The reason that so many conservative evangelicals these days appear to be moral relativists is that they *are* moral relativists.

They would deny this, of course. But that doesn’t make it any less true. Here's why.

Conservative evangelicals recoil from this approach, as they should.

And how is moral truth empirically verified? The Bible, of course. Problem solved.

Second, apart from special revelation, it’s difficult to imagine where we might go to find empirical verification of moral truth—you can't *see* moral properties.

And if moral truth is unchanging, why are evangelicals constantly amending their moral convictions from one decade to the next?

There’s a third category that isn’t fact or opinion: namely, objective truth that isn’t empirically verifiable. That’s where we find objective morality.

More from Society

Imagine if Christians actually had to live according to their Bibles.

Imagine if Christians actually sacrificed themselves for the good of those they considered their enemies, with no thought of any recompense or reward, but only to honor the essential humanity of all people.

Imagine if Christians sold all their possessions and gave it to the poor.

Imagine if they relentlessly stood up for the widow, the orphan, and the foreigner.

Imagine if they worshipped a God whose response to political power was to reject it.

Or cancelled all debt owed them?

Imagine if the primary orientation of Christians was what others needed, not what they deserved.

Imagine Christians with no interest in protecting what they had.

Imagine Christians who made room for other beliefs, and honored the truths they found there.

Imagine Christians who saved their forgiveness and mercy for others, rather than saving it for themselves.

Whose empathy went first to the abused, not the abuser.

Who didn't see tax as theft; who didn't need to control distribution of public good to the deserving.

"If they start canceling these American presidents, they're gonna come after Bible characters next. Mark my words" -- Fox News "news side" host Bill Hemmer pic.twitter.com/qTPV0NERv8

— Aaron Rupar (@atrupar) February 19, 2021

Imagine if Christians actually sacrificed themselves for the good of those they considered their enemies, with no thought of any recompense or reward, but only to honor the essential humanity of all people.

Imagine if Christians sold all their possessions and gave it to the poor.

Imagine if they relentlessly stood up for the widow, the orphan, and the foreigner.

Imagine if they worshipped a God whose response to political power was to reject it.

Or cancelled all debt owed them?

Imagine if the primary orientation of Christians was what others needed, not what they deserved.

Imagine Christians with no interest in protecting what they had.

Imagine Christians who made room for other beliefs, and honored the truths they found there.

Imagine Christians who saved their forgiveness and mercy for others, rather than saving it for themselves.

Whose empathy went first to the abused, not the abuser.

Who didn't see tax as theft; who didn't need to control distribution of public good to the deserving.

You May Also Like

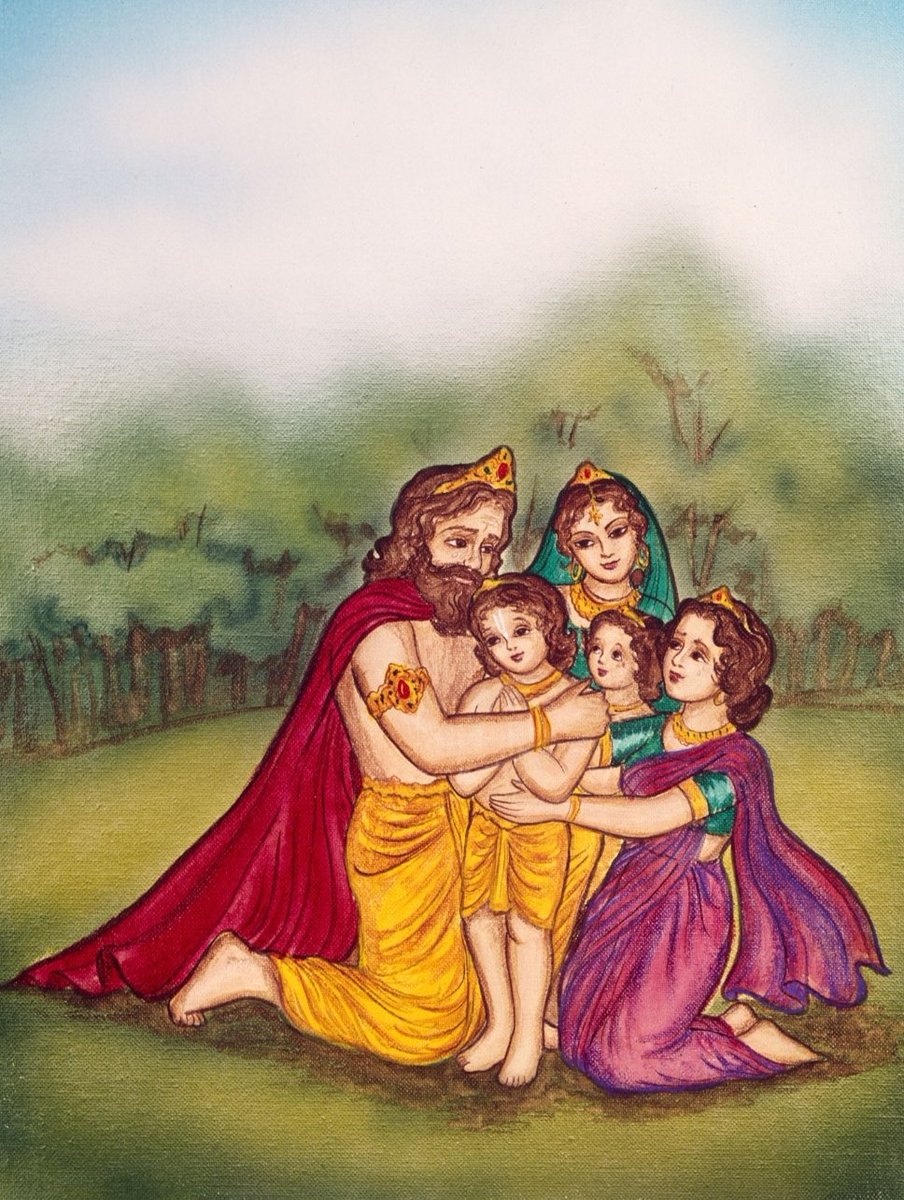

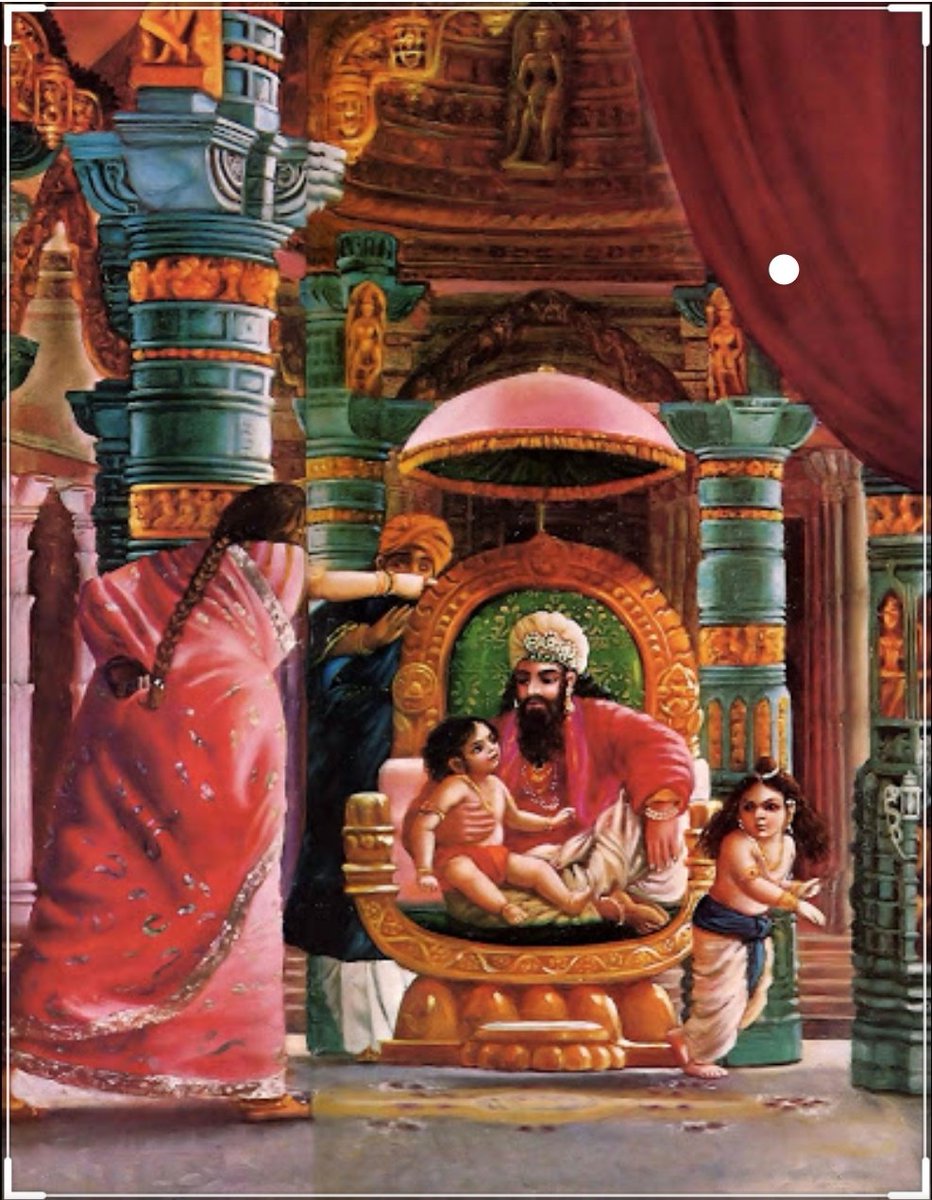

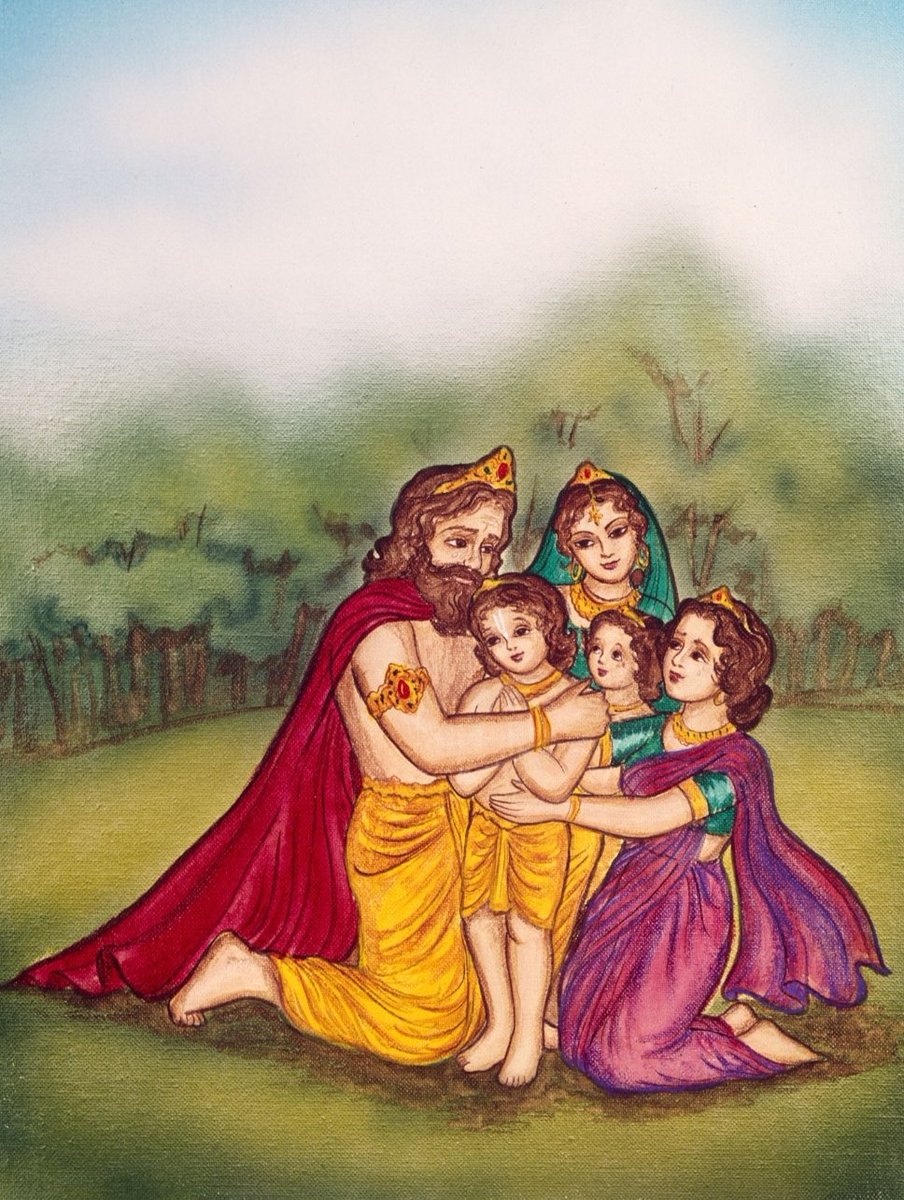

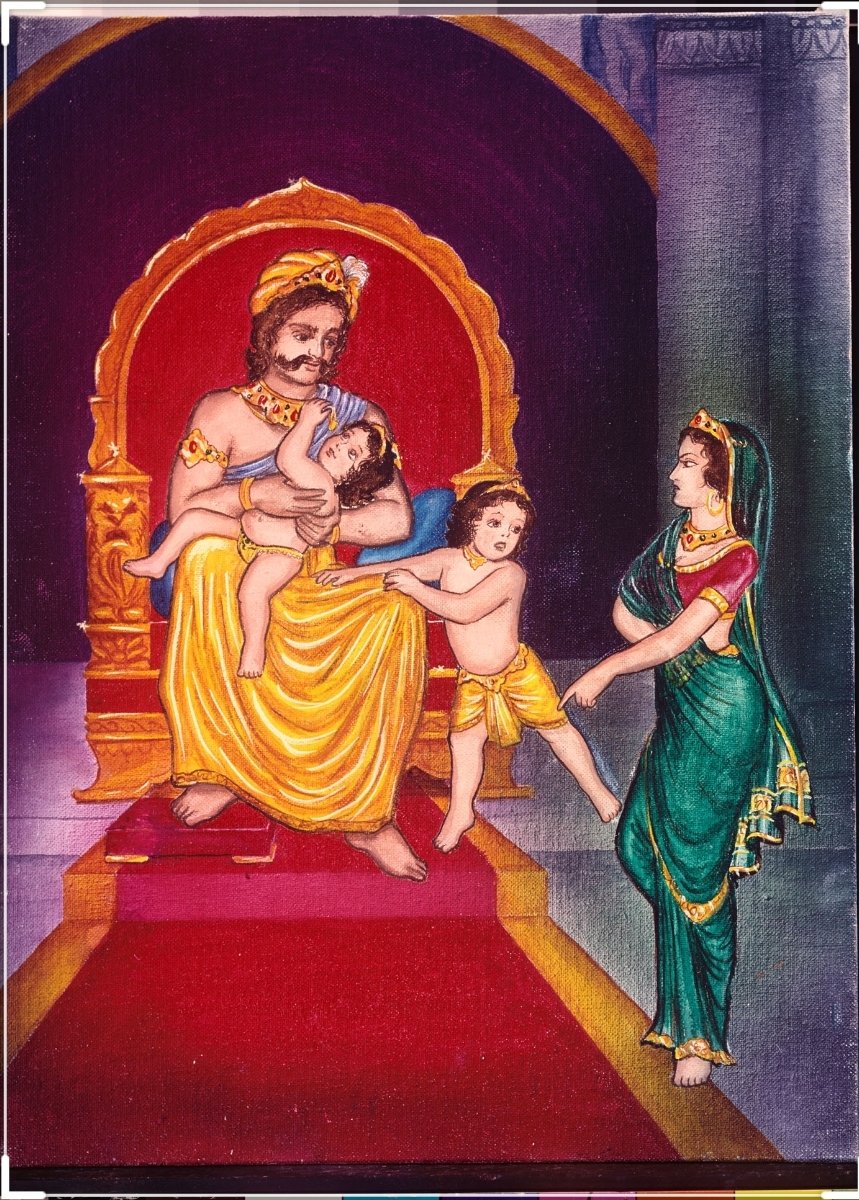

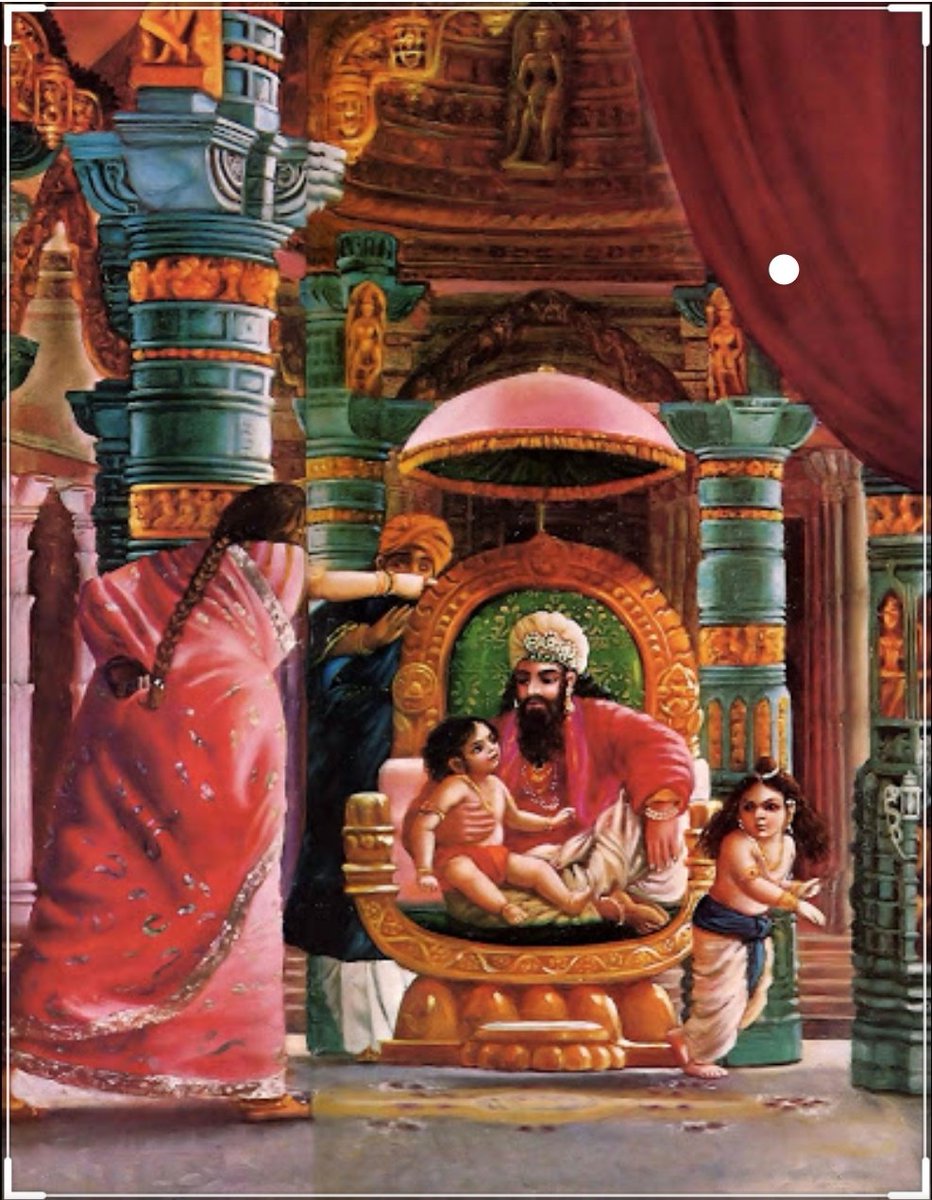

🌿𝑻𝒉𝒆 𝒔𝒕𝒐𝒓𝒚 𝒐𝒇 𝒂 𝑺𝒕𝒂𝒓 : 𝑫𝒉𝒓𝒖𝒗𝒂 & 𝑽𝒊𝒔𝒉𝒏𝒖

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

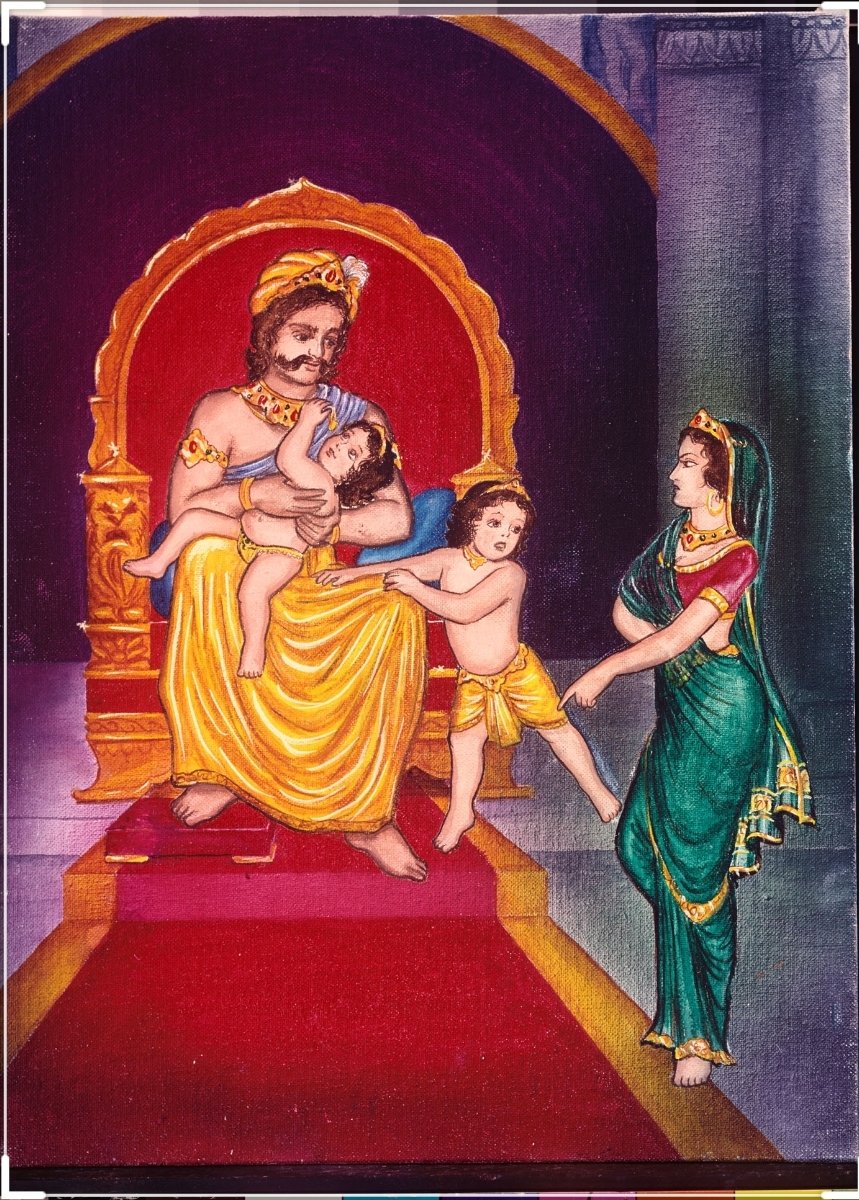

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Prabhu says i reside in the heart of my bhakt.

— Right Singh (@rightwingchora) December 21, 2020

Guess the event. pic.twitter.com/yFUmbfe5KL

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

Department List of UCAS-China PROFESSORs for ANSO, CSC and UCAS (fully or partial) Scholarship Acceptance

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research