#FreeTip Qrly EPS breakout stocks are more likely to move in excess of 5% multiple times after a technical price breakout. High double or triple digit Annual qoq EPS growth rate have even more chances. Best site to see this is @MarketSmithIND . Egs #Datamatics #Icil etc.

More from ScorpioManoj

More from Screeners

Time for a new thread on the possibilities I am looking for.

Do read it completely to understand the stance and the plan.

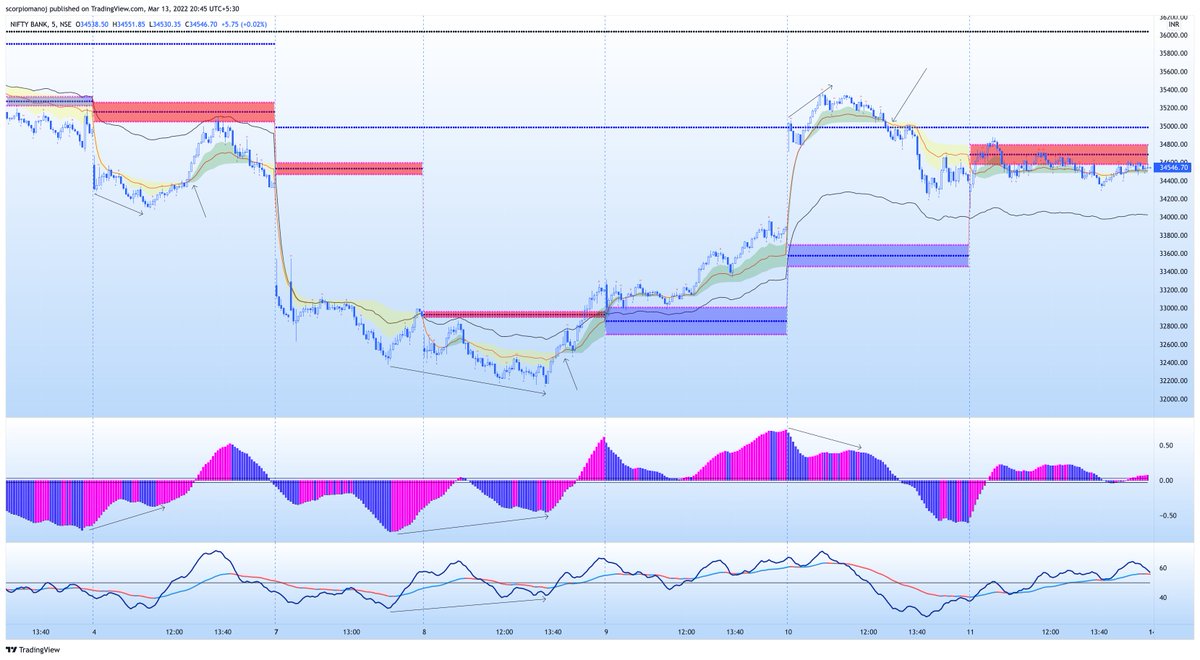

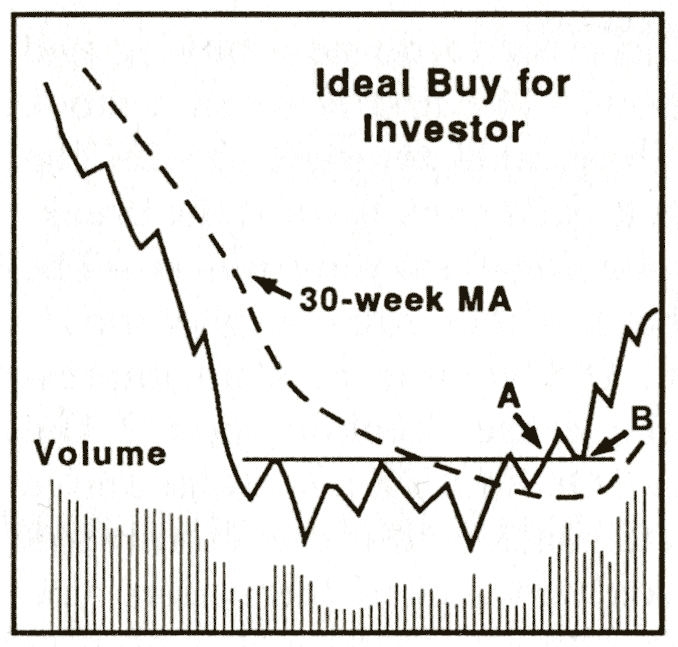

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

You May Also Like

1/Politics thread time.

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

Bad ballot design led to a lot of undervotes for Bill Nelson in Broward Co., possibly even enough to cost him his Senate seat. They do appear to be real undervotes, though, instead of tabulation errors. He doesn't really seem to have a path to victory. https://t.co/utUhY2KTaR

— Nate Silver (@NateSilver538) November 16, 2018