in Manhattan and graduated from DeWitt Clinton High School in the Bronx. His pulp-fiction heroes have come to define much of popular culture in the early 21st century.

Tying Marvel’s stable of pulp-fiction heroes to a real place — New York — served a counterbalance to the sometimes gravity-challenged action and the improbability of the stories. That was just what Stan Lee wanted. https://t.co/rDosqzpP8i

The New York universe hooked readers. And the artists drew what they were familiar with, which made the Marvel universe authentic-looking, down to the water towers atop many of the buildings. https://t.co/rDosqzpP8i

The Avengers Mansion was a Beaux-Arts palace. Fans know it as 890 Fifth Avenue. The Frick Collection, which now occupies the place, uses the address of the front door: 1 East 70th Street.

Stan Lee, who died Monday at 95, was born in Manhattan and graduated from DeWitt Clinton High School in the Bronx. His pulp-fiction heroes have come to define much of popular culture in the early 21st century.

Tying Marvel’s stable of pulp-fiction heroes to a real place — New York — served a counterbalance to the sometimes gravity-challenged action and the improbability of the stories. That was just what Stan Lee wanted. https://t.co/rDosqzpP8i

The New York universe hooked readers. And the artists drew what they were familiar with, which made the Marvel universe authentic-looking, down to the water towers atop many of the buildings. https://t.co/rDosqzpP8i

The Avengers Mansion was a Beaux-Arts palace. Fans know it as 890 Fifth Avenue. The Frick Collection, which now occupies the place, uses the address of the front door: 1 East 70th Street.